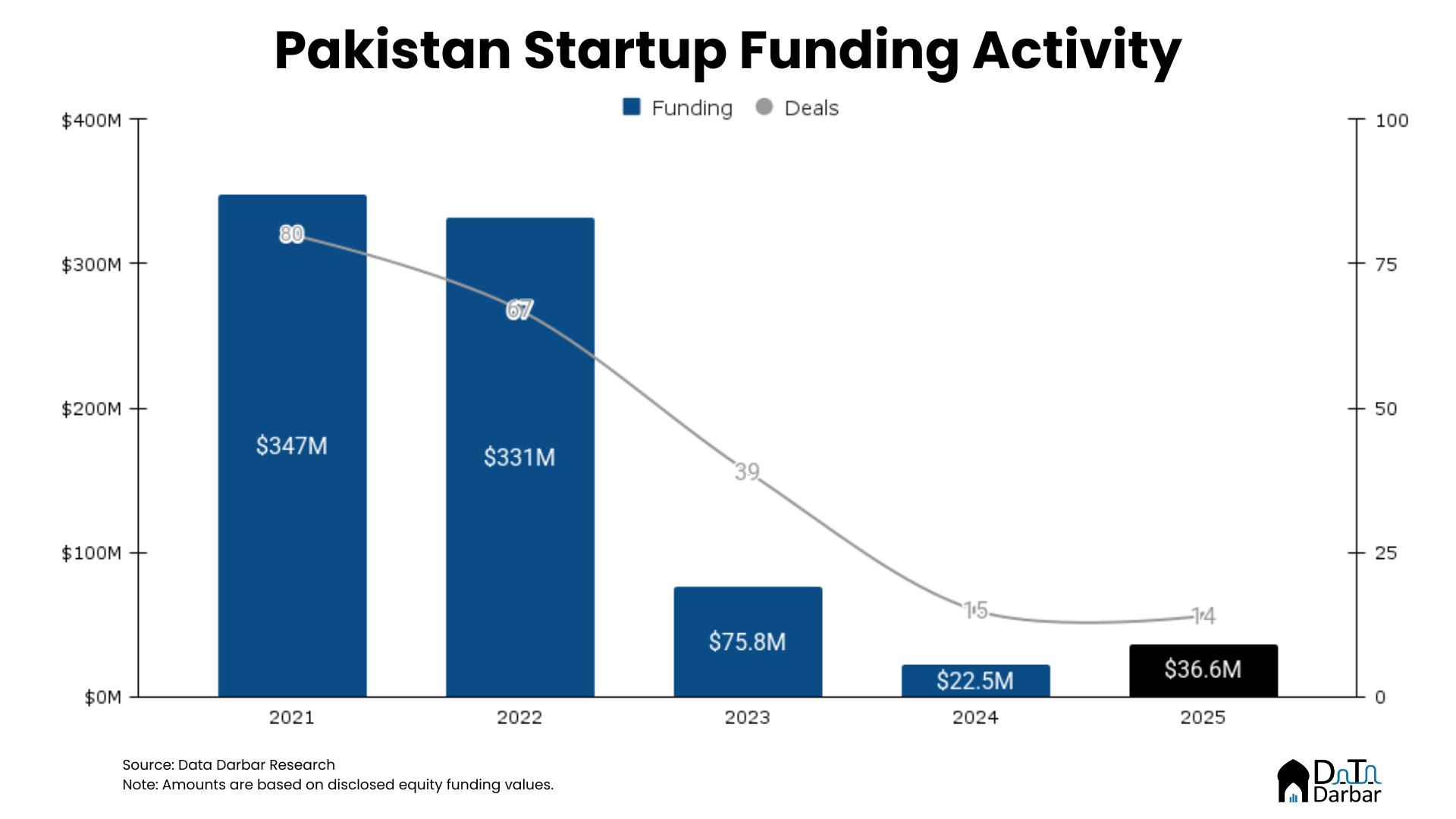

Pakistani startups in 2025 experienced a modest increase in funding activity, although the ecosystem remains significantly below its previous levels. Based on press or social media announcements, startups raised approximately $36.6 million in equity capital across 10 rounds, while four additional transactions did not disclose dollar values.

On a yearly basis, equity funding recovered modestly in 2025, rising to $36.6M from $22.5M in 2024, even as dealflow edged slightly lower to 14 transactions from 15. While the increase marks a clear improvement in capital deployed, activity remains concentrated in a handful of larger rounds, indicating that the recovery is being driven more by ticket size than by broader participation. The average disclosed equity deal size stood at roughly $3.7M, up meaningfully from last year, though this likely understates actual activity, as four of the 14 equity deals did not disclose amounts, particularly at the seed and angel stages.

From a gender lens, female-led startups raised $8.8M in disclosed equity funding, accounting for around a quarter of total capital deployed, despite representing a larger share of dealflow. This is a marked deviation from long-term trends and represents a major improvement over 2024. However, like all numbers in the last two years, every minor change is amplified due to the low-base effect.

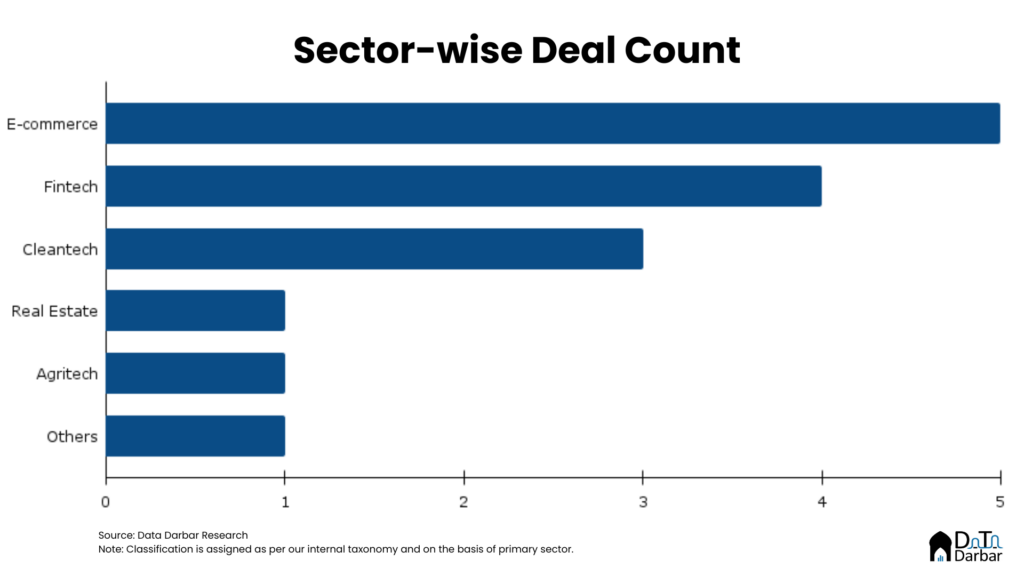

Fintech once again dominated, both in terms of volume and capital raised. The sector was anchored by Haball’s Pre-Series A funding round, backed by Zayn VC and Meezan Bank, alongside Metric’s $1.3M seed round led by an international syndicate. Consumer-facing fintech remained selective, with Qist Bazaar raising $ 196,000 in debt as part of its Series A round from Bank Alfalah. In contrast, additional angel and early-stage rounds contributed to the volume without materially moving the aggregate dollar figures.

Healthtech emerged as the second most active sector by both equity value and number of deals. MediQ’s $6M Series A, led by Rasmal Ventures and Joa Capital, was among the largest disclosed equity raises of the year, followed by Xylexa’s $1M seed round. Accelerator-backed startups such as BeMe further contributed to deal activity, underscoring continued investor interest in digital health and wellness models.

Beyond equity funding, 2025 also saw two major trends: the continued rise of alternative capital and consolidation. Haball raised $47M in debt financing from Meezan Bank, making it the single largest capital deployment of the year, while Bazaar Technologies’ acquisition of Keenu highlighted continued consolidation within fintech infrastructure. While these transactions sit outside traditional equity metrics, they point to a gradual shift toward balance-sheet-led growth and platform integration.

In our upcoming detailed report, we’ll break down more of these trends and contextualize in light of the regional and global developments. Sign up here to get your copy in time.