In the early days of my career, I used to collect all the newspapers containing my bylines. The plan was to make a cool folder or do wall clippings, as journalists in movies do. But as time passed and the writing output increased, the exercise seemed a little futile and the stack of papers soon found its way to the raddi wala. Not only because there were just too many articles to keep up with, but also because they had nothing noteworthy. I hadn’t really done any groundbreaking investigations or foretold some landmark future events. For the most part, any article on its own was quite inconsequential.

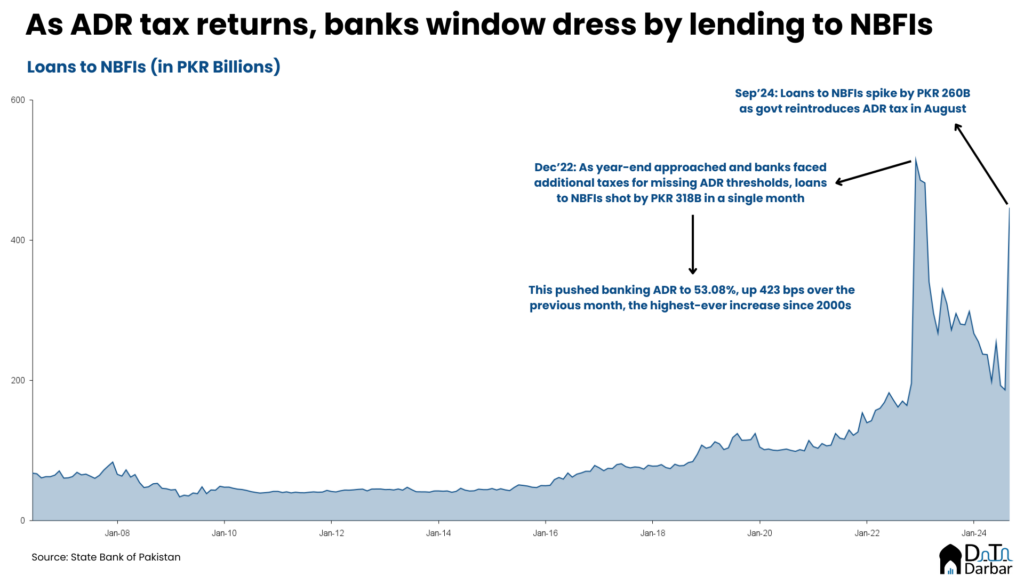

But there’s one piece I am still very proud of. In early 2023, I was casually looking into the credit data by the SBP. Generally, the most important trend lies in how much banks have lent to the government and private sector. However, as they say, the devil is in the details. In one small line item, there is the amount of loans banks have extended to non-banking financial institutions.

On its own, any lending between financial institutions is usually flattish and doesn’t tell much, ignoring SBP’s flury of repurchase agreements. However, this time it was screaming: between November and December 2022, loans to NBFIs surged from less than PKR 196B to over PKR 514B. Basically, more money was lent out in a month than in over a decade and a half.

Some small movements at quarter ends are not unusual as financial institutions have been doing window dressing for ages. But this was on a different scale. The reason was quite simple. During that year, the government announced an additional tax on banks failing to meet a certain threshold of advances to deposits ratio (ADR). Needless to say, the big boys of Chundrigarh had no plans of actually doling out loans to businesses and consumers.

As December drew to a close, they turned to their relatively poorer buddies. I mean those without a full-fledged banking license, such as microfinance and development finance institutions. Some of them were starving for such excess liquidity to then invest in government securities. You know, the circle of life.

Though there still remained differences among banks, this move helped improve the sector’s overall ADR to 53.02% by December 2022. That’s an increase of 423 basis points in a single month — the highest-ever jump since at least 2002. In the end, it didn’t really matter because the government temporarily put off the tax, except for certain NBFIs where the bet didn’t pay off. You are probably wondering what’s the point of all this blabbering. Other than massaging my own ego, it’s to say that history repeats itself.

Old habits die hard

Earlier in August, talks of the same tax resurfaced again as the waiver deadline passed. This time, banking was in more trouble as their ADRs were at a historically low level of 38.36%. So the efforts had to begin earlier as the gap was too big. Assuming the deposits maintain their past growth trajectory, they will reach PKR 31.7T by year-end. Consequently, the minimum advances to escape the tax altogether need to be at PKR 15.85T, compared to August’s PKR 11.81 T.

Needless to say, there’s no way banks would, or could, lend PKR 4T in just four months. So what do they do? Write big cheques to buddies running NBFIs, taking us back to that not-so-insignificant line in the credit dataset. According to the SBP, loans to NBFIs reached PKR 446.4B by September — surging by PKR 259.7B in a single month. In other words, the increase was bigger than August’s outstanding amount.

To be fair, there’s nothing wrong with lending to NBFIs if funds are to be used for any productive purposes. That’s not really the case here as these entities just can’t absorb so much liquidity, at least for onward lending. For context, the aggregate increase in net advances of microfinance banks between FY17 and FY24 was PKR 266.3B — translating into a quarterly average of PKR 9.5B. Similarly, development finance institutions had a net loan book of PKR 190.6B as of June, having increased by an average of PKR 4.1B per quarter since FY17.

ADR Deficit: Where the big banks stand

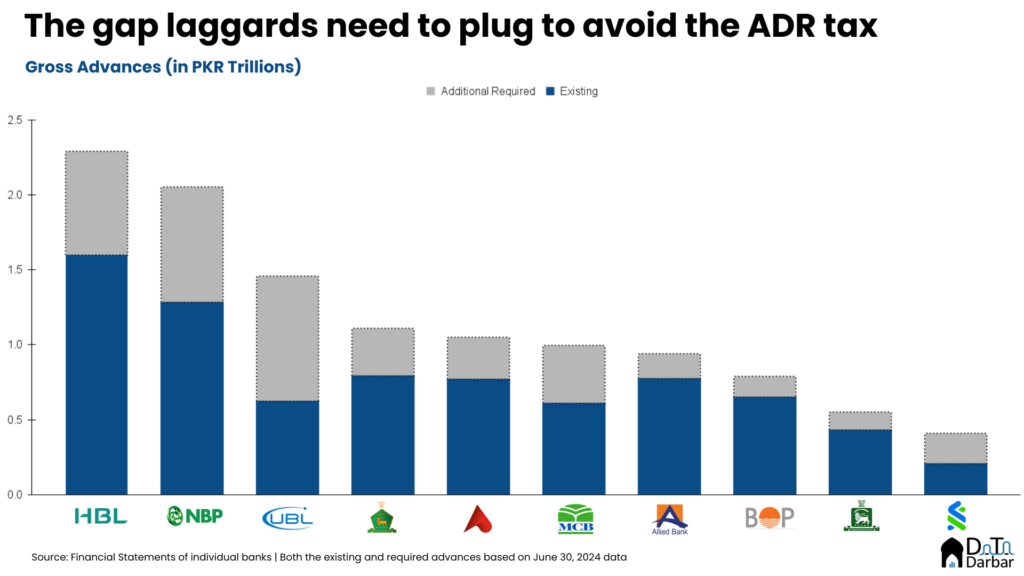

Since some institutions are yet to release September results, let’s use the June numbers to get a sense of how behind or ahead they are. According to our previous analysis, only four out of the 20 listed banks had an ADR of more than 50%.

In absolute numbers, UBL, NBP and HBL have a particularly huge task ahead of themselves as they need to increase advances by PKR 830B, PKR 769B and PKR 690B, respectively. Of the 13 banks with asset base exceeding PKR 1T, only Faysal and Askari sit over ADR of 50% while Meezan had a more manageable deficit of PKR 87B.

It’s actually a little funny. Not because the banks are exploiting the loophole but that even two years later, policymakers haven’t learned a thing. If the goal was to promote private sector financing, then maybe the government could have defined ADR narrowly, i.e. net of loans to NBFIs? Doesn’t sound too difficult, right? I guess the finance minister is still a banker at heart, giving back to his community of rich old men. You know, the most deserving of all.

If there’s any solace, the gap in advances is too big to be all channeled towards NBFIs. Banks will have to do some actual lending if they want to avoid the additional tax. Who benefits from that is a whole another debate though. Traditionally, it’s been the big corporates and there’s no reason history won’t repeat itself this time. As per September data, manufacturing noticed the second largest increment in advances of PKR 80B, out of total private business financing of PKR 159.5B.