Not too long ago, Pakistan was a basket case of financial inclusion. As of FY17, the country had only 69M accounts with formal financial institutions, of which only 50M were unique. But things have changed drastically since then, even if the story hasn’t been told right.

By FY24, the total number of accounts had reached a healthy 211M with 91M of them being unique — or almost 60% of the adult population. That’s massive progress, made possible not through legacy financial players, but rather the branchless banking institutions. In other words, most of this improvement has been enabled through the growing penetration of technology. Seven years ago, 42.3M of all the accounts belonged to scheduled banks and only 27.3M were branchless. Since then, while scheduled bank accounts more than doubled to 90.8 million, branchless accounts jumped 4.4x to 120 million by June 2024. Put another way, almost two-thirds of the new accounts during this period are thanks to the aggressive push from players like JazzCash and Easypaisa.

While there’s no denying technology’s impact in unlocking scale, especially in financial services, we tend to ignore the value equation mostly. Digital may be great in reaching tens of millions of users, but at least for now, they are nowhere near worth as much as offline customers. It’s a pretty global problem — one that digital banks around the world are trying to tackle. Just consider the fact that the 120.3M branchless accounts had total deposits of PKR 138.9B as of June while a smaller customer base with scheduled banks held more than 100x that amount: PKR 14.2T. As a result, the difference between the average balance of a mobile money account versus that of a scheduled bank is staggering: PKR 1,155 versus PKR 153,142.

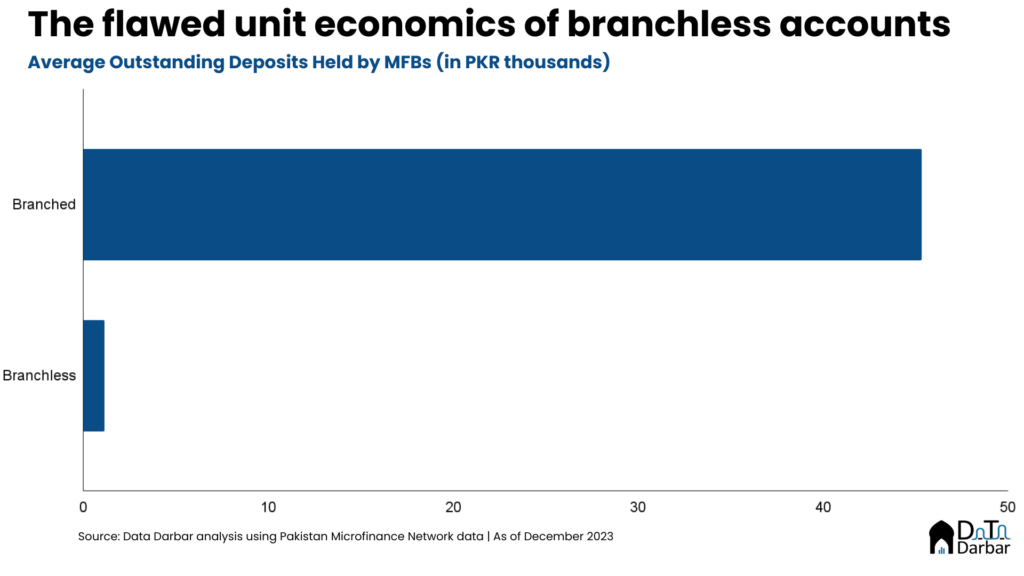

To be fair, this is not a great comparison considering how each of them serves quite different customer segments. However, the disparity between the value of offline and online users persists irrespective of the underlying license regime. While the data for scheduled banking is not available at such granularity, luckily it’s possible to do the comparison for microfinance banks.

As of December 2023, a microfinance customer through the branch had on average PKR 45,327 in their account. In contrast, the branchless user held a deposit of just PKR 1,150. Put another way, one branched client is worth 40 branchless consumers. Of course, there would be a big difference in their respective acquisition costs — such as the expenses to set up the physical infrastructure, sales staff, utilities, etc.- which will reduce the gulf. Though there’s no hard data here, it wouldn’t drastically change the equation, at least to the magnitude of 40x.

To be clear, this problem is not specific to Pakistan. Banks around the world face a similar problem. According to an analysis by McKinsey, branch customers were responsible for 55% of the new accounts but 80% of the incremental deposits in Asia Pacific during 2023.

While digital financial services entail a lot more than deposits, I have limited my lens to this metric for a good reason. Firstly, its data availability is quite comprehensive and granular. Secondly, Pakistani banks have historically prioritized deposit maximization, barring the recent instances where some institutions imposed fees on accounts exceeding PKR 1B. Therefore, for digital adoption to truly add economic value to the bottomline, deposits per customer would need to be optimized. Perhaps the industry is not focusing on this metric right now and looking to maximize volume-driven indicators like users and number of transactions. However, once the ecosystem matures, unit economics would become a lot more important as the concerned department or group would have to prove itself sustainable and provide financial returns to the bank.

Currently, the digital channels of Pakistani banks are no more than an electronic money institution — where a customer effectively performs three functions: fund transfers, bill payments, and mobile top-ups. For anything else, you almost always have to go to the bank. The only difference is that they don’t have restrictive limits imposed on them, as digital wallets do. Nonetheless, it limits potential monetization avenues to just payments, whose economics are far from lucrative — especially with existing transaction volumes in scheduled banking. To be fair, some players have tried to expand their scope and brought in new products, in search of the financial super app dream. But at least for now, customers aren’t digging it.

The financial superapp pipe dream?

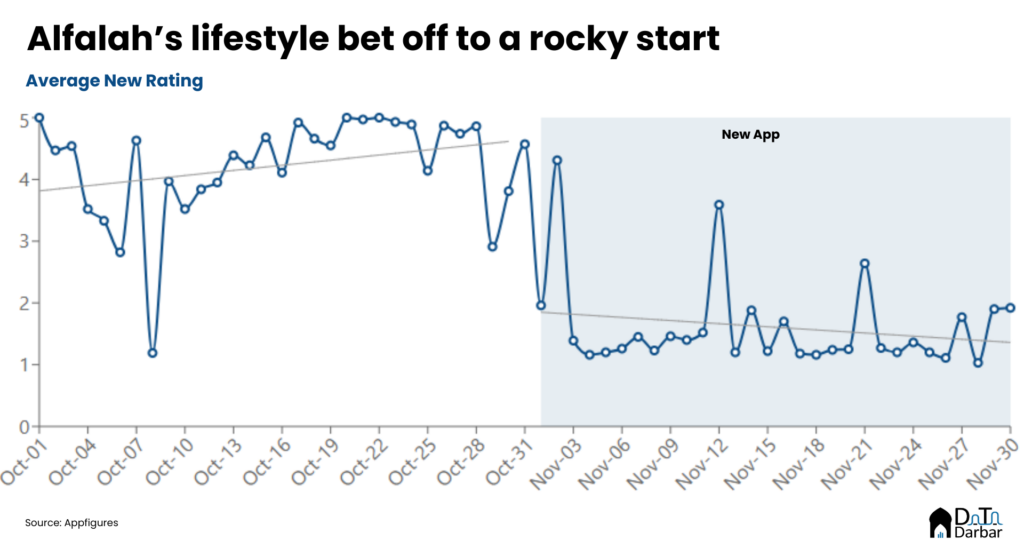

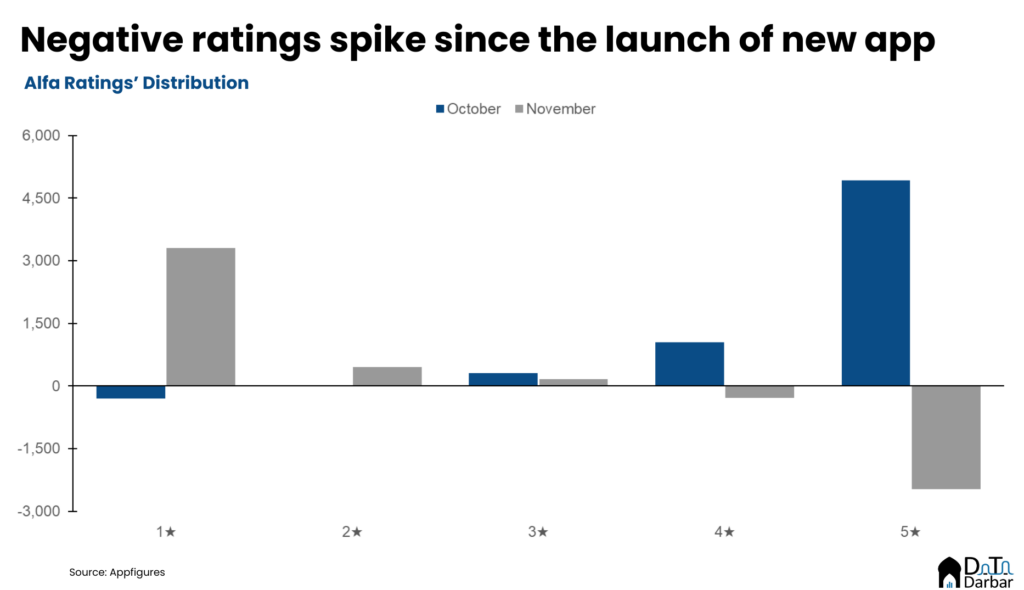

Take the case of Alfalah, which recently unveiled a new lifestyle app amid a lot of hype. This was just one among a series of measures by the management to drive better engagement through its platforms, whether online or offline. However, the early results don’t paint a great picture. We looked at the new ratings of Alfa one month before and after the launch of the updated app to gauge the sentiment.

Between Oct 1 and 30, Alfa’s median new rating was 4.51. So by and large, customers were quite satisfied with the product. But then came the new app and for the following month, the median daily new rating plunged to 1.32 — less than a third of its preceding levels. During this period, 1- and 2-star ratings shot up by 3,307 and 456 while the count of 4- and 5-stars plunged by 278 and 2,472, respectively.

Note: In case you are wondering how the number of app ratings can be below zero, here’s an explanation.

The point here was that with respect to technology, it’s not like banks haven’t tried things or shied away from spending money. The problem lies elsewhere. Is it a skill issue? Execution? My own explanation is a lot more simplistic and contentious: the industry’s DNA is just not cut out for anything other than collecting deposits from branches and then handing them over to the treasury.

Spon on,

The legacy banking industry is like the very successful, for their time, industries, like railways or land lines. They will always be a need and a core niche, but this is not where innovation or market scale lives anymore.

Painful reckoning is coming, as it always does.

Excellent insight, as always,