Nothing unites Pakistani fintech enthusiasts on Twitter more than their hate for local banks. Especially HBL, the self-proclaimed tech company with a banking license, whose app is down like five times a week and takes three months to fix basic bugs. But beyond that edginess (and customer experience), how has it done in terms of growth and scale in digital channels?

While ATM and real-time online branches come under e-banking, we are going to exclude them. Instead, our focus will be on the remaining channels: e-commerce, point of sale, mobile, and internet banking. There are some other proxies for digital that we track. So let’s get into it.

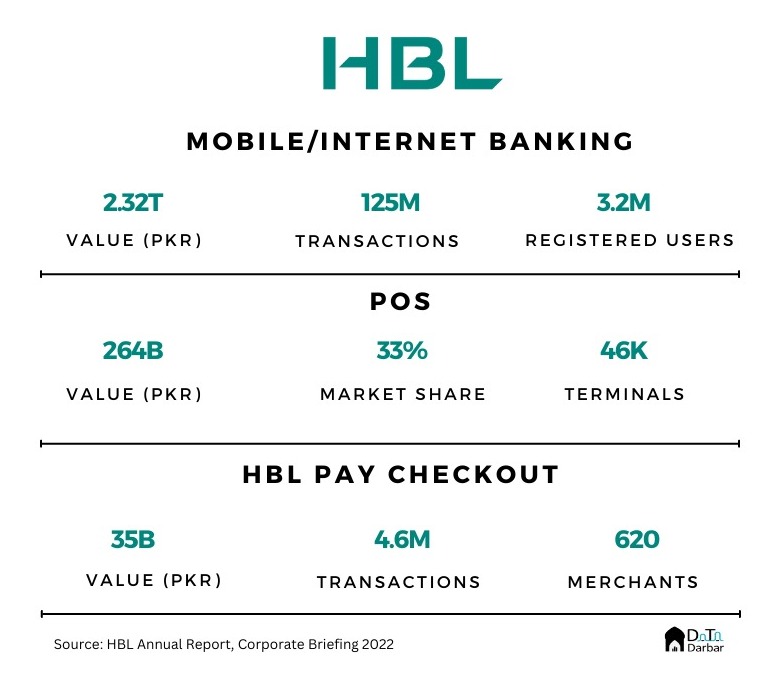

HBL’s total mobile and internet banking subscribers rose by 744K, or 29.9%, to reach 3.2M in 2022. While the growth is healthy, it means only 9.68% of the bank’s total customer base of 33.4M were using these two channels. However, that’s also because of Habib Bank’s involvement in the disbursement of social security payments, such as the Benazir Income Support Programme.

With a larger digital customer base, HBL’s throughput through MB/IB surged 109% to PKR 2.23T in 2022. The volume also jumped to 125M, from 79M the year before. As a result, the average transaction value improved to PKR 18,592, from PKR 14,088 while the corresponding number for the industry in FY22 was PKR 41,762. Do keep in mind that ideally, these two channels shouldn’t be clubbed in the first place.

By the way, this doesn’t include Konnect, which recorded another PKR 629B of throughput, including G2P payments of PKR 229B. This is branchless, so it incorporates both agents and digital channels — but mostly the former. That’s best reflected in how only 364K of the 2.65M registered app accounts had logged in the last 90 days. Side note: somebody please tell HBL the difference between monthly active users and registered accounts.

The Card Spending Bonanza

HBL also had a good year in POS acquisition with total spend up 46% to PKR 264B, from PKR 181B. Meanwhile, the number of machines jumped by 6,879 or 17.5% to 46,151. As a result, the bank maintained its market position as the biggest player. However, its throughput per terminal of PKR 5.7M in 2022 was below the industry’s FY22 levels of PKR 6.74M.

The overall card spend by HBL’s own customers soared 71% to PKR 342B in 2022, from PKR 200B last year. Of this, credit cards made up 53.2%, with their share slipping for third year straight as Konnect cards gained momentum. However, uptake in issuance was muted at 6% as the bank issued only 389K new debit and credit cards.

While the exact breakdown for spend on e-commerce is not available, we used some proxies to estimate that number. According to the annual report, 30%, or PKR 36.6B, of the debit card throughput of PKR 122B was on e-commerce. Another PKR 47.3B of online spending should have come from credit cards, based on the channel-wise value mix from Payment Systems Review FY22.

The bank also reported a throughput of PKR 35B across 4.6M transactions in 2022 via HBL Pay Checkout. This translates into growth of 21% in value and a modest 2% in volume. Meanwhile, throughput via QR codes crossed the billion rupee mark to close at PKR 1.36B through 304K transactions.

What lies ahead for HBL on the digital front?

We also tracked HBL’s IT spending spree which accounts for over one-fifth of the total banking expenditure on technology. In 2022, it doled out big bucks and spent PKR 14.45B on IT, up from PKR 10.56B the previous year. Of this, a healthy 43% went towards software — higher than the industry’s median level of 31.4% in 2021. [Some institutions are yet to publish annual reports.]

While far from perfect, technology, software in particular, spending can serve as a leading indicator of a financial institution’s future plans. On this front, HBL has done fairly well and has ranked at top of our Digital Banking Readiness Index 2021.

A lot of these data points are standalone without much comparison to peers. That’s because most financial institutions just don’t bother to publish much relevant information. In such isolation, the story of HBL digital can have many takers but this is as far as the numbers go. Experience suggests a rather mixed picture: one of the biggest banks unable to sort out some long-standing issues. And that story sells more, whether the tech company with a banking license wants to accept it or not. If my app is down every week and the e-statement is not showing, I am not going to take solace in how their MAU has gone up.

Good analysis, bit thick in statistics making it bit hard to absorb.

Fantastic Article. Loving the analysis on HBL. Shows why they’re one of our top payment partners. Kudos

I would like to meet CIO HBL. Can someone connect. Br

sir

account title short tha but main ne branch ja kr durst krwany k liye apply b kia but date 29 2 2023 abi tak amal dramad ni howa mehrbani farma kr masla ko solve krwa di jiye

regard

thanks

Hbl buhat he gandi or bkwas service provid kr rha ha mene cradit card ka Lia apply Kiya howa ha 15/3/2023 ka or aj date 31/3/2023ho gai ha or abi Tak card bank me he process me ha ma help line pe complain be kr di ha but pher be kuch nai howa

Excellent work done

Hbl bank of Pakistan is not good for me because hbl bank is not respons me and not clear my banking application and not clear my pammnat in my account I’m not happy to hbl bank of Pakistan

Good job