As the end of March drew closer, players involved in the fintech space – startups, banks and telcos – were scurrying to submit their applications for the Digital Bank license, for which the State Bank of Pakistan had introduced the regulatory framework earlier in January. With only five licenses up for grabs as against 20 applicants, it’s going to be a competitive process.

The list of applicants is quite diverse and includes everyone from existing banks like UBL to telco-backed JazzCash. Current Electronic Money Institution contenders, such as Finja (in partnership with its investor HBL), and former Special Adviser to Prime Minister Tania Aidrus-led dBank are in the race too, as are a few international players, namely South Africa-headquartered Tyme Bank and Tajik Alif Bank.

The Subjective Language of Digital Banks’ Objectives

But the first question is: what purpose are they supposed to serve that the existing institutions don’t? The SBP identifies six key objectives that the digital banks are *required* to contribute to. First is financial inclusion: the same buzzword that bankers and development professionals throw around at conferences while ignoring it on their jobs. But what does it mean?

The SBP defines financial inclusion as “access to formal financial services by individuals & firms to use a range of quality payments, savings, credit and third party insurance services, which meet their needs with dignity and fairness.”

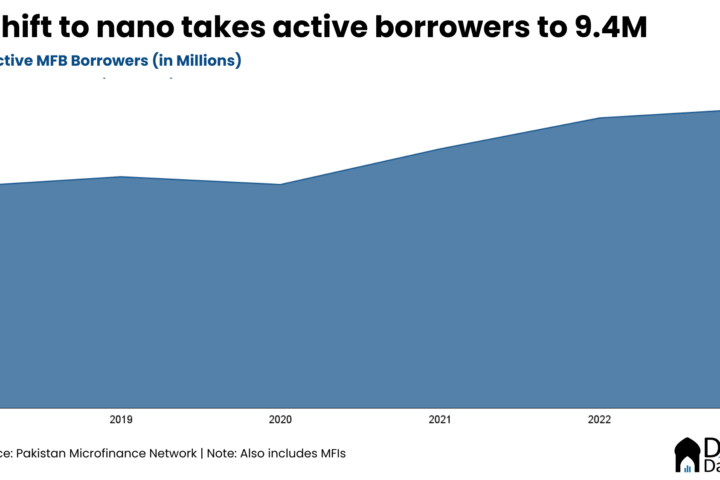

This is a broad, but necessary, objective as Pakistan is among the worst performers in terms of financial inclusion. That takes us to the second goal: credit access to unserved or underserved. Why is that important? Because a majority of people and small businesses can’t obtain loans from banks, which in turn impacts economic activity.

With digital banks, the SBP wants to address this problem – meaning lending should be an important part of their offering. Before getting into its specifics, let’s first get the remaining objectives out of the way; provide affordable digital financial services; encourage application of financial technology and innovation in banking; foster a new set of customer experience; and further develop the digital ecosystem.

Now the second question is, how well-suited are these applicants to achieve the objectives? After all, many of them have banking or microfinance banking licenses and can easily pursue those goals in the existing framework. Would a different license suddenly change their approach and we’ll wake up to a new world where Pakistani banks don’t make over 60% of their income from investing in riskless government papers? Let’s hope. As for fintechs, would they too succumb to the laziness that naturally comes naturally with banking? Too early to call.

Banks and their Flanker Brands

Anyway, at least from the perspective of expanding the financial inclusion net and providing access to credit for unserved and underserved segments, some of the applicants may not have much interest. Well, why go for the new license then? According to Saad Duraiz, a Consulting Director at Mastercard, one reason could be to develop a modern and clean stack.

It could also be part of a broader corporate strategy of building a flanker – a new brand competing in the same category and territory as the original. This strategy has been used across geographies from Royal Bank of Scotland’s to ABN Amro’s New10, as per The Economist. With a flanker, they also have an opportunity to provide a better customer experience – one of the six objectives. Though nothing’s really stopping them from doing the same now.

Interestingly (to me at least), the SBP uses the word “required” while listing the six objectives but later in the document tones it down to “encouraged” when talking about female inclusion and credit access goals. Is that reading too much into it? Possibly, but having followed the financial services industry for some time, there’s good reason to be skeptical. Especially when it comes to credit, let alone gender inclusion. On the other hand, developing of a digital ecosystem and better customer experience could possibly be the more realizable goals.