Almost everywhere in the world, state-owned enterprises have a reputation problem, and rightly so. There’s just something gloomy about them that’s hard to shake off the moment you enter their premises. Unfriendly staff, legacy systems, and worn-down structures — nothing about these institutions conveys modernity. Yet, every once in a while, public orgs try their luck at reinventing themselves: whether through capital injections, getting external investors from private sector or venturing into new, high-growth verticals via their own funds. Not too long ago, the Pakistan State Oil (PSO) took a similar bet.

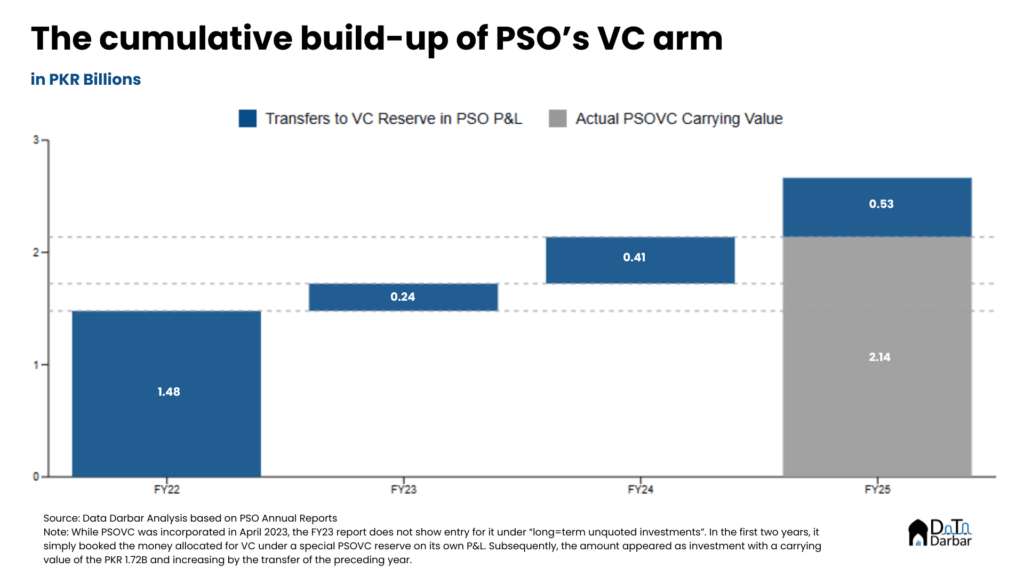

Riding on high profits amid commodity boom, the company decided to explore fresh avenues and set up two subsidiaries — a venture capital firm and a digital wallet fintech. Less than two years later, the bet on VC seems to have crumbled already — without ever making a single deal. On 29th September, the company in a notice to the bourse announced that it’s dissolving PSOVC. The why part of it is anyone’s guess. For starters, the market conditions haven’t been great lately: funding for 2024 was just $22.5M, the lowest in at least five years.

But honestly, that’s more of a supply-side constraint as most of the Pakistan-focused VCs have run out of money and are yet to close their second funds. Plus, very few foreigners are seeking exposure. Therefore, anyone with capital should be able to scoop up good opportunities without too much competition.

Capital but no conviction

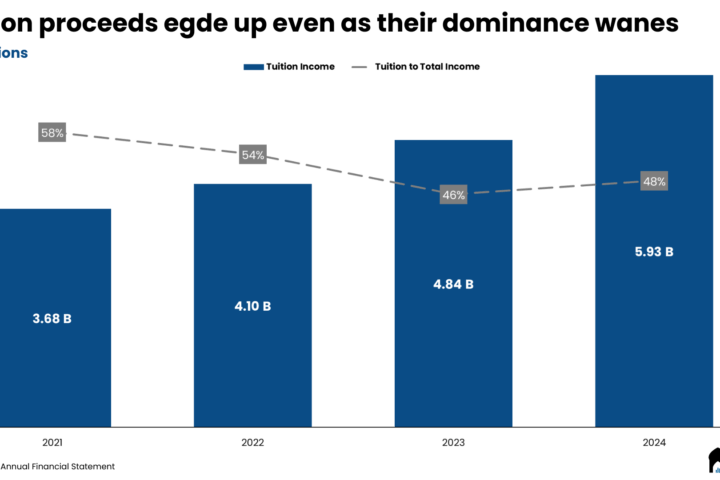

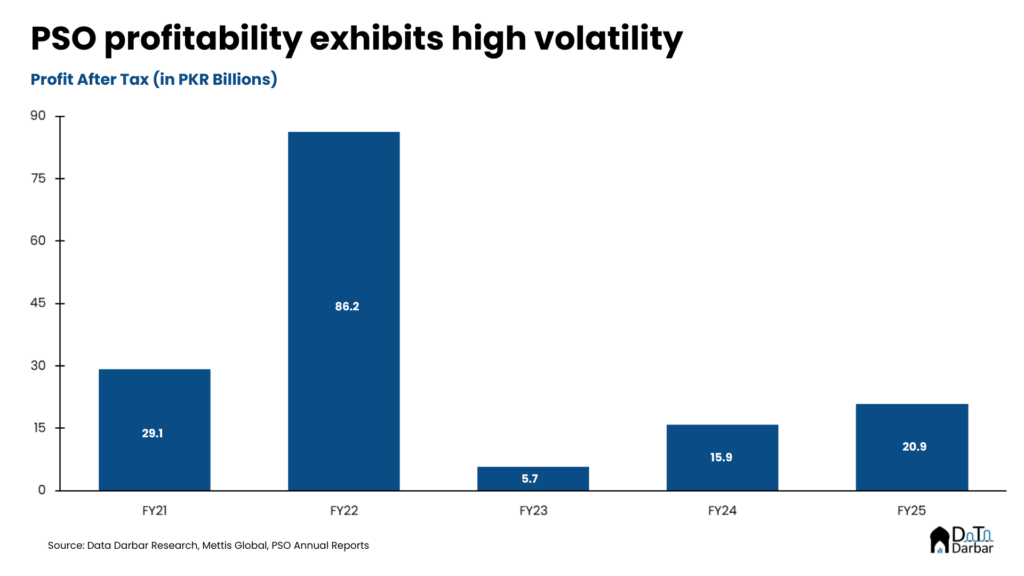

And we know that PSO does have capital. Since FY21, it has recorded cumulative profit after tax of almost PKR 158B. Yes of course, they are not all gonna be used to make VC or PE investments but as of June, the fund itself had a carrying value of PKR 2.14B. In the last four years, the company has transferred ~2% of aggregate net income to a special reserve for this purpose.

At the prevailing exchange rate, it translates into ~$7.5M fund and should be more than enough to get a few good deals, especially considering how capital-starved startups are at the moment. But as far as my knowledge goes, they never participated in any transaction. Obviously, it shouldn’t surprise anyone that the bet didn’t take off: the expectations are generally low from any state-owned enterprise but even in the private sector, we have seen such initiatives fail for a variety of reasons, be it bureaucratic red tape, misalignment with the asset class’s characteristics among other things. That said, others at least tried to get their hands dirty first before being stung by a few high-profile losses. On the other hand, PSO backed off without ever investing a penny.

All eyes on fintech wallet now

Anyway, it’s not yet the end of PSO’s adventures. Cerisma, the digital wallet, is still alive though it’s hard to keep an eye on how things are going for them. The annual report barely says anything of note and their LinkedIn profile isn’t particularly active either. However, a bit of snooping around shows that other than Farees Shah (one of the many Daraz co-founders) as the chief executive, the EMI has onboarded functional heads for finance, product and operations. They are also trying to fill up other vacancies, at various seniority levels, through this recruitment firm, Human Resource Solutions International.

More importantly, Cerisma is going by the brand “Payvay” and has joined the 1LINK network for a host of services including ATM switch, 1BILL, IBFT etc, with Bank of Punjab as the settlement FI. Other details available on the website are quite generic — as in what all the EMI is going to offer and a bit on the user journey. You know, the usual suite of fund transfers, bill payments and mobile topups, as the license allows.

The (possible) rationale

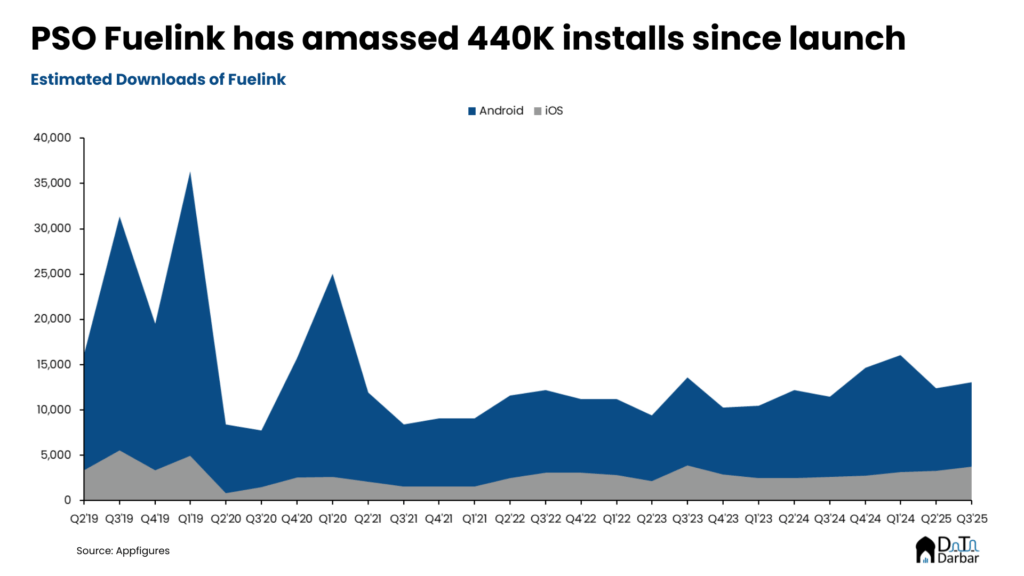

Now why would PSO even want to build a digital wallet? Well, the basic idea is to leverage the company’s 3,500+ outlet-strong retail network. Plus, they already kinda have a fintech offering by the name “Fuelink”: the app lets you manage fuel expenses, apply for a “digicash” card and get loyalty points etc. Currently, this is being done by their tech partner, Altpay, that also offers similar payment and point of sale solutions to players in retail and oil marketing verticals.

Consumer side

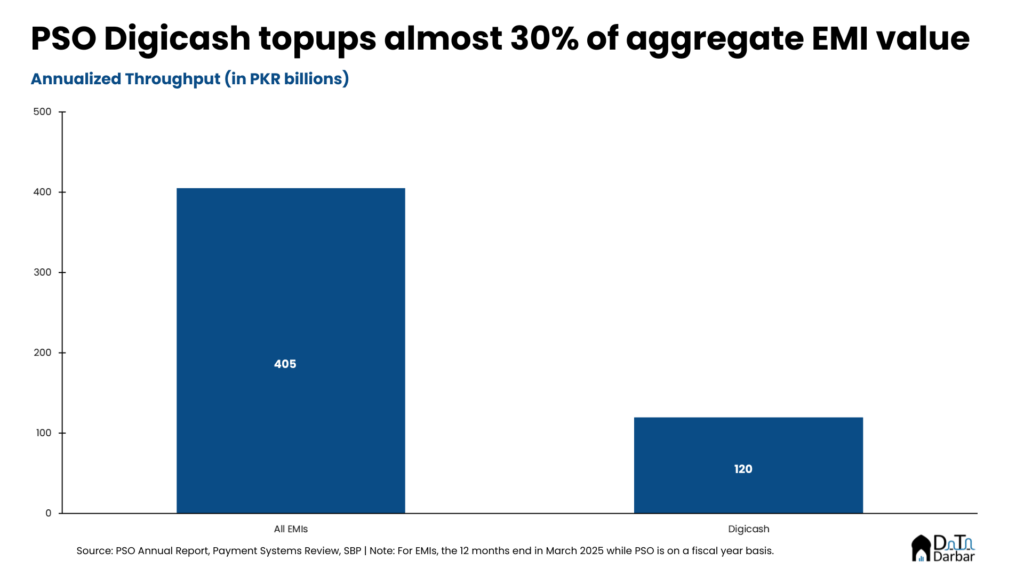

As per the latest annual report, Digicash processes “PKR 10 billion per month”. For context, all EMIs combined had a throughput of PKR 405B in the 12 months ending March. So for a single entity, it’s not at all a bad number. More importantly, these are retail transactions, quite unlike EMIs where 95% of the usage is for fund transfers. By the way, this shouldn’t include payments made via QR codes or bank cards at the counter.

If they manage to route entirety to Digicash to Payvay, here’s a rough sketch of high-level numbers:

- Monthly Digicash throughput: PKR 10B

- Assumption: 50% of topups are card-based (rest via 1BILL or other wallets)

- Card-based value: PKR 60B annually

- At 2% MDR, potential annual savings: PKR 1.2B

- Float calculation assumptions:

- 20% of monthly throughput (PKR 2B) sitting idle at any time

- Invested at 10% annualized return

- Potential float income: PKR 200M annually

- Total potential consumer-side benefit: ~PKR 1.4B

Needless to say, there are problems with the whole approach. For starters, money doesn’t usually sit for long in topup wallets as people only recharge when required and spend right away. More importantly, it’s hard to imagine PSO becoming the platform of choice for consumers while competing options are HBL, Meezan, JazzCash, Easypaisa, Nayapay etc.

Merchant side

In theory, merchant dynamics may be more favourable given PSO’s market share and possible power over its retailers. Leveraging that could generate some savings on the MDR but by how much? Again, let’s run hypothetical numbers.

- Assuming PSO processes PKR 50B via bank cards (not Digicash)

- Average MDR: 1.5% (assumed to be borne by PSO rather than dealers)

- Potential annual MDR savings by routing via Payvay: PKR 750M

- Impact on net margin (based on FY25 financials): +3 basis points

Here, we have ignored any costs related to running the fintech itself so the actual impact should be lower. Secondly, these savings will be drastically reduced as Pakistan moves from cards to account-based payments. In a recent research, Better than Cash Alliance proposed a floor MDR of 0.35% for Raast QR channel. For fuel, it will be even lower. At 0.35%, the MDR savings will be PKR 175M — peanuts for an organization this size honestly.

Sure, there would be float too and may even represent a meaningful number. I wouldn’t venture to do any back-of-the-envelope calculations because there are just too many unknowns. The following data points would have probably helped:

- Share of revenue coming from retail outlets

- Proportion of retailers availing credit and average cycle of payment

If it ain’t broke?

But the biggest caveat remains: everything is easier said than done. Building a fintech, or anything, is a long, painful and costly endeavour — marred with bureaucracy and licensing delays. Having a nationwide network is surely a benefit but is that really reason enough to do everything on your own? That too for what’s essentially a rounding error.

It’s kinda funny because PSO already has a pretty elegant solution in place on the consumer side through Digicash, without much licensing or tech hassle. Sure, the merchant end is missing at the moment but even that can be solved through partnerships — for which probably any FI would line up outside their office. But yeah, that wouldn’t sound as sexy as building a wallet. Which is what both the VC and fintech bets seemed all about: glamour.

Note: The math here is very wonkish and only meant to illustrate high-level numbers. Secondly, like all analyst notes, this one is also based on available public information and at no point did I try to get the management’s view.