2021 was sort of a coming-of-age moment for the blockchain industry. Globally, record venture capital of $25 billion poured into the space across different use cases, from exchanges to decentralized finance. Similarly, major cryptocurrencies, despite their volatility, produced solid returns, and saw their market capitalizations surge. Pakistanis too jumped on the bandwagon and realized crypto gains over $604.5 million during the year, according to Chainalysis.

That translates into realized crypto gains of over Rs98b at the average exchange rate in 2021. It reinforces the popularity of cryptocurrencies in Pakistan as the country ranked third in the Global Crypto Adoption Index. Between July’20 and Jun’21, the on-chain value received by Pakistanis was over $20b. That number caused quite a stir in economic circles as many confused it with assets owned.

Policymakers panicked as high crypto trading activity could potentially lead to dollar outflows and further deplete the forex reserves. As a result, a committee comprising the State Bank and other regulators recommended a ban on blockchain in Pakistan. However, that seems to have failed in deterring Pakistanis away from Web 3.0, the third generation of the world wide web built using decentralized tech such as blockchain, peer-to-peer networks, etc.

Pakistan’s Crypto Obsession

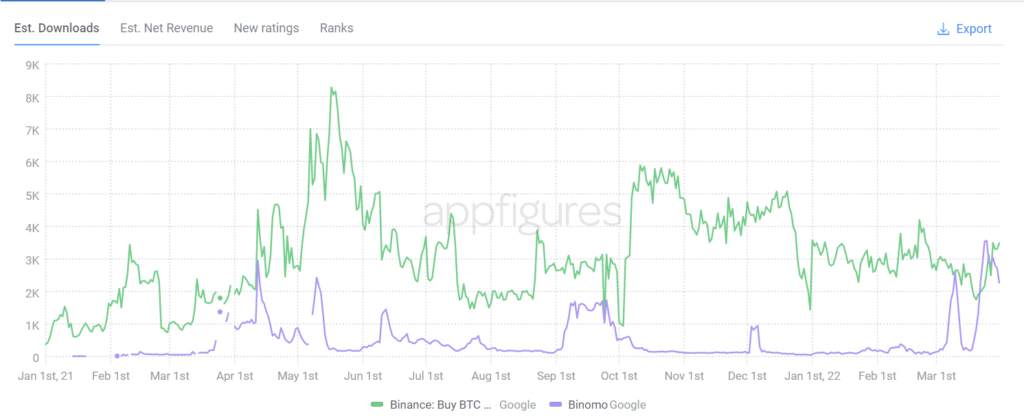

We can gauge that interest from how people are flocking to crypto trading platforms. According to Appfigures, Binance has an estimated 1.4 million downloads in Pakistan since the beginning of 2021 while Binomo has some 200,000.

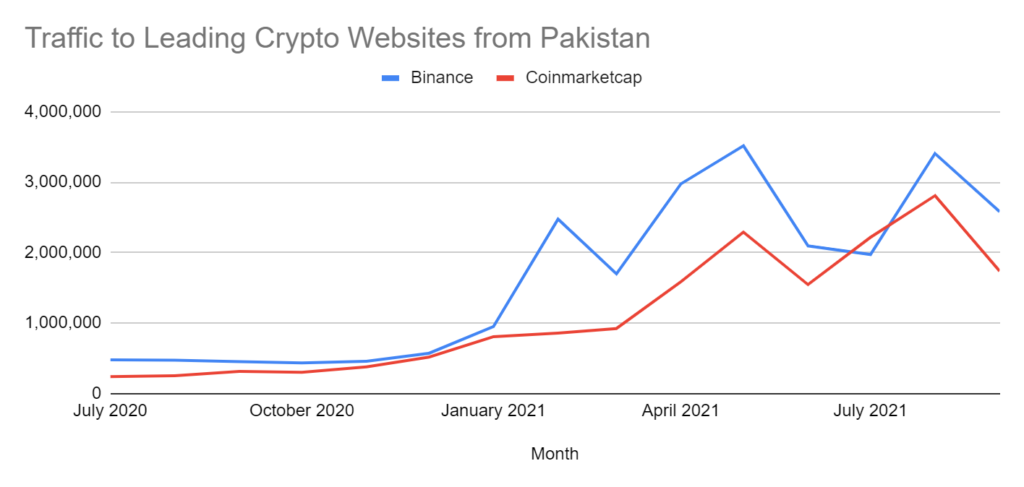

That’s just the apps side. We can also turn to web traffic and search data, which shows that the average traffic from Pakisan to Binance and Coinmarketcap between July 2020 and September 2021 was 2.4m and 1.6m, respectively. No wonder then that regional crypto exchanges are bullish on the market and looking to enter.

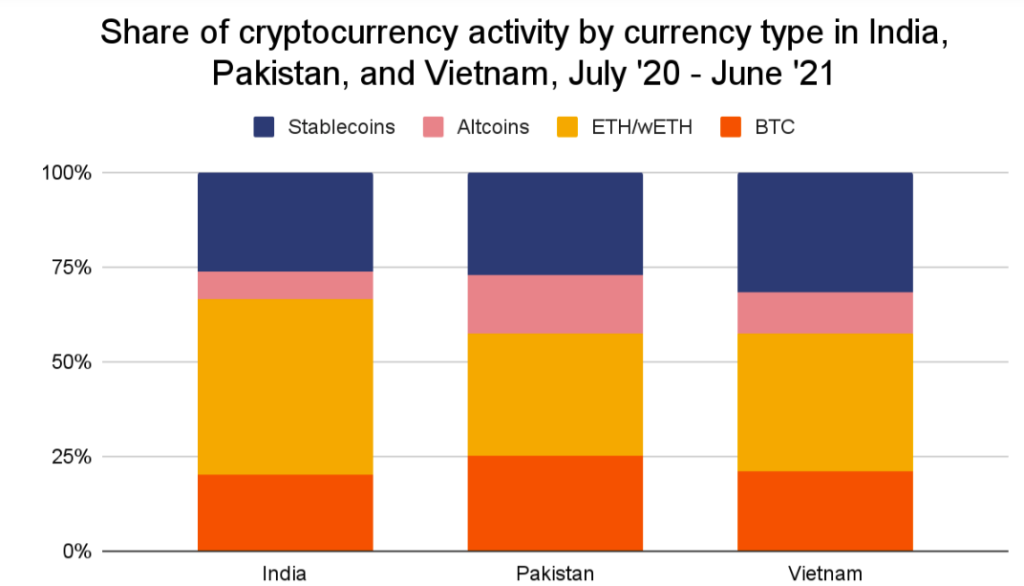

But, back to crypto gains. While the size of gains seems big, it’s the lowest among all the countries Chainalysis covered. Globally, the value of realized crypto gains was around $163b with US investors leading at almost $47b. For Pakistanis, the returns were split 60-40 between bitcoin and Ethereum. This is broadly in line with past investing patterns where the two leading coins accounted for almost 60% of the traded value. Altcoins and stablecoins accounted for the remaining share but appear nowhere in terms of returns.

The question is, what’s ahead for Pakistan’s blockchain ecosystem? It depends a great deal on what mood the policymakers are in. From the looks of it, the new finance advisor, Miftah Ismail, wants to stay out of the innovators’ way and let them innovate. But let’s see if his words are going to match the government’s actions.