Diversification is the closest thing to a free lunch in finance — the one principle every LP, allocator, portfolio manager, and yes, oversmart undergad, swears by. Venture capital, in theory, embodies this: spread bets across sectors, stages, or geographies, and let the power law do its work. Sure, the return itself would still be coming from a very select group but dealmaking leg was different. Now it’s changing at a pace we have never seen before.

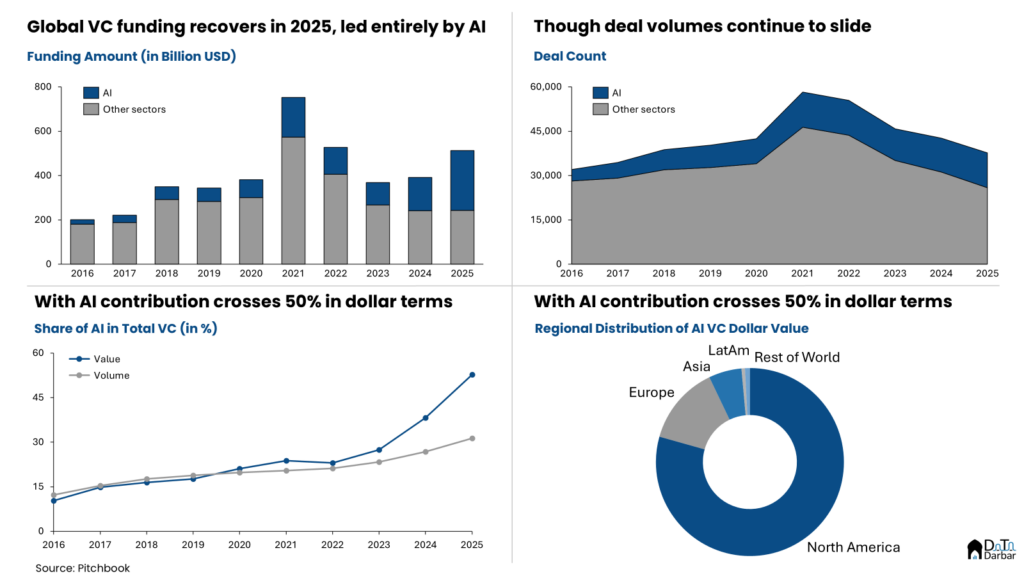

Globally, the aggregate VC dollar value witnessed an increase of 30.8% to $512.6 billion in 2025, recovering back to near-2022 levels but still 32% down from 2021 peak. But beneath the headline numbers lies the more interesting, even if completely expected, story. Essentially, it’s a tale of two halves.

Winner takes all, on steroids

On the one hand you have AI, where investment amount surged 80% to $270.2B, reaching an all-time high while rising at a 10-year compound annual growth rate of 33%. In contrast, funding to all other sectors combined managed to raise $242.4B — i.e. fewer dollars than AI — with the figure essentially flat over the previous year. Over the past decade, rest of the verticals have barely increased at a CAGR of 3.5%, with the aggregate value in 2025 standing lower than where it was in 2018.

By number of deals, AI wasn’t enough to push the aggregate figures upwards as volumes slipped to 37,745 in 2025, down 11.5% from the previous year. Nevertheless, its share in total further climbed to 31.4%, again a fresh peak. To sum up, activity in the venture world is now more concentrated than ever.

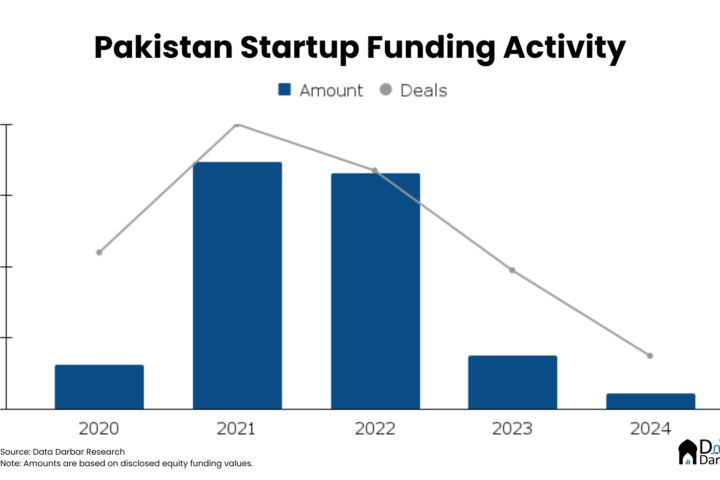

Pakistan Startup Funding 2025 | Teaser

This plays out at two different layers: first, at a geographical level, North America now accounts for over 79% of global AI funding, almost 20 percentage points higher compared to the 10-year average. Rest of the world, which includes all of Asia and Europe, managed just over a fifth. Secondly, even within the US, it’s actually a handful of companies moving the needle substantially. Nothing probably illustrates this better than the fact that the ten largest deals contributed almost two-fifths of all investment raised. Globally, it gets worse: the six largest rounds — including OpenAI, Anthropic, and xAI — contributed 49.2% of the entire dollar value poured into AI, as per CB Insights.

Public markets are no different

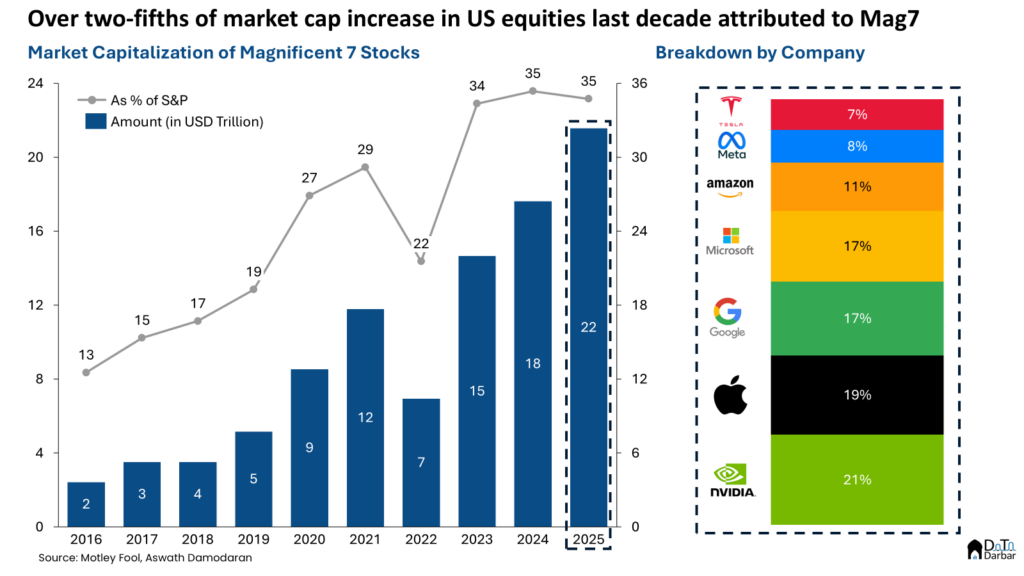

To be fair, the phenomenon is not drastically different from what we see happening in the public markets. While the US accounts for 12.5% of the listed firms, they make up 46.8% of the capitalization globally. Therein, the so-called Magnificent 7 stocks contributed 44% of the incremental capitalization in the United States between 2015 and 2025.

Again, you could argue that the rise of superstar firms was inevitable with advancements in technology and had been foretold as such. Research by Autor et al (2017) documented how technological change and network effects increasingly advantage the most productive firms, creating “winner take most” dynamics — a pattern now playing out in venture with striking clarity. Investors in tech had been prophesizing the same for decades and post social media, even us plebs could experience it firsthand. With the benefit of hindsight, the reasons may even seem intuitive. First, tech allowed the scale AND speed that was previously just not possible as it drastically reduced the labour required to produce marginal output while leveraging unparalleled network effects. Secondly, access to vast troves of data, and therefore an ability to do near-perfect price discrimination (within ad-based models), yielded margins hitherto uncommon, if not unseen.

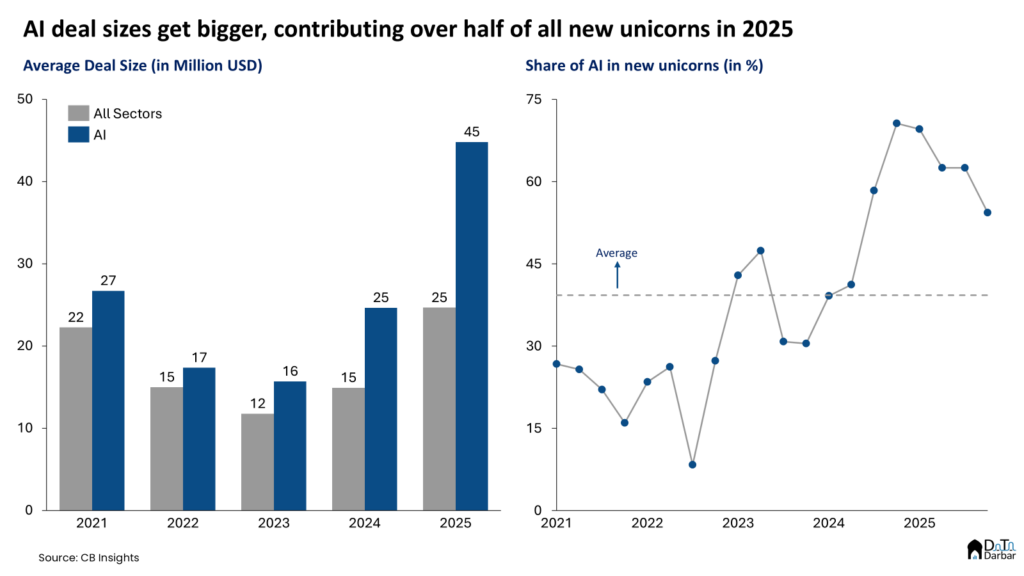

With AI, you can potentially 10x that — potentially being the key word. And for now, investors from the private markets seem quite sold on this potential. OpenAI, the poster-boy of GenAI, as we have come to know it, already commands a valuation of $500B and is eyeing a $1T valuation. The hype, whether based on fundamentals or not is a debate for another day, has pushed the average deal size of an AI company to $44.8M in 2025, compared to the overall mean of $24.7M.

However, the average deal, though indicative, is not the best proxy to assess concentration. For that, we need to look at what’s happening at the top, say 98th, percentile. Here again, the dominance of AI is glaringly obvious, making up 19 of the 35 new unicorns minted in Q4’25 — over 2x of its level back in Q1’21.

It’s the capital value chain, stupid

Understandably, the exit environment mirrors the trends in funding activity. As AI begins to dominate the funding amount, naturally its share in the exit ecosystem also rises, reaching 34.5% in dollar value and 27.2% in volume. Back in 2015, these figures stood at 1.3% and 1.8%, respectively — though it may be more because of the sector still being in the research & development phase than concentration. Though it may take more definitive research to establish that specific claim, the proportion is nonetheless unusual. For instance, fintech, a heavyweight throughout the last decade, has seen its share in exit value peak at just 24% in 2021 before retreating — never approaching the dominance AI now commands.

As far as geographic concentration is concerned, the explanation is incredibly simple. Given its size, currency and the depth of financial markets, the US is naturally the most sought-after market for capital. While this holds true across asset classes, it is glaringly evident in venture as funds in North America raised 57% of all the capital in 2025 — 21 percentage points higher than the average share over the preceding decade. Again, it’s understandable because the region has by far the most liquid exit markets, generating half of all dollar value from 2016-2025.

Such a market structure has major implications for venture as an asset class. As capital requirements and perceptions of value are pushed higher — driven by the outsized outcomes of a handful of superstar firms — the required payout threshold rises in tandem. That, in turn, confines viable investment opportunities to an increasingly narrow set of sectors, stages, and geographies capable of delivering the exponential returns the model now demands. For founders outside this narrow band, and for LPs seeking diversification, the question becomes whether VC is indeed the right model to fund innovation and generate high risk-adjusted returns?