For a long time, I have strongly believed that newsletters are the optimal channel for media distribution. After all, they most closely replicate the newspaper experience where everything worth reading is fit into a defined space and there’s no need to overwhelm yourself by navigating through a clunky website. Yet, as this small startup got slightly less smaller, our own newsletters took a backseat and my personal writing output greatly affected to prioritize client work. I mean, there’s not a lot of incentive to churn out detailed, well-researched pieces with sources linked only to have someone fight under my LinkedIn posts.

But for now, I plan to revive this space and push myself to write more and leverage insights from the graveyard of datasets that piles up on my laptop. The main goal here is to build that consistency and produce content regularly. But I don’t want to overcommit here with a set frequency so this newsletter can be quite arbitrary, at least initially.

Global funding

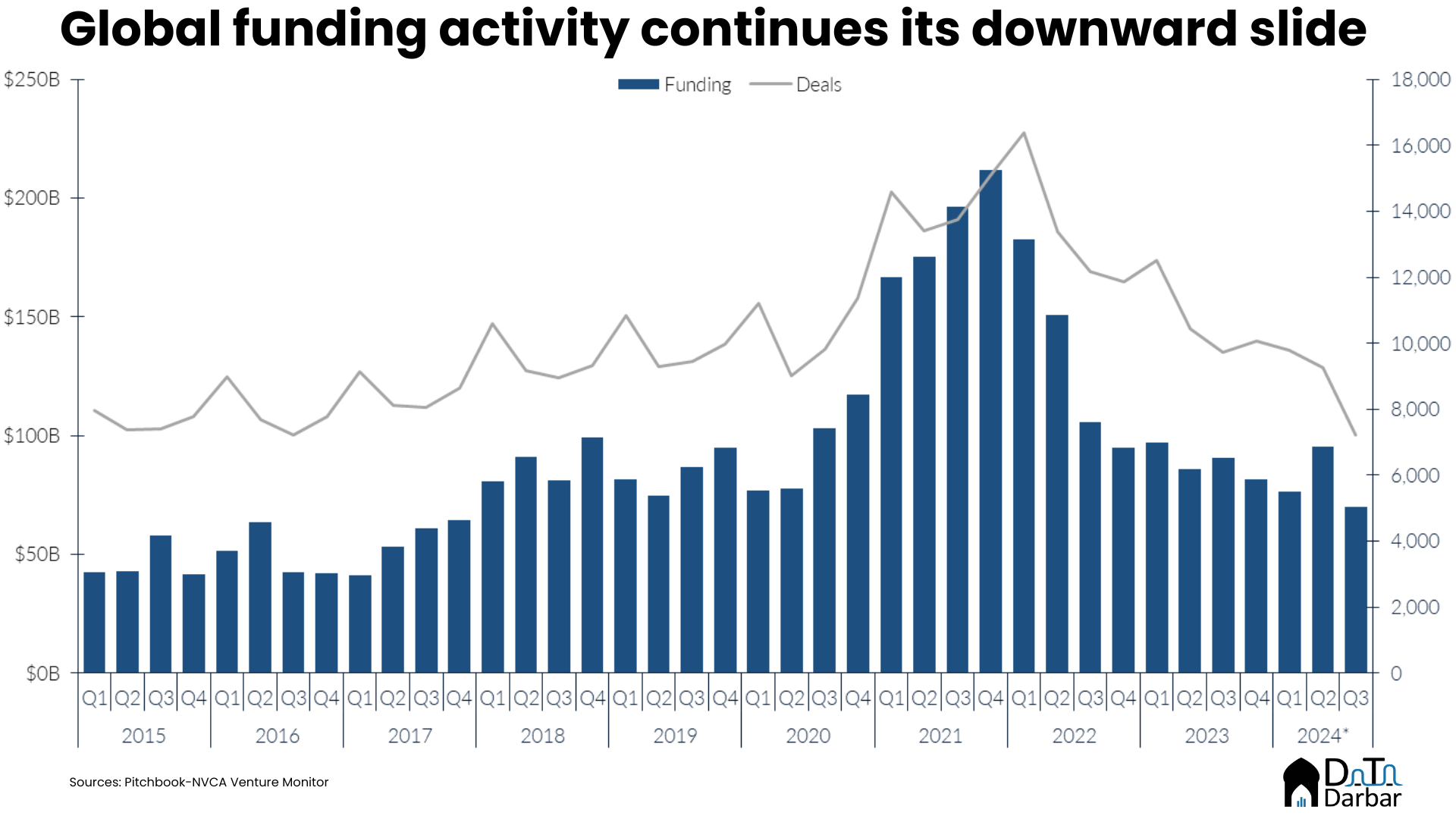

Everyone and their uncle knows that the last couple of years have been rough on venture, not only compared to the highs of 2021 but even before that. The latest quarter was just more of the same, as global funding clocked in at $70.1B — the worst amount since Q4’17. If that wasn’t bad enough, at 7,227, the number of deals reached the lowest level since at least the beginning of 2015, the earliest Pitchbook data is available.

While this decline was largely broad-based, some regions felt the shock more than others, with North America being the only one to post growth over the same period last year. The rest all declined both QoQ and YoY. Asia, in particular, was hit hard as funding reached $14.9B across 2,143 deals in Q3’24, down 51.4% and 31.6%, respectively compared to the same quarter of 2023.

Let’s put this slump in context a little better. Compared to the peak levels, Asia’s funding has nosedived by 78.5% and the Q3’24 investment value is almost on par with Q1’17 levels. While LatAm fares worse, at 86.3%, it’s mostly because of a much smaller base. Contrast this with Europe and North America where capital raising is either on par or above the 2020 values.

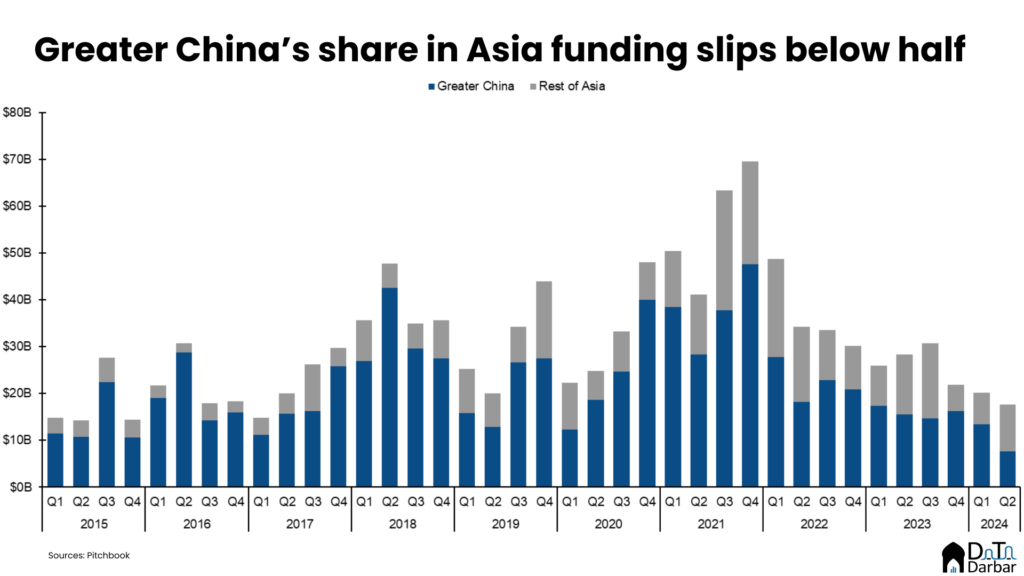

Why is this? Just glance over the country-level data and you have a clear answer. Over the last few years, Greater China (i.e Taiwan and Hong Kong included) have experienced a sharp pullback in funding with amount plunging to $7.7B in Q2’24. This is the the first time since at least 2015 where its value has slipped below 10 digits and the share in continent’s aggregate is under 50%.

Pakistan update

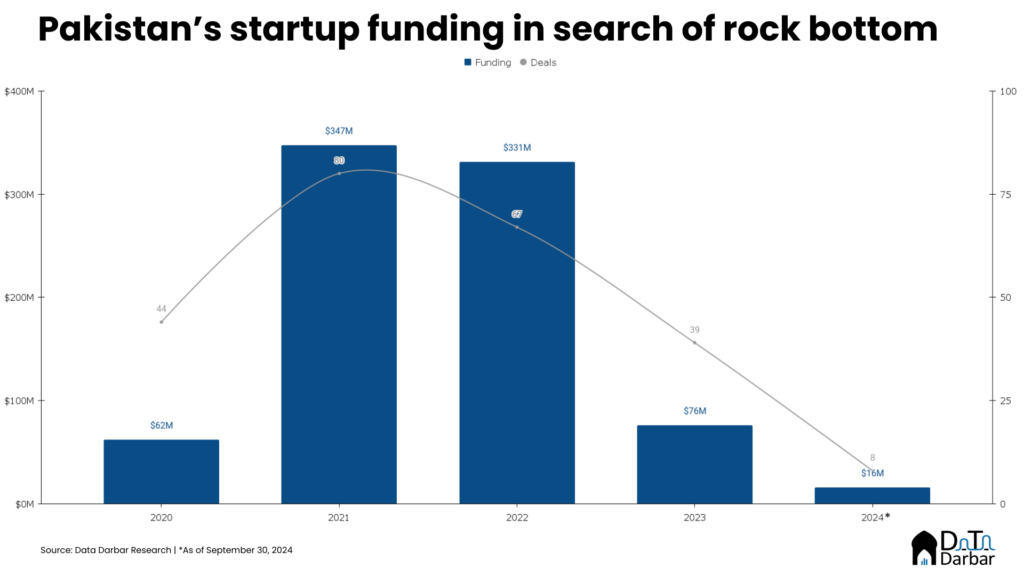

There was once a time when we used to do a quarterly review of Pakistan’s funding activity but the spell has been so dry that there’s barely anything to cover. Or at least that was the case in the first half of this year, when the total disclosed investment stood at a mere $1M. In Q3’24, things looked a little better with $15M raised, excluding Myco’s $10M Series A.

The non-existent values obviously inflate growth on a quarterly basis but the Q3’24 amount is also almost twice compared to the same period last year. Then again, $8M in itself is too small a base for percentage differences to matter. It doesn’t help the cause that three of the announced deals in 2024 did not have an accompanying disclosed amount, further understating the dollar value.

Over the same nine months, KSE-100 was up 25% and briefly crossed the 86,000-mark. But unfortunately, there is no connect between venture and the public markets. The former remains entirely dependent on small foreign funds who came to Pakistan during the frenzy days and pulled out soon after. On the other hand, local capital is all but missing in the startup ecosystem.

Profits galore

That is actually a little ironic because the last few years haven’t been too bad for the listed companies at least. Corporate profits for the top 86 companies in KSE-100 stood at PKR 367.2B during Q2’24, up 8% YoY, according to data compiled by Topline Securities. Expectedly, banking was the dominant sector, accounting for PKR 133.1B, all thanks to the Government of Pakistan.

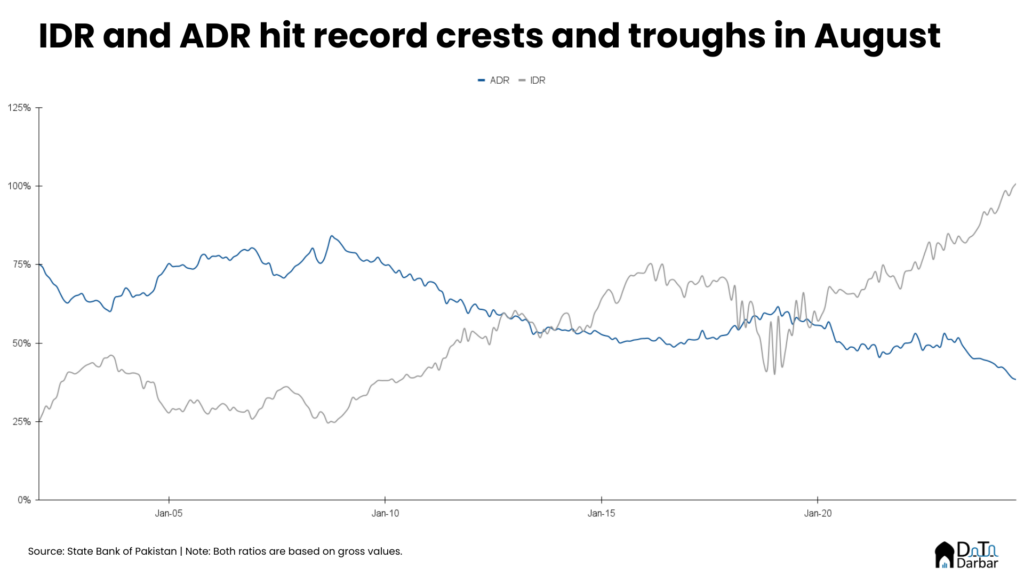

While banks in Pakistan have always been more inclined towards giving their money to the sovereign as against lending to depositors, the last few years have been extreme even by historical standards. In August, the investments-to-deposits ratio crossed 100% — meaning they were now borrowing from other financial institutions, including the SBP, to buy treasury securities.

In fact, borrowings from other financial institutions have increased at a 10-year compound annual growth rate of 25.9%, more than twice as fast as deposits at 12.6%. As of Jun’24, they had ballooned to PKR 13.2T, accounting for 27% of all liabilities — a 20 percentage point jump over the last decade. But as always, aggregates don’t tell the whole story, which you can read in our review of banking in Q2’24.

This is it for today, who knows I will appear in your inbox again tomorrow with more fun data.