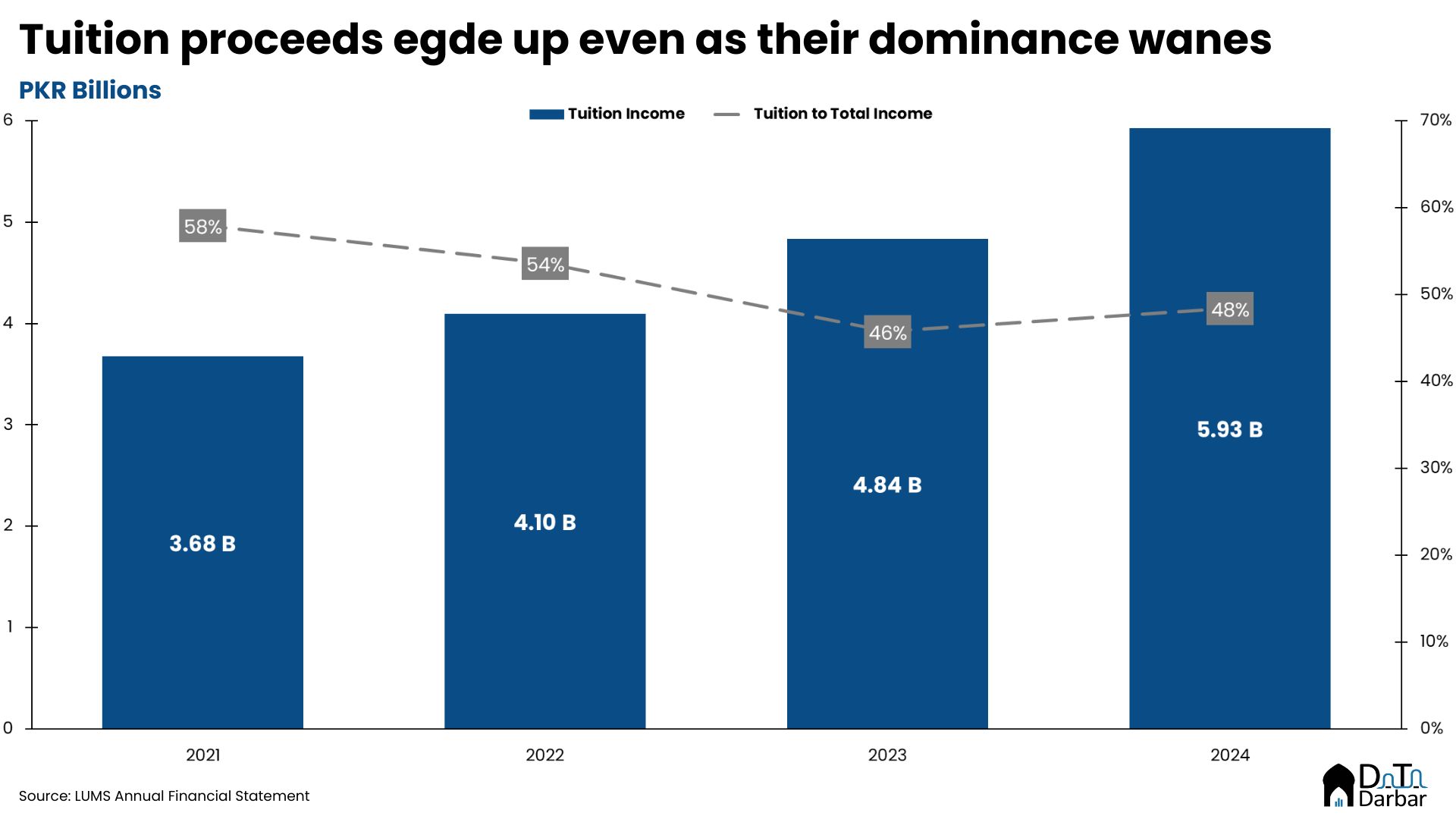

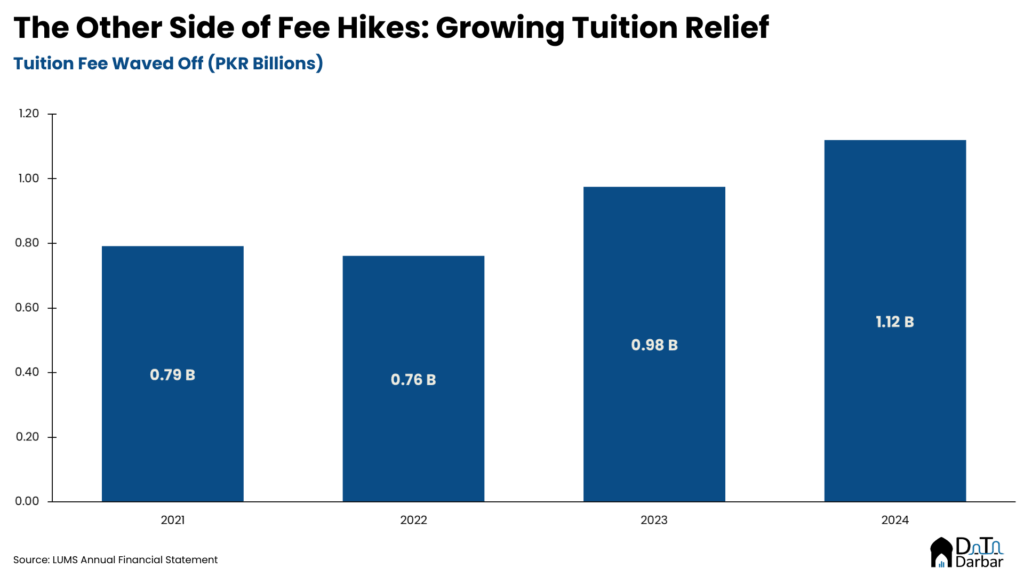

Over the past few years, “fee hike” has become a familiar phrase at LUMS. For many, it’s a source of frustration. Each year, tuition has climbed steadily, usually tracking inflation. Between 2021 and 2025, the per-credit-hour fee jumped by 47.4%. That translates to an average year-over-year increase of 10.17%. Despite this surge, the administration is looking for ways to reduce its reliance on tuition as the primary revenue stream.

Over the last four years, tuition has grown in absolute terms. Yet its share of total income fell by 10 percentage points, making up just 48% today. In its place, the university has leaned more on direct grants and investments, which now contribute about 13% each.

LUMS is not unique in this shift. Universities worldwide, especially in the US, rely heavily on endowments to generate investment income. Institutions like the University of Texas, Harvard, and Yale manage tens of billions in assets, funding operations and aid programs with relative ease.

However, what makes LUMS’s diversification different, at least in the context of Pakistan, is the nature of its bet: digital assets. When you think of crypto, the image in your mind is probably that of a retail trader — perhaps Waqar Zaka trying to grift, or some jobless guy hiding behind their screen to avoid a day’s hard work. A university, let alone one of the largest academic institutions in Pakistan, probably doesn’t make the cut.

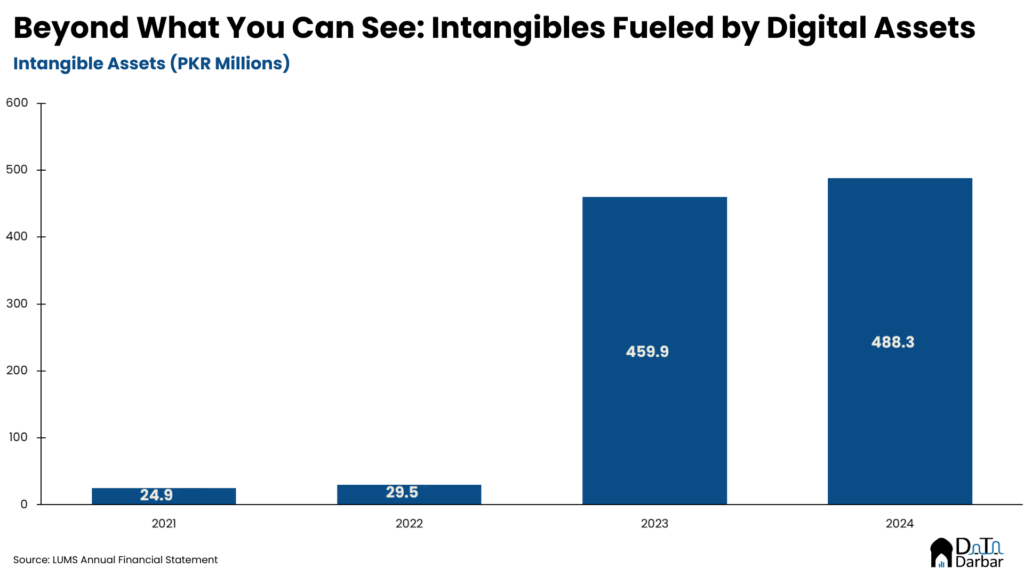

But that’s where things get interesting. Digging through the university’s financial statements, one investment stands out, and not just because of the quantum of numbers. LUMS has made a substantial bet on cryptocurrency, an asset class known for both breakout success stories and painful wipeouts. In 2023, the university’s intangible assets ballooned from just PKR 29 million to PKR 459 million. By 2024, crypto accounted for 93% of those intangible assets, and 95% a year later. That’s a heavy allocation in a volatile market.

LUMS’ crypto holdings largely stem from a Blockstack grant of five million Stacks tokens for research into decentralized systems. But the way the university manages this portfolio suggests a more serious commitment. Of the total grant, 4.9 million Stacks were transferred to LUMS’ wallet and remained there as of 2024. The university chose not to cash out for a safer USD return. Instead, it expanded its crypto exposure by buying 10 Ethereum and 3 Bitcoin.

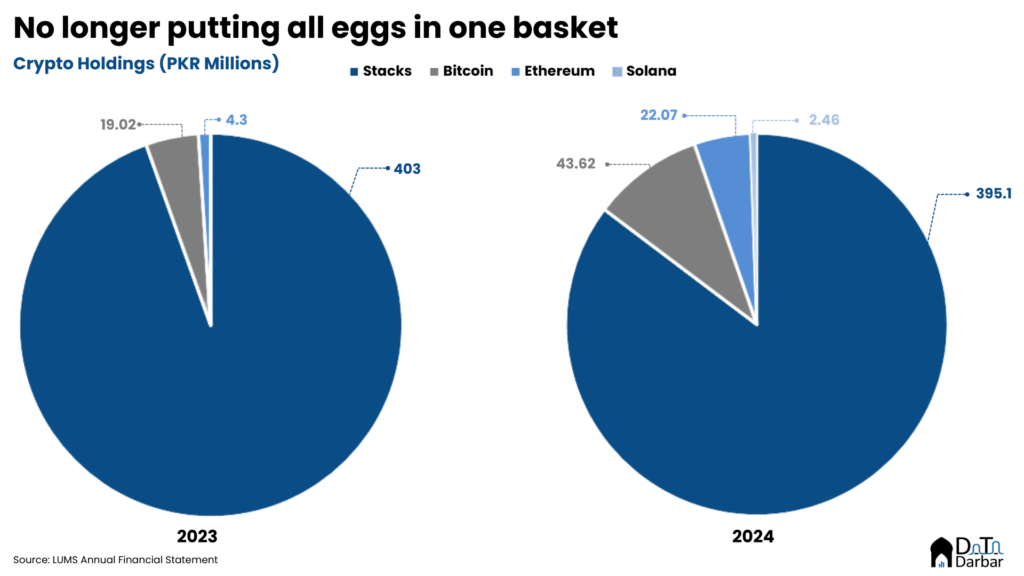

This move suggests a deliberate bet on long-term value appreciation, one bold enough to make even seasoned portfolio managers pause. A year later, LUMS trimmed its Stack holdings. The proceeds went into Bitcoin, Ethereum, and even Solana. Whether strategic or reactive, the shift hints that LUMS’ finance team got cold feet.

Now the million-rupee question: did it pay off? In 2023, the university’s crypto portfolio saw a modest gain. The opening value of PKR 408.70 million rose to PKR 427.35 million by year-end, an increase of PKR 18.64 million or 4.56%. Not bad, especially in crypto terms, where prices can swing wildly within weeks. The year included a PKR 4.73 million sale of Stacks and a reinvestment of PKR 3.84 million into Ethereum. LUMS also reported PKR 19.02 million in Bitcoin earnings, a tidy sum for a university playing in digital assets.

In 2024, the university leaned in harder. It started with PKR 427.35 million and ended with PKR 463.30 million, a PKR 35.95 million jump, or an 8.41% gain. This nearly doubled the return of the previous year. The university diversified further, purchasing Ethereum (PKR 17.72 million), Bitcoin (PKR 9.87 million), and Solana (PKR 2.46 million).

It also sold more Stacks (PKR 8.83 million), continuing its slow shift from its earlier high-conviction bet. Bitcoin earnings for the year dipped to PKR 14.72 million, possibly due to lower yields or timing of the investments. Zooming out, the two-year investment window yields a gain of PKR 54.6 million, representing a total return of 13.36%. Not a home run, but certainly not a flop either.

So, what now? It isn’t just about performance so far, it’s about what happens next. Crypto remains one of the most unpredictable asset classes, which is a problem for what is usually a more risk-averse profile. If prices surge, as they have so far, LUMS could end up looking like a visionary and provide a blueprint for other institutional investors to seek some exposure. Especially as the government continues its drive for digital asset adoption at rapid pace, clear from the establishment of Virtual Asset Regulatory Authority.

But the problem with crypto, particularly in the broader context of institutional investment, is not so much the risk-reward framework as it is about the potential exodus of capital from the country. That will remain the million-dollar question.