June 15th, 2015, marked a significant milestone when Saudi Arabia opened its stock exchange, Tadawul, to qualified foreign investors. Though preceding the launch of Vision 2030, this event was an early indicator of the transformative changes the Kingdom would undergo over the next decade, particularly in capital markets.

For years, Riyadh was a major source of capital for various asset classes across multiple geographies, from being a big backer of Softbank’s Vision Fund to acquiring Premier League’s Newcastle United. While these investments continue, the Kingdom has now become an important destination for capital as well. You can choose many instances to highlight this shift, from Big Tech to high finance amping up their presence in Saudi.

The initial public offering of Rasan perhaps underscores this bullishness the best. Founded in 2016, Rasan was listed on the Saudi bourse, Tadawul, on June 13th, 2024, almost exactly a decade after the country’s capital markets opened up to foreigners. Its debut was nothing short of spectacular, as the 22.7 million shares were oversubscribed by 129x.

Founded in 2016, Rasan is a prominent insurtech firm headquartered based out of Riyadh has and served over 7.5M customers across the country. As of July 9th, its market capitalization stood at almost $1.2B so the investors are excited about the growth prospects. But does the exuberance of the market align with the underlying numbers?

The ever-growing scale of Rasan

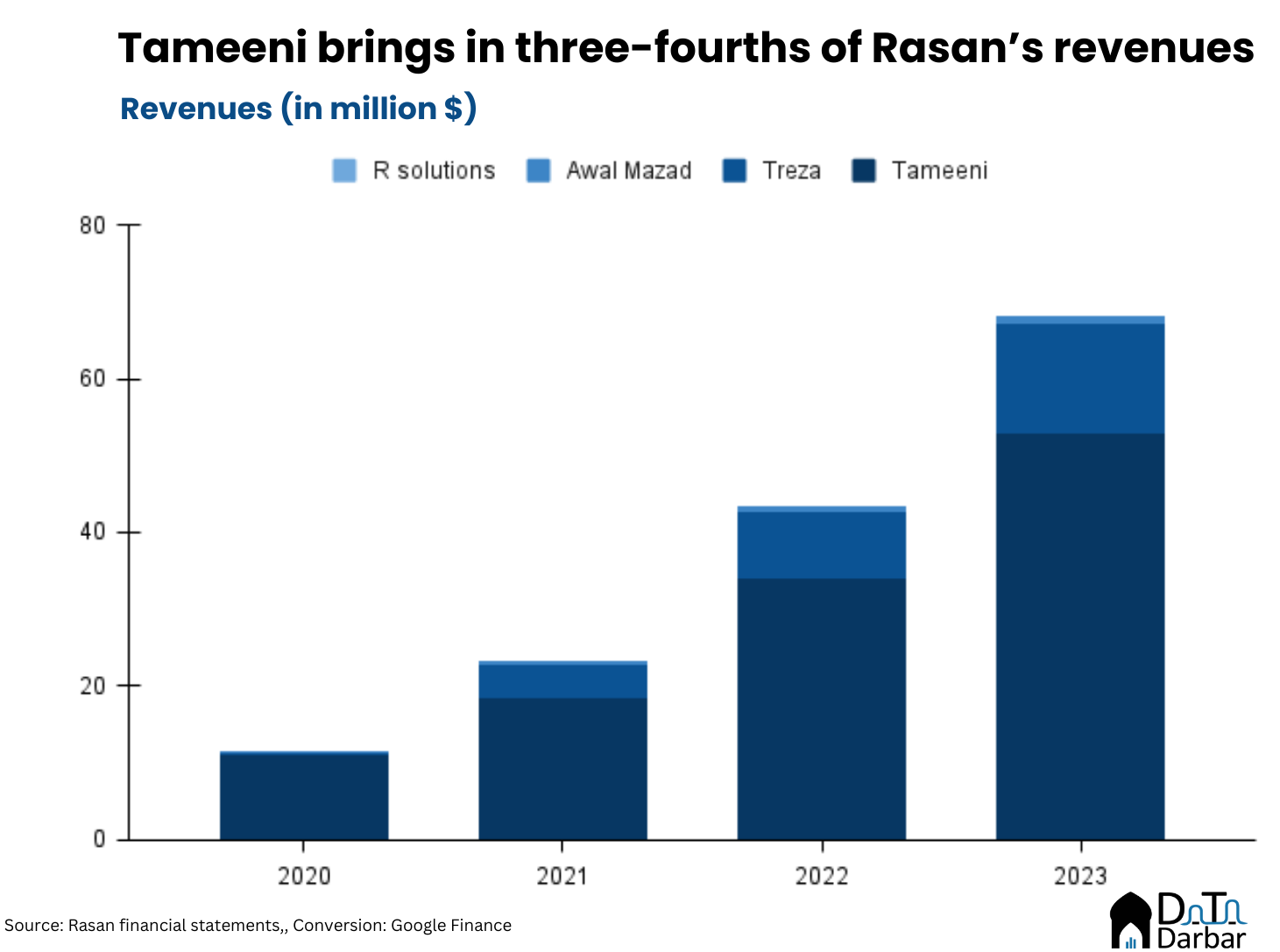

Over the last four years, Rasan’s topline has surged almost sixfold to $68.3M. According to the latest financials, the company had four main revenue sources. Tameeni — a consumer-focused aggregator allowing people to compare multiple insurance options — led the way, generating over SAR 198M ($52M). According to Similarweb, this product had a website traffic of 1.2M in June while Appfigures’ estimates put aggregate downloads over 40K across the two store fronts.

Treza — a backend solution that connects banks and other financing institutions directly to insurers — also contributed $14.2M. Surging 62.4% compared to 2022, this service already controls 60% of the Saudi market. Other streams include business analytic tools under R Solutions and an auction platform for salvaged vehicles named Awal Mazad.

Rasan’s overall revenue growth significantly outpaces the industry average, fuelled by the post-pandemic recovery in the Saudi market. For instance, motor insurance, the second-largest vertical in the Kingdom, rebounded from a 6.6% decline during the pandemic to a 4.6% growth. Similar trends in other segments, such as health, suggest a favorable outlook for the company and its stakeholders.

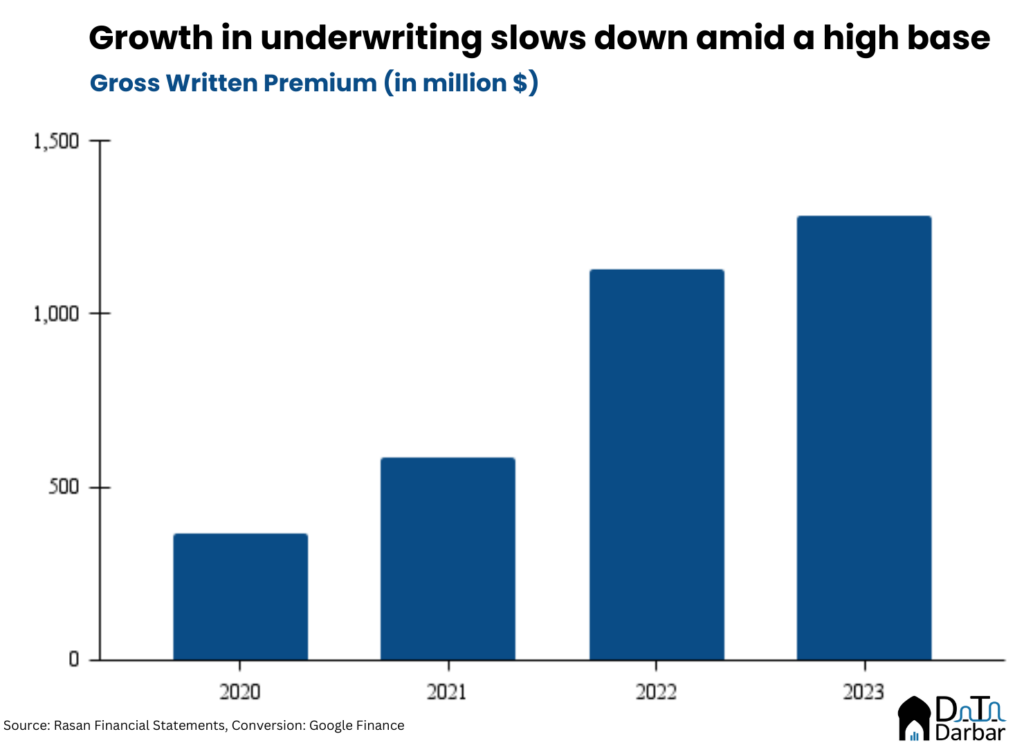

The company has also managed to increase its Gross Written Premium, a key industry indicator, to almost $1.3B. Put another way, Rasan is now in line with the industry average though it still has ample room to catch up with the top 10 firms. This indicates Rasan’s potential to gain further market share.

The unicorn unit economics

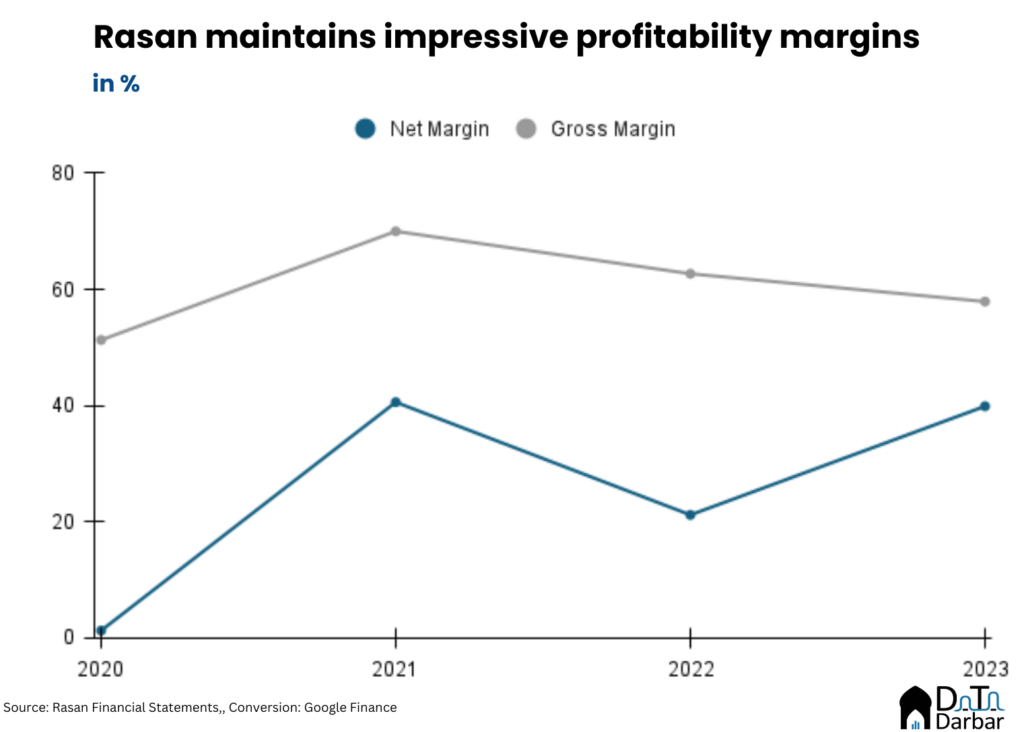

More importantly, the higher scale has not come at the cost of unit economics. In fact, Rasan’s profitability ratios are extremely impressive with a gross margin at around 60% in 2023, and have consistently hovered over 50% throughout the last four years. This provides them a pretty comfortable cushion for expansion or economic downturns.

Though comparatively volatile, Rasan’s net margins are also quite healthy, standing at 17.9% in 2023 —more than 3x the industry average of 5.8%. This high profitability, despite occasional lows due to growth-related costs, showcases the company’s robust financial health and makes it a unicorn in the truest sense of the word. As a result, the profit after tax reached more than $11.9 Million.

To the shareholders, the company has been delivering already with a return on equity of 38.8% in 2023, about 2.5x the industry average of 15.4%. However, there’s still room for improvement here through prudent leverage given its equity-to-asset ratio of 38.1% is still below the top 10 firms’ 51%.

Investor exeuberance

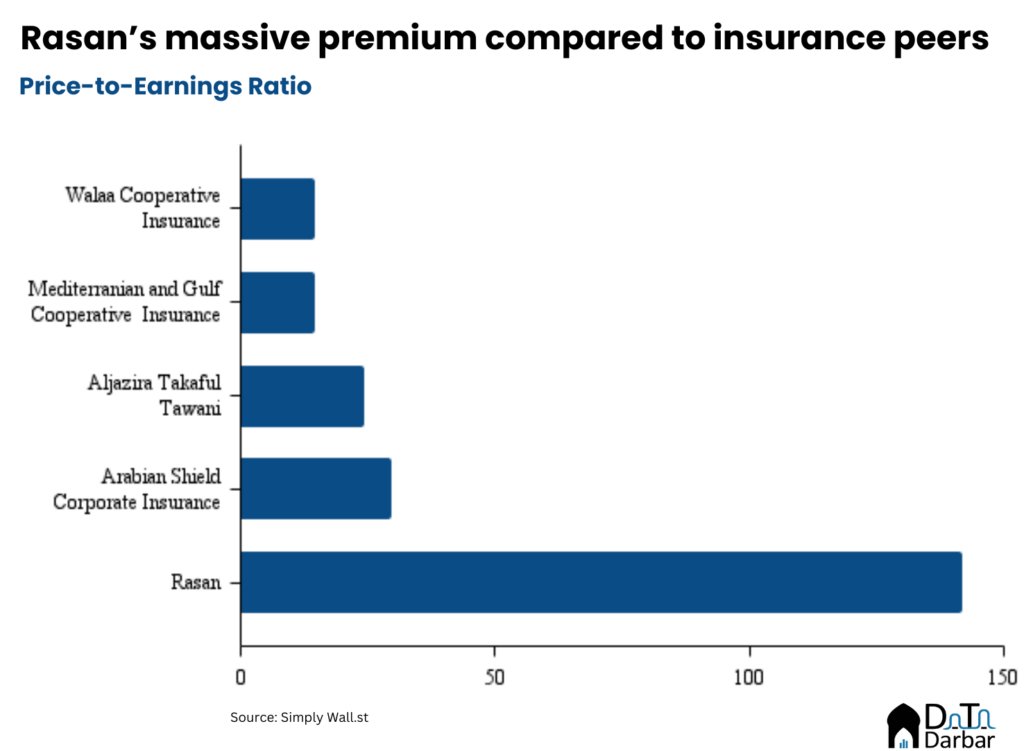

With such numbers, investors are unsurprisingly bullish and the company’s multiples prove that. Its Price-to-Earnings (P/E) ratio is currently an abnormally high 142.1x, up from 80x on the IPO day. That’s a massive premium compared to the industry averages of 28x for insurance and 29x for tech in Saudi-listed companies. However, this not only highlights Rasan’s growth prospects but also underscores the broader optimism in the Kingdom, which continues to attract investment despite global economic uncertainties. More importantly, it proves that valuation and profitability are not mutually exclusive goals.

This is amazing …. In my career this is the first time that I have seen un precedent growth on YoY consecutively for four years … good market to take up this unicorn. Selection of market ie KSA is a very wise decision. If you can chip Reinsurance piece in it the you can further tap 30% to 35% Incase SAMA allows. Circumventing middle market is an immense cost saver. Reinsurance Exchange is a new advancement. Well the growth will reduce in other regions in Asia especially India / Pakistan / Singapore ( Far east margins are thin). Good luck to you all and incase you need any support in terms of subject matter and ops I would love to support.