Egyptian fintech firm MNT-Halan is expanding its reach beyond microfinance. After acquiring a small microfinance bank in Pakistan, the company has made a significant move into factoring by purchasing Tams Finans, Turkey’s largest non-bank leasing company. This strategic shift follows a substantial $157.5 million funding round. While the financial details of the acquisition remain undisclosed, it signals MNT-Halan’s ambitious expansion into the Turkish market.

Factoring: a tale of two halves

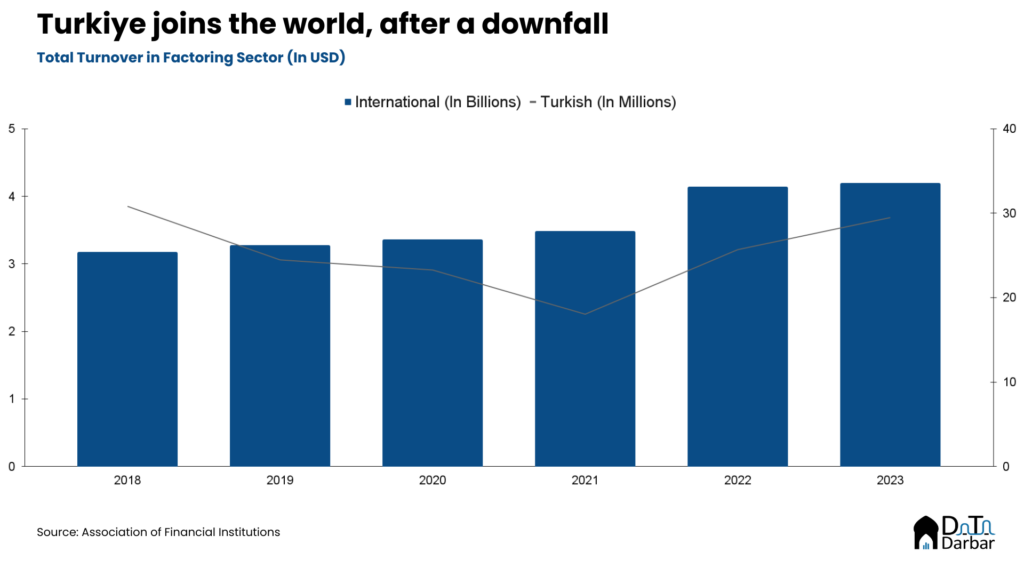

If you run a business, you’ve likely faced the frustration of delayed payments. Waiting months for invoices to be paid can wreak havoc on your cash flow. This often leads businesses to consider borrowing capital to stay afloat. Enter factoring, where a company basically purchases outstanding invoices and clears the receiver’s dues upfront for a certain fee. Globally, this industry has seen significant popularity in the past decade, with turnovers increasing by 9% annually and surpassing $4.5 trillion in 2023. Turkiye, though, tells a slightly different tale.

The Turkish Factoring Industry has proliferated, outpacing the global average with a 19% annual growth rate. It ranks 23rd in total turnover. However, this growth has been inconsistent. The industry thrived in the first half of the decade but declined from 2014 to 2021. Recently, it has shown signs of recovery, even surpassing expectations.

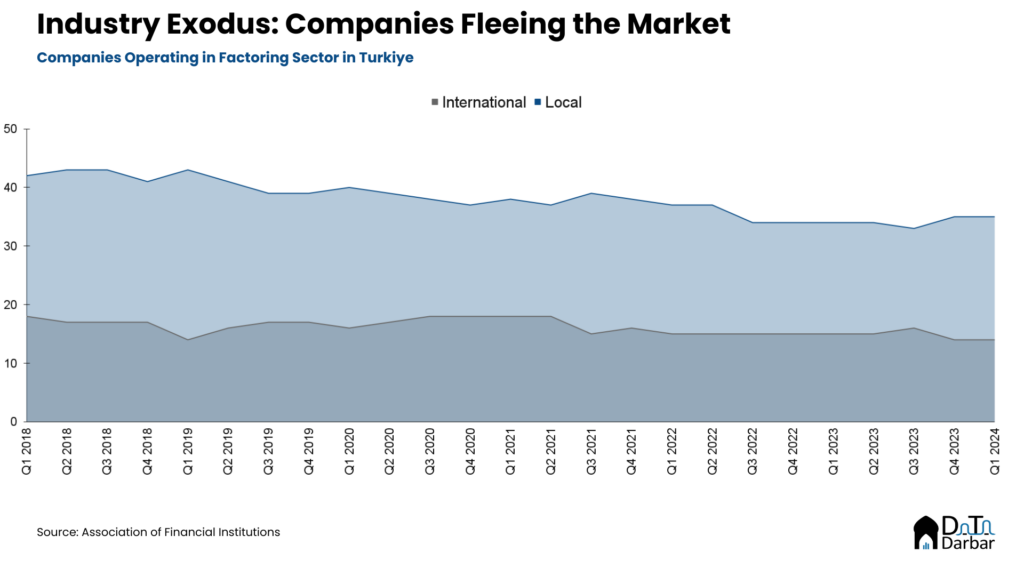

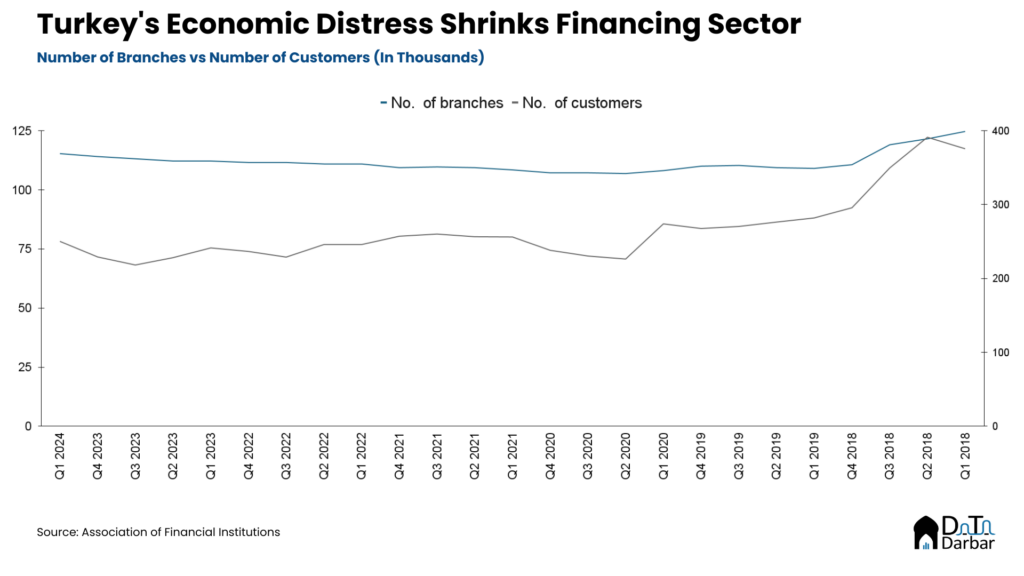

However, since the mid-decade peak, progress has dwindled, with both the number of local and international players and their customer bases plummeting. Since 2018, the total number of factoring companies has shrunk by 18%, with those doing international transactions dropping at an even faster rate

of 22%. The sector has also seen a dramatic reduction in branches and consumers, with the customer base down from 117,000 in 2018 to 78,000 in the first quarter of 2024. But these conditions were seen all over the financing industry in Turkiye, primarily because of its economic crisis, with the lira plunging and the cost of borrowing soaring.

Revenues soar, Expenses follow

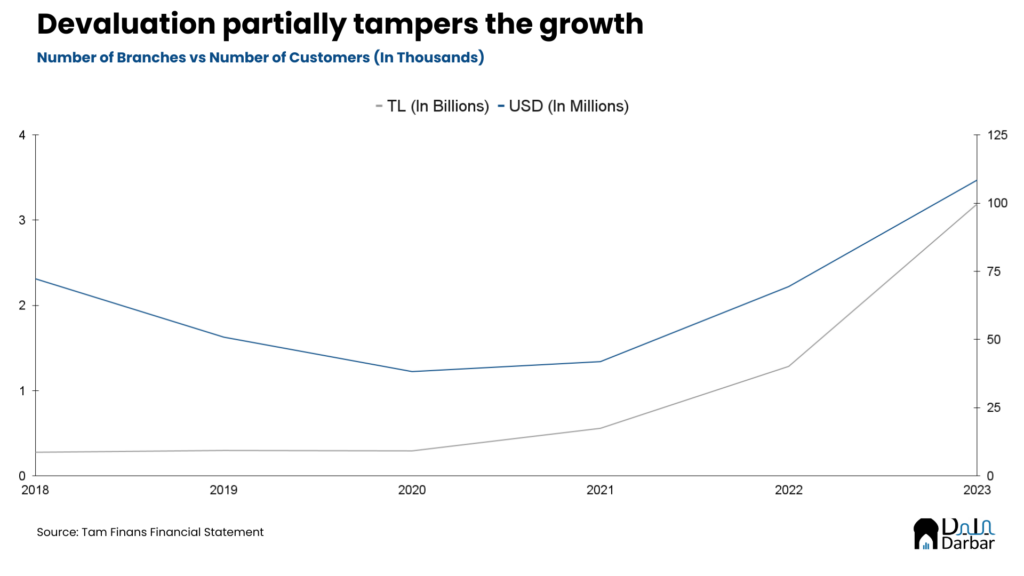

Despite such an adverse climate, Tam Finans has been a standout performer over the past few years, with 2023 being no exception. The company currently has 39 branches and a market share of 40% of the Turkish micro-leasing market. In terms of financials, its operating income skyrocketed by a staggering 148% in 2023 to TRY 3.1 billion, a testament to its aggressive growth strategy. While the growth in dollar terms was hampered by economic challenges and currency depreciation, it still managed to surge by an impressive 56% to $108M.

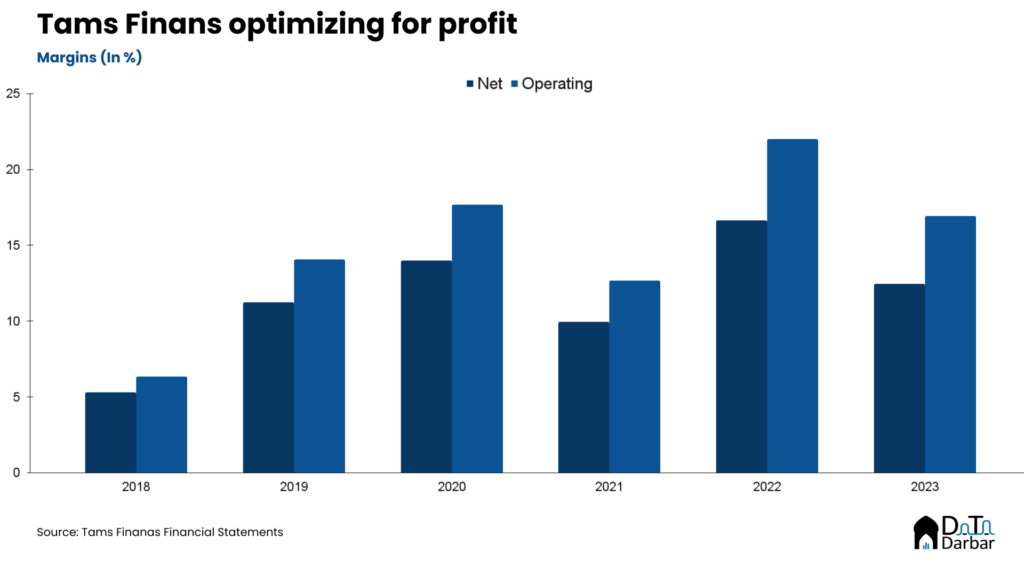

While the company has managed to outpace its competitors in terms of revenue growth, its expenses have also ballooned, primarily due to its reliance on a brick-and-mortar sales force. Operating expenses climbed 63% YoY in 2023 to $17.4 million. Lately, however, Tam Finans has shown impressive resilience and steadily improved its operating efficiency by narrowing the gap compared to its peers. Its average operating expenses to operating revenues ratio over the past five years stood at 57%, significantly higher than the sectoral mean of 32%. However, with economies of scale setting in, this ratio has reduced by an average of 6.5pps annually to reach 34.78% by 2023, only slightly higher than the industry levels.

While the company enjoyed a period of robust growth in both operating and net profit margins during the latter half of the decade, this upward trajectory has since stalled. This suggests that while the firm has managed its core operations efficiently, external factors such as taxation and interest rates have significantly impacted its overall profitability.

Defying the Odds in a Risky Market

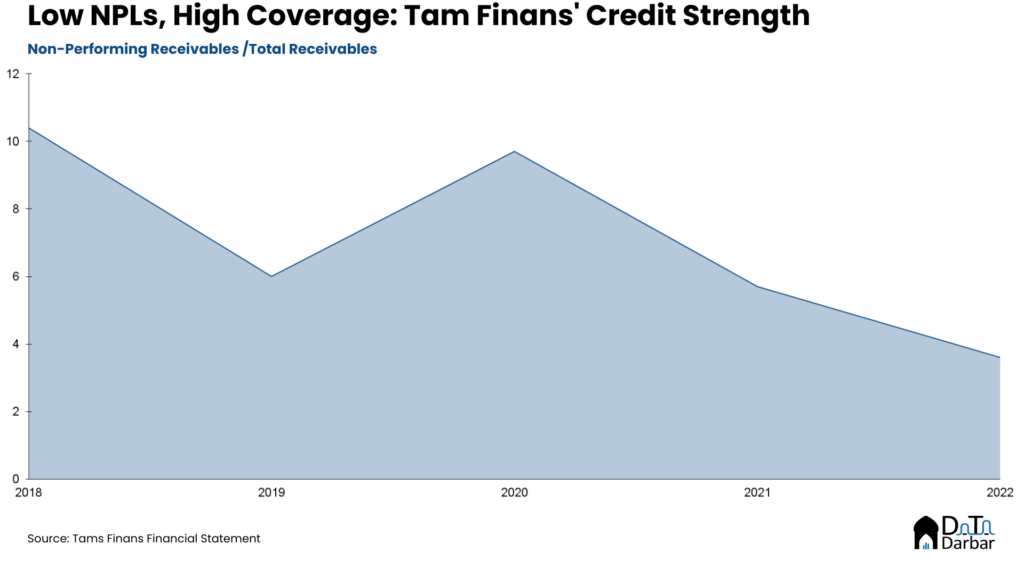

The main aspect that stands out is Tams Finans’ ability to handle its credit risk, with non-performing receivables significantly lower than the industry average of 0.6% at the end of 2022, compared to the sector average of 1.6%. Additionally, the coverage of NPLs with loss provisions was high at 254%, a big enough safety net compared to the sector average of 107%. While the company’s cost of risk and new NPL inflows have been above the sector averages since 2018, its effective risk management strategies have kept it in a solid position.

The company’s profitability has been further bolstered by its ability to maintain a higher net interest margin than its competitors. However, the turbulent economic landscape, characterized by soaring inflation and regulatory changes, has posed significant challenges. The company’s net interest margin dipped below the sector average in 2022 due to high funding costs and interest rate caps. Despite this, the company’s Risk-adjusted NIM has averaged 7.08% since 2018.

Push to Balance Debt and Digital

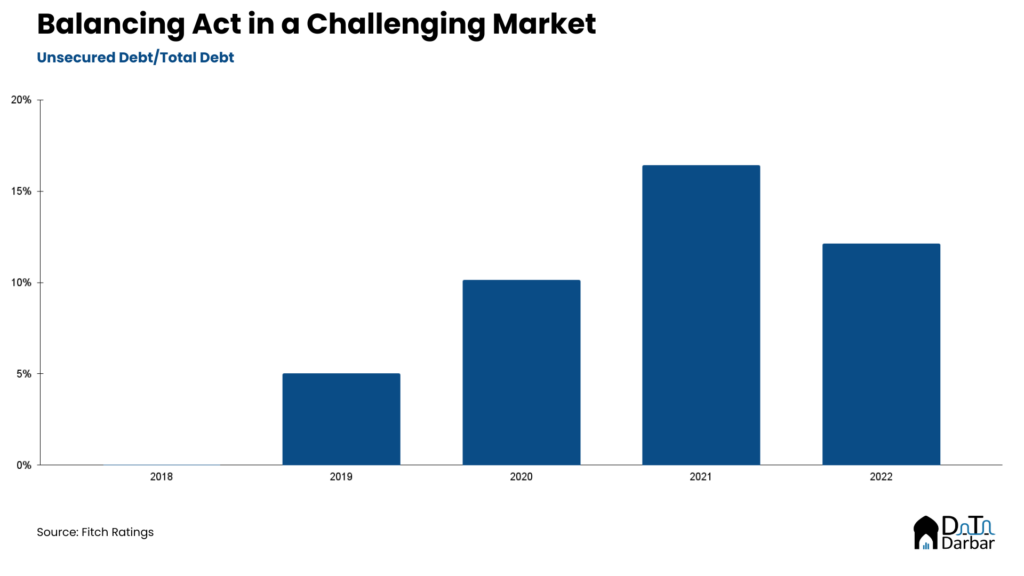

One area of concern is the company’s increasing reliance on unsecured debt. The percentage of unsecured debts of the total loan has increased to 12.10 percent in 2022. With the inflation in Turkey rising from an average of 31.14 to 47.2 in a span of one year, the interest rate for debt instruments issued has also increased, potentially impacting profitability.

As Tam Finans continues to navigate the complex financial terrain, it will be crucial for the company to strike a delicate balance between growth, profitability, and risk management. The success of its new mobile application will be a key indicator of its ability to adapt to the evolving digital landscape and reduce its reliance on a physical sales force.

Strategic Gambit by MNT-Halan

MNT-Halan’s acquisition of Tams Finans is more than just a geographical expansion; it’s a calculated play to diversify its revenue streams and leverage its financial prowess. While Tams Finans has weathered economic storms in Turkey, its resilience has caught the eye of MNT-Halan. The Egyptian fintech giant is clearly eyeing a similar opportunity back home, where it plans to enter the factoring market soon.

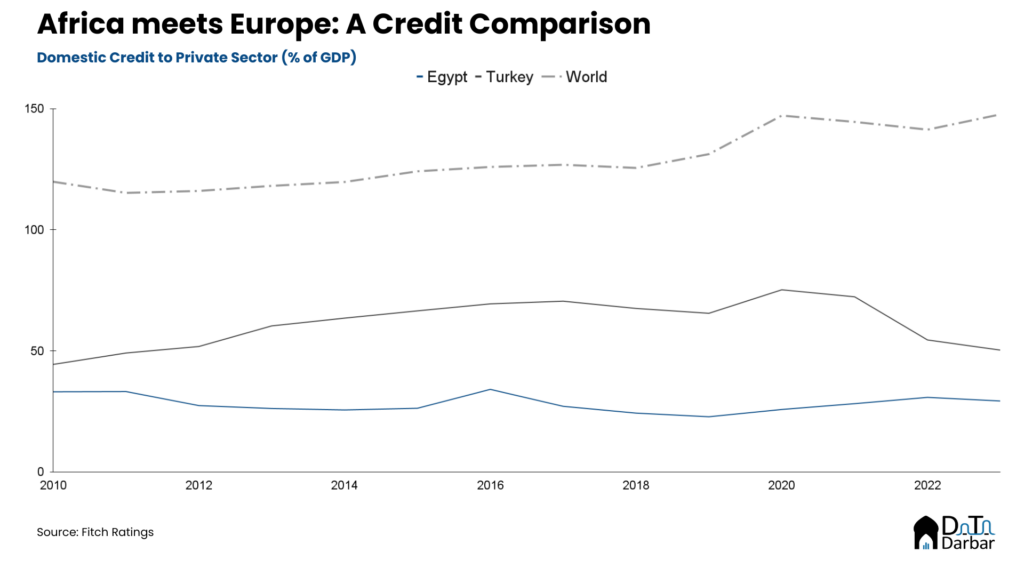

While the country’s domestic credit to the private sector as a percentage of GDP lags behind Turkey’s, boosting this metric is crucial for economic growth. By acquiring Tams Finans, MNT-Halan gains a proven model to replicate in Egypt. This strategic move positions the company to not only serve individual consumers but also small businesses, broadening its customer base and reducing reliance on a single income stream. It’s a bold bet that could reshape the financial landscape in both countries.