It’s been a week since the news report of the National Institute of Facilitation Technology’s data breach came out. As per the last report, the services are yet to be restored. While we are no strangers to cybersecurity attacks, including at the FBR, this case is different and actually has massive consequences. In case you aren’t familiar, NIFT is a clearing house. What does that mean? Basically, they are the ones who process every single interbank cheque in Pakistan. Yes, each one of them. It’s like 1LINK or Raast but for cheques.

The more gen z of you would probably be wondering: wait, people still use cheques? Yes, even if it’s not out of choice at times. While the Internet and mobile banking have become the default channels for most consumer needs, Pakistani corporates still primarily rely on paper payment instruments.

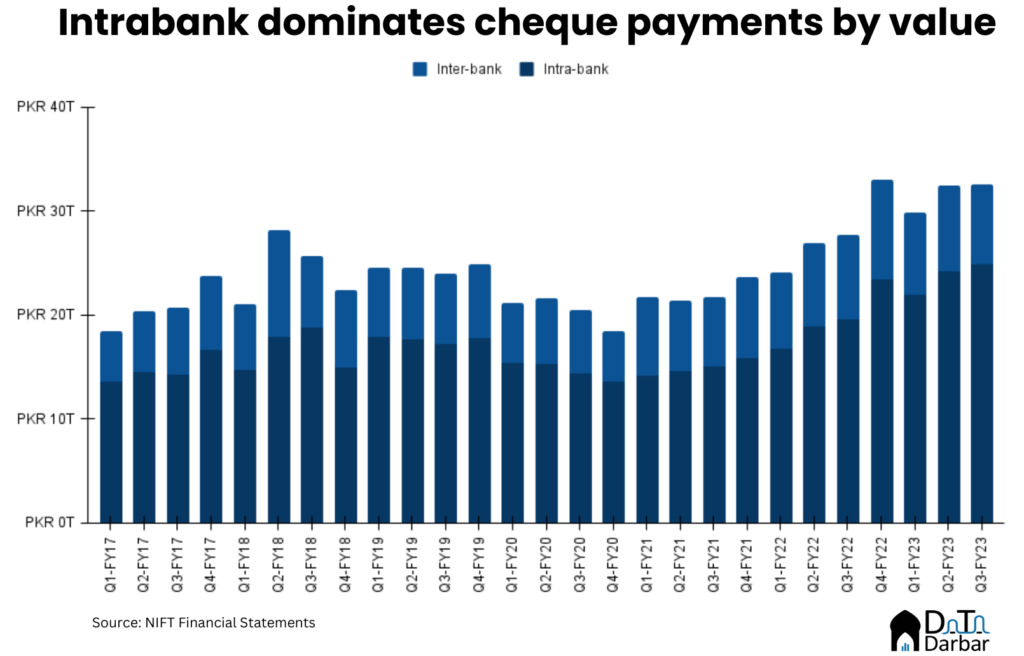

So to understand the ramifications of the breach, let’s try to understand the quantum of cheque payments in the country. During Jan-Mar 2023, Pakistani banks processed 17.4M cheque instruments worth PKR 32.6T. Of this, 23.6% of the throughput and 44.8% of the volume was interbank — translating into PKR 7.7T and 7.8M, respectively.

Put another way, NIFT processes roughly PKR 86B of money and ~87K cheques a day, based on the latest quarterly data. This is not peanuts by any metric and disproportionately affects businesses that inadvertently rely on cheques for any transactions. The average size of a clearing cheque is ~PKR 965K, which while much lower than the intra-bank level of ~PKR 2.6M, is still sizable.

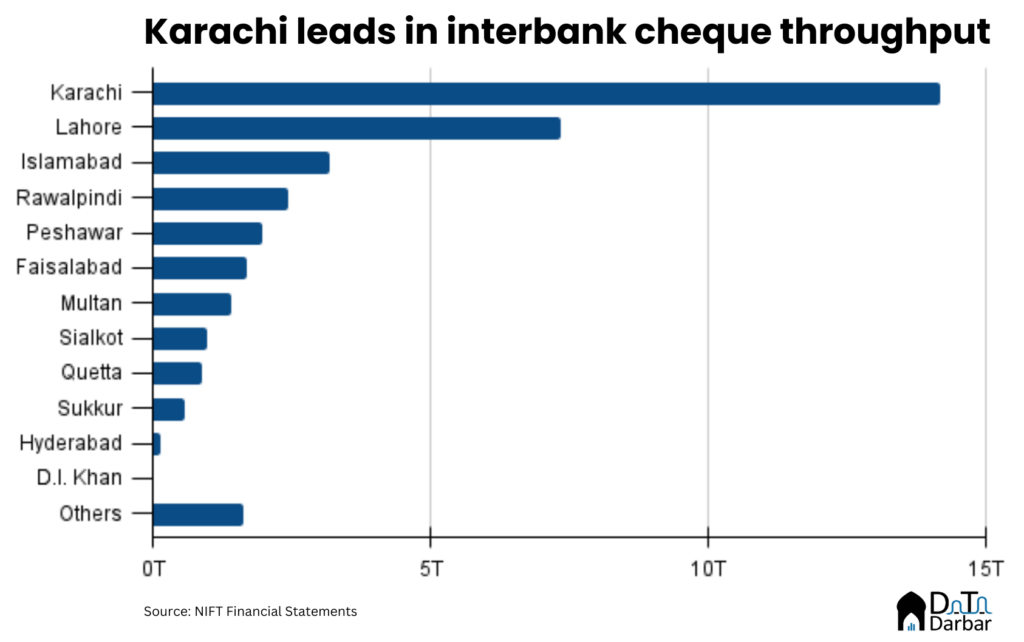

City-wise, Karachi obviously occupies the lion’s share by both metrics. Since 2018, it has accounted for 38.6% of interbank throughput and 49.8% of volume. In Apr’23 alone, it saw ~PKR 958B across 1.24M cheques. Lahore comes in second, at 18.8% and 19.1%, respectively, followed by Islamabad.

NIFT’s own annual report puts the number of instruments processed in FY22 at 48.4M, which is 10M higher than the SBP’s value for clearing cheques. Where’s the difference coming from? That’s because the former probably includes all instruments, including bounced ones, demand drafts, and pay orders.

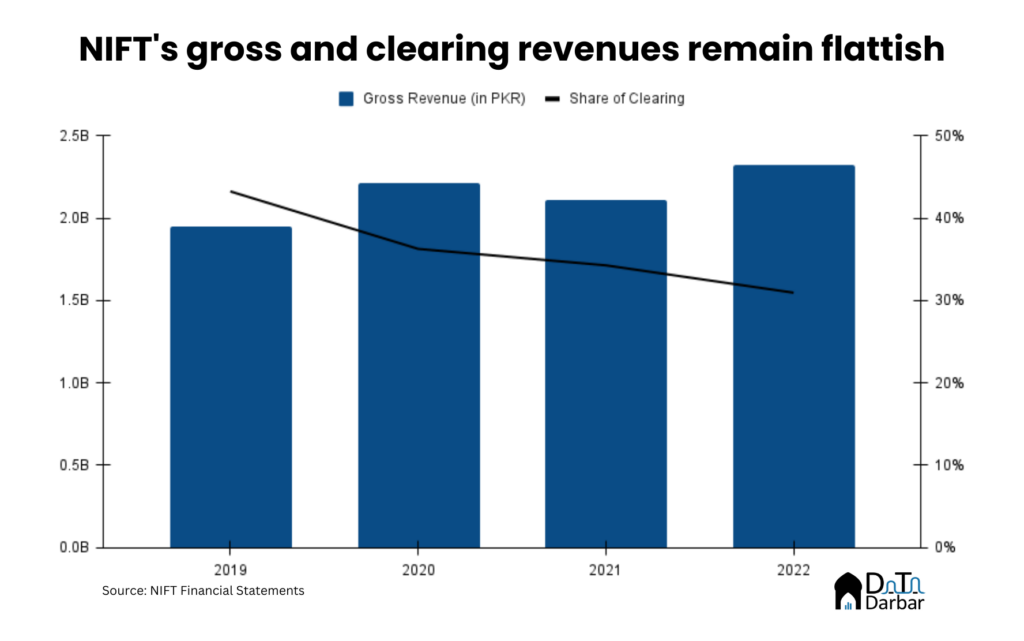

Despite its strong backing (the country’s leading banks) and regulatory advantage, NIFT hasn’t really lived up to its potential. with the topline increasing by a compound annual growth rate of just 4.05% since 2018 to reach PKR 2.07B by 2022. That’s underwhelming. Over 89% of it came from cheque processing and related services.

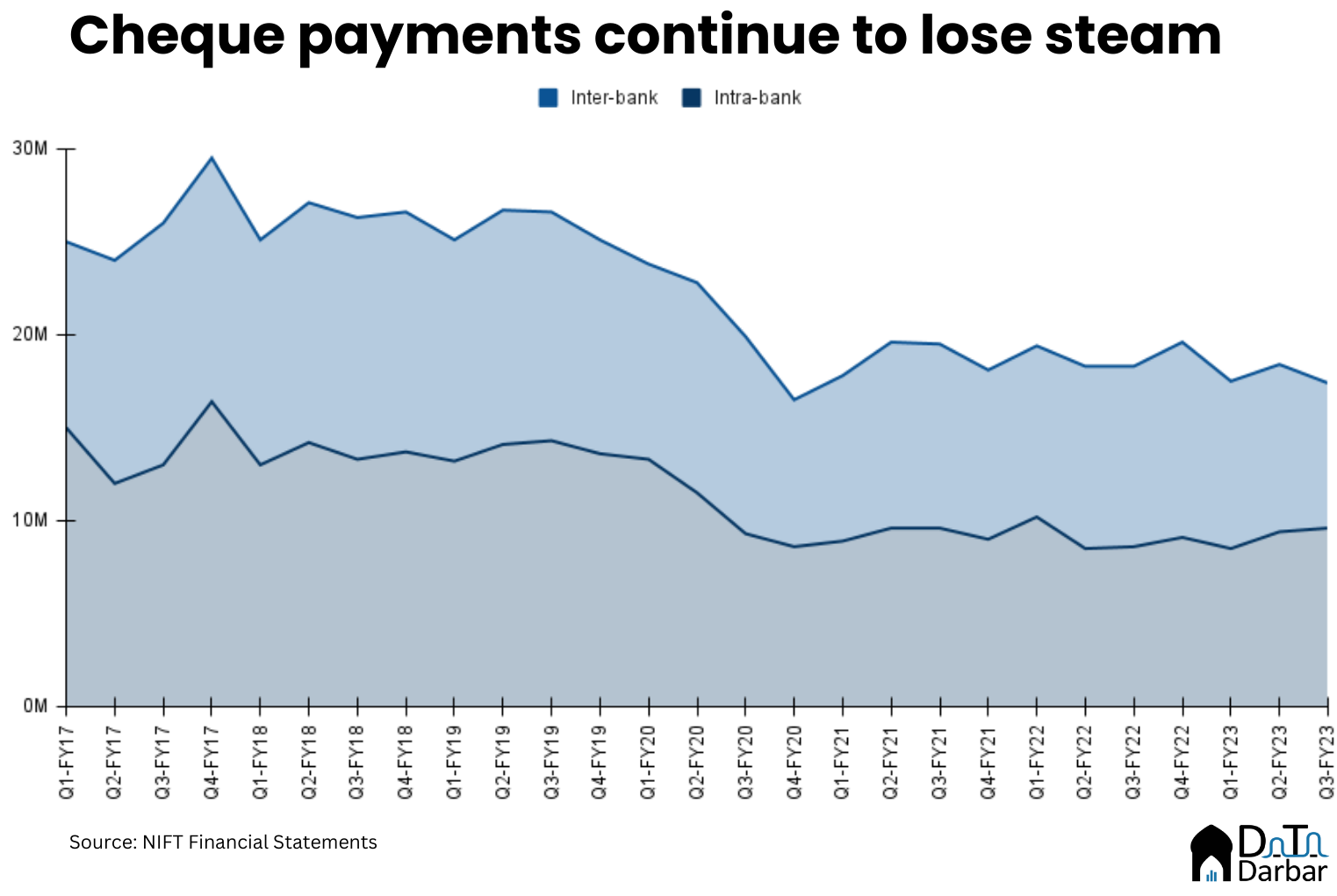

However, if we limit ourselves to only clearing, the picture is somewhat mixed. Since 2019, there’s been a gradual decline in the number of instruments processed, probably as more consumer transactions turned digital. Similarly, income from clearing has edged a little lower while its share in gross revenues has plummeted.

But the company has a host of other services too, like utility payment processing and documentation management system, which combined contributed just over one-tenth of the topline. Perhaps the most disappointing has been NIFT ePay which brought in only PKR 11.4M in 2022. The amount was actually down compared to 2021, despite doing a full year of commercial operations under the PSO/PSP license.

What’s quite hilarious is that NIFT actually offers a range of cybersecurity-related services under eTrust. Of course, that’s no guarantee to prevent your own breach, but it’s still a bit funny. And of course, raises questions regarding the quality of the said services. More importantly, this is an opportunity to streamline the inefficient cheque processing experience, both intra and inter-bank. Because that essentially is what will truly digitalize the B2B payments in Pakistan.