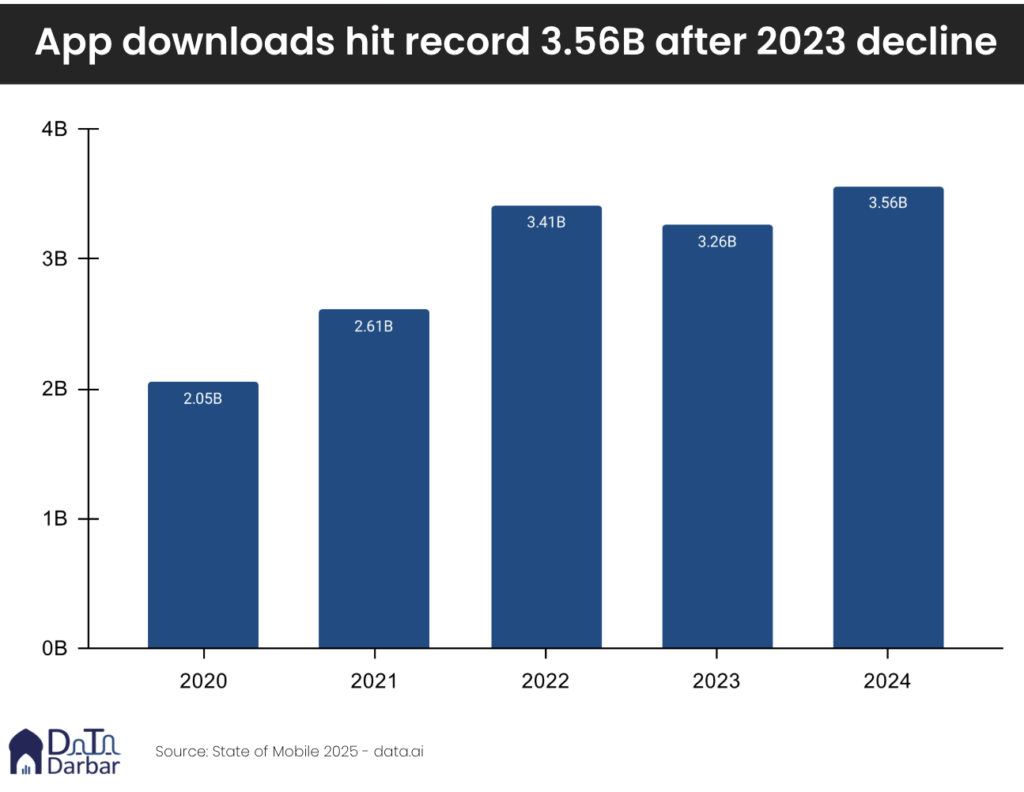

Pakistan recorded 3.56 billion mobile app downloads in 2024, marking a robust 9.2% increase from the previous year and securing the country’s position as the ninth-largest app market globally. More significantly, Pakistanis spent 79.1 billion hours engaging with mobile applications, a 14.1% surge that outpaced every comparable emerging market in the region. Globally, the mobile app industry continued its expansion with 136 billion downloads and $150 billion in consumer spending.

The surge in digital activity coincided with the expansion of mobile infrastructure. Mobile broadband subscriptions grew 8.4% to reach 134.8 million users, while average monthly data consumption per user hit 8.4 GB, nearly double the 4.9 GB consumed in 2020. Pakistan’s smartphone manufacturing sector also staged a dramatic comeback, with locally assembled devices surging 47% to 31.38 million units, accounting for 95% of national demand.

Meta and ByteDance continued to dominate the most downloaded apps chart, with TikTok leading with 32.4 million installs, followed by CapCut (27.1 million), Facebook (24.3 million), and WhatsApp (22.7 million). The communication landscape shifted dramatically as Telegram nearly tripled its user base from 4.4 million to 12 million downloads while VPN usage also skyrocketed following Pakistan’s ban on X (formerly Twitter) in February 2024. , with Super VPN downloads jumping 149% to 19.1 million and Secure VPN growing 158% to 7.6 million.

In e-commerce, Chinese newcomer Temu disrupted the market with 8 million downloads in its debut year, overtaking established leader Daraz (7.7 million). Digital payments remained robust, with JazzCash achieving 19.67 million monthly active transacting users, the highest ever recorded for any Pakistani app, while Easypaisa led in downloads with 12.1 million. The streaming sector showed maturation beyond pure download metrics. While Tamasha’s downloads declined 13.4% to 10.2 million, its monthly active users surged 61% to 17.1 million, and paid subscriptions exploded 367% to reach 1.35 million, demonstrating a shift from acquisition to monetization.

Pakistan’s developer community faced significant headwinds in 2024. Active developers dropped 26% to just 1,400 individuals, while Android app releases plummeted 55% to 1,700 titles. Game development fell 31%, with only 756 titles released. iOS development remained the only stable segment at 784 apps. In total, Pakistani developers released 2,500 apps and games in 2024.

The contraction reflects tightening registration and approval criteria by app stores, as well as developers increasingly registering accounts abroad due to payment and taxation challenges. Despite these obstacles, top locally-developed apps maintained strong performance, with Easypaisa (12 million downloads), Time Warp Scan (11.7 million), and My Zong (10.7 million) leading the pack.

Pakistan’s performance stood out across South Asia and comparable emerging markets. The country’s 9.2% download growth exceeded Indonesia (8.6%), the Philippines (1.2%), Mexico (1.2%), Egypt (-1.7%), and Vietnam (-13.6%). For engagement growth, Pakistan led the region at 14.1%, surpassing the Philippines (8.4%), Mexico (4%), Indonesia (3.4%), and Vietnam (2.6%).

The full State of Apps Pakistan 2024 report provides detailed breakdowns across all major categories and insights into emerging trends shaping the country’s digital economy.