Karachi-based fintech Neem announced it has received a non-bank financial company (NBFC) license from the Securities and Exchange Commission of Pakistan. With regulatory approval, the startup can offer embedded financing solutions to businesses, particularly MSMEs.

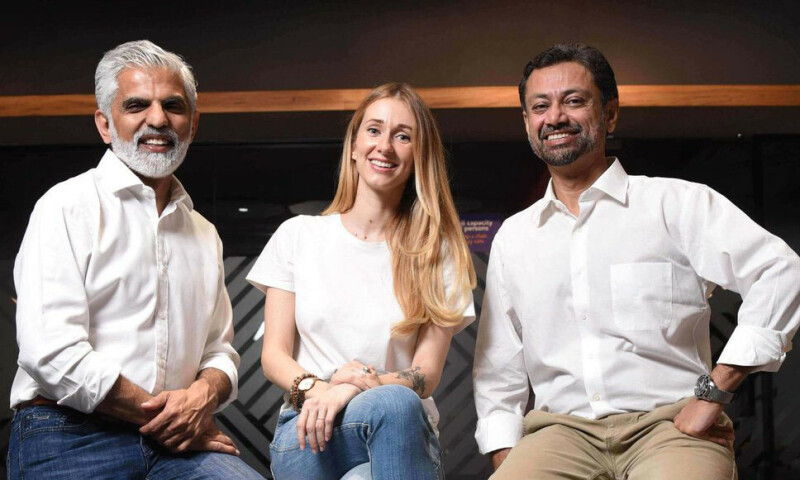

Nadeem Shaikh, Vladimira Briestenska, and Naeem Zamindar founded the startup in 2019. In September, it announced $2.5M in seed funding. The round had investors like SparkLabs, Arif Habib Ltd, Cordoba Logistics and Ventures, Taarah Ventures, My Asia VC, among others.

Naeem Zamindar, co-founder at Neem stated: “Lending is one of the key pillars in the Neem vision of providing Financial Wellness to underserved communities. By partnering with specialized lending infrastructure players we are able to bring to market meaningful and customized offerings. Our initial focus is on the MSME sector, airtime lending, and smartphone financing as principal use cases.”

This makes Neem the latest among new fintechs to have received the NBFC license. Other tech-enabled startups in the regulated space include Abhi, Creditper and SeedCred, etc. It’s part of the broader interest in the lending ecosystem. Since Tez Financial’s $1.1M seed round in 2018, licensed local fintechs alone have raised $52.5M. At the same time, e-commerce players like Bazaar and Dastgyr have also launched BNPL products.

Meanwhile, credit to the private sector by banks has starting slowing down amid economic situation. During June-October 2022, there was only Rs94B of net borrowing, compared to Rs351B in the same period last year. Similarly, loans to NBFIs had net retirement of Rs18B.

Helping them develop their product offerings is Kuunda Holdings, Africa’s second-largest liquidity solutions provider. This joint venture partnership will allow Neem to finance kiryana stores in Pakistan as well as have their solutions embedded within distribution partners like Udhaar Book, Digikhata, and OneLoad.

“In Pakistan, Kuunda and Neem are working jointly to address the needs of the underbanked. Today, Neem’s NBFC license, together with Kuunda’s scoring and loan management platform, is providing tailored growth financing products for retailers, micro-merchants, and agents across the country” said Jalal ul Haq, CEO of Kuunda Pakistan.

Besides solutions for MSMEs, Neem is developing embedded lending products for airtime ending space as well as smartphone financing options. All of these are powered by data insights, a focus on community, and dynamic credit profiling, as per the company.

“Neem’s embedded finance and B2B2C (Business-to-Business-to-Consumer) market approach aims to transform lending from the point of service to the point of experience to serve consumers and MSMEs with contextualized lending products where and as they need them,” a press statement said. The lending platform is one of the three core products from Neem.

The startup also recently entered into a partnership with JS Bank. This enabled them to bring financial wellness to underbanked communities in Pakistan by leveraging JS Bank’s Open Banking platform.

“We are very pleased to have partnered with JS Bank in creating a unique offering to the marketplace that leverages the core strengths of both our organizations. This partnership will enable us to drastically reduce the time to market for our financial products while providing the underbanked customers with the trust and credibility of a Tier 1 Bank,” commented Nadeem Shaikh, Co-founder at Neem.