For decades, Pakistan has struggled to bring a large part of its population into the formal financial services net. Economic consequences aside, the biggest casualty of this is how we watered down the benchmark for acceptable levels of inclusion. As long as you have a bank account or even a more tamed-down digital wallet, you’re cool. Kinda like how we measure our literacy rates.

So what ended up happening was that in our obsession to get those accounts opened, we ignored everything else that really comprises financial inclusion. This is most applicable to credit, where Pakistan is arguably one of the biggest laggards, not just in the region but globally. For example, our private sector credit to GDP stands at only 14.8%, far lower than Egypt’s 30.8% or Bangladesh’s 39%.

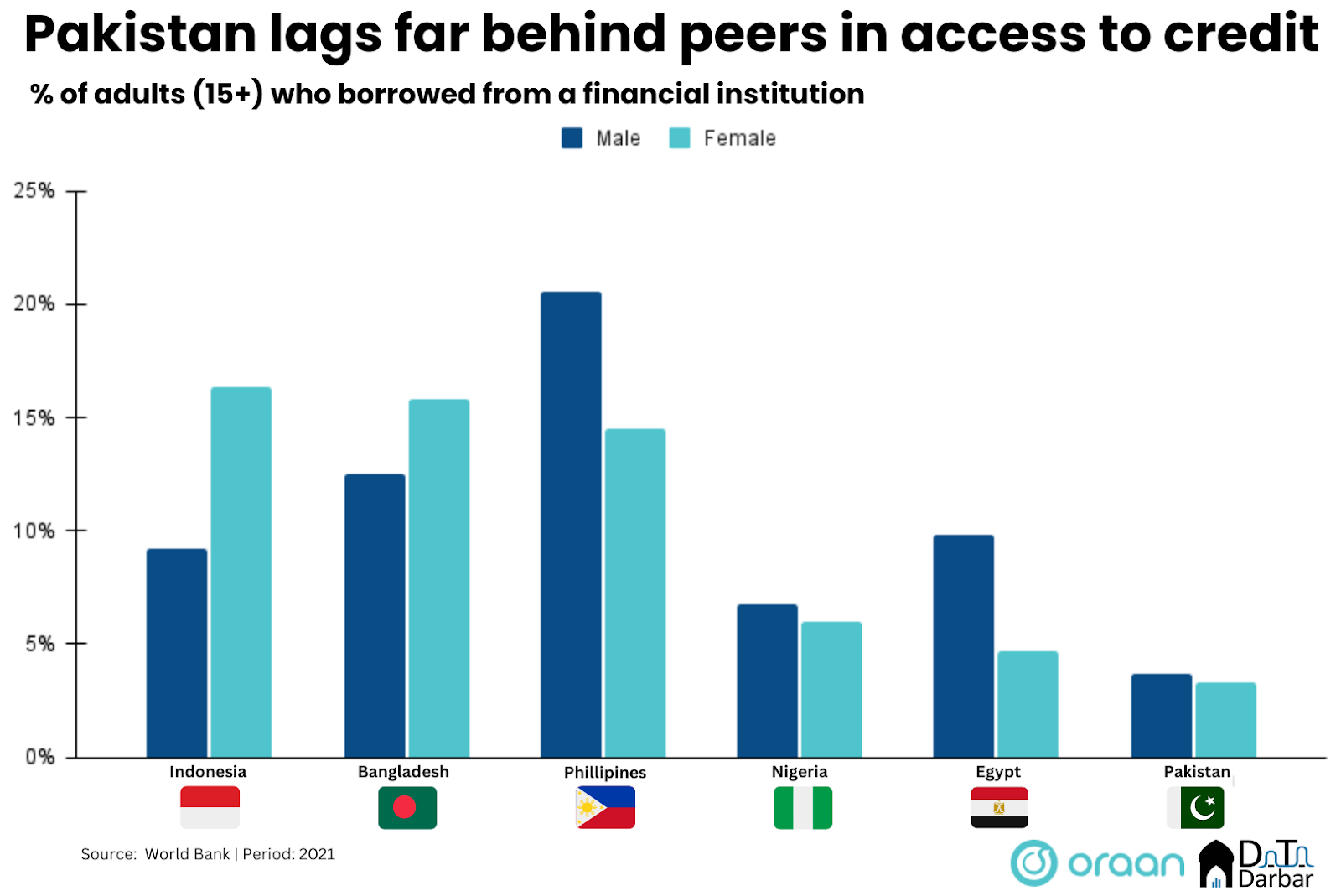

Most of that amount goes towards the few big corporations, and very little, just ~10%, finds its way to individuals. As of July 2023, the total outstanding consumer financing portfolio of scheduled banks stood at PKR 859.7B and is on the decline amid a high interest rate environment. And no matter how bad the overall situation is, it’s inevitably worse for women. In fact, only 3.28% of adult females in Pakistan had borrowed money from a financial institution, according to World Bank’s Findex. This is considerably worse than all peer countries.

While one can deliberate on the survey, the supply-side data isn’t too comforting either. Well, whatever little of it exists anyway because the regulator or the industry don’t bother to publish much. Luckily, the Pakistan Microfinance Network does, even if it accounts for just ~6% of the overall banking loan portfolio. Plus, the number of borrowers compensates for the small proportion.

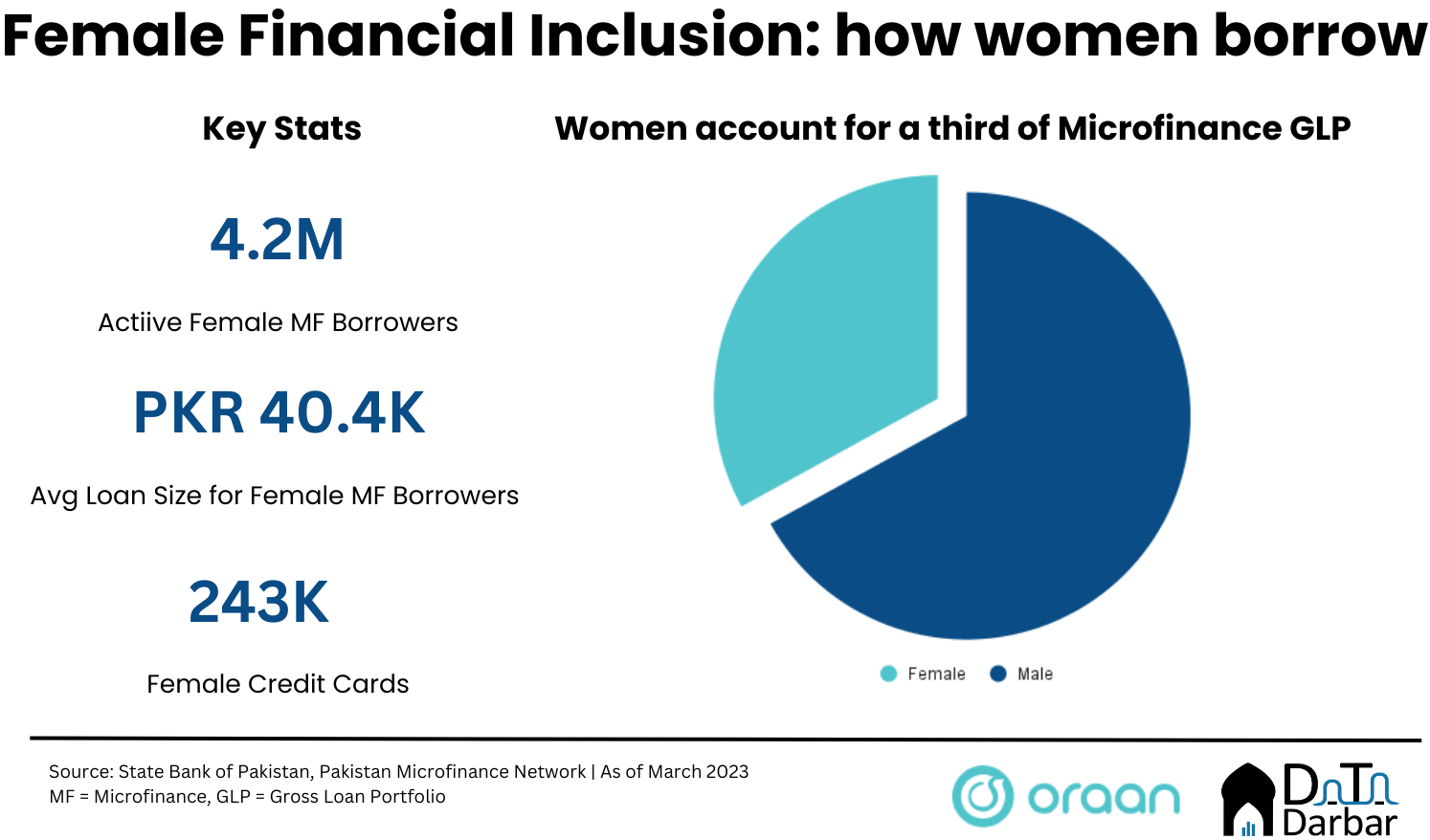

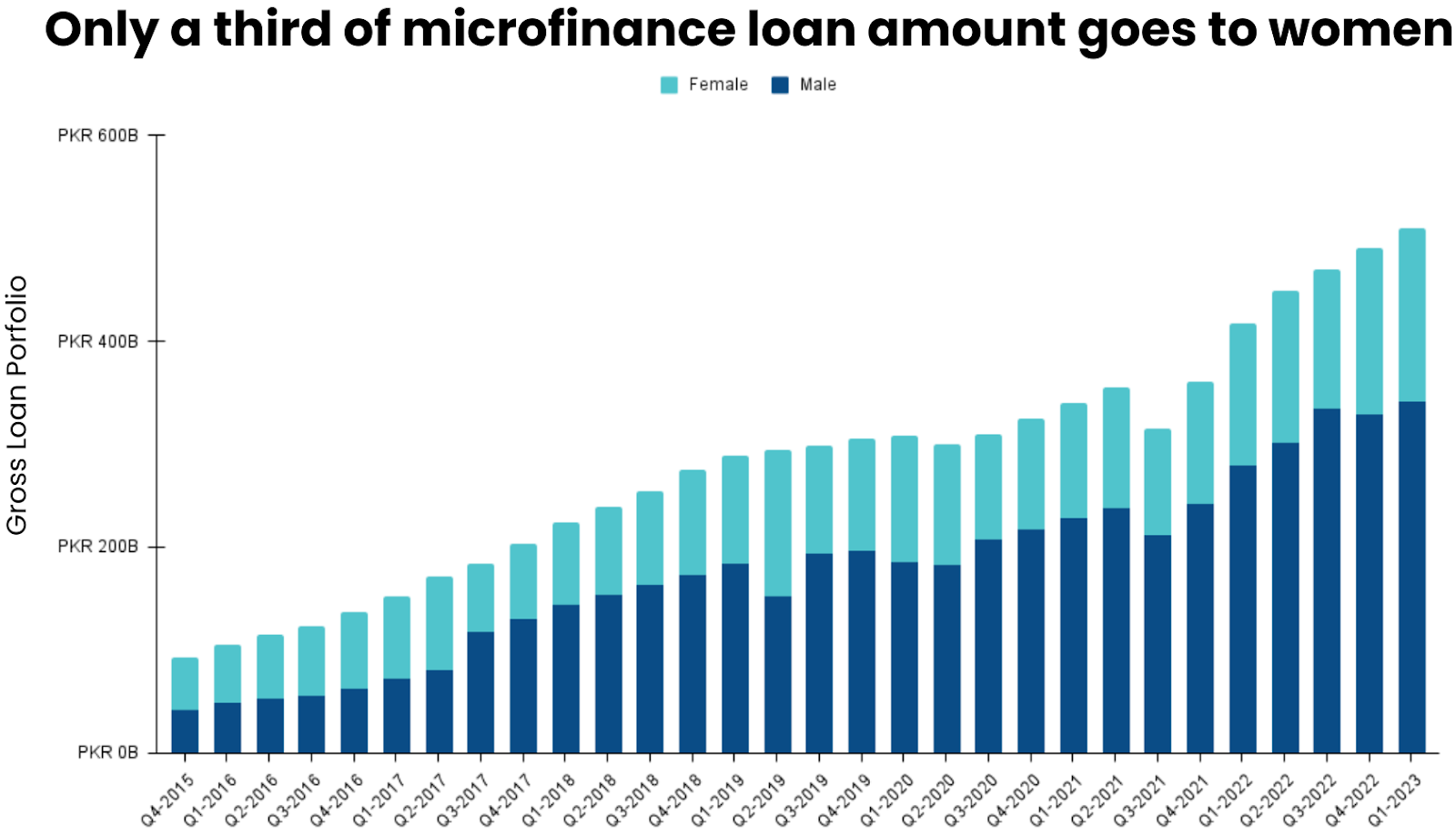

This allows us to have some understanding of how women borrow. So, let’s dive in. For starters, the total gross loan portfolio of the microfinance industry (banks + institutions) reached PKR 509.6B as of March end. Only a third of this amount, or PKR 168.2B, went to females.

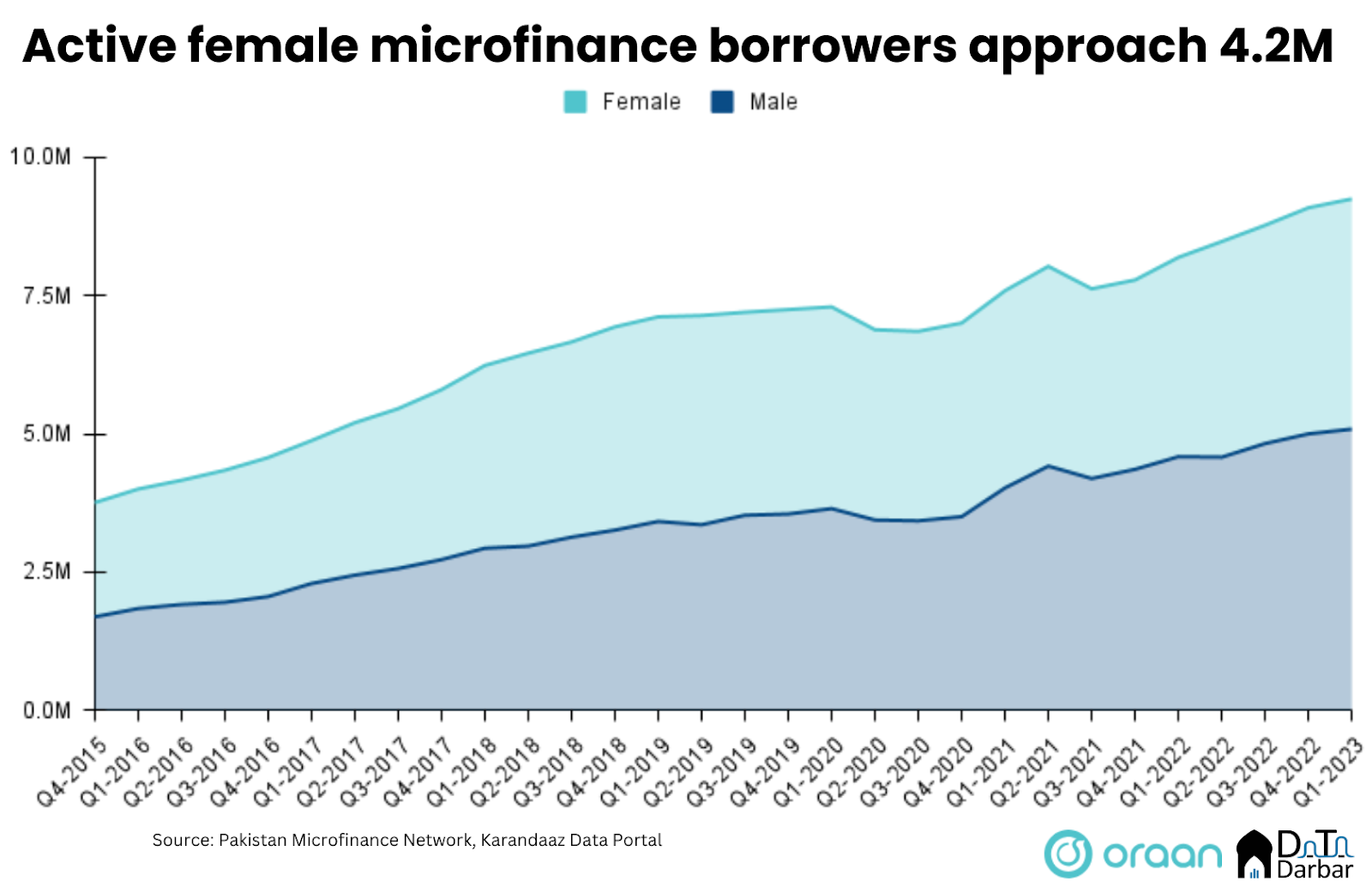

Over the last 7+ years, female share in microfinance GLP has actually gone down drastically. In Q4-2015, the first period with available data, it used to be 55%. A similar trend plays out in active borrowers, where women now make 45% of the total, compared to 55% by December 2015. However, in absolute terms, active female borrowers have doubled from 2.1M to 4.2M during the period under review.

Back in the day, not only were more women getting loans from microfinance, but they also obtained a higher overall amount. This should ring alarm bells because it’s too unlikely in Pakistani financial services. And the biggest explanation takes us away from data: the industry has long had a practice where loans are issued in the name of female customers, but the actual beneficiary is male.

For example, a husband would use his wife’s CNIC and other details to get credit. It still happens to an extent, but before biometric requirements were tightened, the whole process was even easier. This could at least partly explain why women were getting so many loans. Kazim Alam from Dawn wrote a great story about it over two years ago.

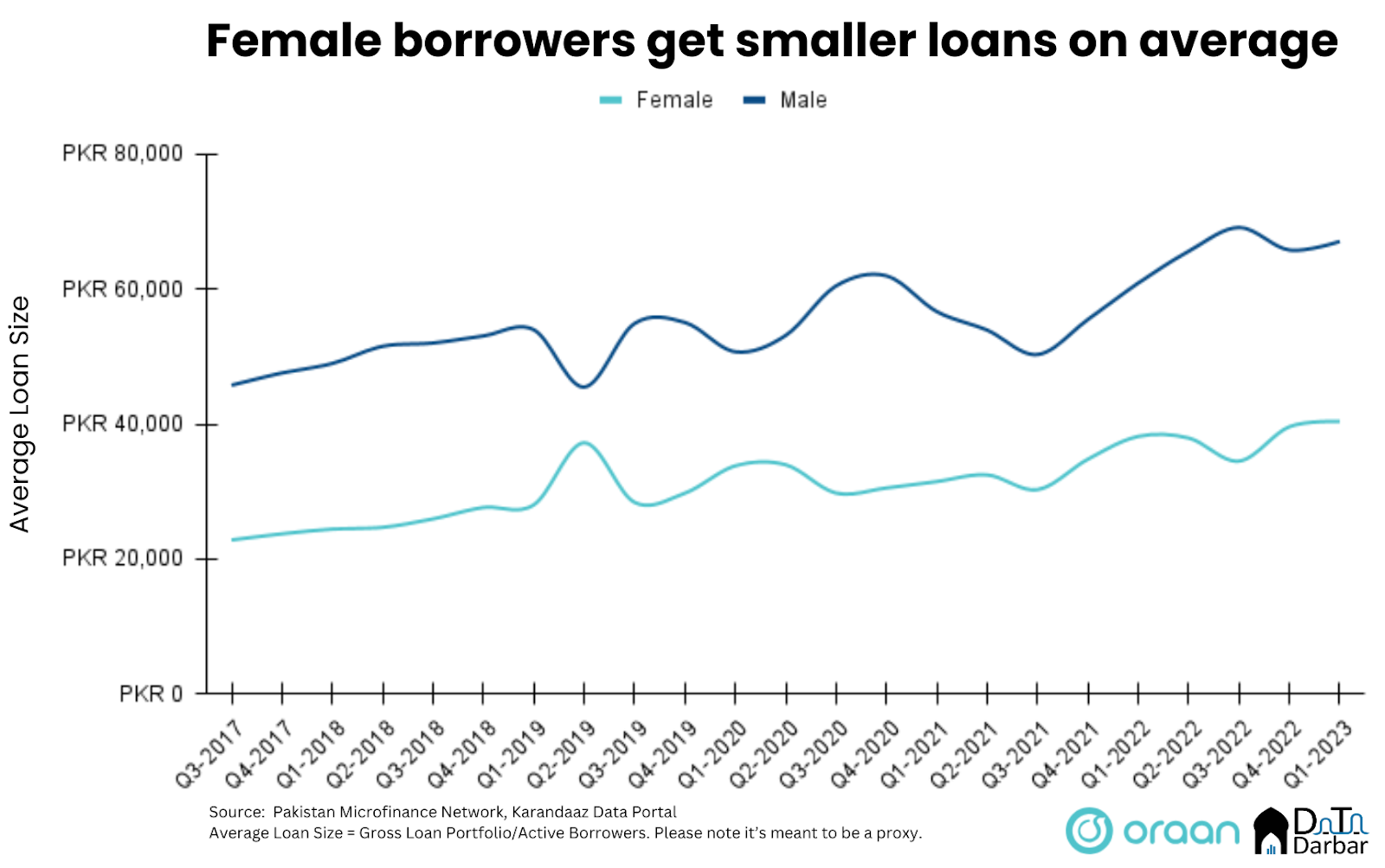

Though it still happens, we can only play with available data. So, let’s analyze it a bit more. One interesting trend is the difference in loan sizes1 across genders: the average amount for females in Q1-2023 stood at PKR 40,393, much lower than PKR 67,099 for males. That said, it has grown by 76.9%, or PKR 17,561, since Q3-2017.

But as we mentioned, microfinance is only a fraction of the overall financial services industry in terms of loan portfolio amount. Most of it is concentrated towards scheduled banks, which we have barely discussed. Unfortunately, there is not much data on their credit allocation to women.

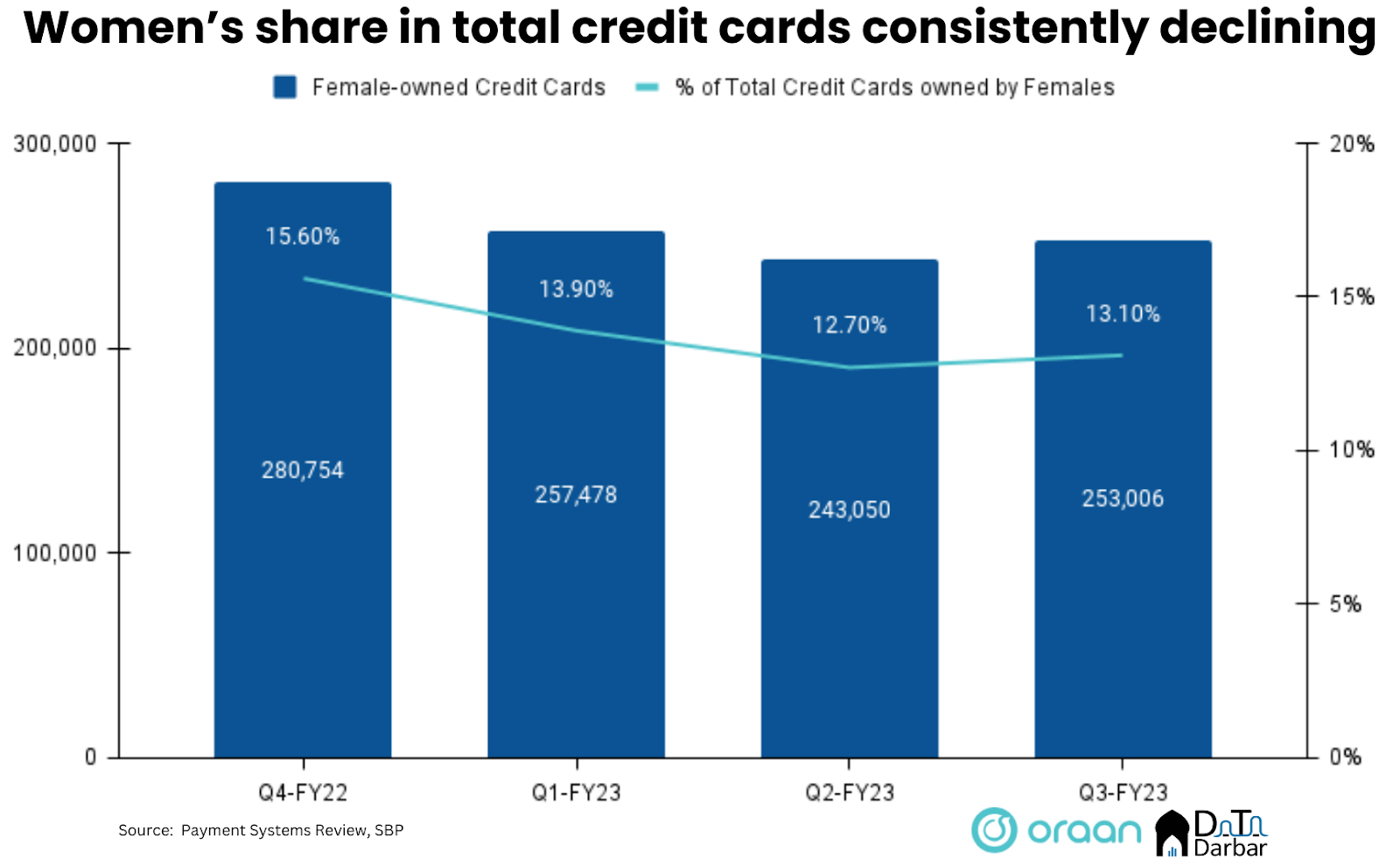

One minor exception is credit cards, where the SBP’s Payment Systems Review gives us at least some idea. As of Q1-2023, 243,050 credit cards, or 13.1% of the total, belonged to women. Another way to interpret this is that only 1.4% of female accounts at scheduled banks (17.2M) had a credit card by December 2022. What was their total outstanding loan amount? There is no way to know at the moment. Also, remember that we are NOT talking about unique customers here.

Pretty much every credit-related indicator paints a rather depressing picture. While we can surely attribute part of it to Pakistan’s macroeconomic environment, which discourages banks from lending. However, when it comes to issuing loans to women, even incentives don’t seem to work, as the minor uptake of the SBP’s refinance scheme suggests. Quite unlike the bonanza doled out to the textile sector and other big business groups.

- While the average loan is not published by PMN, we have estimated it as Gross Loan Portfolio/Active Borrowers.