Pakistan’s digital payments story is a bit strange. If you ask people about their experience, you wouldn’t stop hearing complaints about user interface, app crashes, customer service etc. Yet the data screams growth across virtually every metric, probably enough to comfort those sitting in the boardroom. I guess that’s the power of digitization: even the steady state, at slightly above bare minimum, can show great results?

And the latest numbers back this up. Expectedly, FY25 continued to show an impressive shift towards digital payments as a whole, albeit with wide variances within. Overall, the share of digital in banking transaction volumes crossed 60%, while that in throughput reached 21.7% by June, recording a jump of over 8pps YoY in both. To be clear, this is only for transactions facilitated through scheduled banks and doesn’t include the cash-based exchange of money outside the formal financial system. Or even the branchless universe.

Before we look into the most important trends from payments, let’s take a moment to understand what that includes. First is obviously the paper-based instruments such as over-the-counter cash deposits or demand drafts. Then you have PRISM, a high-value real-time gross settlement system, with only 59 participants. This is what banks use to send proceeds among themselves, or how money flows into government securities. Until recently, the SBP also used to classify real-time online branches under e-banking. Its current definition of digital payments includes:

- ATM

- Internet banking

- Mobile Banking

- Call Center/IVR

- Point of Sale

- E-commerce

However, we take a narrower approach and exclude ATMs. Instead, our focus is on POS, e-commerce, internet, and mobile banking. To maintain consistency, we exclude branchless due to different scale and data reporting standards. With all disclaimers out of the way, let’s review the key trends and put numbers in context.

Mobile Banking

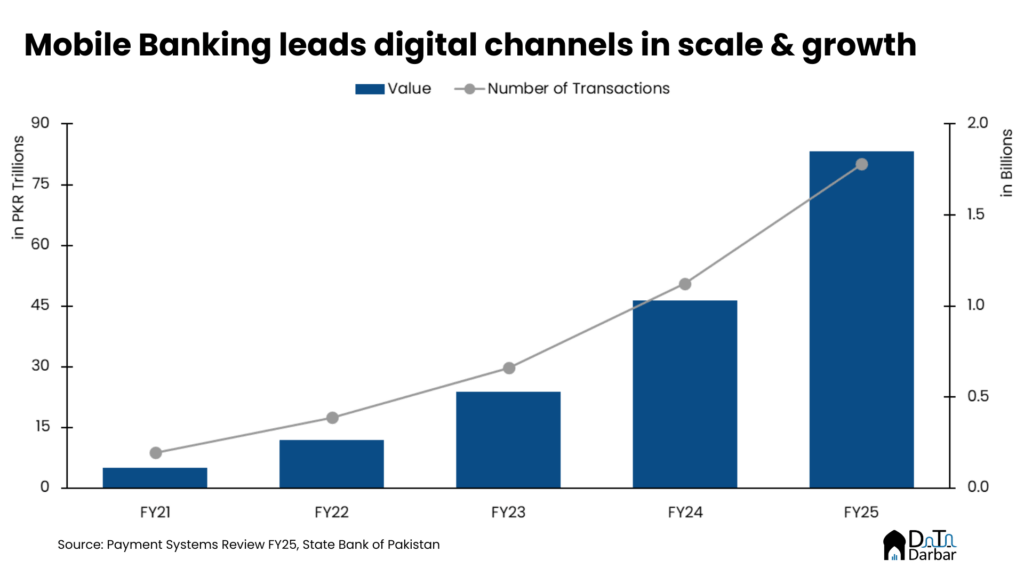

With each passing day, the gap between mobile banking and the other channels is growing. In terms of volumes, it accounted for 71.65 of all digital payments transactions during FY25, while the corresponding share in throughput was 67.3%. Only branchless is bigger, which is not included here.

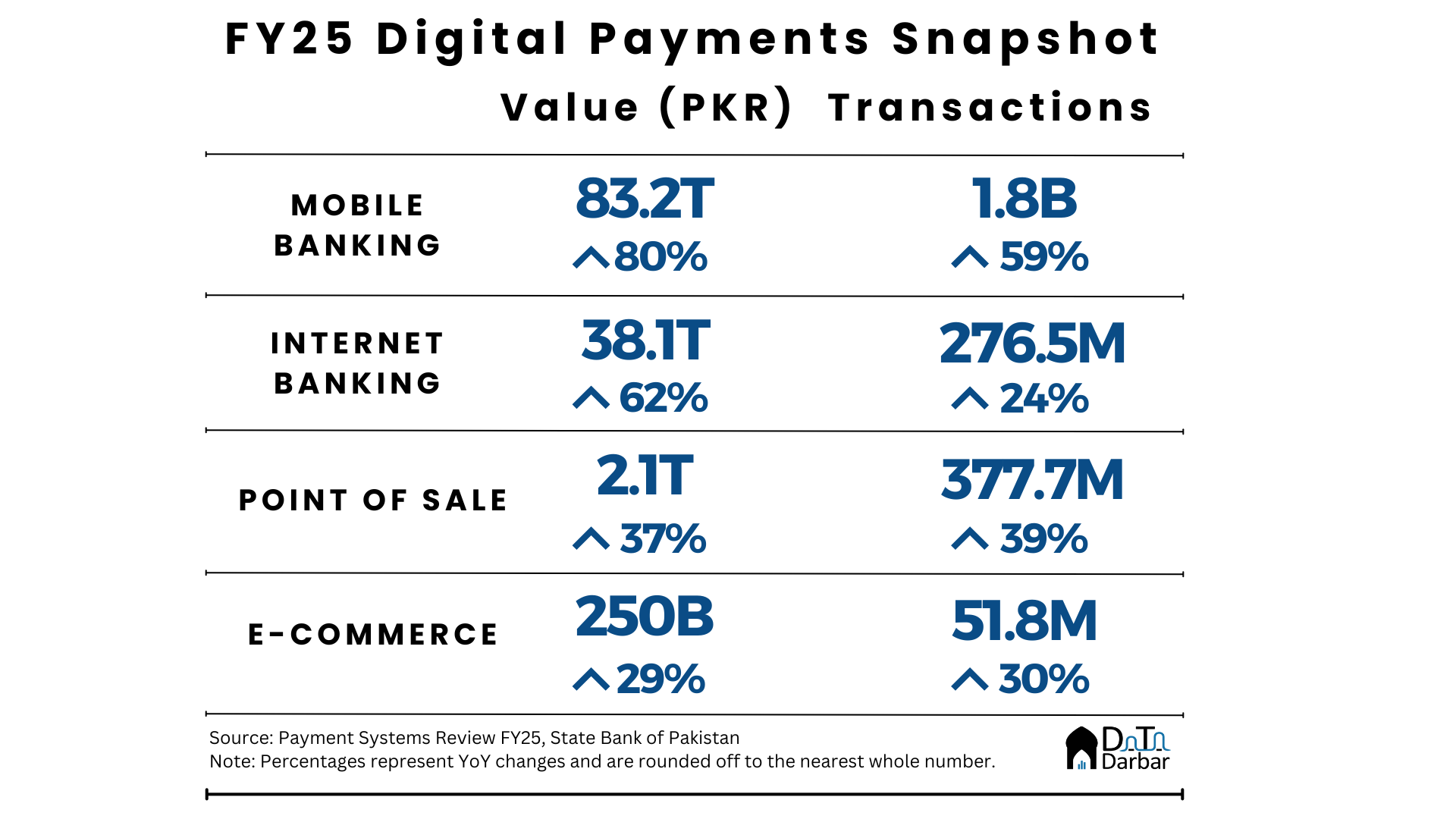

The total MB throughput reached PKR 83.2T across 1.8B transactions during FY25, up 79.6% and 58.6%, respectively. In fact, mobile has outpaced all other digital channels by value in each of the last five years. Could that be because the rest aren’t doing all too well? Umm, not really. Meanwhile, the average transaction size has maintained its upward trajectory, reaching PKR 46,743 in FY25, up from PKR 41,276 in the previous fiscal year.

Switching to quarterly, the value surged 78.9% YoY to PKR 24.2T whereas volumes jumped 56.9% to 508.2M in April-June, breaching the 500M-mark for the first time. However, on a sequential basis, both throughput and number of transactions saw a slight tapering off, usually witnessed in Q4, as the rate of increase slipped below 5% for both variables.

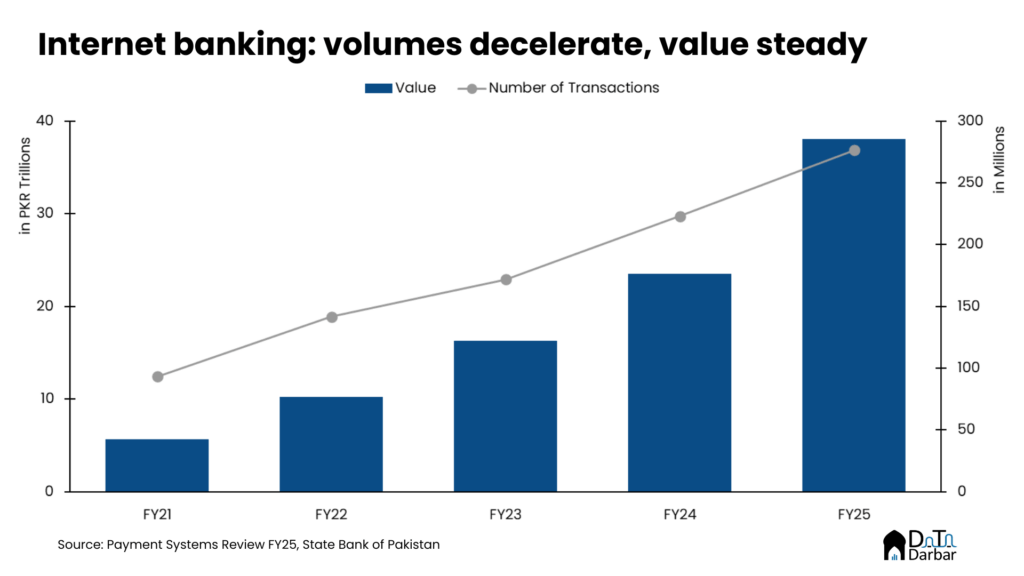

Internet Banking

Internet banking value rose by 61.9% YoY to PKR 38.1T in FY25, maintaining its runner-up position. Meanwhile, volumes increased by a relatively slower 23.9% to reach 276.5M during the outgoing fiscal year. As a result, average transaction size jumped by a steep 30.7% to PKR 137,691, up from PKR 105,369 in FY24. One potential reason behind this is the gradual adoption of NETB by businesses while mobile became the popular choice channel for individuals. In Q4, the channel processed 76.4M transactions worth PKR 11.2T, up 32.6% YoY and 59.8%, respectively.

Point of sale

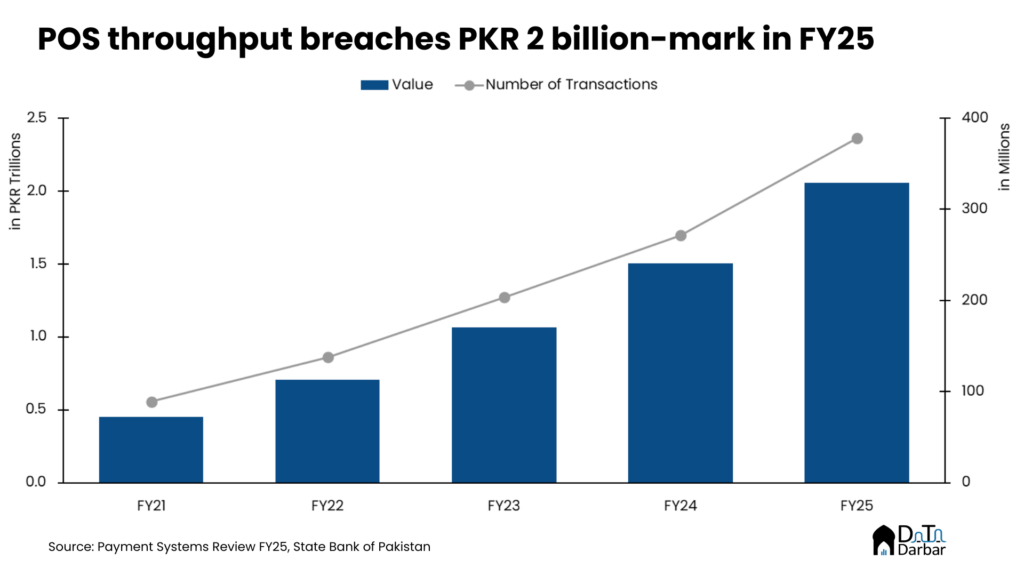

Probably the oldest digital channel in Pakistan, point of sale has never truly managed to reach masses. There are many explanations, ranging from the lack of incentives to acquirers to the heavy burden of merchant discount rates and everything in between. However, the past few years have been quite interesting to say the least, with the entry of new players, change in pricing structure as well as the regulatory push.

In FY25, the channel breached the 2-trillion mark for the first time and closed at PKR 2.1T, up 36.8% over the previous year’s PKR 1.5T. Volumes clocked in at 377.7M, rising by 39.2% over the preceding year. This was enabled by improving infra, both on the issuing and acquiring sides, with total payment cards reaching 59.3M whereas the number of terminals hit 195,849.

However, the average transaction value has held steady for a while now, standing at PKR 5,440 in FY25. Over the last five years, POS has witnessed the slowest uptick in mean ticket size at just 1.3% 5Y compound annual growth rate.

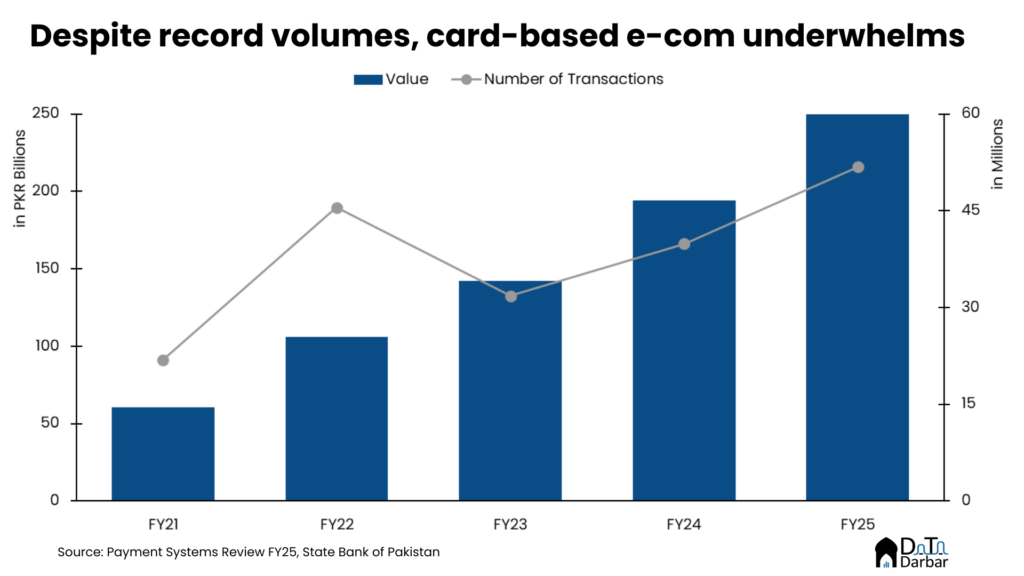

E-commerce

For too long the disappointment, card-based e-commerce had a mixed year at best. On the plus side, volumes finally crossed 50M to hit 51.8M in FY25, rising by 29.8% and at least breaching the FY22 levels. Throughput also grew at a similar pace to PKR 249.7B, from PKR 194.3B the previous period. This is despite some improvement in acquiring infra, where bank-registered merchants reached 9,584 while EMIs amassed a network of 16,635 by June.

The actual story was on the non-cards side, where branchless banking wallets processed a far more impressive 683.9M transactions worth PKR 662.7B in FY25. Though no one has yet tried to calculate it, an even bigger throughput for e-commerce would be hidden somewhere in the MB fund transfers.

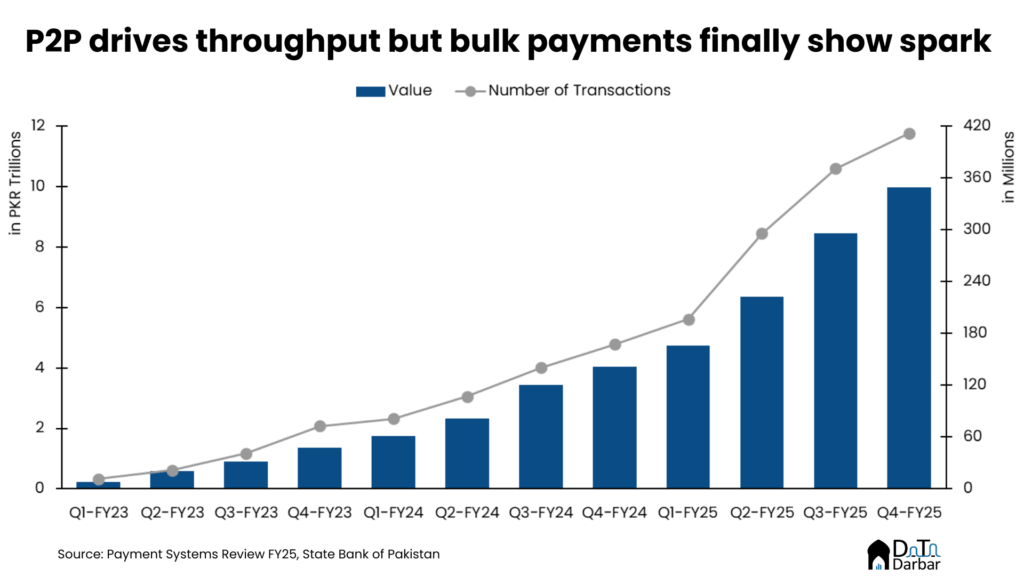

Raast

Now for the flagship project of the SBP, i.e. Raast. It’s been an interesting year for the national digital payments rail, with the finance ministry announcing subsidies to encourage acquiring by financial institutions. In aggregate, it processed 1.28B transactions — breaching the barrier of 1B — during FY25, surging 157% from 496M in the preceding period.

Similarly, throughput witnessed a 156% jump to PKR 29.6T in the outgoing fiscal year, from 11.6T in FY24. The growth trajectory has remained exponential, with Q4 seeing volumes and value of 412.2B and PKR 10T. Though SBP doesn’t give any such disclosures, these flows are dominated heavily by branchless banking wallets and must include a significant JazzCash ⇆ Easypaisa corridors. In fact, the former accounts for ~50% of all Raast IDs.

More importantly, bulk payments module scaled to PKR 1.1T in April-June. Despite being the earliest offering, this module had a pretty slow uptake and only recent push has brought it to the forefront. On the flip side, P2M is yet to find its footing with only 2.2M transactions worth PKR 6.5B in the last quarter.

Notes on Raast P2M: adoption, subsidies, and challenges

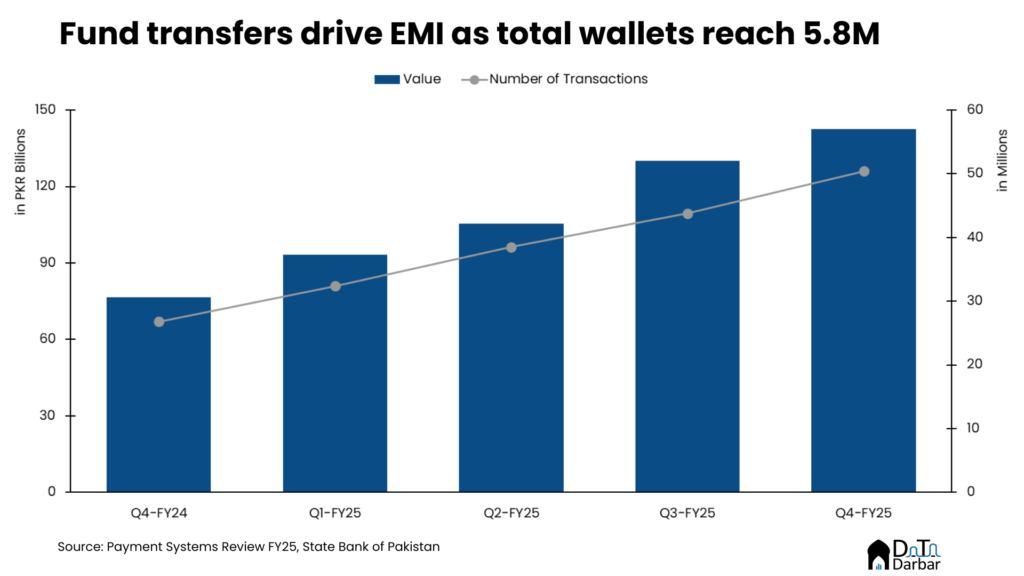

EMIs

On the other hand, EMIs are arguably yet to truly take off. In FY25, they cumulatively processed PKR 471.3B across 165.1M transactions. Issuing and acquiring activity showed more promise, reaching 5.8M wallets and 16,635 e-commerce merchants, respectively.

But the one area where digital wallets, primarily thanks to Sadapay, truly shined was the freelancer segment, having opened 323,885 accounts by June. This was only made possible after the change regulations in 2023 to include new revenue streams for EMIs and has already bore some fruit. But the core challenge of making money payments, amidst Raast and few issuing + acquiring incentives, remains in place.