Numbers are funny. Under all the garb of objectivity, how people use them is often pretty subjective, or even manipulative. What you do and don’t report can matter equally, particularly in business and economics. Financial metrics and macro indicators embody this phenomenon the best. Just read a press release of some corporate’s earnings announcement: the narrative would always try to embellish facts.

But nothing manipulates stories like percentage changes. They have this magical ability to make small absolute differences seem monumental or huge shifts appear modest, depending on what serves the narrative better. Startups use this playbook regularly by boasting exorbitant growth rates. After all, a 2,000% jump sells the story a lot better than “our in revenue increased from $100 to $2,100 over a year.”

Governments are no different in this regard, if not worse. They have mastered the art of cherry-picking, even if people don’t really buy their narratives. I remember attending a briefing in April 2021 where the then Governor SBP, Reza Baqir, was speaking. This was when the economy was still in the expansionary mode, thanks to unfettered money printing. Highlighting that success, he mentioned how auto sales were growing at high double-digits while conveniently omitting that the base period included two months of peak Covid-19, which even today remain the worst-ever for the sector.

Percentages to the rescue

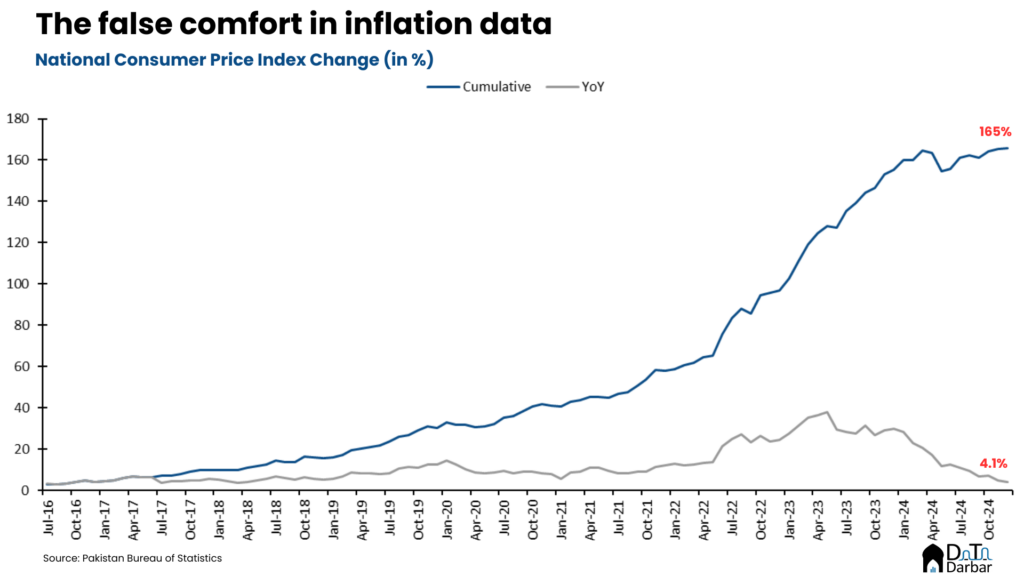

In some cases, a high base works better to sell optimism. Inflation is a great case in point, and quite relevant to the Pakistani government’s current narrative of a stabilizing economy. After hitting a peak of 38% in May’23, price levels have come down substantially to reach 4.1% by Dec’24.

Looking at the monthly inflation numbers will put you under the impression that we are returning to prosperity. That’s because, well, the data is commonly reported in percentage changes over the same period of the previous year. There’s nothing wrong here, per se. I mean it’s done the same way pretty much anywhere in the world. But numbers without context are misleading, especially when coming from governments, and in particular ours.

To be fair, the context is usually missing not because of some ulterior motive but due to the way inflation is calculated. Statistics departments select a basket of goods which is representative of an average household and track their retail prices across various markets. Then they index them by assigning a reference period as base year, against which all changes are measured.

In Pakistan, that basket comprises 356 items for urban and 244 for rural while the base year is FY16. This “consumer price index” is technically the measure of inflation and reveals far more than standalone YoY or MoM percentage changes. Like in Dec’24, when prices were up 4.1% over the same period last year, the cumulative increase since FY16 stands at 165%.

Put another way, things, on average, are 2.65x more expensive today than they were in Jun’16. Goes without saying that there are lots of differences within. For example, alcoholic beverages & tobacco have seen the sharpest jump in prices, having risen 3.8x since the base year. No surprise there for my Gold Leaf lovers.

No sugarcoating the rot in microfinance banks

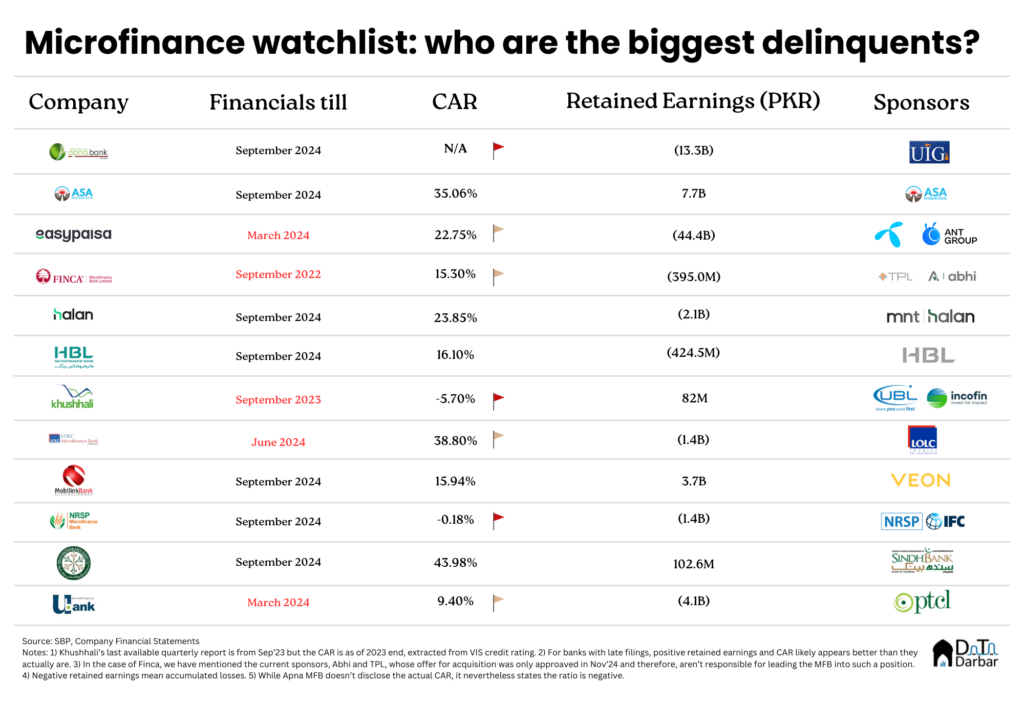

However, some numbers are simple and it’s a lot harder to twist them around. In such situations, the easier option is to just hide information altogether. This is what’s happening in Pakistan’s microfinance sector, where five out of 12 banks haven’t publicly disclosed their financial results for the latest quarter i.e. Q3’24. Some actually stopped bothering a while ago, like Finca whose most recent report is from Sep’22 — or two years ago.

Others have now followed suit, given there are few repercussions, at least beyond the closed doors of central bank headquarters. In fact, even the central bank didn’t care enough to include Finca or Khushhali’s 2023 data in its publication on financial institutions. Either the regulator is trying to protect the MFBs or there wasn’t enough money with the banks to even pay the auditor. Are our MFBs so broke that they don’t even have like PKR 10M to hire a firm? Do remember that they are required to submit Q1 and Q3 statements within 30 days.

Read: The skewed fundamentals of microfinance

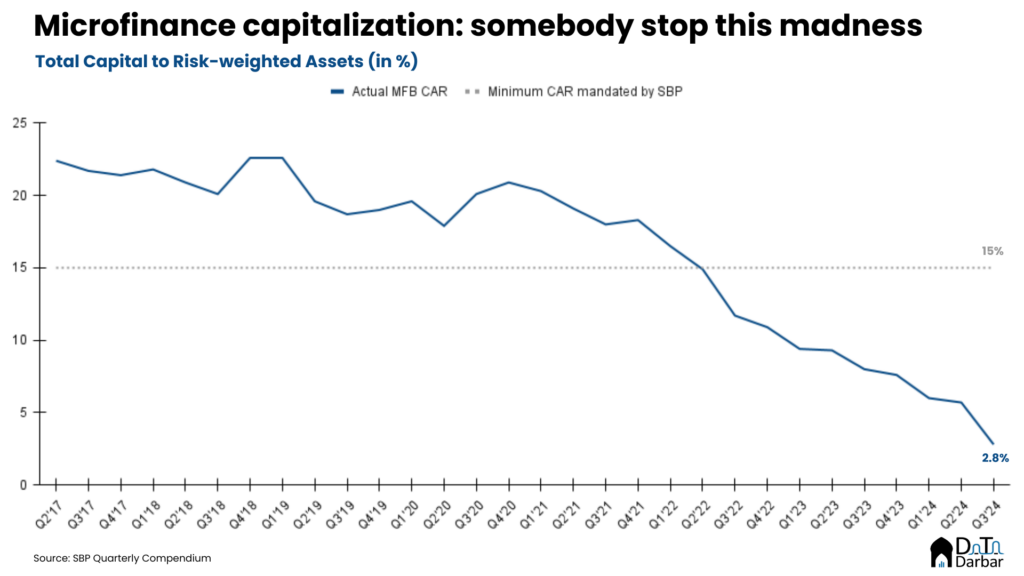

The simpler, and more plausible, explanation is that the regulator is quite fine with such information staying in the dark. And why wouldn’t it be? After all, microfinance banks are a mess, having incurred aggregate losses in all but one quarter since Q2’19. The rot has spread well into the equity and eaten up capital buffers. As of Sep’24, their capital adequacy ratio had fallen to a dismal 2.8% against the minimum required level of 15%. Things didn’t get to this point in one quarter and CAR has been on a steeply downward trajectory from the beginning of 2022.

Everyone seems to be running behind this iron curtain. First, it was the Pakistan Microfinance Network, which silently deleted all the quarterly microwatch publications from its website after the revamp. Then, individual banks joined the party too. More recently, even the SBP’s own data on MFBs across various publications didn’t add up, with differences running into billions.

To be fair, the SBP has reportedly been trying to find new sponsors for the practically bankrupt microfinance banks. In fact, we have already seen two acquisitions: Finca by TPL and Abhi, and Advans by Egypt’s MNT-Halan. But is creating, or at least enabling, an information blackhole the right way to go about it? After all, silence speaks louder than numbers.

After writing about Mobilink Bank’s nano loans, I’ve periodically checked PMN’s website to access Microwatch reports, hoping to track sector loan growth and update my previous analyses. Despite numerous attempts with their publication search system, I could only locate one or two older reports. Your article clarified that these reports have been removed from the website, saving me from future futile searches. Thank you for this helpful information.

PMN just confirmed to me over email that the missing information is temporary due to website revamp. Once it’s done, there is a new data portal coming up as well. In the meantime, one can reach out to them directly for any data requirement.

I will rhyme and want you to guess the song.

“Corruption koi niklyyyy tu regulator usy bujhaaye, Regulator jab corruption machayeeee, usyy kon bujhaaye”?

When regulators are supposed to be the knights of ethics and guardians of the economy’s lifeline, seeing them crib from foreign playbooks is like watching a plagiarist ace an exam—they pass, but the integrity? Failed. The one hope—morals—seems to vanish faster than transparency when it’s time to bare truths. Instead, it’s cloak-and-dagger decisions galore.

Everyone’s got their own spin on the “behind the iron curtain” saga, but your spotlight on Finca steals the show. TPL’s digital bank dreams dashed? Enter Plan B: Abhi—a proxy so familiar it might as well carry their DNA. The real twist? Watching the regulator hand a vault of public trust to a startup embroiled in credit-rating chaos, run by greenhorns selling a growth story to international investors. Plot thickens: the same SBP-exiled puppet master pulling strings at Finca.

The cherry on this sundae? Making “son-in-law of Habib” the “son-in-law of the nation.” A bold ask for regulators: don’t serve us reheated rotten dishes; do your job.