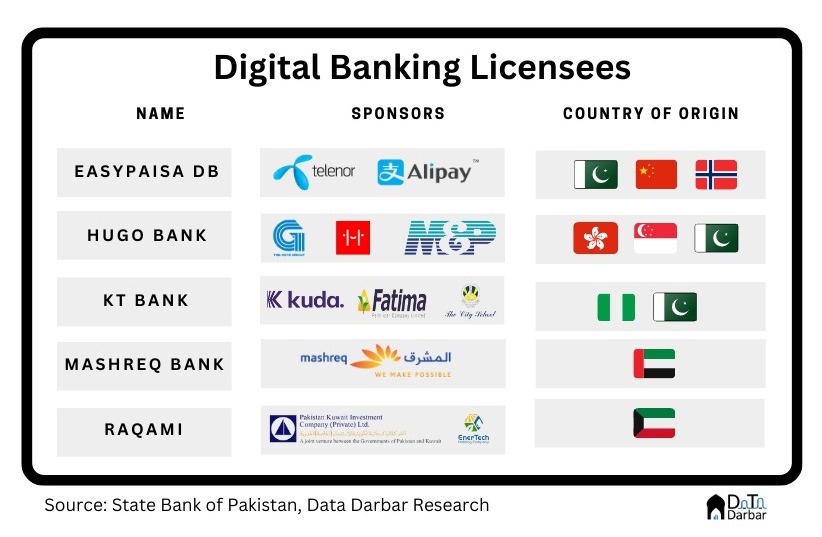

Almost nine months after 20 parties submitted their bid for the five available digital banking licenses, the State Bank has announced the winners. Technically It has issued no-objection certificates to Easypaisa, Hugo Bank, KT Bank, Mashreq Bank, and Raqami. These groups will now have to incorporate a public limited company and then apply for in-principle approval.

Within the tech community, this has triggered somewhat mixed reactions given the exclusion of major names. For example, South Africa’s Tyme Bank, Sequoia-funded Dbank, and local fintech Finja were all unsuccessful in obtaining the NOC. Instead, the awardees had a strong representation from the local business groups, such as City School as one of the sponsors of Kuda or M&P behind Hugo. On the positive side, none of the existing commercial banks made the cut.

Easypaisa DB

- Who are they? This is one name in the list that almost every Pakistani is familiar with so let’s move on to the next part

- Scale: 4 million transactions per day and deposits of PKR 32 billion in 2022.

- Why go for a digital banking license?

- The existing microfinance license has a relatively higher cost of funds

- Its existing branchless banking network of ~190K is expensive to sustain, which a transition towards digital can rationalize

- Comments: The financial position of Easypaisa, or technically Telenor Microfinance Bank, is in pretty bad shape. Since 2018, it has been posting heaving losses — big enough to wipe off entire equity and only survives thanks to injections from sponsors.

- Sponsors’ Cred: This part is somewhat mixed: on one hand, Telenor Pakistan has been reportedly looking for a buyer to exit the country. Even Easypaisa was up for sale with MCB and UBL doing due diligence on the company. On the flip side, they have the backing of Alipay — arguably the largest fintech in the world.

Hugo Bank

- Who are they? It’s a joint venture between Getz Bros — the pharma, Pakistani courier M&P, and Atlas Consolidate, which runs the Singaporean fintech Hugosave.

- Scale: The only player with financial services experience here is Atlas, which has raised $10.5M in funding to date. They have reportedly amassed over 60,000 customers (only) and recently got the Major Payment Institution (MPI) license in Singapore.

- Why go for a digital banking license? Honestly, little clue.

- Comments: For starters, two out of the three sponsors have no stake or experience in fintech. Even Hugosave is still at a pretty early stage and has barely begun its payments operations.

KT Bank

- Who are they? This is a joint venture between two Pakistani companies — Fatima Fertilizer and City School — and Nigerian-origin fintech KudaBank.

- Scale: While both Fatima Fertilizer and City School are among the top players in their respective industries, it’s not too relevant here. Meanwhile, KudaBank has raised $90M+ and boasts 4M+ customers, according to their press kit. However, the bank incurred losses of $14M+ in 2021.

- Why go for a digital banking license? Kuda’s case is a bit curious because it brands itself as the money app for Africans — both on the continent and elsewhere. How exactly Pakistan fits into their plans is not too clear. As per a media report, City School and Fatima Fertilizer are looking at use cases for education and agriculture while the fintech will power technology.

- Comments: Fatima Group’s venture arm had already invested in TAG, the now-defunct digital wallet that was reported to be in the race for the license. It also expressed interest in acquiring Samba Bank. However, the concern here is again that two of the players have virtually no financial services expertise.

Mashreq Bank

- Who are they? Mashreq is among the biggest banks in the Middle East, majorly owned by UAE’s Al Ghurair family.

- Scale: As of Jan 13th, it had a market cap of AED 19.5B and reported net profit of AED 2.6B in 9M2022. However, the investor presentation doesn’t mention anything about the extent of its digital operations.

- Why go for a digital banking license? The answer is somewhat ambiguous but it could be part of the broader push toward Mashreq Neo. While the bank wants to expand its footprint in Pakistan, even the latest communication mentions it in the context of offshoring.

- Comments: While Mashreq is a strong sponsor on paper with relevant financial services experience, it is still a legacy bank. Very rarely have such institutions managed to do digital right. Also, it’s quite strange that an institution this size doesn’t even report the number of its e-banking customers despite harping about the digital strategy.

Raqami

- Who are they? Kuwait Investment Authority is the main sponsor here through Pak Kuwait Investment Company and Enertech Holding.

- Scale: KIA is a sovereign wealth fund with $738B of assets under management while PKIC reported ~PKR 7B in profit during 9M2022.

- Why go for the digital banking license? KIA has lately been investing heavily in tech and counts the likes of Careem and Indiamart in its portfolio. This could be further exposure to the Pakistani market.

- Comments: Raqimi will be led by Nadeem Husain, the founder of Tameer Bank and thus the brainchild behind Easypaisa. Earlier in 2021, PKIC had invested $3M in Planet N as well.

While the announcement has garnered excitement among fintech enthusiasts, it’s still a long way to go before we see these entities in action. Even when these banks do go live, it remains to be seen if the SBP’s objective of promoting financial inclusion can be achieved.

Good info can you plz tell us what addition services these banks will be offering not by conventional banks

Mutaher Khan, great research. Well done and good job. Very interesting to see the financial digital banking landscape. The question is what’s the impact of future developments and embracement of Ai and ChatGTP as this is just around the corner. And the disruption to virtual financial systems is life changing.

The fact that the sequoia, kperkin and nubank backed DBank hasn’t gotten the license is puzzling. Here’s an entity backed by 2 of the worlds largest VCs + the world’s largest digital bank and SBP prefers a school, a local pharma and a fertilizer backing. Unbelievable. Decision reeks of politics.

Cashless, peaple Less, paper less industry. How they are educate the Ilitrate Pakistans villages to understand online money transfer and buying something or anything through mobile Application?

Pakistan is an agriculture country,where most of the people are unaware of online banking,due to this they are often victim into the fraudster’s trapped and resulting financial loss.So currently the people of Pakistan are not ready to cashless program.They need cash not cashless to full fill their need.

Usman Khan, agreed…specially D was very active on most of the platforms familiarizing everyone with the concept of digital banking. Would love to hear from the applicants that didn’t make the list. SBP and specially their listening authority PSP and oversight department has quite abnoxious and unprofessional approach.

EXCELLENT RESEARCH DONE FOR FINTECH

Just a little correction, its Pakistani Largest distribution & Courier company. M&P, A billion-dollar company , b2b reached is over 100K customers, Dedicated Mobile financial Services department with 200+ agents, partner of EasyPaisa & Jazz. Plus, 2nd largest courier company in Pakistan.

Change our life and the other

Why it was not awarded to D is very concerning. Funding with top VCs along with experience and leadership of top ex-googlers from pakistan should be better than city school and fatima fertz? Should be a report from SBP on why they and some other applicants were not considered.

Can we get the list of all the applicants as well?

پاکستان ایک زرعی ملک ہے، جہاں زیادہ تر لوگ آن لائن بینکنگ سے ناواقف ہیں، جس کی وجہ سے وہ اکثر جعلسازوں کے شکنجے میں پھنستے ہیں اور اس کے نتیجے میں مالی نقصان اٹھانا پڑتا ہے۔ اس لیے فی الحال پاکستانی عوام کیش لیس پروگرام کے لیے تیار نہیں ہیں۔ انہیں نقد رقم کی ضرورت نہیں ہے۔ ان کی ضرورت پوری کرنے کے لیے بغیر نقدی کے۔