The burgeoning interest in Pakistan’s IT exports is not without merit, particularly in its potential to boost the nation’s exports and allow the country to steer clear of the habitual recourse to the IMF in the coming 5-10 years. Last year’s official figure for Pakistan’s IT exports stood at $2.6B, and with a 20% year-on-year growth rate – ambitious yet achievable – we might see these figures swell to $6.5B in five years and $16.1B in a decade.

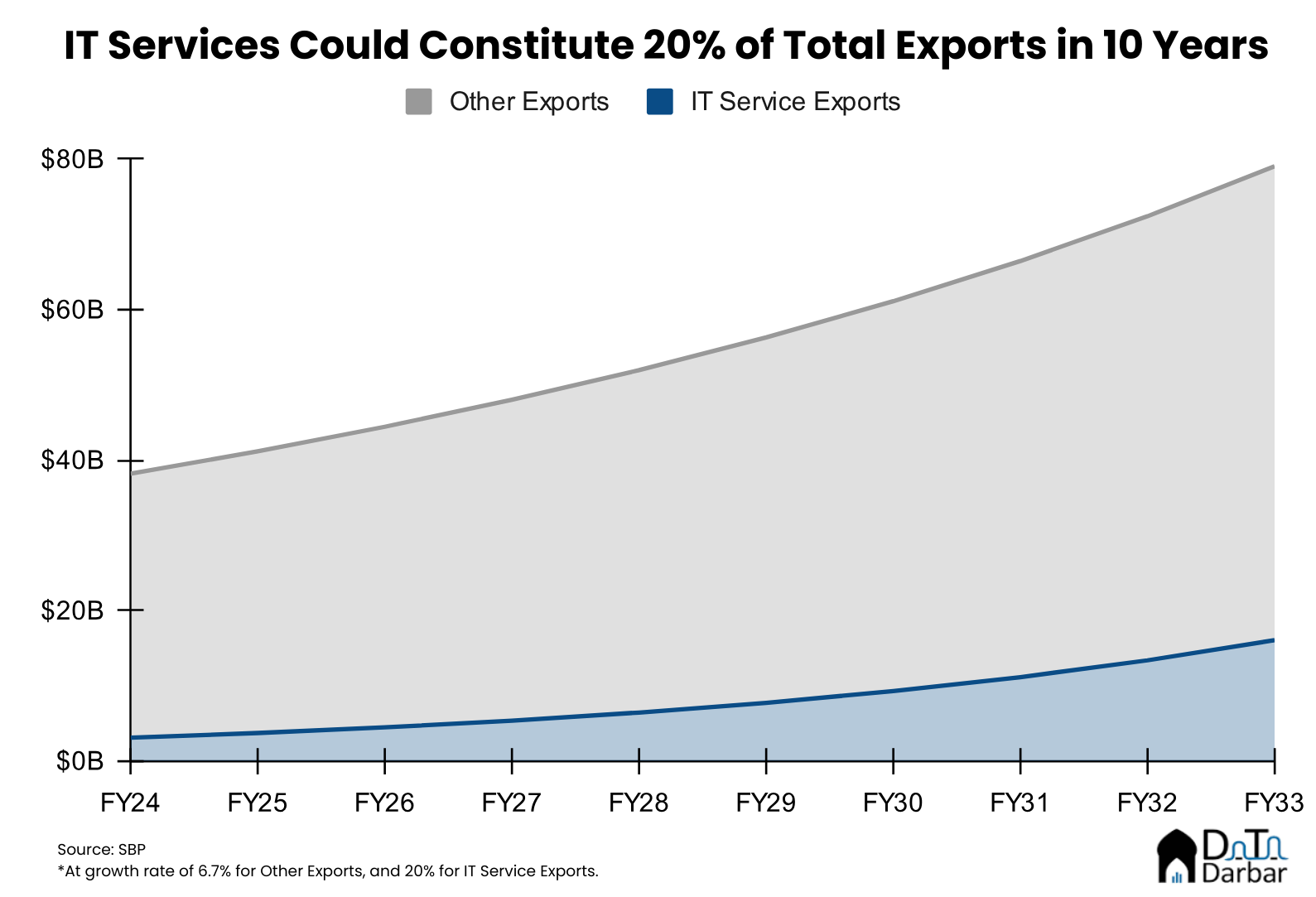

Considering the 6.7% annual growth in Pakistan’s non-IT exports from FY17-FY22, if sustained, IT exports could account for 12.4% of the total export bill by 2028 and 20.3% by 2033, if this trend persists. This trajectory is promising, raising the pivotal question: can we maintain a 20% growth rate annually? However, there’s more to consider than just the growth rates. A significant difference exists between the actual and documented IT exports.

In essence, many IT companies do not fully repatriate their export income, and the reasons for this are complex. Firstly, repatriating dollars into Pakistan poses challenges for financing international acquisitions or operational expenses. Secondly, the current near-zero IT corporate tax rate in Pakistan makes companies apprehensive about potential future tax hikes, which could increase their costs by up to 30%.

Thirdly, the process of repatriation itself is burdensome. For instance, banks typically convert a large portion of dollars into rupees upon entry, and with our currency’s rapid devaluation, it’s often financially wiser to keep dollars even in non-interest-bearing accounts abroad. Lastly, for some company founders, maintaining funds offshore facilitates dollar-denominated compensation methods, such as salaries, dividends, or bonuses. Bringing these funds into Pakistan would necessitate their conversion into rupees, thereby complicating the transfer of personal wealth overseas.

Estimating the undocumented

To find out the total revenue parked outside the country by IT companies, we created an intuitive model that relies on two main variables, the total workforce of the sector and the average revenue per employee in IT companies.

First, we estimated the total tech employment to be 600,000. This figure was found by using the growth rate of 12% over 5 years on the base of 340,600, which is the tech sector employment in the 2017-18 Labour Force Survey. For an alternative approach, we multiplied the estimated number of exporting companies in Pakistan’s IT sector (about 5,000, based on membership in the Pakistan Software Export Board) by the average company size (125, as per P@SHA’s survey). This method brought us to the same figure out of 600,000 tech employees.

However, there are some caveats to consider. The actual number of exporting IT companies might be higher than 5,000, as not all companies are members of the Pakistan Software Export Board (PSEB). Additionally, the average company size of 125 might be overestimated, as the P@SHA survey might include larger companies. Despite these potential variances, we believe these factors balance each other out, and our estimate of 600,000 employees remains robust.

Next, we calculated the average revenue per employee. We started by analyzing Systems Ltd., a company with publicly available financial data. For the first nine months of 2023, their average revenue per employee was PKR 5.3M. Annualized, this equates to an average revenue per employee of $25,000 at Systems Ltd at an exchange rate of PKR 278.8 to USD 1. Recognizing that Systems Ltd. likely commands higher rates than the industry average, we applied a discount factor of 0.5, resulting in an industry average revenue per employee (ARPE) of $12,591.

By multiplying the industry ARPE with the total number of tech employees, we estimated the total earnings of the IT industry at $7.5 billion. According to P@SHA survey data, around 70% of these earnings are expected to come from exports, leading to an IT export figure of $5.3 billion. Considering that the documented IT exports stand at $2.6 billion, our model suggests that an equivalent amount of approximately $2.7 billion in IT exports remains undocumented. You can test with your own inputs below in this calculator.

While this may seem like a big number, officials have long complained about Pakistan’s undocumented IT Exports. On March 24th, 2023, the National Assembly Standing Committee on Information Technology and Telecommunication was told that Pakistan’s IT exports are over $5B, twice as much as the documented number.

While not hard proof, there’s anecdotal evidence of entities parking their earnings abroad in the recent past. In the wake of the Vote of No Confidence and the resulting political and economic uncertainty, Pakistan’s IT exports slowed down drastically, after growing in mid-20% every month for around two years preceding that. While the industry was continuing to hire aggressively, the overall foreign earnings somehow were on a downward slope.

How the future might look

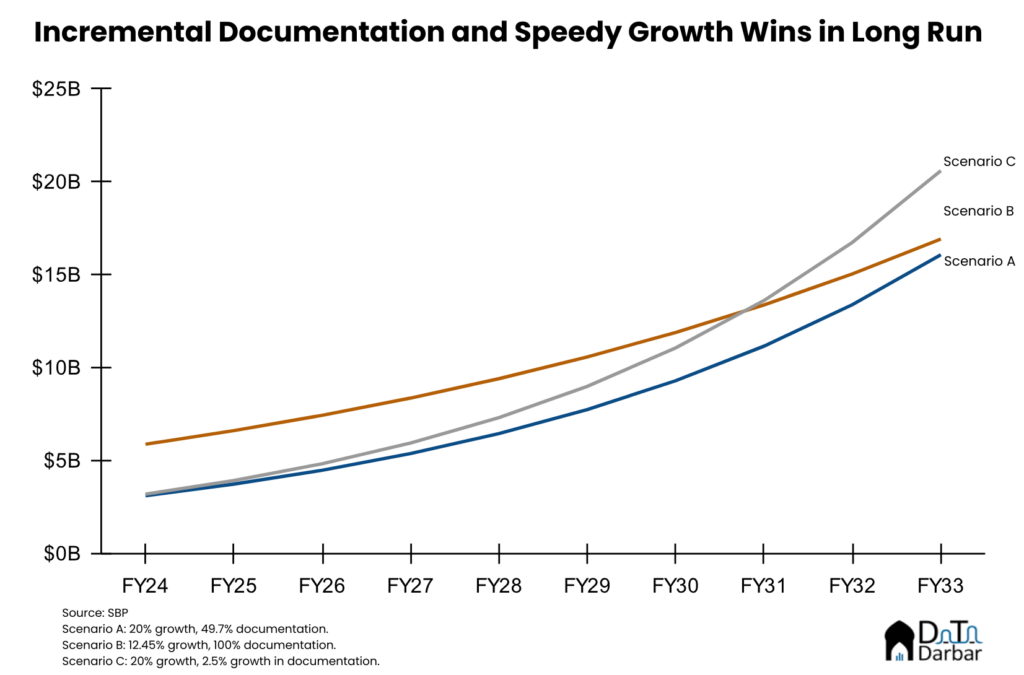

So what steps should the state take? We forecasted three scenarios to find which one would lead to the highest IT Exports figure in 10 years.

Currently, just ~50% of Pakistan’s IT Exports are documented per our model. If the state were only to push for high growth without working on increasing documentation, we would reach an IT Export figure of $16.1B by FY33. If the state were only to focus on documentation, even bringing up documentation to 100% overnight, while growth stayed at the status quo of 12.4%, IT Exports would reach $16.9B by FY33.

However, if the government takes an incremental approach concerning documentation while focusing on high growth, this would bring us to an IT export figure of $19.3B by FY33. Therefore, the issue is not solely about accurate documentation but involves creating the right incentives for companies to repatriate their earnings.

Thus, while we should strive for the 20% growth target, it’s equally crucial to address the gap in export figures. Managing these discrepancies effectively might allow us to meet our targets with even lower growth rates of 4.3% and 11.9% over the next 5 and 10 years, respectively. This discrepancy from our desired growth rate is notable. Surpassing the 20% mark would, of course, be ideal but not necessary to achieve the desired results. The impact of bringing more dollars into the country could be profound. It could reduce our current account deficit and therefore the need for IMF assistance while alleviating inflation by stabilizing the Pakistani rupee against foreign currencies.