“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair.” When Charles Dickens wrote these iconic lines, he could very well be referring to venture markets where on the one hand, artificial intelligence (AI) space is experiencing a gold rush while everything else is in a crisis.

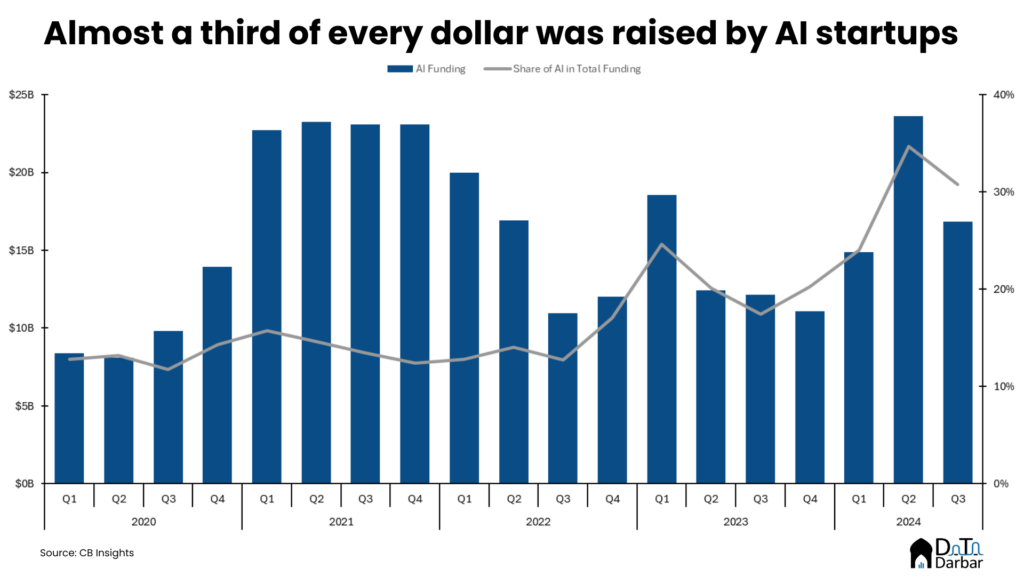

According to CB Insights, AI companies raised $16.8B in Q3’24, surging 38.8% over the same period last year. However, the amount was down 28.7% compared to the peak of $23.6B in the preceding quarter. Contrast this with the overall venture market, which continued its downward trajectory as investment reached $54.7B, down almost by a fifth both QoQ and YoY.

Basically, almost 31% of all dollar value between July and September went towards AI. The major credit for this goes to the overall slowdown in venture rather than the sector’s exceptional run. In fact, total AI funding of $55.4B during 9M’24 is still lower by a fifth compared to the same period of 2021. Except that a 20% decline is quite mild in contrast to the broader market environment.

Read: How AI dominated global funding in 2023

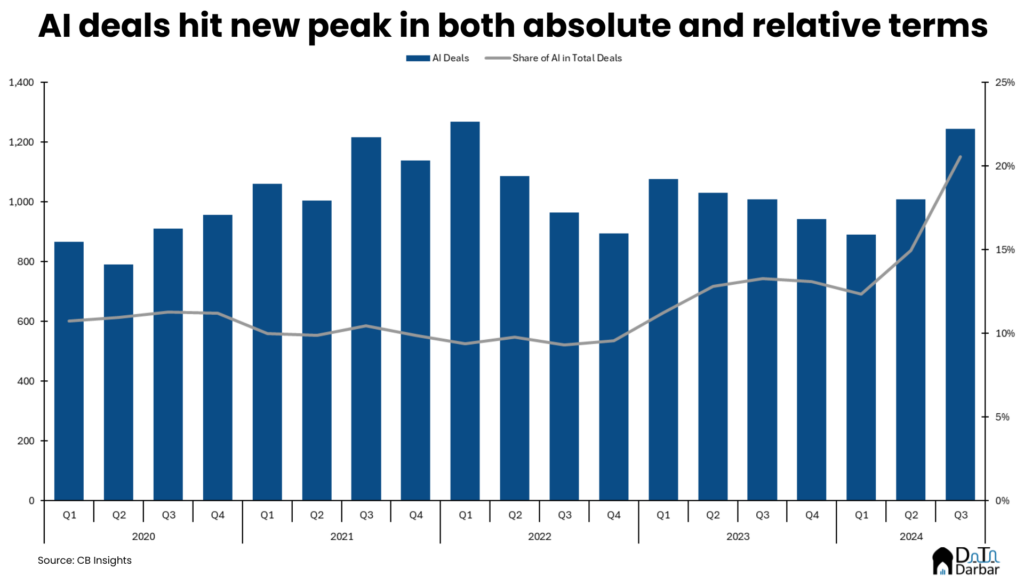

While Q4’24 certainly started with a bang as OpenAI announced a $6.6B round, it may take some effort to overtake the 2021 total of $92.1B. But you never know, anything is possible. On the other hand, the divergence is perhaps more visible in volumes where the number of AI deals scaled to 1,245 in Q3’24 — the highest since at least 2020 — even as the overall count slipped to their lowest level of 6,056.

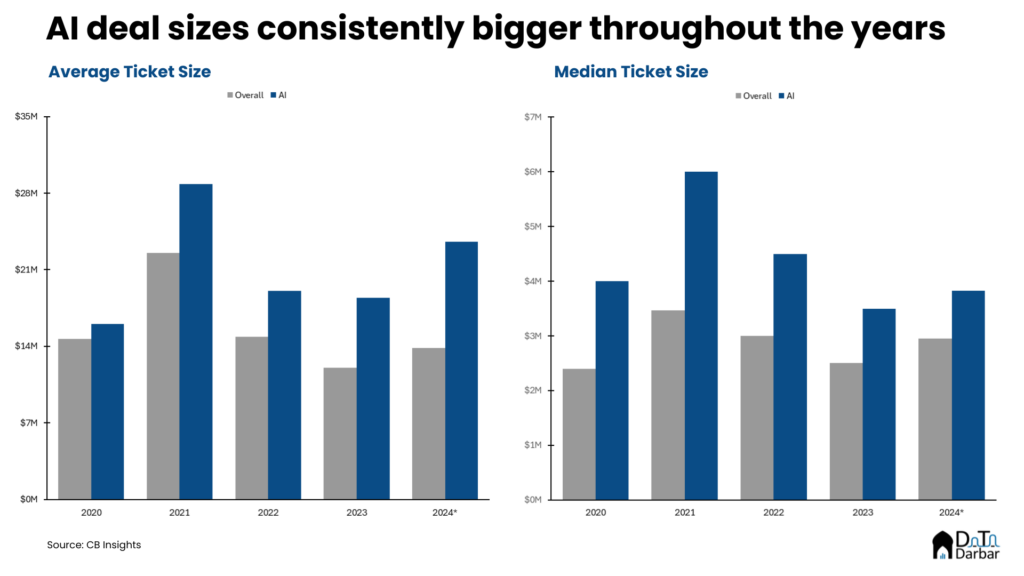

Not only are more funds and deals flowing to AI companies, but even their size tends to be bigger. The average ticket of a round in AI was $23.5M in 9M’24, almost $10M higher than the overall venture’s $13.9M. Understandably, the difference in median was narrower where the former stood at $3.8M against the latter’s $3.0M. However, this gulf is not a new phenomenon and has existed across every stage for around three years now.

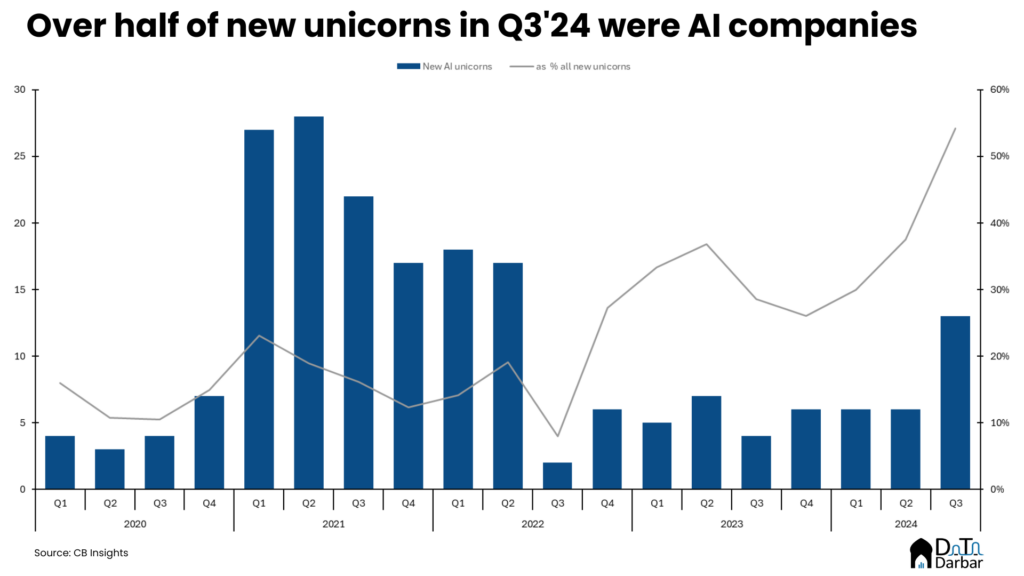

That said, AI companies have certainly been doing the heavy lifting in carrying mega rounds. Of the $81.6B raised in deals of $100M or more during 9M’24, AI accounted for $34.2B or over two-fifths. As a result, the sector’s dominance has only grown in the unicorn charts.

In fact, 13 of the 24 new companies that achieved $1B valuation during Q3’24 were from AI. Put another way, the latest quarter saw more AI startups become unicorns than all other sectors combined. Four of the five biggest equity deals during Q3’24 were in AI, including the $1B round by OpenAI co-founder Ilya Sutskever for Safe Superintelligence.

The question is: how long such momentum can be carried because the exit environment still remains lacklustre? Particularly in AI, mergers and acquisitions activity was at a seven-quarter low of just 62 deals. Is the capital patient enough or are these bets going to drag fund performance of VCs in the coming months? Honest answer? No clue whatsoever. Official response? Some fancy words to say: it depends.