In cricket, there is this frustrating thing where you can watch four sessions straight with absolutely nothing in the match but the moment you take a brief break, suddenly the whole batting order collapses. It’s annoying when that moment of joy or grief is snatched away from you. Something similar happened to me when the State Bank of Pakistan finally published its Q2’FY24 Payment Systems Review.

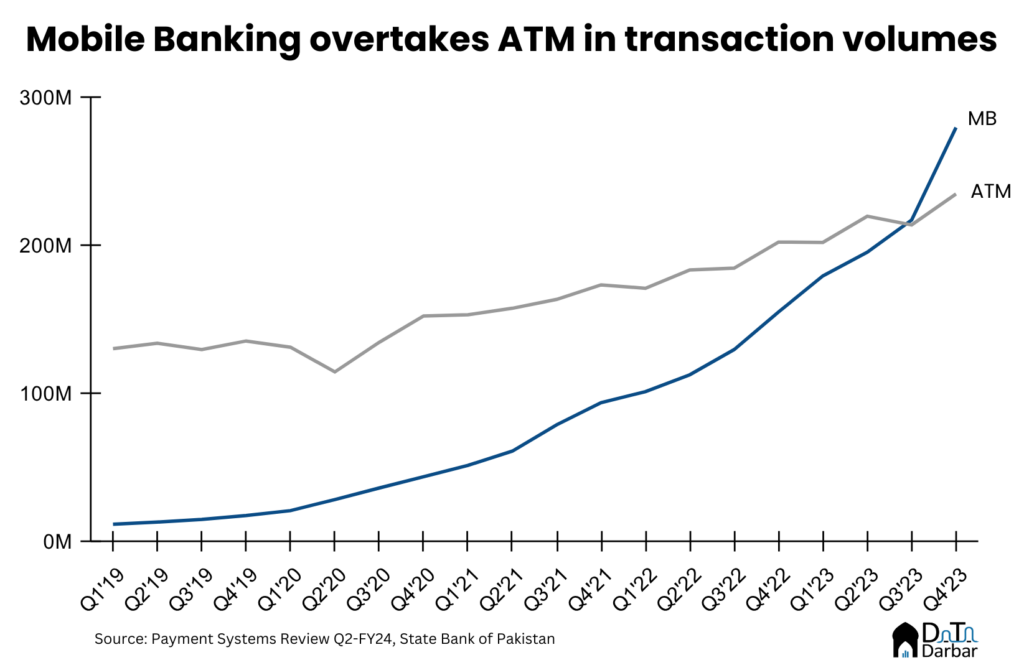

I have been following the PSR for years and spent the last few quarters waiting for a major milestone: mobile banking volumes overtaking ATM. In Q3’23, the former was only behind a couple millions so inevitably, it was gonna happen in the last quarter.

Except when the latest data was published, the SBP restated the value for July-September and mobile banking narrowly edged out ATM in terms of transactions, thus becoming the single largest channel. After revision, the former stood at 217.4M while the latter was 214.1M. In Q4’23, this difference further widened as MB volumes reached 279.9M versus ATM’s 235M. Just five years ago, i.e. in Q1’19, ATM transactions of 130.5M were more than 10x of MB’s 11.9M.

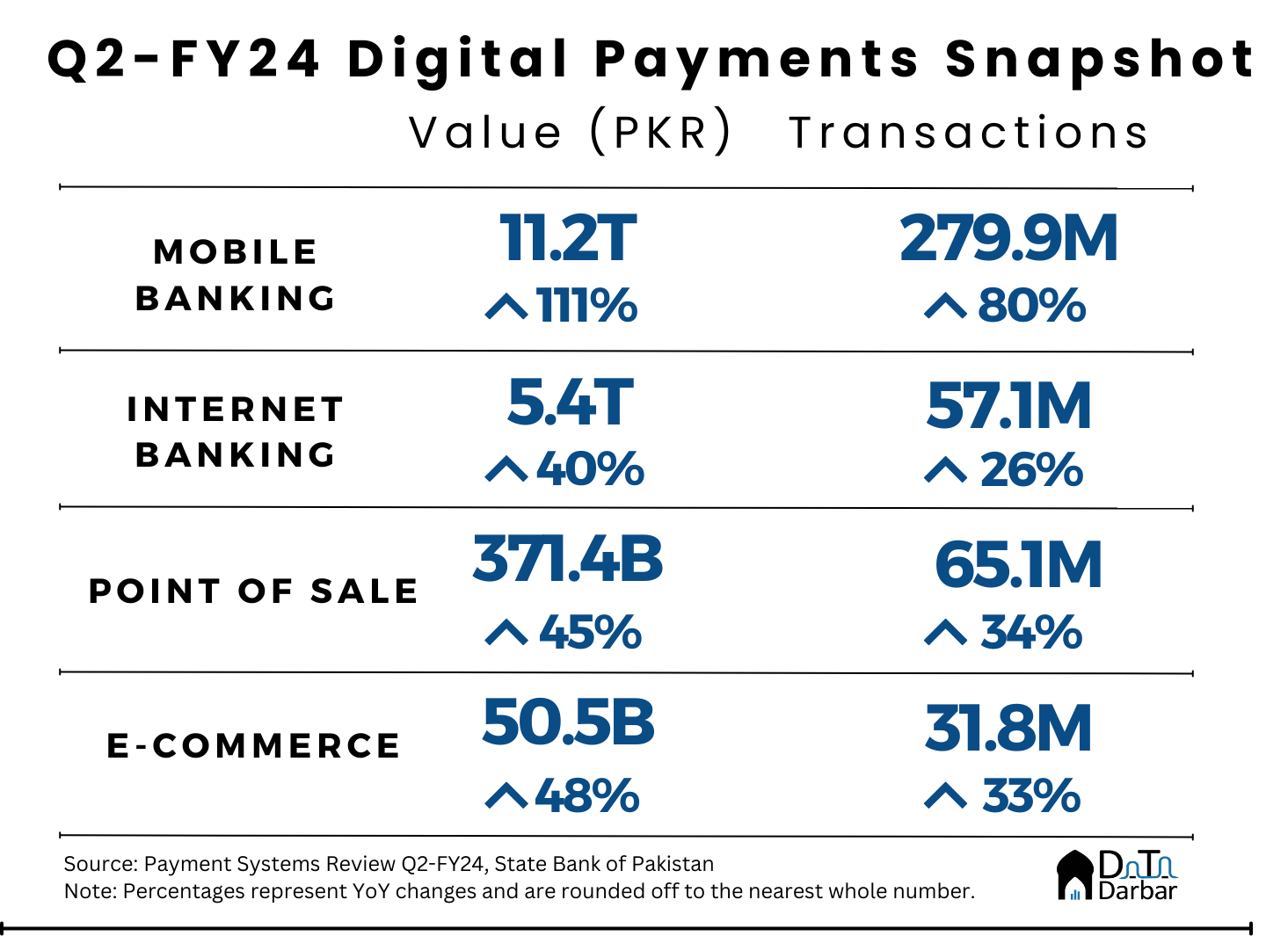

Anyway, this was sort of a detour and now we will return to our usual template for the PSR. Since the SBP has changed the reporting format, it won’t be possible to calculate the share of digital transactions. At least until the Monthly Statistical Bulletin is out, which would be at least another two weeks. As always, we’ll stick to point of sale, e-commerce, internet, and mobile banking.

Mobile Banking

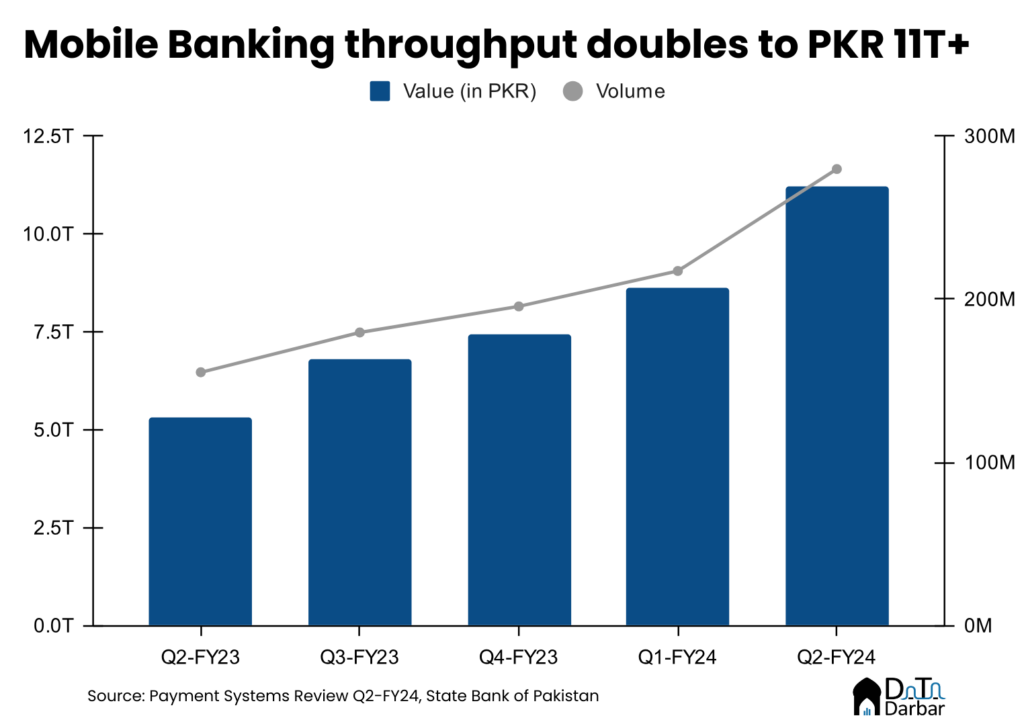

As stated above, MB finally became the single biggest channel with transactions of 279.9M, making up 34.3% of all retail payment volumes in the country. The number was up 28.7% QoQ and 80.2% YoY — by far the fastest growth. Similarly, the throughput surged to PKR 11.23T, surging by 110.9% over the same period last year and 29.9% compared to the preceding quarter.

If this pace continues, as it likely will be, MB volumes on a trailing 12-month basis will surpass one billion by Q2’24 latest. Faster throughput growth also pushed the average transaction size to PKR 40,108 in the latest quarter, up from 34,276 in the same period last year. Unsurprisingly, funds transfers were the most dominant transaction, accounting for 92.9% of the value and 85.0% of the volumes.

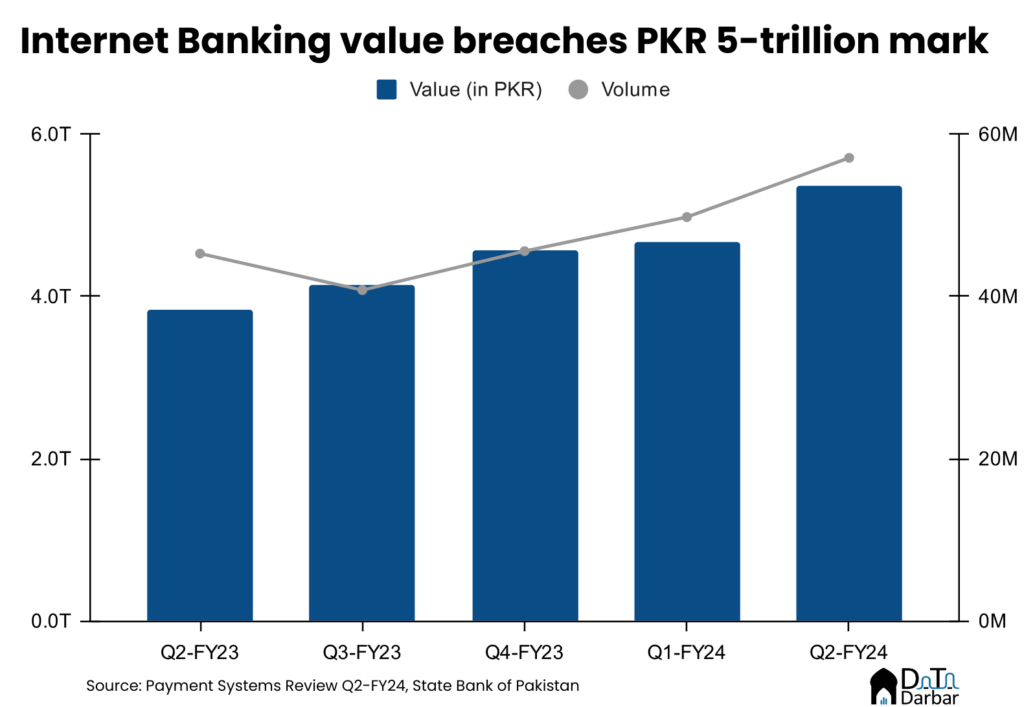

Internet Banking

On the other hand, internet banking witnessed the slowest growth in relative terms even though throughput was higher sequentially by 39.7% and volumes 26.1% to PKR 5,369.3T and 57.1M. Among our “digital channels”, it’s comfortably the second biggest by throughput and will remain so for the foreseeable future. Given its corporate tilt, IB also has the highest transaction size on average, which clocked in at PKR 94,033 in October-December.

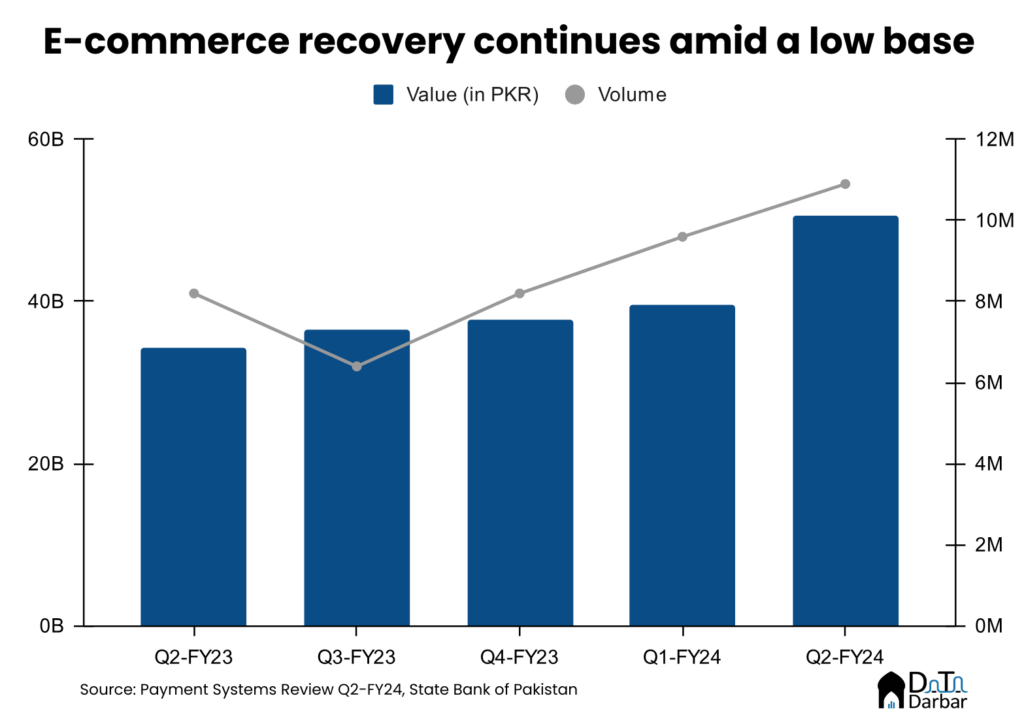

E-commerce

Yet again, e-commerce numbers were a little disappointing though there was marked improvement in the latest quarter. Throughput crossed PKR 50B for the first time, registering an increase of 47.7% YoY and 27.6% QoQ. Similarly, volumes rose to 10.9M, though they were still below the peak of Q4’21.

Since then, the sector has seen sharp contraction with heavyweights Daraz and Foodpanda doing multiple rounds of layoffs. Unsurprisingly, the supply side remained constrained with 857 new e-commerce companies coming online in 2023, which is lower than 910 in FY23 and 1,038 in FY22. However, banks continued to push their acquiring efforts and onboarded 320 new merchants during the quarter while EMIs didn’t add any.

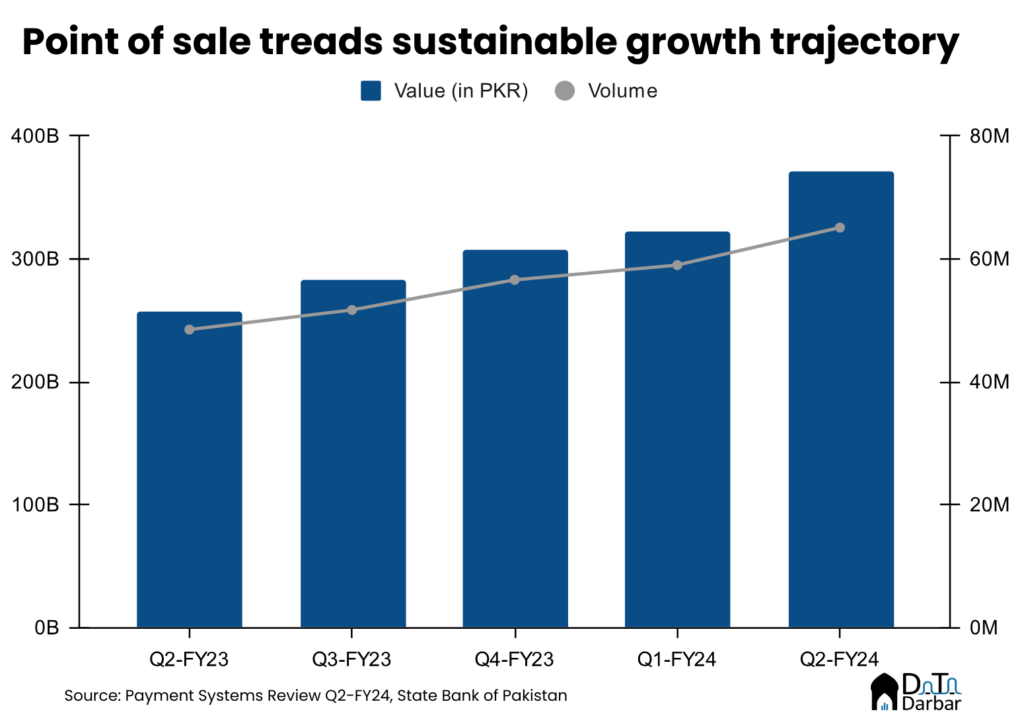

Point of sale

Things became more competitive in the point of sale industry as the Bank of Punjab and Faysal Bank entered acquiring business and total terminals increased by 3,345 to 121,789. However, a majority of these machines remain concentrated at a small number of big merchants, which must be expanded in order to have retail digitization or documentation. In any case, POS throughput surged 44.6% YoY and 15.4% QoQ to PKR 371.4B in Q4’23 while the number of transactions jumped 29.4% YoY and 10.3% to 65.1M.

EMIs

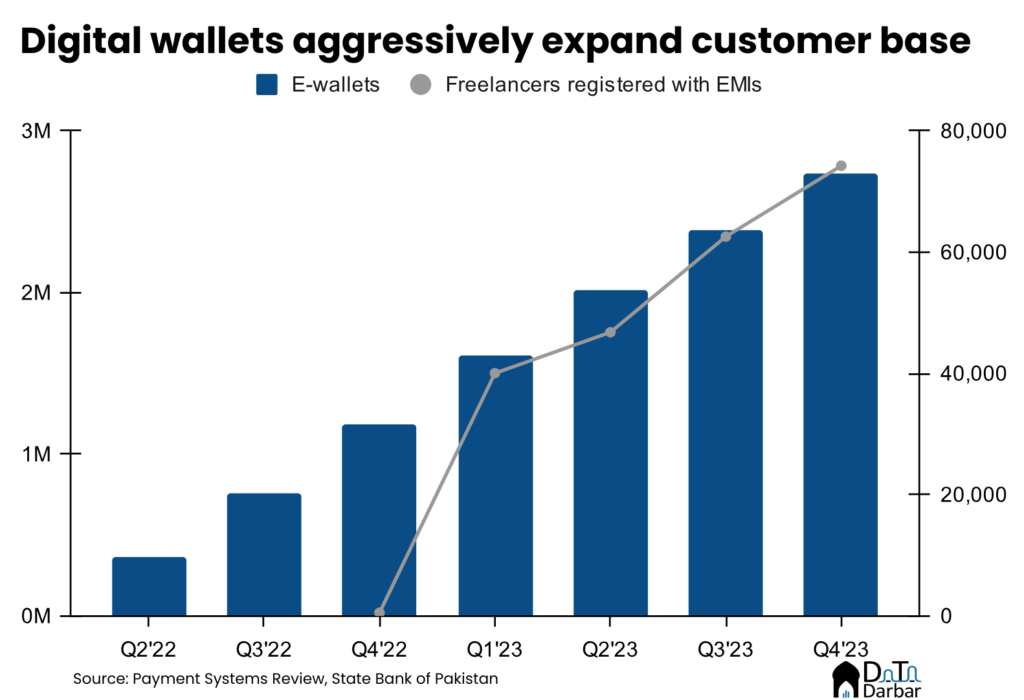

While these four channels continue to grow, to varying degrees, both the regulators and the customers seem to have their hopes for a digital revolution pinned elsewhere. At least most of them. Lately, we have heard a great deal about the virtues of Raast and digital wallets, so let’s review the performance.

For starters, Akhtar Fuiou Technologies (Digitt+) got its commercial license, which took the number of live EMIs to 5. On the transactions side, there has been a change in data reporting compared to FY23 PSR, making historical comparison difficult. However, going by the latest report, e-wallet throughput rose to PKR 50.8B across 20.1M transactions, up 37% and 30.5%, respectively.

Luckily, it was still possible to keep track of indicators on the issuing and acquiring side. The total e-wallet accounts increased by 358K over the quarter to close Q4’23 at 2.74M. Meanwhile, freelancers registered with EMIs reached 74,273, compared to just 528 at the end of last quarter of 2022.

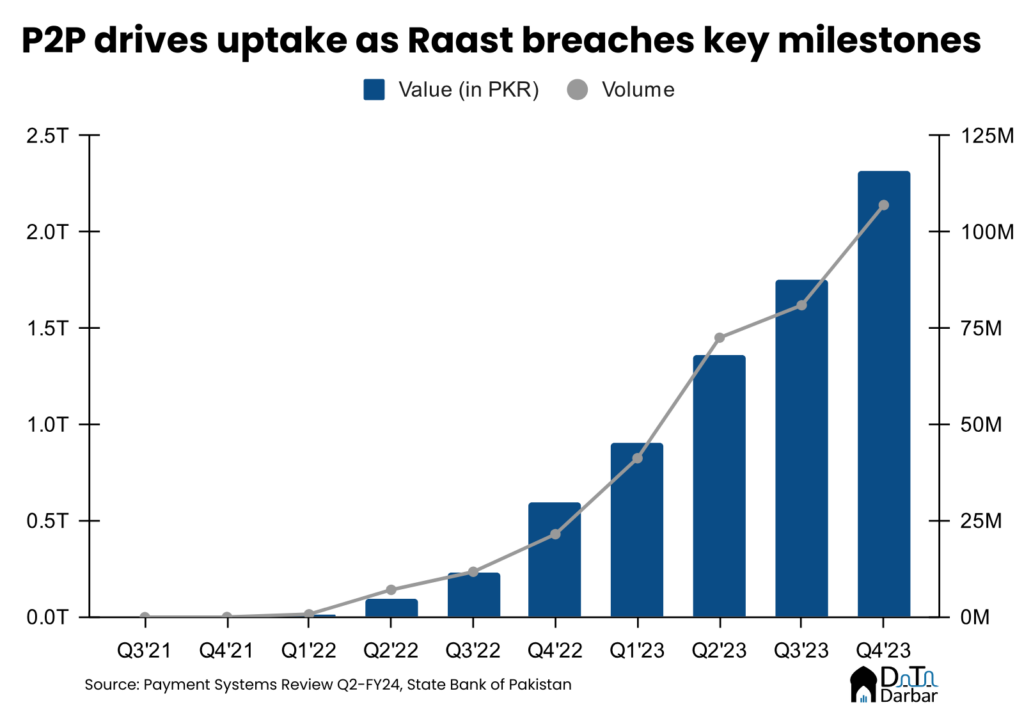

Raast

Similarly, it was an important quarter for Raast too with the launch of the person-to-merchant module. However, for now, P2P will continue to dominate as its throughput reached PKR 2.26T across 106.8M transactions — crossing both the PKR 2T and 100M marks for the first time. Compared to the same quarter of last year, these represent increases of 290% and 397%, respectively. On the other hand, bulk transfer value was ironically quite negligible at PKR 63.2B, up 259% off a low base.

Despite the significant uptake of Raast, there is one major thing to note. The average P2P transaction size stood at PKR 21,136 — much higher than what one’d expect from a micropayments switch. That’s partly because the SBP was using regulatory might to push its flagship project. But come P2M, the same approach won’t be possible and a much more serious merchant acquisition would be required.