Over the past year, we have all been bored to death of listening to that tech dudebro in our circle telling us about the impending fintech revolution in Pakistan.

You probably have heard it all: from the outlandish ones predicting a crypto future with no place for fiat to how startups will dethrone existing financial services providers once Raast, the central bank’s real-time micropayments gateway, truly takes/picks up pace. Earlier last week, we got one step closer to the latter as Prime Minister Imran Khan launched the second phase — instant peer-to-peer payments — of Raast.

What that means is now you can transfer money to anyone through Raast. If you are wondering, how does that change anything since the same task can be done via 1LINK’s Interbank Funds Transfer (1IBFT)? For starters, the former is currently absolutely free “in spirit to promote financial inclusion in Pakistan”. Secondly, it’s much more convenient as you don’t need all those details such as a bank account number in a specific format to send the money. Their Raast ID — which can simply be a mobile number, email address, or another moniker — is all that’s required.

So far so good, right? But before you get too excited, do remember that Raast is just a switch system that connects all the financial services intermediaries and brings in interoperability. To make the transactions, you’d still need to channel the transaction through your bank which is where the real hassle was in the first place. I mean it doesn’t matter whether you are sending someone money through Raast or 1LINK if the bank’s app is down, which is a routine occurrence for a certain tech company with a banking license, there is little that can be done.

The State Bank of Pakistan’s website lists 18 banks that are already offering Raast, of which 14 have it integrated with their e-banking channels while the remaining four have it available only at specific branch counters. “I had registered my Raast ID very early on using my bank’s mobile app and then did a transaction or two. Everything was smooth. But a few days later, when a friend transferred funds using Raast, I did not receive any money even though his app showed the transaction as successful. On calling the bank, they told me I am apparently not registered despite my Raast ID showing up as beneficiary to others,” says Fayaz Hussain.

While it might still be early days, a casual audit of banks’ websites doesn’t give a particularly comforting picture. For example, one fine institution simply copy-pasted the SBP’s list on its Raast FAQs (frequently asked questions) page, even the “Please reach out to your bank regarding limits on Raast transactions” instead of giving its own limit.

And that basically emphasizes the importance of Raast in potentially bringing some freshness to Pakistan’s moth-eaten financial services industry where boomers assess their performance by the number of memoranda of understanding signed every month. The SBP’s interoperable micropayments gateway will make it easier for new entrants to easily integrate with other entities and enable payments.

Secondly, it will open up possibilities for fintechs to develop new use cases on top of Raast. The SBP cites request-to-pay as one such example: “Under pull payments, a retailer would be able to pull money from the customer’s account, provided there is a confirmation mechanism or a pre-existing authorization from the customer. A common example of pull payments is direct debit.”

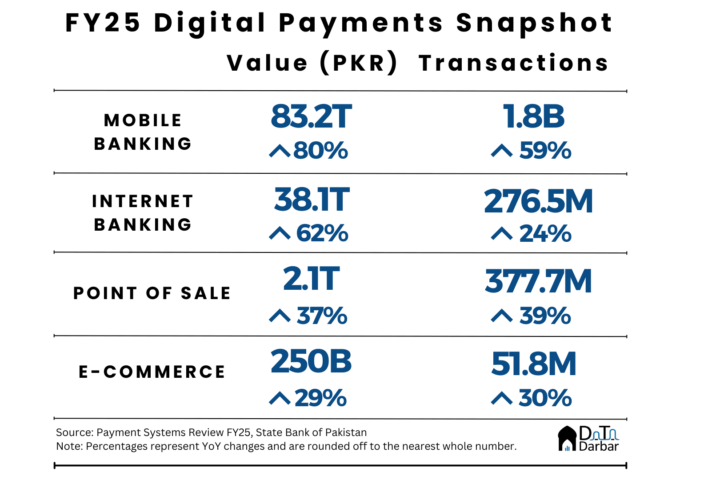

The regulator is pinning hopes on Raast to promote financial inclusion as well as trigger a further shift toward digital payments, which has seen significant growth since the onset of Covid-19 and the subsequent temporary waiving of IBFT charges. Mobile and internet banking transactions combined surged to Rs10.6 trillion (286.8 million volume) during 2020-21, from Rs4.7tr (139.4m) the previous fiscal year.

However, paper transactions still hold considerable weightage as their total value of Rs151.6tr is much larger than the aggregate of e-banking (which also includes primarily cash-based channels like real-time online banking and ATM). That, in essence, shows the potential for digitization.

Moreover, peer-to-peer is just one part of the Raast vision: the other two are bulk payments (which was the first to be launched back in 2021 and has over 30 banks onboard) while the yet-to-be-launched third phase is person-to-merchant payments. Unfortunately, little data has been made available by the SBP on the volume and value of bulk transactions to assess what the uptake has been like.

This article originally appeared in Dawn.