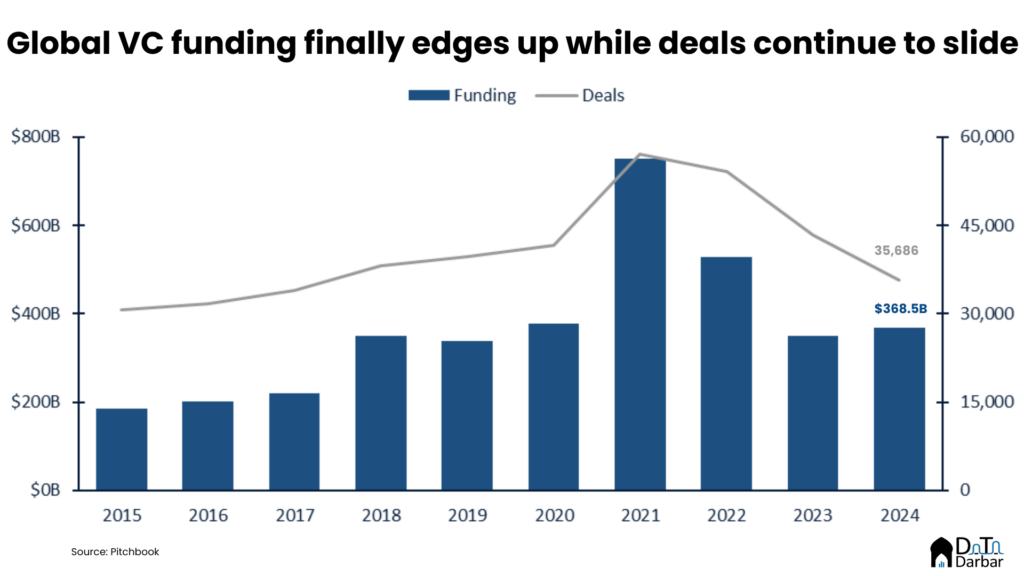

Writing on venture has been a pretty boring affair over the last few years. For the most part, the story was pretty much the same: that both funding amount and volume continue to fall, touching new lows. The headline numbers remained pretty gloomy, until AI finally breathed some life into deal activity. Both Pitchbook and CB Insights released their datasets, showing investment edged up slightly.

According to Pitchbook-NVCA venture monitor, global funding finally bounced back in 2024, inching up 5.5% to $368.5B. While the figure is still below the highs of the pandemic era boom, it nevertheless exceeded the 2019 levels. On the other hand, deal count continued to trend downwards, reaching 35,686 — the lowest since 2017.

During Q4’24, total funding clocked breached the $100B mark for the first time in eight quarters. At $108.8B, it was also the highest amount since Q2’19 and rose 34% YoY, the steepest increase 2022 onwards. However, the deal count remained depressed compared to past standards, slipping 31% YoY and clocked in at 7,023 — the lowest on record. Naturally, this means that average ticket sizes are getting bigger and all the credit for that goes to AI.

Read: Pakistan Startup Funding 2024 | Teaser

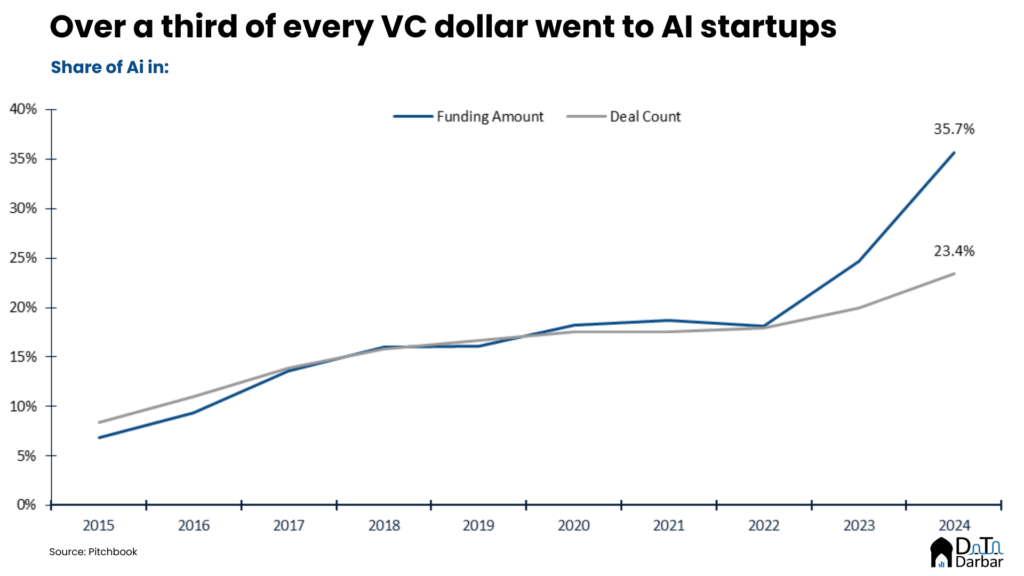

We have seen quite a few massive rounds recently, including OpenAI’s record $6.6B in October, only to be trumped by Databricks’ $10B two and a half months later. Shortly after, xAI also announced a $6B Series C, taking its total capital raised just this year to $12B, while Anthropic a cumulative $8B across two deals in 2024.

AI vs the rest

This essentially sums up the state of VC during 2024, where outsized rounds in AI drove bulk of the activity and accounted for 35.7% of dollar value — 11 percentage points higher over the previous year and almost twice compared to 2022 levels. In Q4’24, the sector’s share in investment stood at an astounding 50.8%, raising more than all others combined. Though AI’s contribution to volumes was not as dominant, it still came in at a record 23.4%. This is despite the sector’s deal count slipping to 1,818 — under 2,000 for the first time in 16 quarters and the lowest since Q3’20.

Growth-wise too, AI had a great run, surging 52.4% over the previous year. In contrast, all other verticals combined saw dollar value slip 9.9% while the number of unique rounds were down 21.1% during 2024. Though the headline percentage change paints a disappointing picture, the reality is more nuanced as it was the slowest decline in the last three years.

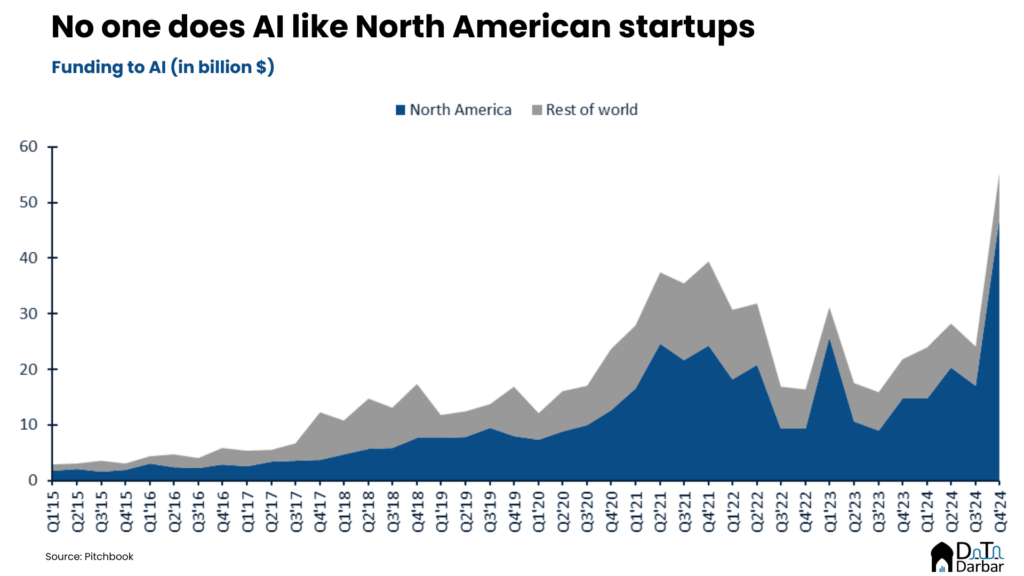

North America has no peer in AI

The regional distribution of capital shows the underlying disparities as North America received a record 58.7% of the global pie during. Its dollar value surged by an impressive 28.1% to reach $216.4B while Latin America was also up 31.6%, albeit off a lower base. On the other hand, both Asia and Europe got fewer funds than the previous year. In terms of volumes too, North America witnessed the smallest dip of 6.8%. All other regions saw deals falling in double digits, with Asia faring the worst at 24.9% decline.

Again, the answer lies in AI, where North America reigns supreme and accounted for 75.3% of all dollars and 50.3% of deals in the sector during 2024. For all regions except LatAm, the share of AI in their respective capital raised went up compared to the previous years, even if the numbers weren’t big enough to make a big dent in the global pie.

However, AI wasn’t enough to propel exit activity, which slipped 5% to $318.4B across 2,719 transactions. Asia was responsible for dragging down the numbers as it recorded a 40.4% plunge in value while North America and Europe bounced back 19.7% and 47%, respectively. On the other side of the spectrum, VC fundraising remained muted as well 1,344 funds worth $169.7B, both substantially below pre-Covid levels.