A lot of discussion on digitization in Pakistan inevitably gets either technical or hypothetical. Unfortunately, this diverts attention from the most important aspect: ensuring that any innovative solution reaches the masses and becomes part of their daily lives. This is what Careem or Bykea managed to do successfully.

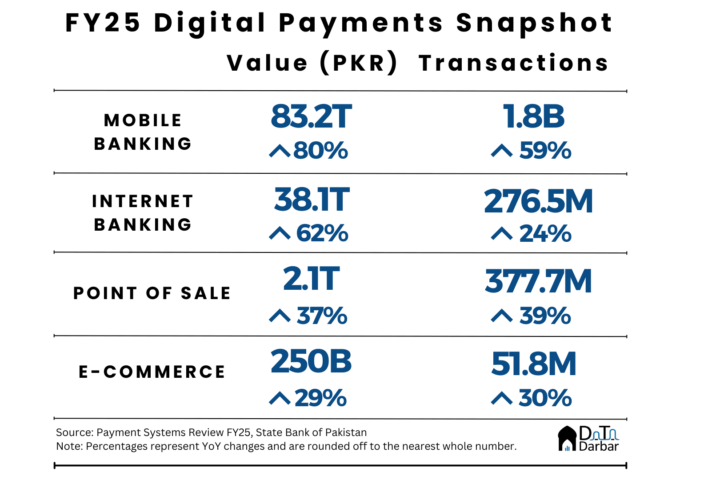

Simplifying an average person’s routine tasks and responsibilities is where the digitization efforts should focus on e.g. making it seamless to get your degree verified or ordering a cab. Bill payments fall exactly under that category. Data from the past few years shows a major spike in the use of digital channels.

Currently, numbers for utility bill payments (UBP) are reported in two separate sources by the State Bank of Pakistan (SBP): first, in the Payment Systems Review under e-banking, which is further divided into mobile phone, internet, call center, and ATM. Then, in the Branchless Banking Newsletter, which has categories of mobile wallets and over-the-counter (OTC) transactions, of which only the former is of our use as the latter basically means dealings in cash through an agent.

So to look at the trends in just digital UBP, we can add numbers of five channels: m-wallet, ATM, call center, mobile phone, and internet banking. According to aggregate data, Rs159.6 billion was paid in utility bills across 43.9 million transactions in the first quarter of 2020-21, giving an average ticket size of Rs3,633. This represents a staggering surge of 167 percent and 115pc, respectively, from the same quarter of 2019-20. That means in just one year, both value and volume more than doubled.

Of this first-quarter value, 65.9pc came from either of the four e-banking channels — with the internet and mobile accounting for almost the entire share — while m-wallets contributed 34.1pc. On the other hand, volumes were led by m-wallets at 59.25pc and e-banking at 40.75pc. That could possibly be an indication of how despite the traditionally banked customers — i.e. users of e-banking channels — driving the value, branchless banking still has a lot more market penetration in terms of the number of transactions.

Within the individual e-banking streams, UBP accounts for over one-third of mobile banking volumes and a quarter in that of internet banking. However, in terms of value, none occupied a share of more than 6pc in its respective category during the quarter. Unfortunately, due to some missing branchless banking newsletters in between and some consistency issues, it was possible to compile aggregated UBP for only six quarters: from April-June 2019 to July-September 2020.

For a longer horizon, let’s just stick to the e-banking numbers, which show that UBP value and volume reached Rs212.4bn and 53.9m in 2019-20, posting cumulative annual growth rates of 39.1pc and 29.5pc since 2011-12. The increase is even more impressive if we zoom in a little, with respective CAGRs coming in at 58.9pc and 40.9pc from 2015-16. What did exactly change in 2016-17 that all of a sudden numbers jumped so much? No one knows for sure, but perhaps it can be attributed to more banks opening up their digital platforms for bill payments.

Another reason could be how everything, including utilities, became pricier in the wake of the continuous devaluation of the rupee, says 1LINK’s Chief Disruption Officer Syed Ahsan Aslam. Obviously, volumes shot up as well, which the company’s CEO Najeeb Agrawalla attributed to the pacing up of digitization efforts and the introduction of mobile apps by banks.

However, to really understand the penetration of digital channels in UBP, it’s important to look at their share in the overall bill payments. Unfortunately, that’s not possible because there is no dataset that gives the figures for cash-based transactions as well. Attempts at getting some insights from utility companies didn’t materialize immediately.

A rather imperfect way to overcome this can be through digging into the branchless banking data and calculating the share of m-wallet UBP vis-a-vis OTC. The former has increased from 23.2pc to 51.1pc in volume and 31.9pc to 49.4pc in value from April-June 2019 to October-December 2020. This was led by both m-wallet value and volume increase in absolute terms and those of OTC declining. However, these percentages should still be read somewhat cautiously before drawing any broader conclusions for two reasons: the time horizon is still quite short and the overall numbers may or may not be representative of the country-level trends.

Better would be to refer to a report by Karandaaz, which undertook a similar exercise and estimated the total amount being paid in utility bills using the Household Integrated Economic Survey of 2015-16. Based on that, an average Pakistani household spends around Rs22,000 per year on utilities — giving an aggregated annual utility spend of Rs638bn during that year.

“For comparison with the latest supply-side payment data, the aforementioned estimation of Rs638bn is extrapolated using two projection variables: (i) growth in the overall population (in the case of landline and internet connections, growth in respective subscriber bases has been used instead of population) and (ii) inflation in order to arrive at a market size as of December 2019,” the publication notes.

In the end, the report comes up with a figure of Rs908bn for the total spend in 2019. During the same year, Rs258bn was routed through the digital channels (based on the e-banking and branchless datasets), meaning their share in the overall UBP is estimated to be around 28pc. Obviously, this is based on a number of assumptions but in the absence of national-level aggregate figures, and inconsistency with the newer HIES, a proxy is all we have.

To state the obvious, this is certainly an area with a desperate need for convenience as the current process is unbelievably inefficient: just the idea of submitting your CNIC’s copy for every transaction to the bank should really be a matter of extreme embarrassment for our regulators and the powers that be. With a payment as recurring as bills and an estimated Rs650bn being done via cash, there is massive room for improvement.

This article originally appeared in Dawn.