We’re quite late to the party but the State Bank of Pakistan recently published the Q1-FY24 Payment Systems Review. This is the source for all data related to digital payments in the country. But this time around, it experimented with a new format, reporting data by type of transaction instead of channel. That made comparison with our past coverage trickier, which is why we had to wait until the Monthly Statistical Bulletin was published in order to be consistent. But let’s not waste any more time.

As per the latest data, digital channels accounted for 80% of volumes In Q1-FY24. However, this includes both ATM and real-time online branches (RTOB), which at least from a customer point of view aren’t exactly digital. By our comparatively narrower criteria, 10.2% of the throughput was digital, which is actually down from 11.3% in the previous quarter. Volume-wise, the figure stood at 48.2%, up from 46.3% in Q4-FY23. Once you add in branchless, the quantum changes entirely as m-wallets processed 878.9M transactions in the first quarter. Keeping with tradition, we’ll stick to point of sale, e-commerce, internet, and mobile banking.

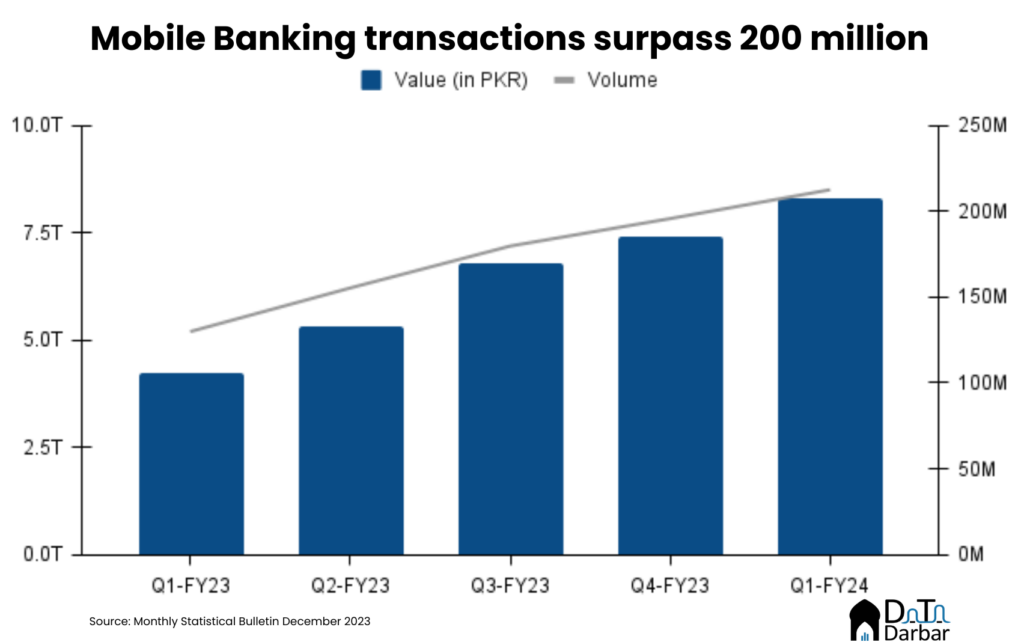

Mobile Banking

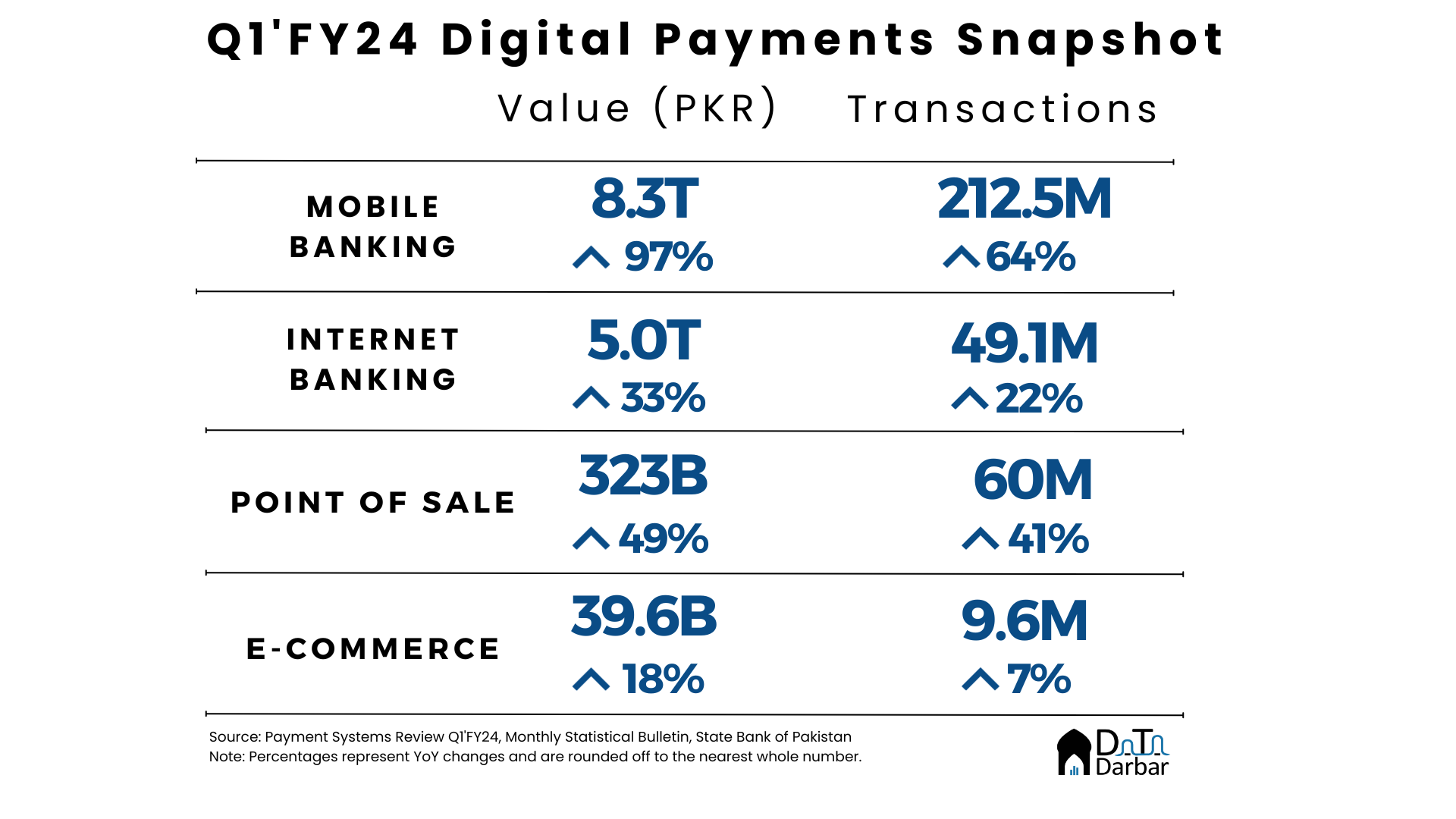

For starters, MB throughput clocked in at PKR 8.3T in Q1-FY24, from PKR 4.2T in the same period last year. This translated into a growth of 96.8% — by far the steepest for any channel, digital or offline payments. Meanwhile, the number of transactions reached 212.5M, jumping by a comparatively ‘lower’ growth rate of 63.6%. This is the first time MB volumes have crossed the 200M mark and are just one quarter away from overtaking ATM to become the single-largest e-banking channel.

Higher throughput growth relative to volumes also pushed the average transaction size to PKR 39,128 in Q1-FY24, from 32,523 in the same period last year. The State Bank data shows that funds transfers accounted for over 90%, or PKR 7.5T, of the value and 82.6% of the volumes.

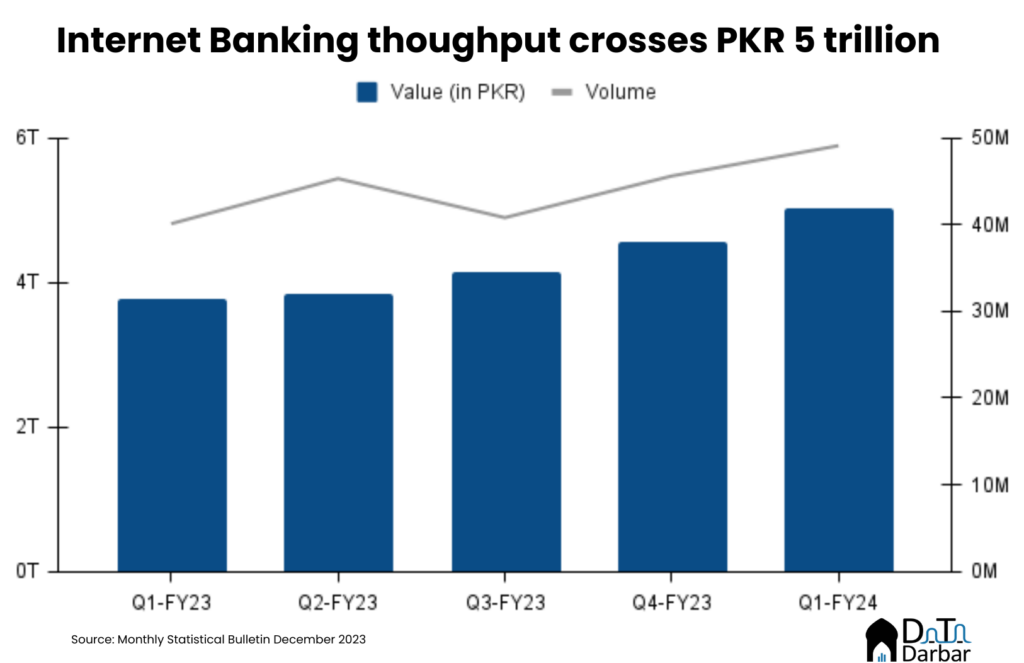

Internet Banking

Though much less impressive than MB, internet banking also witnessed decent growth as value surged 32.9% to PKR 5.02T in Q1-FY24. This is the first time the channel has breached the 5-trillion mark. Similarly, volumes grew 22.43% to 49.1M, from 40.1M in the same period of the last fiscal year. Consequently, the average transaction size reached PKR 102,269 — the biggest for any digital retail channel in our review. That’s because of its B2B tilt, as many of the corporate and payroll transactions largely go through IB.

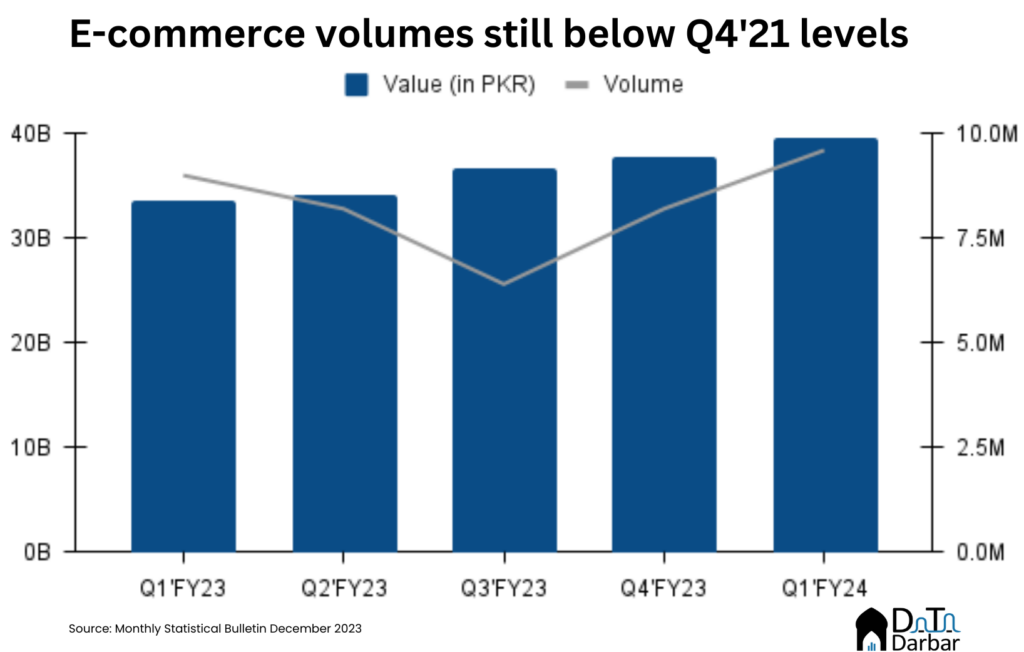

E-commerce

E-commerce was the worst performing digital payments channel. While volumes edged up 6.64% to 9.6M in Q1-FY24, the number is still below the peak of 13.6M seen in October-December 2021. Throughput was also up 18.17% YoY to PKR 39.6B but that’d because of the inflationary pressures as the last fiscal year’s consumer price index was almost 30%.

The average e-commerce transaction was worth PKR 4,124 in Q1-FY24, up from PKR 3,722 in the same period last year. During the quarter, banks also added 421 new merchants while acquiring by digital wallets was almost unchanged. Unfortunately, the shift away from channel–wise reporting means we don’t know what value and volume of transactions went through EMIs.

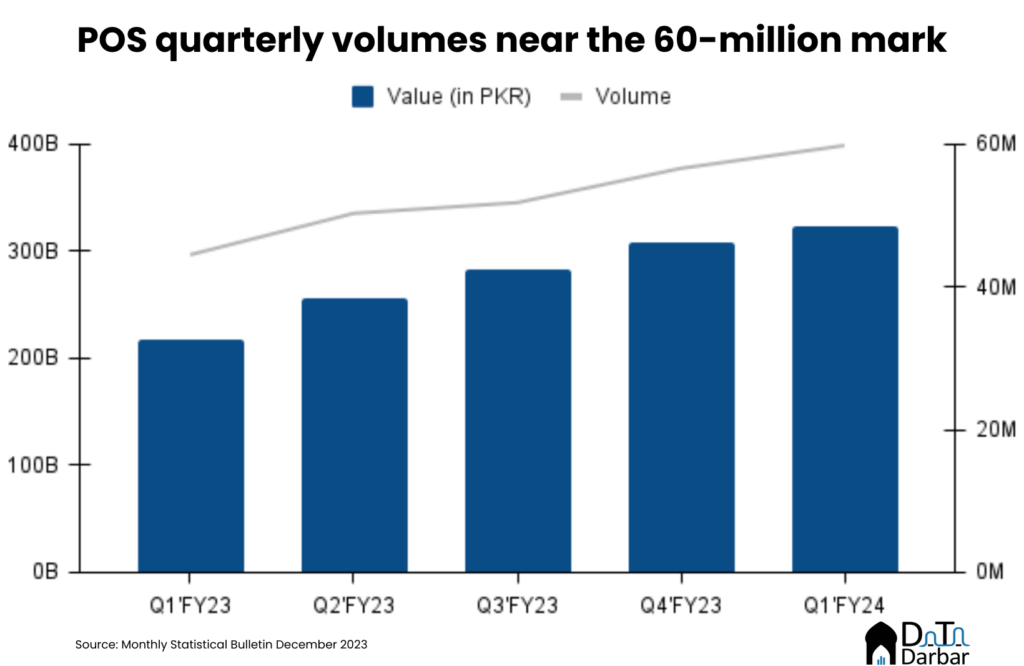

Point of Sale

On the other hand, point of sale has continued to outshine other more-hyped digital payments channels. In Q1-FY24, throughput reached PKR 323B, up 49.3% from PKR 307.5B in the same period of last year. Volume-wise, the growth rate of 40.8% was second only to mobile banking, taking total transactions to 59.8M, up from 42.8M. During the quarter, 3,156 new machines were deployed on a net basis, taking the total to 118,444. While the data for each player is not available, this growth is likely to be driven by Meezan Bank, which alone added 1,420 terminals in Q1-FY24.

For the last few editions, we have also been breaking down the scale of Raast and EMIs but that may not be entirely possible this time. While the SBP puts overall volumes via Raast at 81.2M in Q1-FY24, the numbers for previous quarters don’t match with previously pubished data. Neither does it provide breakdown by P2P and bulk use cases, let alone any progress on the P2M module. Similarly, for EMIs, no transaction-level details were given.