Over the last few years, Pakistan’s banking has reaped massive profits on the back of the sovereign’s ever-growing fiscal needs. Consequently, it has drawn the ire from everyone, including the International Monetary Fund recently, for depending on the government. However, one area where the industry has done well, at least relatively, is in digitizating payments.

In this regard, FY24 was no different as digital transactions continued not only in absolute terms but also as part of the overall pie. Their shares in throughput and volumes reached 13.4% and 52.4% in the outgoing fiscal year, compared to just 2.6% and 16.9% in FY20. Lest anyone gets confused here, this is only for transactions facilitated through scheduled banks. It doesn’t include the cash-based exchange of money outside the formal financial system.

Before we look into the most important trends from payments, let’s take a moment to understand what that includes. First is obviously the paper-based instruments such as over-the-counter cash deposits or demand drafts. Then you have PRISM, a high-value real-time gross settlement system, to which only 59 entities in the country have access. This is what banks use to send proceeds among themselves, or how money flows into government securities. Until recently, the SBP also used to classify real-time online branches (RTOB) under e-banking, which no longer is the case. Its current definition of digital includes:

- ATM

- Internet banking

- Mobile Banking

- Call Center/IVR

- Point of Sale

- E-commerce

We have always taken a narrower approach and excluded even ATMs from digital. Instead, our focus is on POS, e-commerce, internet, and mobile banking. To maintain consistency with previous editions, we will exclude transactions through branchless — where the scale is on an entirely different level. With all the disclaimers out of the way, let’s go over the key trends from the latest edition and put the numbers in context.

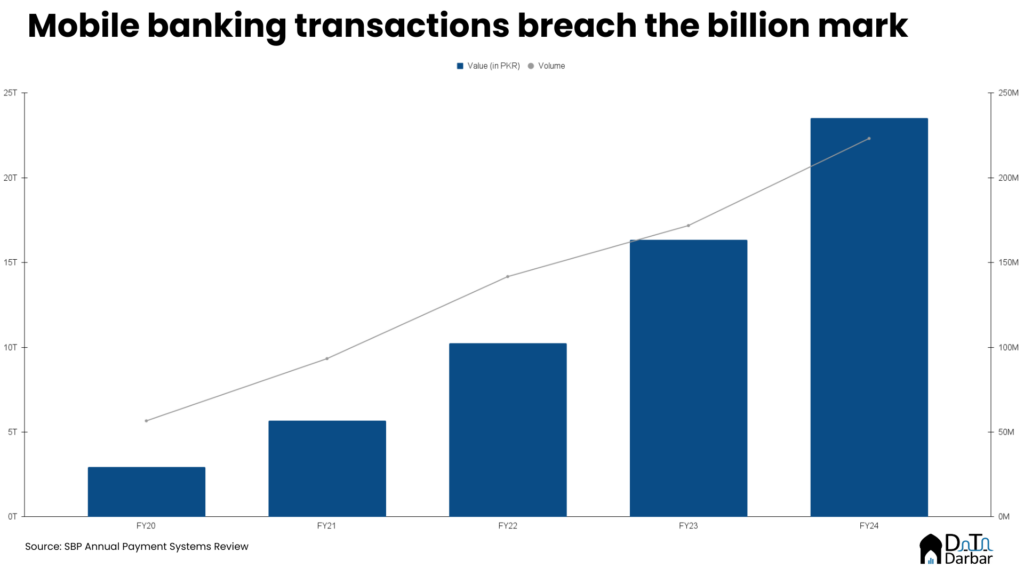

Mobile Banking

The fiscal year started with mobile banking overtaking ATMs by volumes to become the single largest digital channel during the first quarter. Its lead has only extended ever since, with transactions reaching 324M in April-June. This took the FY24 aggregate to 1.12B — crossing the coveted billion-mark — representing a YoY increase of 70%.

Similarly, throughput surged 95.1% to PKR 46.3T in FY24, around twice as much as any other digital channel in both absolute value and percentage change. However, during April-June, the throughput barely edged up 4.3% QoQ — the first time it slipped below 5% after Covid-19. Yet, the average transaction size marched upwards to PKR 41,267 for the entire year.

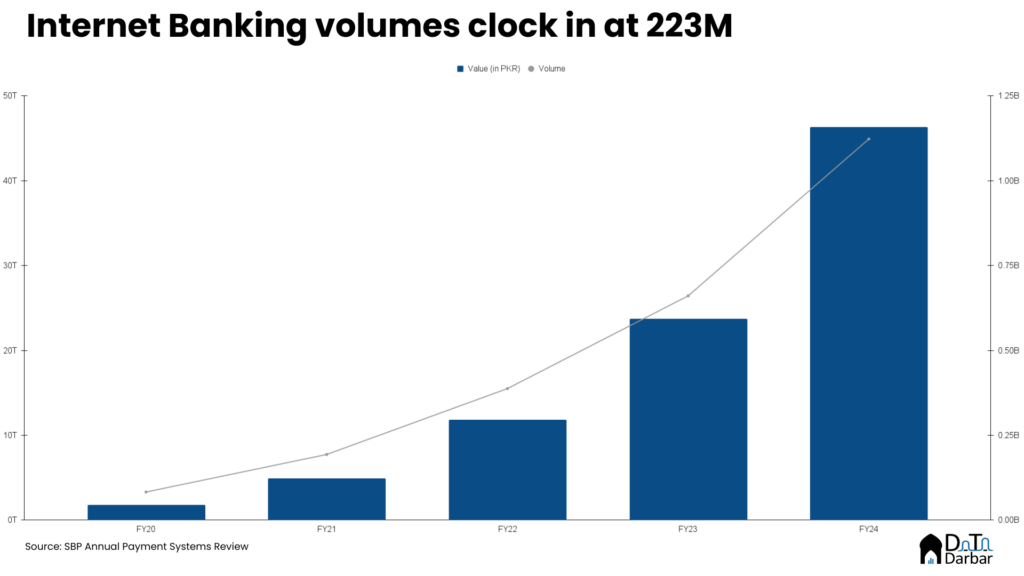

Internet Banking

Internet banking also had a good run, processing volumes of 223.2M worth PKR 23.5T during the year — up 30% and 44%, respectively. As a result, its average transaction surpassed PKR 105,000, crossing the six-digit threshold for the first time. While the State Bank doesn’t explicitly give a breakdown of the underlying use cases, this channel has a tilt towards B2B payments though an even larger, albeit declining, component continues to go via cheques. In Q4-FY24, throughput jumped 53.6% YoY to PKR 7T while volumes actually slipped 1.9% QoQ to 57.6M.

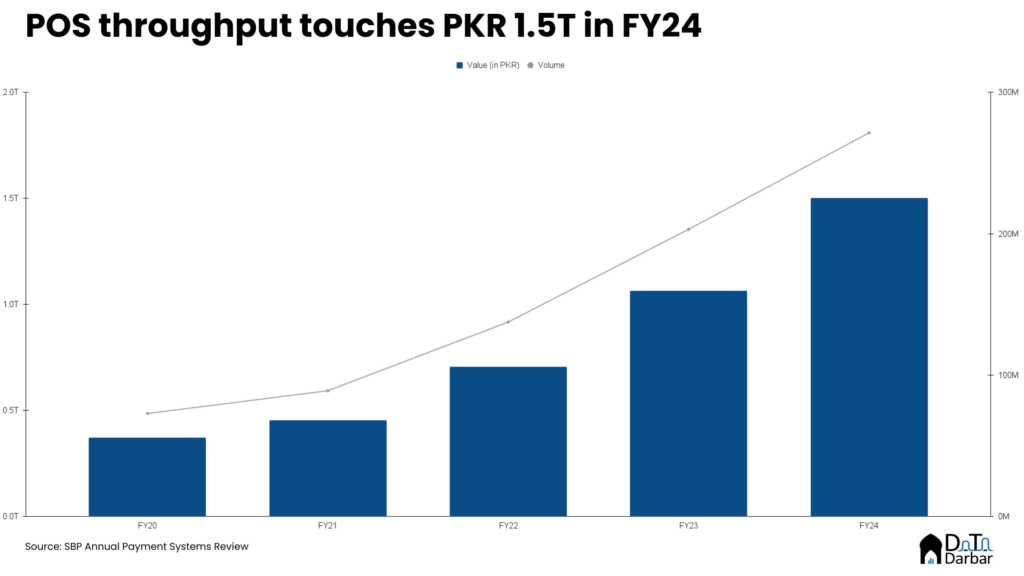

Point of sale

In the merchant-oriented space, POS throughput breached the 400-billion mark during April-June to close at PKR 415.1B. This took the FY24 total to PKR 1.5T, translating into a YoY growth of 41.2%. Similarly, last quarter’s volumes of 76.7M pushed the annual aggregate to 271.4M transactions — positioning it as the second fastest-growing channel by volumes.

However, its average transaction size of PKR 5,535 during FY24 remains a fraction of both mobile and internet banking. Meanwhile, the number of POS terminals reached 125,593 across 98,936 merchants by June, rising by 10,305 and 13,550, respectively over the last year.

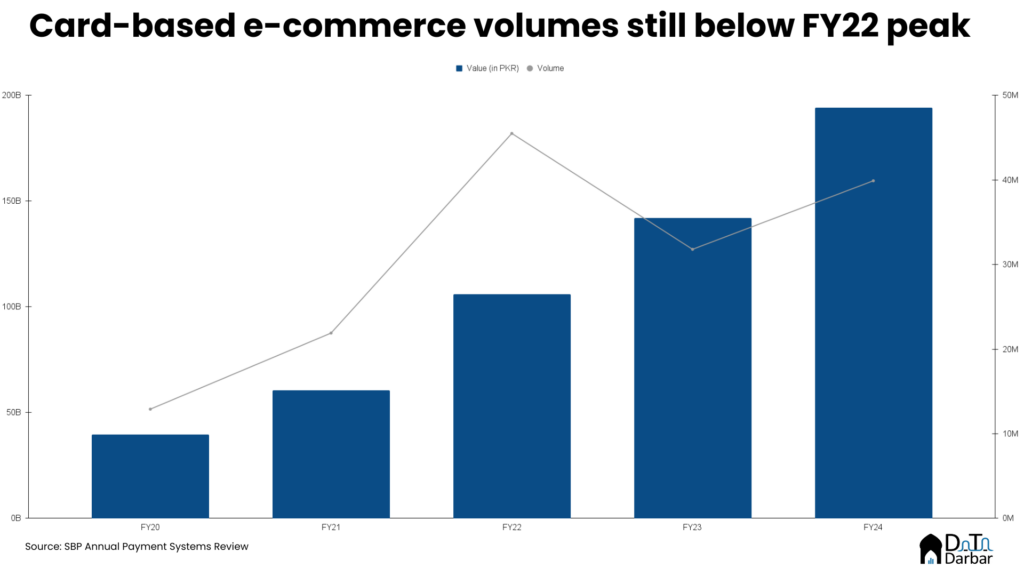

E-commerce

On the other hand, e-commerce had yet another uninspiring year. Though volumes were up 25.5% to 39.9M, they still remain considerably below the FY22 peak of 45.5m. Nevertheless, throughput managed to increase by 36.8% to PKR 194.4B, thanks to the inflation. However, this is only part of the story as the data only corresponds to card-based payments.

Based on both anecdotal evidence and small surveys, cards are actually not the preferred channel for digitally paid online orders. Fund transfers reign supreme there and the latest PSR gives a glimpse of that for the first time. According to the SBP, 269M transactions worth PKR 211.6B were actually processed via accounts and digital wallets. Put another way, 87.1% of the volumes are not through cards. In all likelihood, this doesn’t include the fund transfers via mobile banking, where the average transaction size — and therefore the throughput — should be much higher.

That problem also applies to physical retail transactions where a significant share of non-cash payments actually go through online fund transfers. You have probably done it to pay your Careem captain, the neighbourhood kiryana, or even at the electronics market in Saddar. From both the buyer and seller perspective, these are essentially digital transactions and are arguably even cheaper. but they have some limitations in the grander scheme of things.

First of all, their quantum remains largely unknown because of how data is recorded and outside the reach of tax authorities. Secondly, P2P transfers also come with one big limitation in that there is no recourse for the customer. Think of all those social media posts where people are complaining how they sent money to an e-commerce store and then got ghosted. With proper merchant payments, there is dispute resolution and possible chargeback.

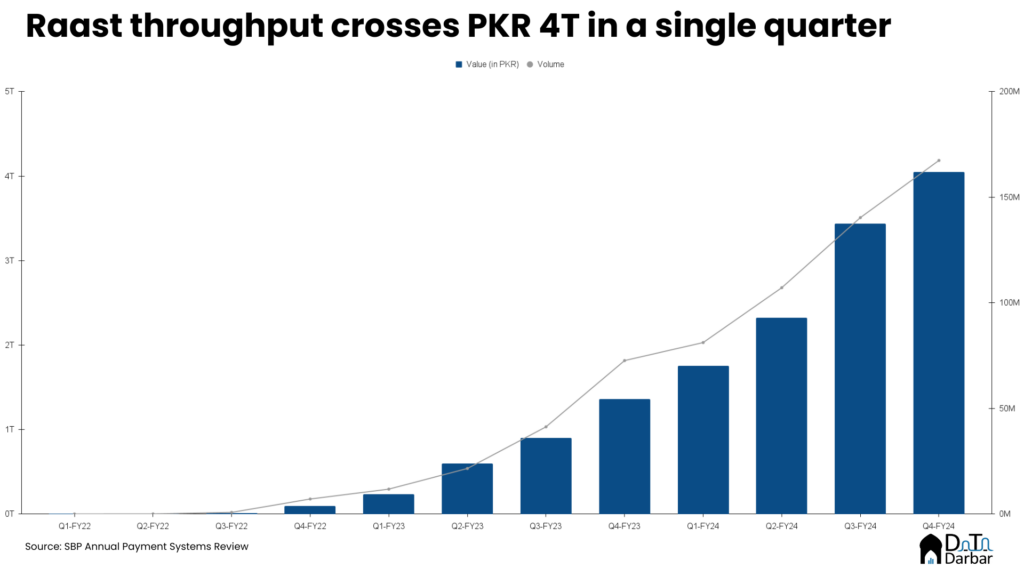

Raast

This is what Raast P2M plans to change: by aligning the incentives for businesses and making the technology convenient for users, such as QR or request-to-pay. However, the module is still in the early days and will take some time before progress becomes visible. Where the switch has done well so far is on the P2P side, processing a throughput of PKR 3.9T across 116.8M transactions during April-June alone — surging by 198% and 130%, respectively over the same period of the previous year.

At the same time, it masquerades the underlying gap in our digitization journey where most growth remains quite concentrated towards the P2P side. Individuals with bank accounts or digital wallets already seem to be transitioning towards digital channels quickly. But the progress on the B2B front is quite muted as banking institutions remain practically uninterested in building any innovative products.

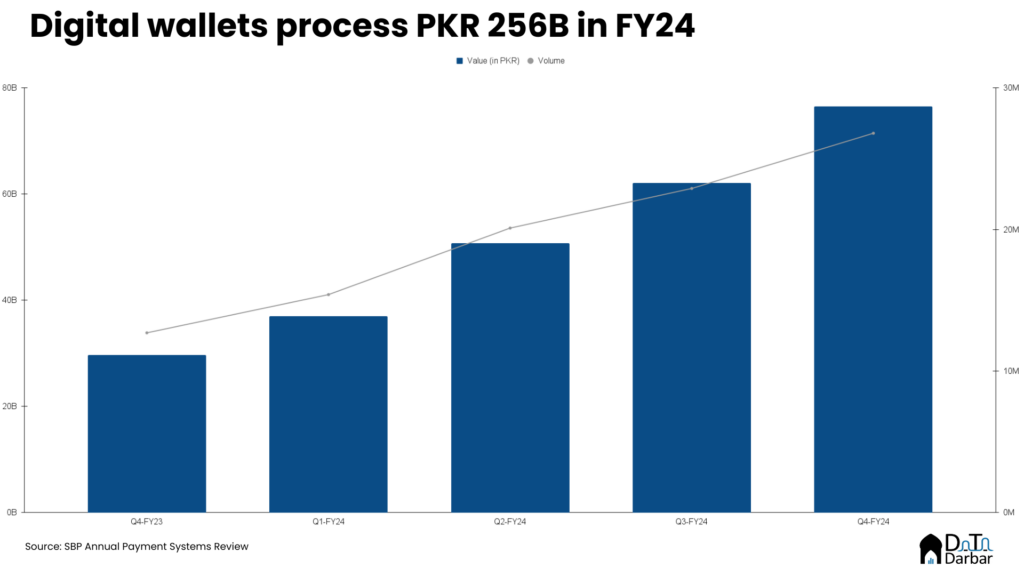

EMIs

Though relatively less explosive in terms of growth, electronic money institutions also seem to be on the right track. In Q4-FY24, their throughput soared 157.6% to PKR 76.5B while transactions jumped 111% to 26.8M. This took the annual cumulative to PKR 226.4B and 85.2M, respectively.

New user acquisition kept a steady pace as 475K new e-wallets were opened between April and June, reaching a total of 3.7M. EMIs also onboarded another 59K freelancers during the quarter, taking the FY24 value to 243,639. The entire credit here goes to Sadapay entering the freelancer segment and creating a new product for them.