Last week, Mashreq became the first digital retail bank to receive the SBP’s node to commence pilot operations. Over the next few months, we will probably see others joining the list, which will hopefully bring a breeze of freshness to the financial services industry. Commercial licenses will take their sweet time though, so don’t get your hopes up just yet.

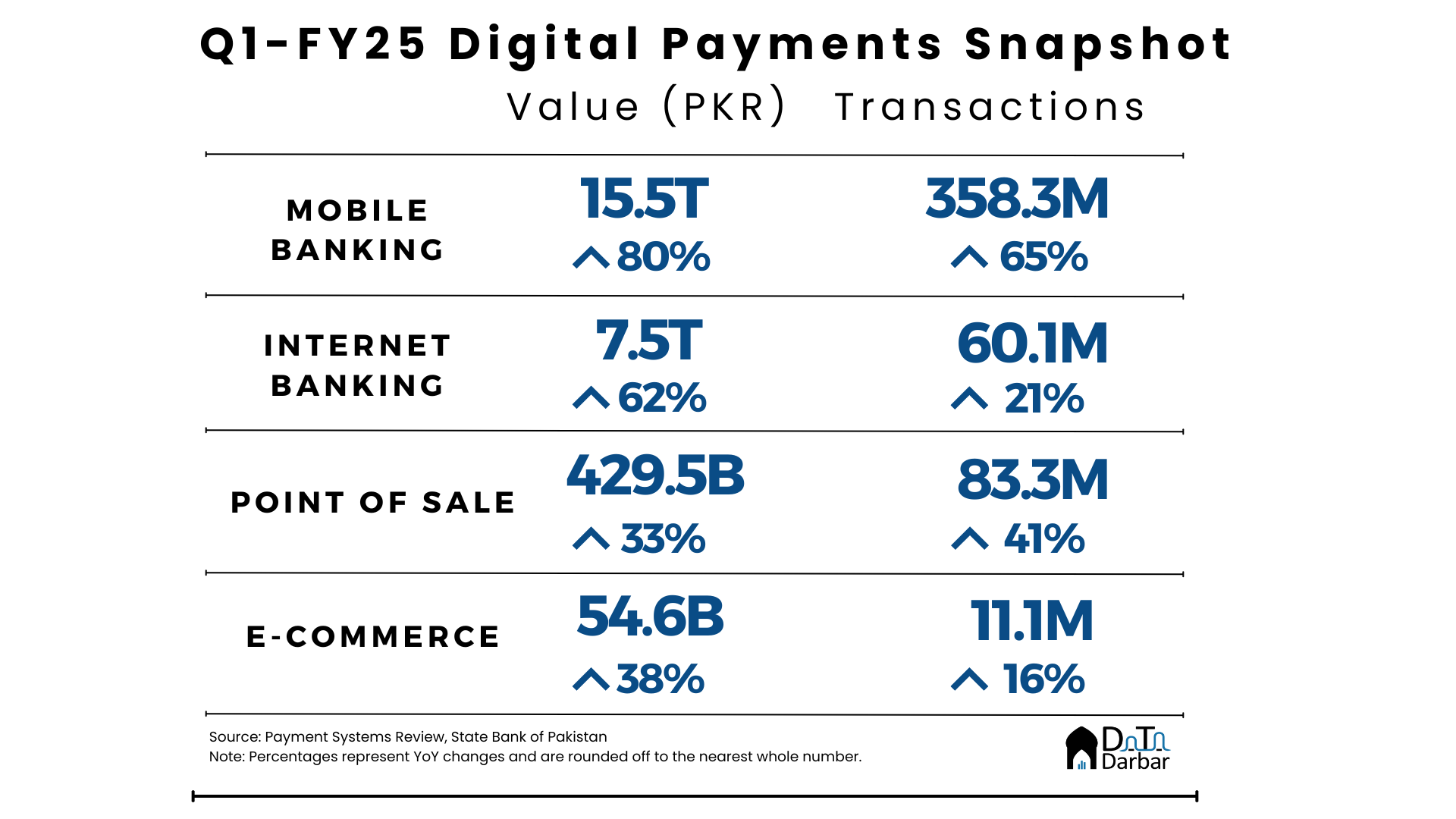

Till then, let’s stick to assessing how our beloved legacy banks are doing on the digital front. From a customer perspective, feedback may not be too great but as far transactions are concerned, the data speaks loud and clear. In Q1-FY25, 17.8% of throughput and 57.1% of volumes were already digitized, compared to 10.2% and 48.5% in the same period of the previous year. Lest anyone gets confused here, this is only for transactions facilitated through scheduled banks. It doesn’t include the cash-based exchange of money outside the formal financial system or even activity by branchless.

Before we look into the most important trends from payments, let’s take a moment to understand what that includes. First is obviously the paper-based instruments such as over-the-counter cash deposits or demand drafts. Then you have PRISM, a high-value real-time gross settlement system, to which only 59 entities in the country have access. This is what banks use to send proceeds among themselves, or how money flows into government securities. Until recently, the SBP also used to classify real-time online branches (RTOB) under e-banking, which no longer is the case. Its current definition of digital includes:

- ATM

- Internet banking

- Mobile Banking

- Call Center/IVR

- Point of Sale

- E-commerce

We have always taken a narrower approach and excluded ATMs from digital. Instead, our focus is on POS, e-commerce, internet, and mobile banking. To maintain consistency with previous editions, we will exclude transactions through branchless — where the scale is on an entirely different level. With all the disclaimers out of the way, let’s go over the key trends from the latest edition and put the numbers in context.

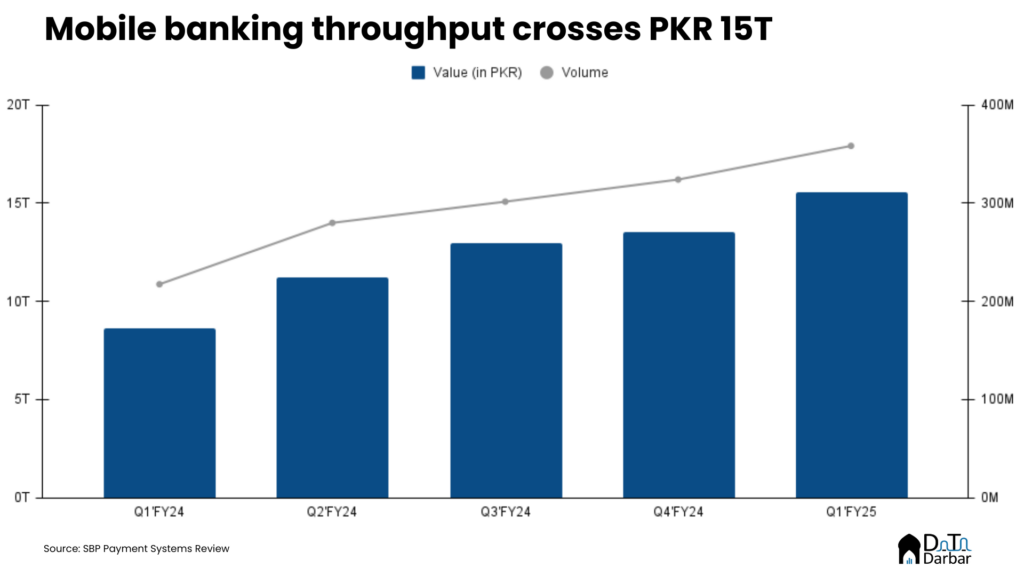

Mobile Banking

As always, mobile banking remained on top as both the largest and the fastest growing channel. Between July and September, it processed volumes of 358.3M worth PKR 15.5T, representing an increase of 64.8% and 79.8% over the same period of the previous year. This took the trailing 12-month aggregate to 1.26B and 53.24T, respectively.

Similarly, average transaction size also continued its upward trajectory, reaching PKR 43,377 in Q1-FY25. Meanwhile, the number of registered mobile banking users rose by 900,000 to reach 19.6M.

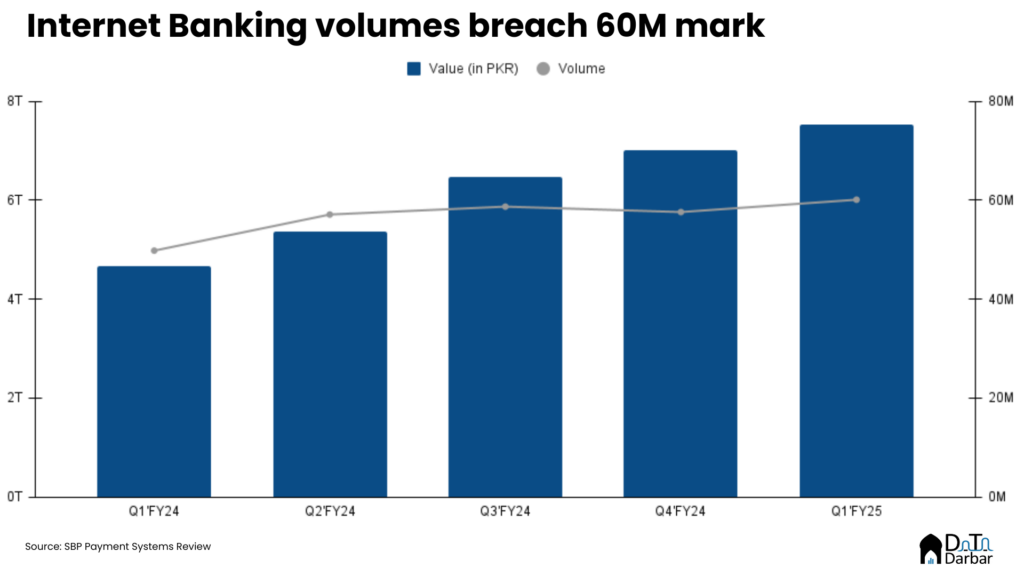

Internet Banking

Internet banking throughput surged 61.5% to reach PKR 7.5T during Q1-FY25, experiencing the steepest increase in two years. This was complemented by a 20.7% jump in volumes, which breached the 60-million mark to reach 60.1M. As a result, the average transaction size improved further to PKR 125,408. On a trailing 12-month basis, the channel hit figures of PKR 26.4T and 233.5M, respectively.

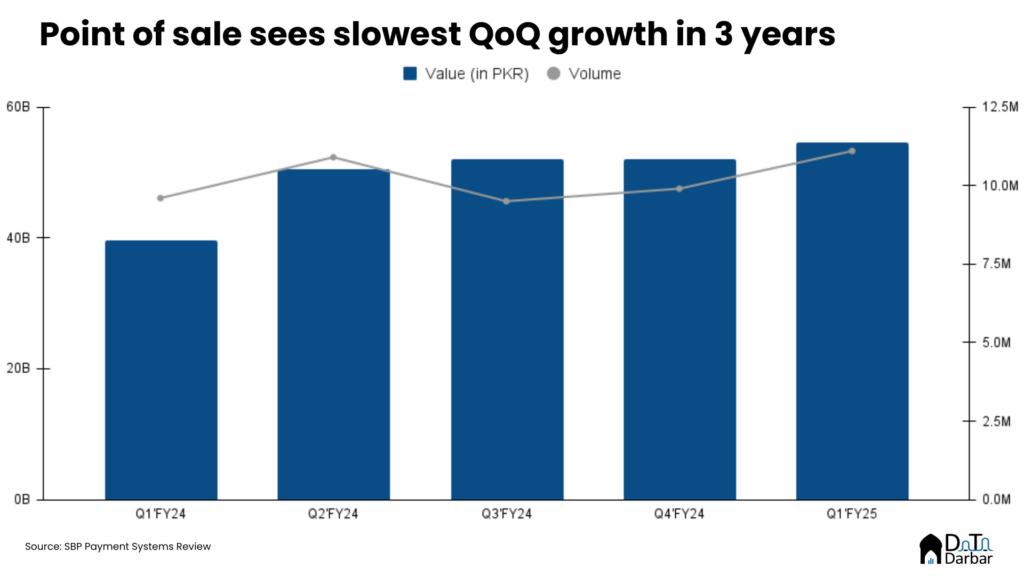

Point of sale

In the merchant-oriented space, volumes through point of sale touched 83.3M while value reached PKR 429.5B during July-September. This represented a jump of 41.2% and 33.4%, taking the trailing 12-month total to 295.7M and PKR 1.6T, respectively. However, the average transaction has remained range-bound around PKR 5,000 and stood at PKR 5,156 in the latest quarter.

Acquiring activity by banks also picked pace with the number of terminals clocking in at 132,224 — increasing by 6,631 over the preceding quarter. Similarly, the number of POS-enabled merchants rose to 104,281, from 98,936 in April-June. Over the last few years, the industry has heated up amidst the aggressive entry of banks, particularly Meezan.

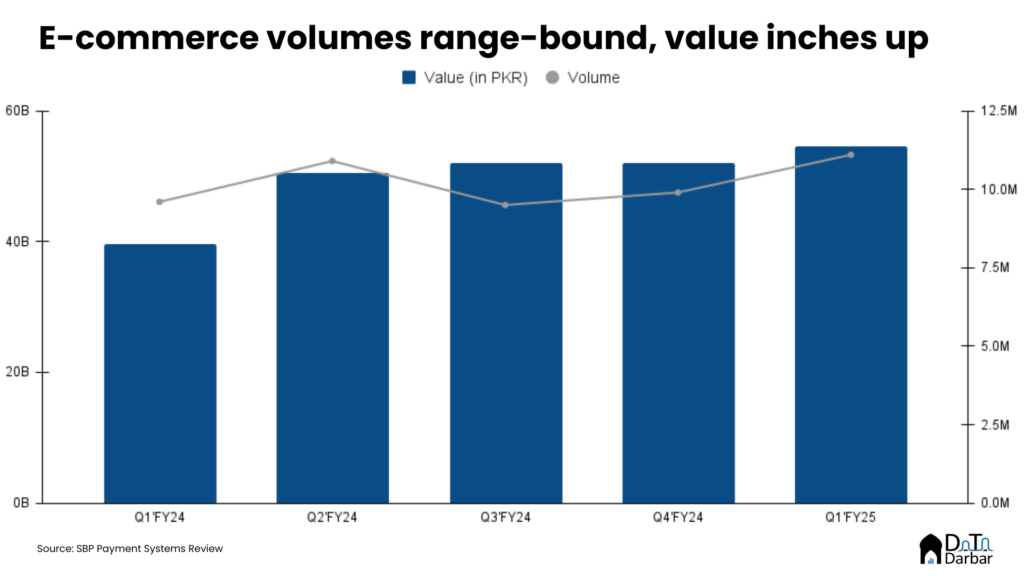

E-commerce

For e-commerce, it was yet another mixed bag of a quarter with a throughput of PKR 54.6B. Compared to the same period of the previous year, it was up 37.9%, helped by price pressures. Meanwhile, volumes bounced back by 15.6% to eight figures, at 11.1M during Q1-FY25. Consequently, the 12-month aggregate value breached the 200-billion mark to stand at PKR 209.3B while transactions were 41.4M, respectively.

However, the average transaction size slipped QoQ 6.5% but edged up 19.2% to PKR 4,919. On the acquiring side, banks and MFBs maintained a steady pace and onboarded 373 new merchants, taking the total to 8,189 by September. That said, card-based payments constitute a pretty small share of overall e-commerce. Cash obviously remains king but among digital channels, mobile banking and wallets are far bigger. While there’s no data for the former, the latter has seen impressive growth.

According to a recently introduced dataset in the PSR, branchless wallets processed 106.6M worth PKR 93.3B in closed-loop payments during Q1-FY25. These are not necessarily sales through online stores like Daraz or Khaadi, but primarily comprise purchases on Tiktok or PUBG, given the ticket size of just PKR 875.

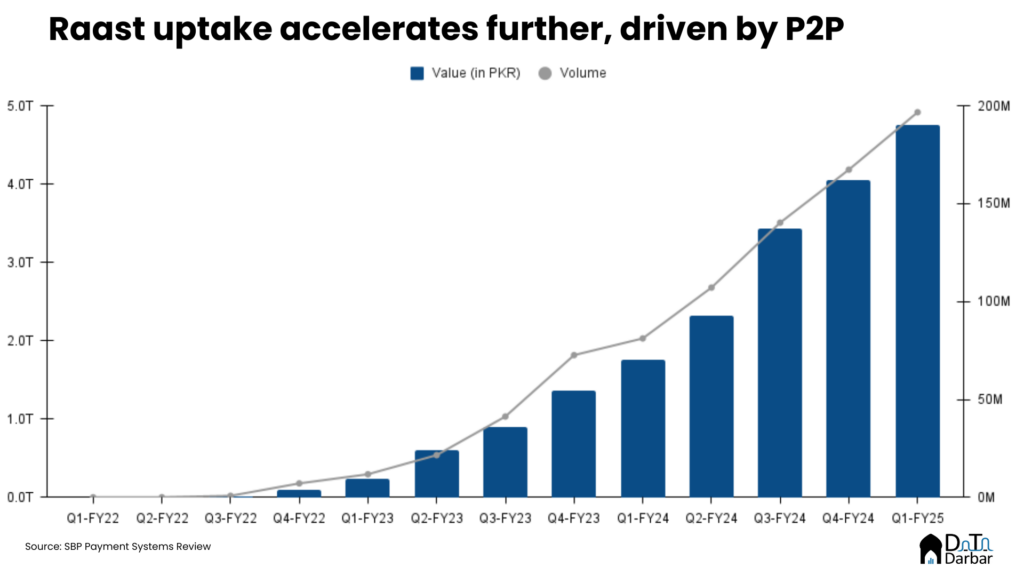

Raast

The problem with closed-loop payments is interoperability, which is what Raast person-to-merchant module plans to change. It’s still early days though and will take some time before progress, and data, becomes visible. In Q1-FY25, the national switch system processed a throughput of PKR 4.75T across 196.7M transactions — up 171.2% and 142.3% YoY, respectively.

But almost the entire activity was driven by P2P, with bulk payments contributing just 2.1% of value and 0.3% of volumes. Number of registered Raast IDs also increased to 39.5M, half of which can be credited to JazzCash alone.

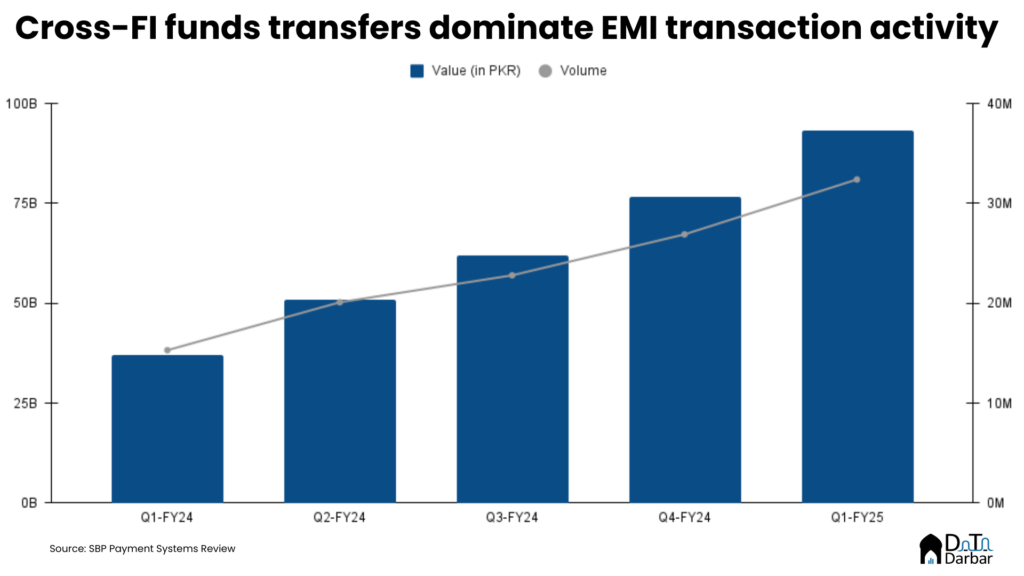

EMIs

Finally to the last bit, which probably holds the most appeal to people in my network due to the brand Sadapay and Nayapay have built. In Q1-FY25, electronic money institutions saw further growth as throughput soared 152% to PKR 93.3B while transactions jumped 112% to 32.4M. Impressive as the growth figures may look, a large part of it is due to the low base.

These wallets kept their customer acquisition pace pretty steady, opening 536,888 accounts during the latest quarter, taking the total to 4.2M. Another bright spot was the deepening in the freelancer segment with the onboarding of 59,123 new members, thanks to Sadapay. WIth Finja’s license now transferred to Opay, we also finally saw an uptick towards the retail side as the total merchants finally edged up to 5,317 after staying stagnant for two years.