Since Donald Trump returned to the White House on January 20, 2025, the global order seems to have changed overnight — for the second time after a brief gap. Whether that tilt leads to progress or chaos probably depends on where your ideological inclinations lie, but the shockwaves are undeniable. They have rolled through markets, institutions, and regulators, forcing governments to rethink a question they avoided for years: how should money move in a digital age, and who gets to control the rails.

Pakistan is one of the more fascinating places where those ripples are turning into seemingly momentum. Look back just a few months, and the pattern is hard to miss. Every few weeks there is fresh buzz, a new headline or latest signal that the state is no longer treating crypto like a side quest. And blaming this entire shift on one foreign political moment would be lazy, because the country already had its own intense and complicated love affair with crypto. At least among the general population, even if the policymakers had (or have) an aversion to it.

The Duality of Crypto: Illegal on Paper, Ubiquitous in Practice

To understand why the current moment feels so explosive, you have to zoom out. Pakistan’s official posture from 2017 to 2022 was basically the restrictive hammer. The State Bank drew a hard line in 2018, telling regulated entities not to deal in virtual currencies or facilitate related activity. By early 2022, a committee formed under the Sindh High Court proceedings was recommending a complete ban.

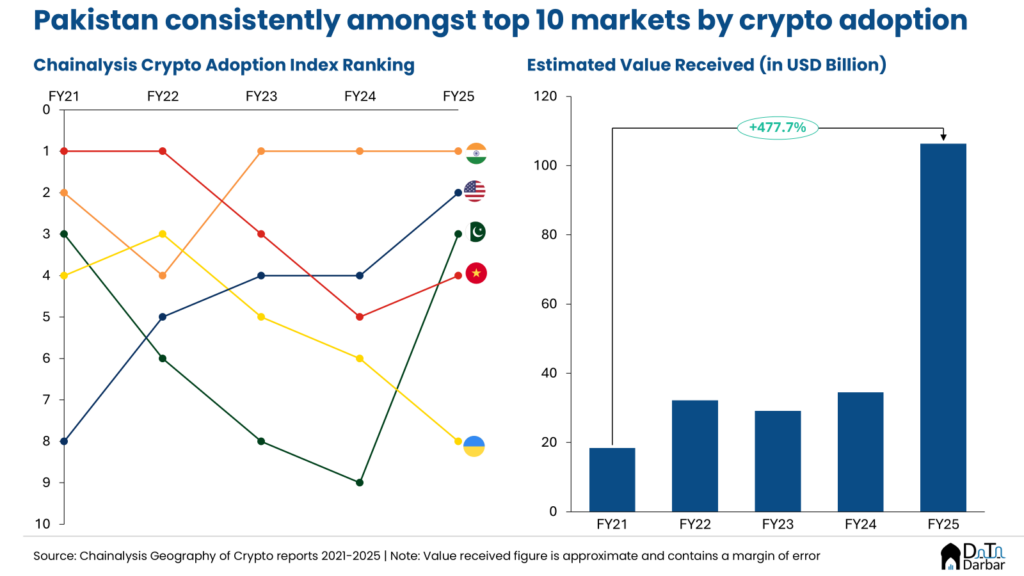

But as we all know, policy and user behaviour don’t necessarily align. So while the legal stance remained that of prohibition, it did little to dissuade people from experimenting in the world of crypto. Throughout the last half decade, Pakistan has consistently ranked among the top 10 markets on Chainalysis Crypto Adoption Index. In 2025, it secured third place, just behind the United States and India. The same data provider puts the value received at more than $100B in FY25, almost 3x compared to the previous year. Other estimates are even wilder, with the finance ministry pegging the annual crypto transaction value at $300 billion and active users north of 25 million. Now one can debate about the underlying methodology or its validity, the broader would still stand: crypto isn’t a niche hobby here.

The legal greyness did not kill crypto; it simply changed its shape. If exchanges could not easily plug into banking rails, people leaned harder into peer-to-peer, which in any case is the dominant payment channel now. Luckily for them, this was right after Covid-19, i.e. around the time when digital transactions were beginning to take off.

Naturally, reasons were varied. Some came to protect savings from devaluation and price spikes, with inflation peaking at 38% in May 2023. Others were seduced by the capital mobility, such as freelancers wanting the freedom to spend their money on foreign platforms or families tired of waiting to receive their remittances. And yes, plenty came for pure FOMO after watching influencers claiming to have made fortunes.

For the next two years, a similar amiguity prevailed where the users and usage grew while policymakers pretended to act unaware. There were occasssional raids by the Federal Investigation Agency or some crackdown by banks on specific accounts due to “suspicious activity” but nothing really serious. At last not major enough to deter people.

A change in posture

Then in March 2025, the stance officially shifted with establishment of the Pakistan Crypto Council, under the Finance Ministry umbrella. Bilal Bin Saqib was announced as its CEO and a key public face of this new posture. At the time, plenty of people shrugged and justifiably so because the country has had no shortage of councils and task forces that die quietly while bleeding an already under-resourced kity.

To be fair, we still don’t know what’s eventually going to happen and whether the momentum will sustain or not. But for now, the push feels extremely real. Within weeks of the formulation of PCC, Changpeng Zhao, CZ, the founder of Binance, was appointed as its strategic adviser. Symbolically, it showed intent that the country was no longer whispering about crypto from behind closed doors. Instead, it was inviting one of the most recognizable names in the industry into the room and rather publicly.

Pakistan’s Crypto Journey: Live Tracker

| Year | Key Development | Observation |

|---|---|---|

| 2018 |

|

De-banking Crypto Institutional access is cut off. By removing formal banking channels, crypto activity is pushed effectively into a grey/informal zone. |

| 2020 |

|

Regulatory Exploration A subtle pivot from a blanket “warning” to acknowledging that a regulatory framework for trading platforms might eventually be necessary. |

| 2021 |

|

The Legal Question The debate moves from circulars to the courts. The judiciary forces a multi-agency assessment to determine if a ban or regulation is the correct path. |

| 2022 | Hardline Stance AML/CFT sensitivity dominates the narrative due to FATF requirements. The state views crypto primarily as a capital flight and compliance risk. | |

| 2023 | Defining the Alternative Public narrative hardens against private crypto, while the CBDC is positioned as the safe, state-sanctioned alternative. | |

| 2024 |

|

The CBDC Blueprint While crypto activity for retail remained in legal darkness, SBP showed intent to experiment with digital rupee as legal tender, allowing them to manage currency in both virtual and physical forms. |

| 2025 |

|

Regulated Adoption A massive shift takes place, from banning to embracing. The focus turns to both creating the legislative framework to oversee adoption and exploring potential in mining by building data centers through subsidized energy. |

| 2026 |

|

The Hybrid Era The ecosystem matures into a dual approach: a state-backed CBDC for domestic sovereignty alongside regulated stablecoins for international liquidity. |

By April and May 2025, headlines shifted from “ban” to “build.” Pakistan signaled it would allocate 2,000 megawatts of electricity in a first phase to support bitcoin mining and AI data centres. Soon after, Bilal Bin Saqib unveiled what was framed as the country’s first government-led Strategic Bitcoin Reserve. Whether you read find it visionary, reckless, or just a marketing gimmick, the point is that Pakistan was no longer behaving like a country trying to keep crypto out. It was experimenting with ways to extract value from it, even if the clarity was missing.Around the same time, Pakistan also began courting Trump-linked crypto infrastructure, which has been a major theme throughout this newfound love affair. In April 2025, the PCC signed a Letter of Intent with World Liberty Financial, a Trump family-backed venture, to explore areas like blockchain innovation and stablecoin adoption.

The regulatory (not-so) fine print

On the legal and regulatory front, the building blocks started appearing. In July 2025, Pakistan’s central bank was preparing to pilot a digital currency. Separately, the Virtual Assets Ordinance, 2025 was enacted to create an independent regulator, Pakistan Virtual Assets Regulatory Authority (PVARA), tasked with licensing and overseeing the crypto sector.

While the Act does provide a glimpse into potential legislation, there are still more questions than answers about the role of PVARA and its its relationship with other regulators, particularly the SBP and SECP. But they haven’t done much to restrict the momentum as by late 2025, the ecosystem moved on to more announcements.

Sure, memoranda of understanding do come dime a dozen in Pakistan but by December 2025, you could see tangible stuff. None so more than Binance and HTX receiving initial regulatory clearances to set up local subsidiaries and start the process toward full exchange licensing. If you want a clean marker of “something is changing,” this is it.

And then January 2026 landed with another big announcement as Pakistan signed a memorandum of understanding with SC Financial Technologies, affiliated with World Liberty Financial, to explore collaboration on a dollar-pegged stablecoin called USD1 and its integration into Pakistan’s developing digital payments framework alongside the central bank’s virtual currency infrastructure. That is not a small headline. It is a signal that the country is thinking beyond domestic regulation and into cross-border settlement rails, the kind of infrastructure that can reshape remittances, trade flows, and how value moves in and out of the country. Of course, tech is not why we lag there and how blockchain fits into a policy obsessed with capital control would certainly be fun to witness. We’ll get into that in a later piece.

And now comes execution

The same metaphor keeps ringing true. This is not a gradual sunrise. It is a flashbang. For years, the official door was bolted shut while the public quietly climbed in through windows and back alleys, driven by inflation, devaluation, unemployment anxiety, and the fear of being left behind. Then, almost abruptly, the same state started renovating the room for guests, inviting global names to sit on the sofa, and drafting the rulebook as it went.

The only honest conclusion is that the story is no longer about whether Pakistanis will use crypto. They already do. The story now is whether the state can build a framework that channels that demand into something productive, compliant, and investable, without turning the whole experiment into another short-lived fever dream. It’s easier said than done for blockchain only adds more regulatory complications to an already difficult financial services ecosystem. But is there any other option?