There are industries which are considered sexy and then there are those that are not. Finance, technology, entertainment etc come under the former while the latter includes the boring ones like education or health. It’s not necessarily because of their underlying unit economics but rather the perception. You’d have production houses with all the glamour yet struggling to survive against universities minting money and still not hip.

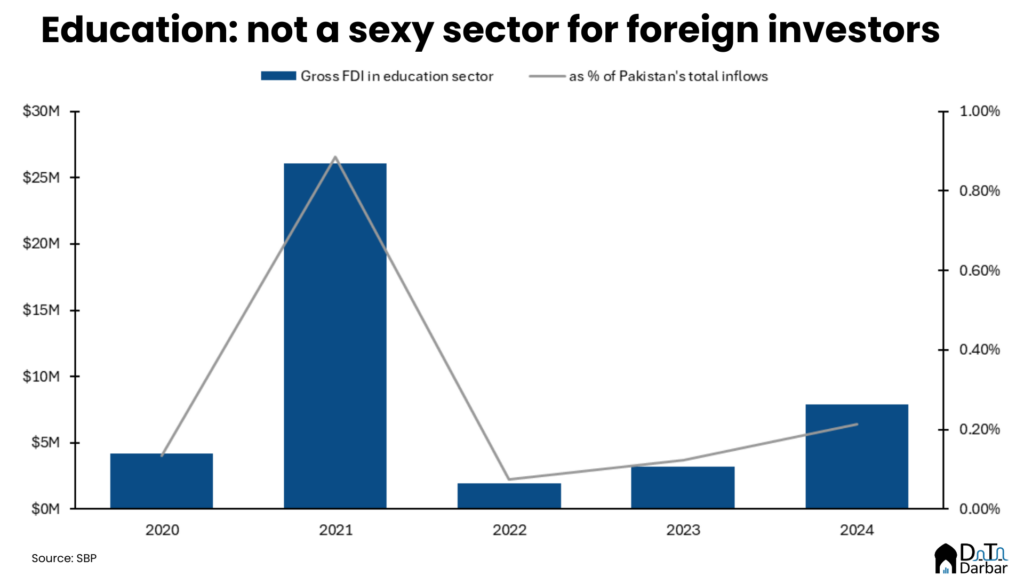

For better or worse, these vibes matter when it comes to capital allocation, where education has traditionally not been the favourite. Between 2020 and 2024, the sector has attracted gross foreign direct investment of only $43.3 million — or a mere 0.3% of the aggregate inflows in Pakistan.

Local institutions fared scantily better, with the sector’s share in outstanding private business financing at an insignificant 0.5%. That is until banks needed somewhere to park their funds in order to avoid the additional tax on advances-to-deposits ratio. All of a sudden, educational institutes were raking in more money than they had ever seen before.

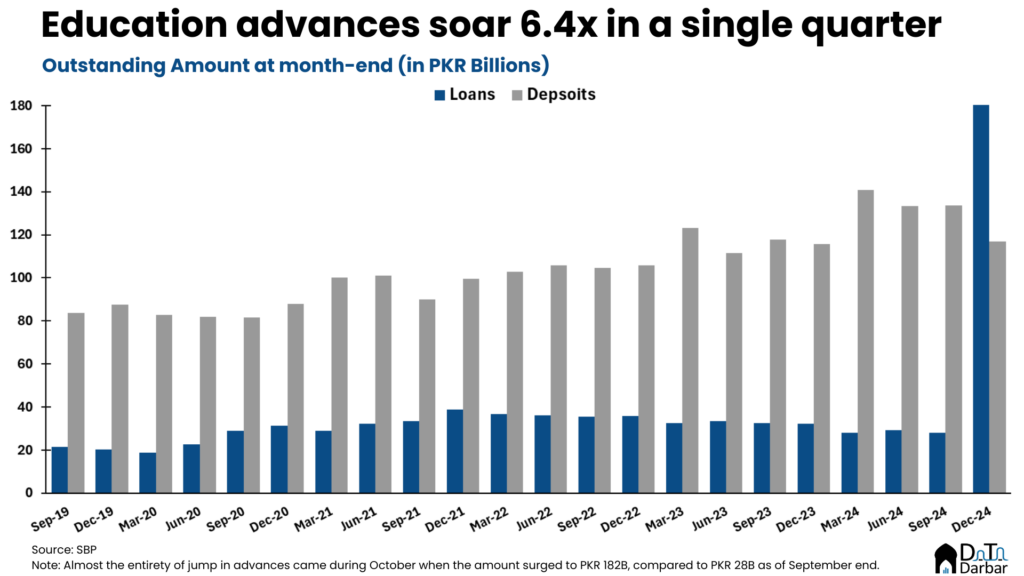

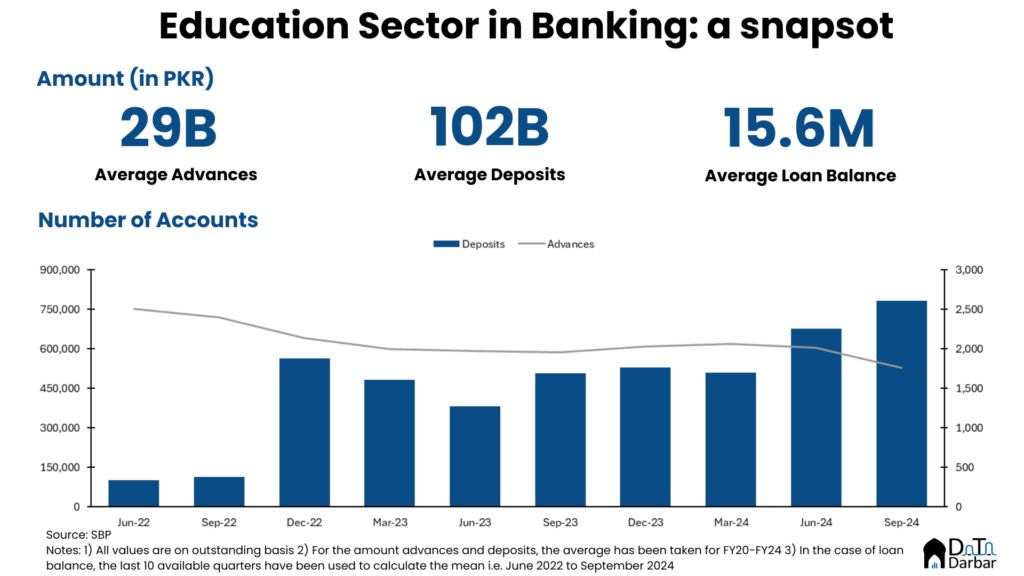

Between August and December the sector received net loans of PKR 152.9B — against the average monthly outstanding loans of PKR 29.4B between July 2019 and June 2024. But comparing to past levels doesn’t tell the whole story so we looked into the finer details of where the financing went and contextualized it with the sector’s other indicators.

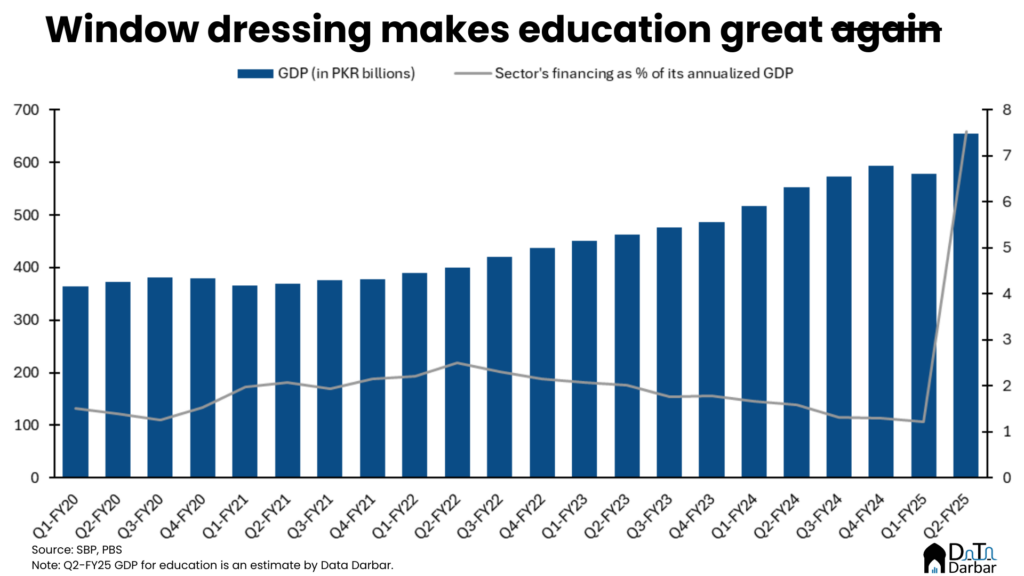

Over the last five fiscal years, education has held average deposits of PKR 101.8B. This means that for every rupee kept with banks, they got 29 paisa as loans. This is worse than the ADR for overall private sector businesses, where manufacturing helps pump up the ratio in part thanks to subsidized financing schemes. Even within services, the metric was low compared to the broad category average of 55%. Another way to look is through credit as share of sectoral GDP, where education financing averaged just 1.8% during FY20-FY24.

Read: Banks’ winter of window dressing and who benefited from it

A new false dawn for education

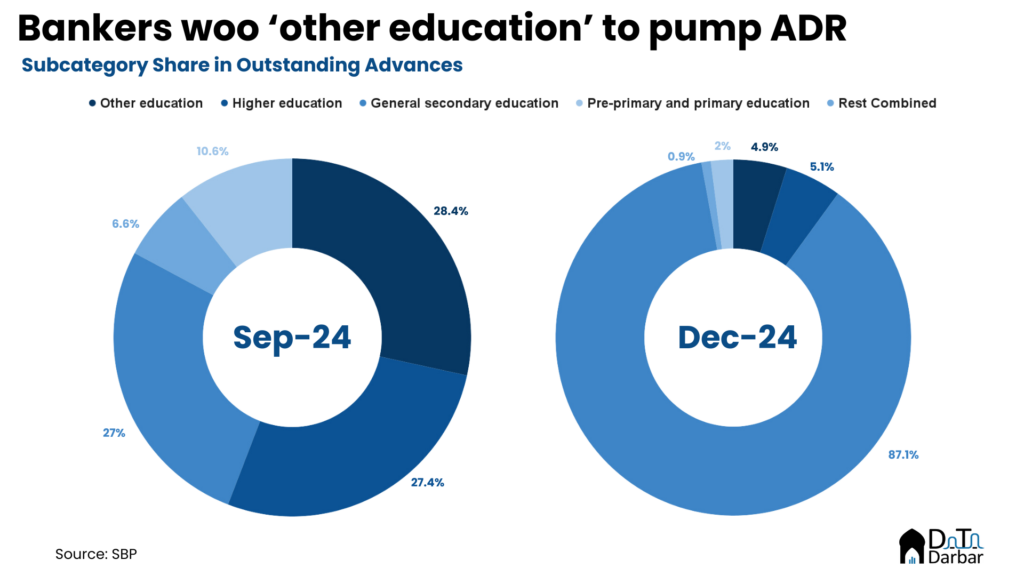

But come October, both metrics shot up like never before: ADR to 136.1% and then further to 154.9% while financing-to-GDP reached 7.8%. That’s too big a jump to ignore. Luckily, the SBP publishes sub-category level information, giving us a peek into which particular segment all this money went to. It classifies indicators under the following: pre & primary, general secondary, technical & vocational, higher, sports & recreation, cultural, support, and finally, “other”.

It takes no genius to guess that ALL the financing was directed towards “other”. I mean every penny of it. As per International Standard Industrial Classification, this group “includes general continuing education and continuing vocational education and training for any profession. Instruction may be oral or written and may be provided in classrooms or by radio, television, Internet, correspondence or other means of communication. This group also includes the provision of instruction in athletic activities to groups or individuals, foreign language instruction, instruction in the arts, drama or music or other instruction or specialized training, not comparable to the education in groups 851– 853.”

All roads lead to window dressing

Must be hell of a business, right? Not quite. In terms of deposits, the two largest segments within the sector are higher, and pre & primary education. ‘Other’ comes in a somewhat distant third. By number of institutes, the trend was slightly similar — partly thanks to government — with primary and secondary schools naturally the largest categories.

Unfortunately, there is no data on how many “other” education institutes exist but anecdotally, it’s not a lot. Admittedly, there seems to have been a surge in such organizations lately, like those upskilling platforms teaching you how to earn in dollars through Amazon or Upwork. But it’s highly unlikely that they would be 1) big enough already to absorb such liquidity or 2) possibly even documented to clear banks’ KYC requirements.

The math ain’t mathin’

Let me put into context the big enough part. In the last 10 quarters, the average outstanding loan to education businesses has stood at PKR 15.6M while the number of borrowers is almost 2,100. Now, for banks to lend so much capital to the sector requires either the volumes or the mean to go up substantially. I mean by an order of magnitude.

Based on September’s 1,760, banks needed to find 9,620 additional borrowers during the last quarter. The only problem is that there aren’t enough education companies registered with the Securities and Exchange Commission of Pakistan. Did the money trickle down to entities without formal incorporation? Alternatively, the mean size of the loan should have surged to 102M.

Obviously, the simpler explanation is that only a select few companies got lucky (read: willingly participated in window dressing). The whole point of this rambling was not to reveal something unknown but rather just highlight the shit going down in our banking system. Preliminary private sector credit already shows a reversal of PKR 234B during the week ending Jan 17th. In time, the sectoral breakdown will also become available, confirming what was always obvious, but who’s looking anyway?