There’s absolutely no doubt that 2023 was the year of artificial intelligence as it took over our search feeds, news articles, and conferences while also opening a new career path for the erstwhile crypto grifters. In the world of venture, that hype sells like hotcakes, or so we are told. But what does the funding data say about AI?

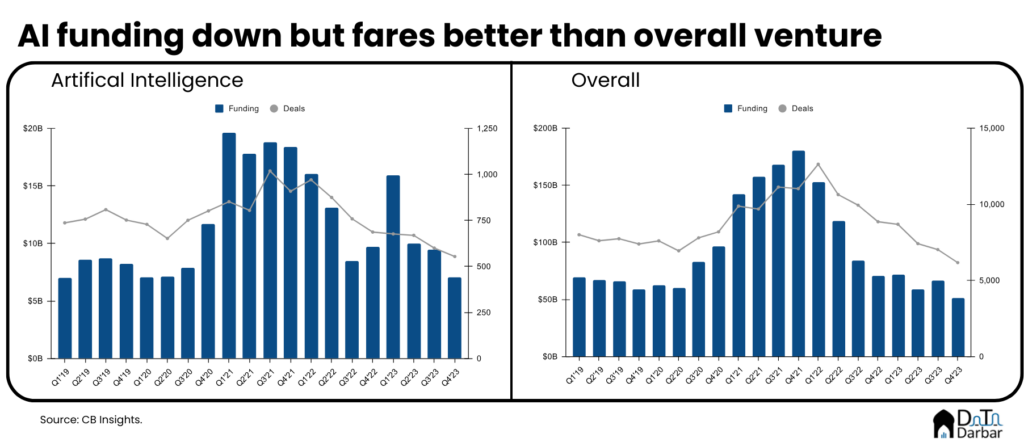

According to CB Insights, AI companies raised cumulative funding of $42.5B across 2,500 unique deals in the outgoing year. Though it does sound like a lot of money, the numbers are actually down 10.2% and 24.1% YoY. Both funding value and volumes peaked in 2021 and have receded 43.0% and 30.3% respectively since then. Even the 2023 amount came on the back of AI’s biggest poster-boy, OpenAI, which contributed $10B, or 23.5%, to the total.

Then what’s all the hype about? Well, it’s all relative. Once you contrast the numbers to the overall venture ecosystem, AI begins to stand out as a bright spot. As per CB Insights, 2023 saw $248.5B raised across 29,303 deals — lower by 41.7% and 30.4% YoY, respectively. Compared to the highs of 2021, the investment value has plunged by 61.7% and volume by 29.8%.

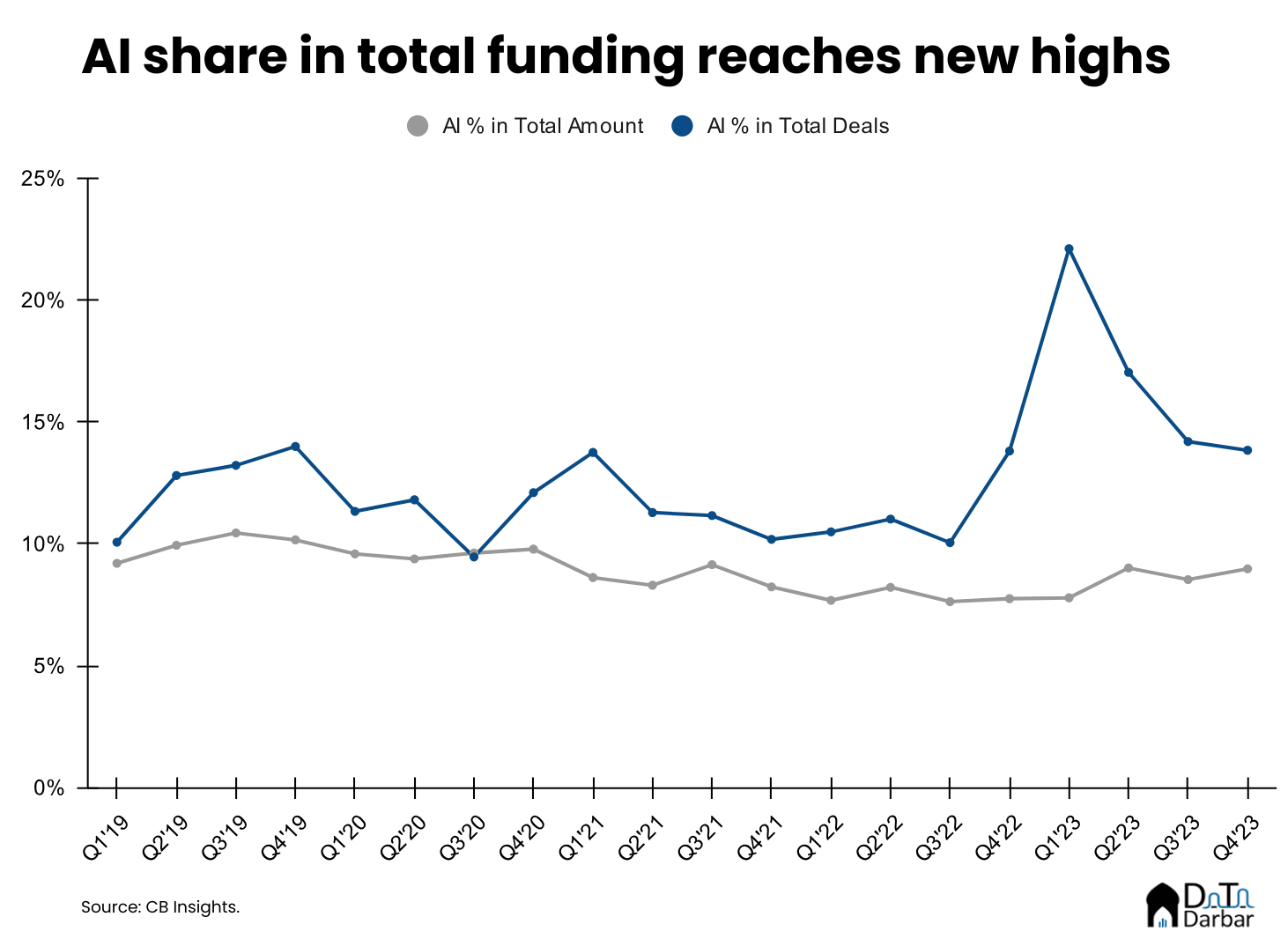

Basically, while investment in AI have evidently slowed down, the rate of decline is better than the overall funding trends. As a result, the contribution of AI to total dollar value reached 17.1%, compared to 11.1% in 2022 and the last four years ’ average of 11.6%. On the other hand, its share in deal count edged up slightly to 8.5%, but remains around historical levels.

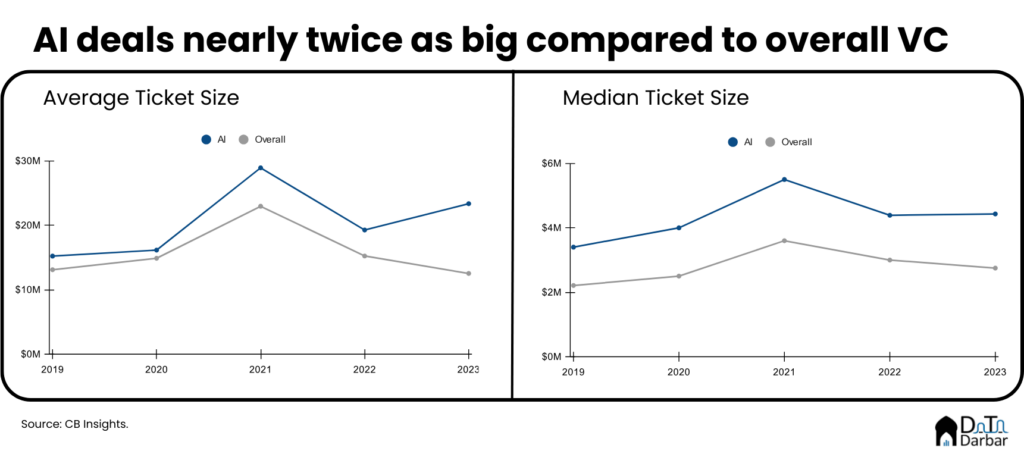

Basically, AI deals have gotten bigger with the average and median hitting $23.4M and $4.4M, respectively. Both are at the highest in the last five years, apart from 2021 of course. In comparison, the average ticket size for overall VC was almost half at $12.5M while the median stood at $2.8M.

This gap has persisted across all stages and years. In 2023, the median early-stage AI deal was $2.7M versus $2M for total funding, though the difference is the lowest since 2019. On the other hand, the gulf widened to the highest level for mid-stage where the median for AI was $25.6M compared to $19.4M overall.

Surprisingly, the median late-stvage AI deal didn’t balloon up in 2023. At $41M, it was significantly down compared to the past four years. However, it was much higher than the overall median of $21M and the gap lowest it has been since 2019.

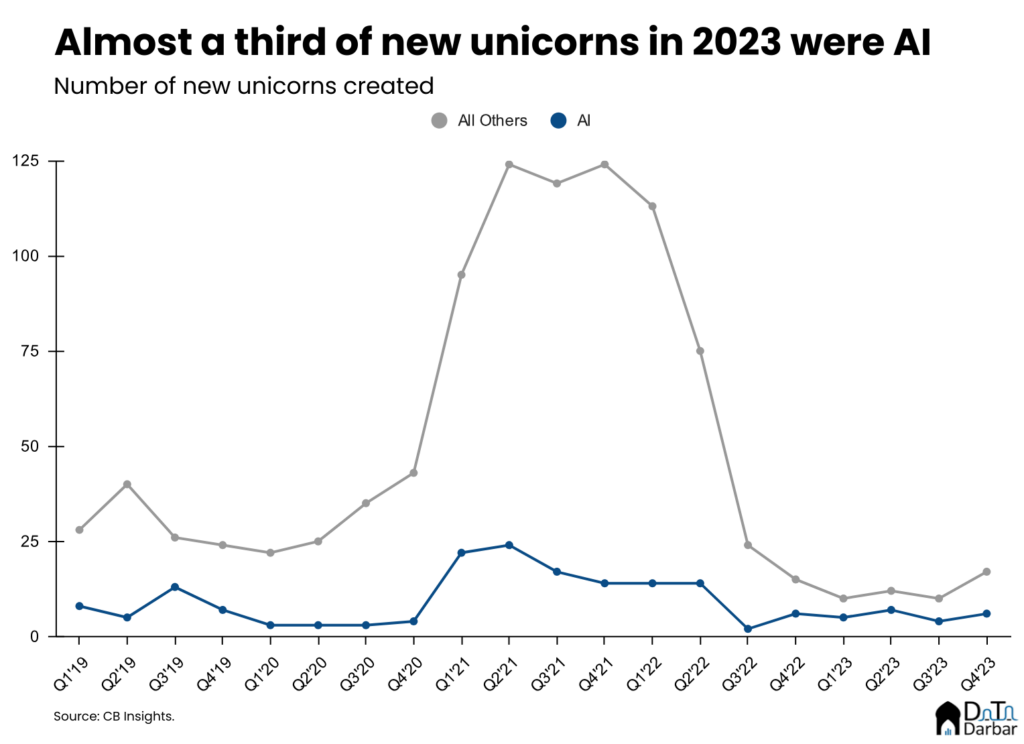

However, AI still heavily dominated the unicorn chart, accounting for more than a fourth of every new company reaching a billion-dollar valuation. In Q4’23, 23 startups managed to get the unicorn status, of which 6 are from the AI space. For context, this share is significantly higher in the quarterly average of 15.6% over the past four years.

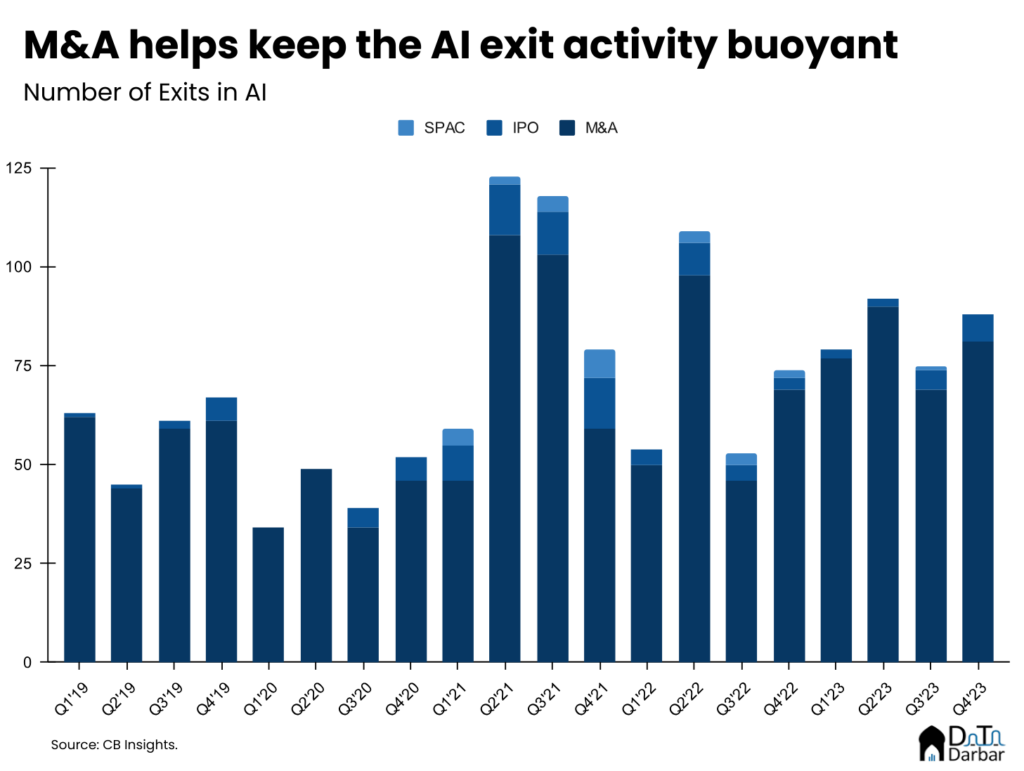

Similarly, the exit activity in AI has remained somewhat buyoant. According to CB Insights, there were were 16 initial public offerings in the space during 2023, which is similar to the levels seen 2022 though down significantly from 2021 highs. On the other hand, the M&A continued unabated with a deal count of 317 — the highest on record. However, this could also possibly be because of the decline in funding amount, forcing more startups to join forces.