Data Darbar, a data and market intelligence platform, along with Emirati premium streaming platform Begin, announced the release of its annual State of Apps report for Pakistan. The report provides a comprehensive overview of the country’s mobile app landscape, highlighting key trends and insights that are shaping the industry.

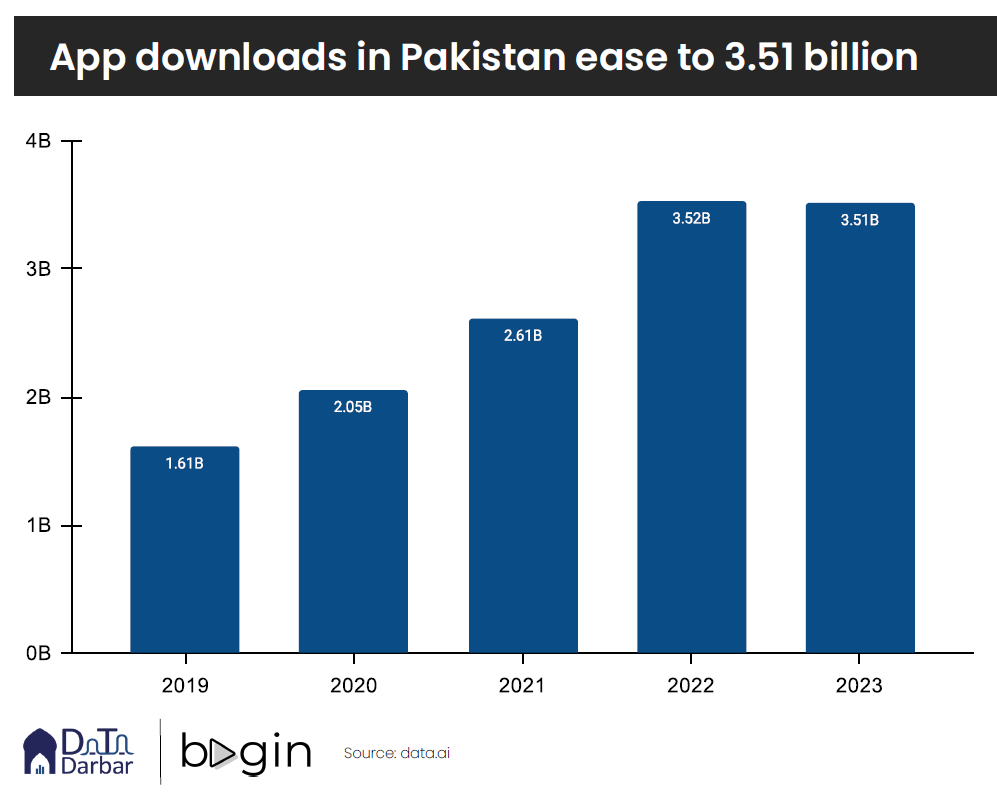

Pakistan saw 3.51 billion mobile app downloads in 2023, almost flat compared to 3.52 billion downloads the year before, as per Data.ai. However, consumer spend in the country rose to $87M+, from $82 million. Globally, the mobile app industry witnessed some recalibration where growth in new installs moderated 0.8% to reach 257 billion while consumer spend edged up 2.4% to $171 billion.

“After two years of being the fastest growing major market, new app downloads from Pakistan tapered off slightly in 2023. However, in addition to the relatively higher base at play, this was in line with the global slowdown where many peer countries, such as Egypt, Indonesia and Vietnam, experienced a similar trend,” said Natasha Uderani, co-founder of Data Darbar.

However, with continuous decline in the cost of broadband, Pakistanis are now consuming more mobile data than ever. This inevitably means that apps will take the centre stage for the country’s digitalization wave and the growth in downloads will reaccelerate in the coming years.

Meta and ByteDance dominated the most downloaded apps chart, with Tiktok comfortably taking the lead at almost 32 million installs during 2023 while WhatsApp Business followed behind. This was in line with the global trend where the two big tech giants remained the top publishers. Among games, the offline habits replicated in the online realm as three of the five most downloaded games in Pakistan were Ludo apps.

Among categories where publishers performed well, entertainment and finance stood out with downloads of 172 million and 144 million, respectively. The former featured Jazz-owned Tamasha in the top spot while Telenor’s Easypaisa led in the latter.

“The rise of streaming and finance apps in Pakistan underscores the underlying shift towards mobile for the delivery of not only entertainment but also banking services,” said Jonathan Mark, the chief commercial officer of Begin, a UAE-headquartered premium streaming service launching in the GCC region and South Asia. “As consumers become more tech-savvy and their demand for digital services increases, we expect to see further growth and innovation in these and other app categories.”

On the supply side, Pakistan-domiciled publishers around 5,000 apps in 2023, putting it just behind the regional powerhouse, Vietnam. With sustained uptick in the incorporation of new information technology companies, the industry is poised to grow over the coming years, particularly presenting a massive opportunity in export-oriented categories in games and applications.

Sign up to get your copy.