In the fields of art and even journalism, there has been a long-standing debate on whether to educate the consumer or feed them what they already like, thus reinforcing their tastes. Think how directors of masala movies (or Pakistani dramas) justify their dull and formulaic approach to the masses, often arguing this is what the market demands. That in turn leads to echo chambers of essentially the same thing produced by everyone, dumbing down the viewer’s taste over time. Thanks to big tech and its obsession with algorithms, the issue has become even more pronounced and led to an obvious polarization of society.

All of this could somewhat apply to the state of financial services in Pakistan as well. Think about it, even the most financially included people here mostly have access to just a current or savings account — that’s as basic as it gets. Getting a credit card is a hassle, let alone obtaining a loan. Despite this, every few years, the regulator comes in, albeit with the good intention of nudging financial institutions (FIs) in the right direction, by introducing lite versions of already simple accounts. This effectively sets the bar even lower for the banking fraternity who can now get away with a few memoranda of understanding and self-congratulatory posts.

For quite some time (and even now to an extent), this was how the State Bank (SBP) planned on bringing more women into the financial inclusion net, such as introducing Asaan Accounts. It didn’t seem to have worked well and this time the regulator has apparently taken a more holistic approach. To this end, it published ‘Banking on Equality Policy: To Reduce the Gender Gap in Financial Inclusion’ last Friday.

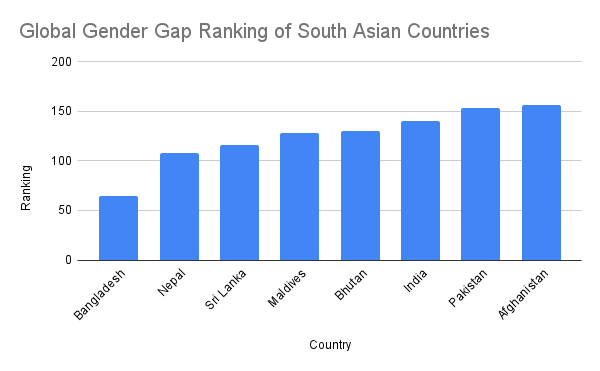

It begins by identifying the magnitude of the problem as the gender gap in Pakistan, as measured by Findex, has broadened by 12 percentage points to 28 per cent in 2017, compared to 2014. This makes us one of the worst performers in South Asia. Despite adding 5.5 million accounts in three years, the total number of female bank accounts at the end of June 2020 stood at just 18.6m, roughly 18pc of the adult women population.

To address the issue at hand, the 36-page document identifies five pillars that need to be strengthened in order to make financial services more inclusive for women, the first of them being ‘Gender Diversity in Financial Institutions and their Access Points. It mandates FIs to come up with their respective plans within six months to increase female representation to at least 20pc by 2024, in addition to setting up a sub-committee and nominating focal person(s) that will meet quarterly with the SBP for review. The same applies to branchless banking agents where women make up just 1pc of the total, which the regulator plans to bring up to 4pc by December 2022 and eventually 10pc by the end of 2024.

The second pillar, Women-Centric Products and Outreach Targets, talks about setting specific targets for credit and savings and applying a gender lens to those services. Part of the plan is to set up a female marketing team that works towards promoting financial literacy and could include engaging influencers or religious scholars. It further discusses partnerships with other organisations, such as the Ehsaas programme where beneficiaries could be graduated from cash transfers to more sophisticated instruments. Last but not the least, the document talks about the simplification of loan processes and documentation.

It also publicly acknowledges how women feel intimidated visiting bank branches and to this end, proposes the presence of Women Champions at All Customer Touch Points, the third pillar. These will serve as a central point of contact to provide information about financial products and services, non-financial advisory and complaint redressal facilitation. The banks can train their existing staff — male, female or transgender — for gender sensitivity in the meanwhile but within the next three years, at least 75pc of the champions need to be women and set a phased timeline for this goal.

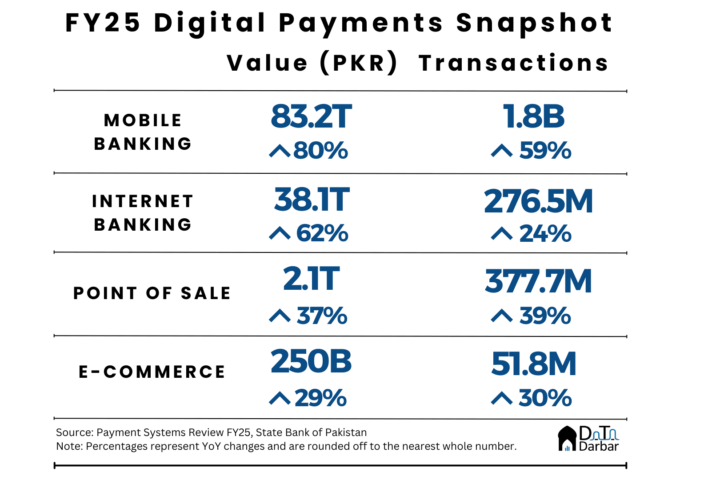

Most importantly, the regulator seems to have finally come to the realisation that empty talks and seminars on equality in financial services serve no meaningful purpose other than marketing unless there are no corresponding numbers with it. Hence, finally, the financial institutions have been asked to “start collecting and submitting quarterly gender-disaggregated data, to remain attentive towards women’s share in bank accounts, credit offtake, payments, agriculture disbursements, Islamic financing etc. This is a good start but it beats me how no one, not even the tech company with a banking licence, could pull this off and needed a comprehensive policy to nudge them.

The SBP plans to assign minimum benchmarks and gender-wise metrics, meeting which could accord financial institutions a “Women Friendly”’ certification from Pakistan Bankers Association. If nothing else, at least brace yourselves to see banks patting themselves on the back all over social media and in newspaper ads for achieving the absolute bare minimum.

The final pillar is setting up a ‘Policy Forum on Gender and Finance’, to meet at least bi-annually, with the aim of reviewing existing frameworks and suggesting improvements. At the same time, the Securities and Exchange Commission is also expected to introduce its own roadmap for non-financial sectors. What’s refreshing to see is that the central bank plans on applying similar standards to itself, as the document fleetingly mentions hiring, retaining and promoting more women within the organisation.

Of course, this is not the first time we have seen a policy come on some existing service gap in Pakistan. In fact, McKinsey as well as some development organisations regularly make a killing out of producing comprehensive strategy documents year after year on issue after issue, yet hardly anything changes on the ground. Let’s just hope this doesn’t end up the same way.

This article originally appeared in Dawn.