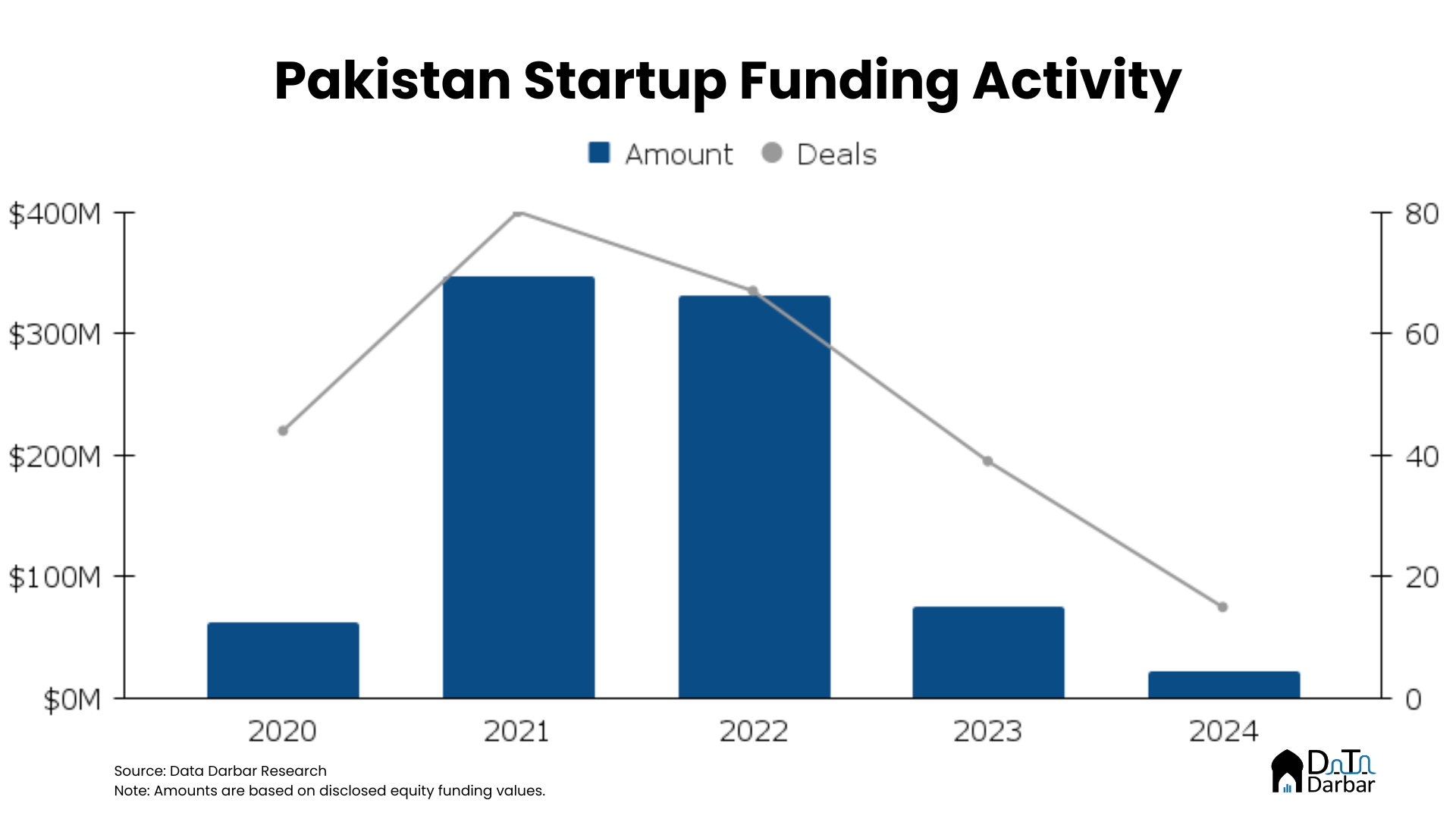

Pakistani startups witnessed another lackluster year as equity funding plunged further to just $22.5M in disclosed value, down substantially from $75.8M in 2023, while the number of deals came in at 15. These readings are the worst since at least 2018 when the ecosystem was quite nascent with hardly any of the current venture funds even launched.

Things could possibly have been worse, with Q1 just recording one deal and Q2 two. Relatively speaking, activity picked up in the second half of the year, especially as July-September funding almost doubled YoY to $15M on the back of four announcements with disclosed dollar values.

While the headline numbers may look dismal, the reality was slightly better, if not good. For starters, the amount is pretty understated as nine of the 15 announced deals didn’t disclose the actual dollar value. Secondly, and perhaps more importantly, we saw some activity in non-equity financing as well. During the year, at least three startups raised debt, with Abhi getting a $15M credit line and Neem another $4M. On the other hand, Shark Tank Pakistan also brought in a fresh funding avenue to local businesses through an entirely different format and saw some massive announcements.

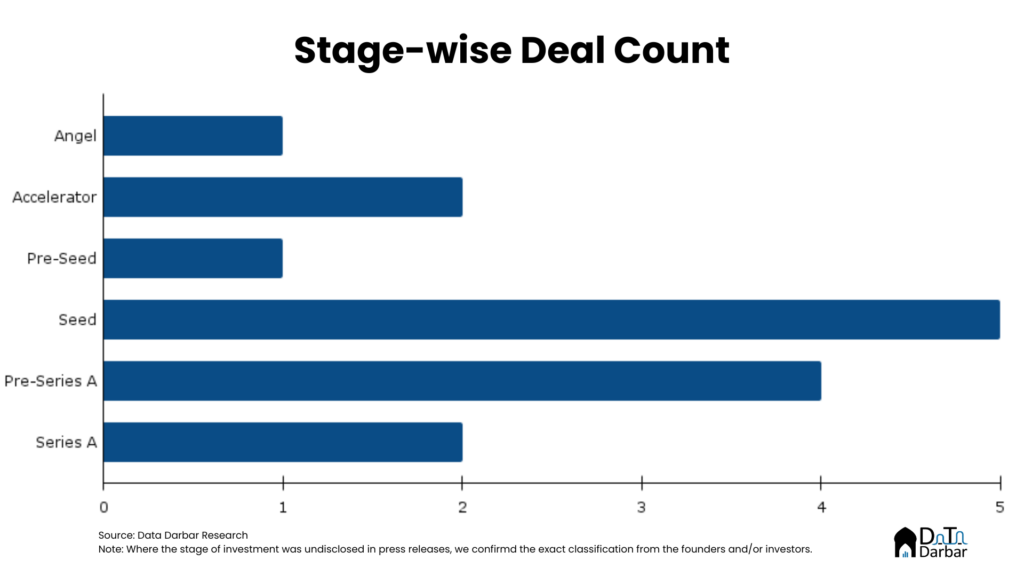

Sticking to equity for now, average deal size clocked in at $3.75M in 2024. This was 68% higher over the previous year, again because only six companies announced the round amount and happened to be not as early stage. Overall, a third of the deals were seed while another four were Pre-Series A and two came at Series A.

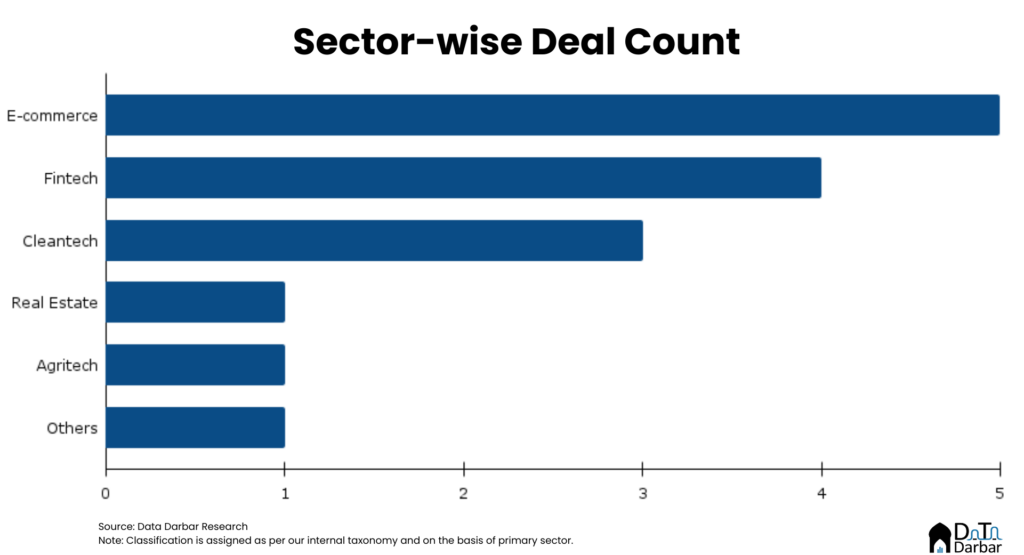

Sector-wise, e-commerce led in volumes with five deals worth a disclosed $8.5M, substantially down from last year. Meanwhile fintech came on top value-wise at $10.5M across four rounds. Transport & logistics, once a heavyweight, did not see any activity whatsoever.

Finally, we saw some signs of M&A, notably Turkiye’s Papara buying Sadapay at a reported price range of $30-50M. There was some consolidation at even earlier stages as Elphinstone acquired Trikl. However, for now, such transactions remain largely stock-based. It may still be a long while before we see any healthy pathway towards exits.

In our upcoming detailed report, we’ll break down more of these trends. Sign up here to get your copy in time.