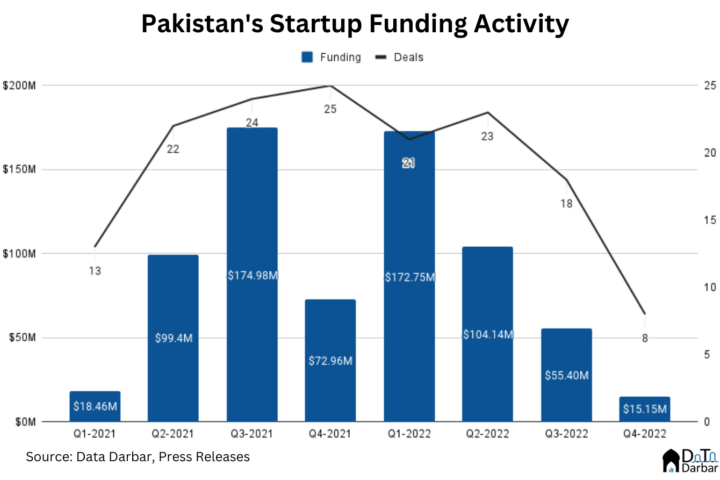

A lot has been written about how Pakistan’s venture funding landscape suddenly changed towards the second half of 2022. Not too unlike how it had taken off in 2021, to be honest, just in the opposite direction. Anyway, with only $15.15M VC investment, the last quarter was really bad — the worst since Q1-2020. Basically, to pre-Covid levels, i.e. before our ecosystem had its big moment. And so far, 2023 seems to be heading in an even worse direction with only one seed and one accelerator round disclosed in January.

In percentage terms, the funding amount plunged 79.24% YoY and 72.65% in Q4-2022. The deal count also slowed to single digits for the first time since Q2-2020. But was this really exclusive to Pakistan and if not, how did we fare in comparison to other markets? Let’s look at a few data points to see how our performance stacks up against global and regional trends.

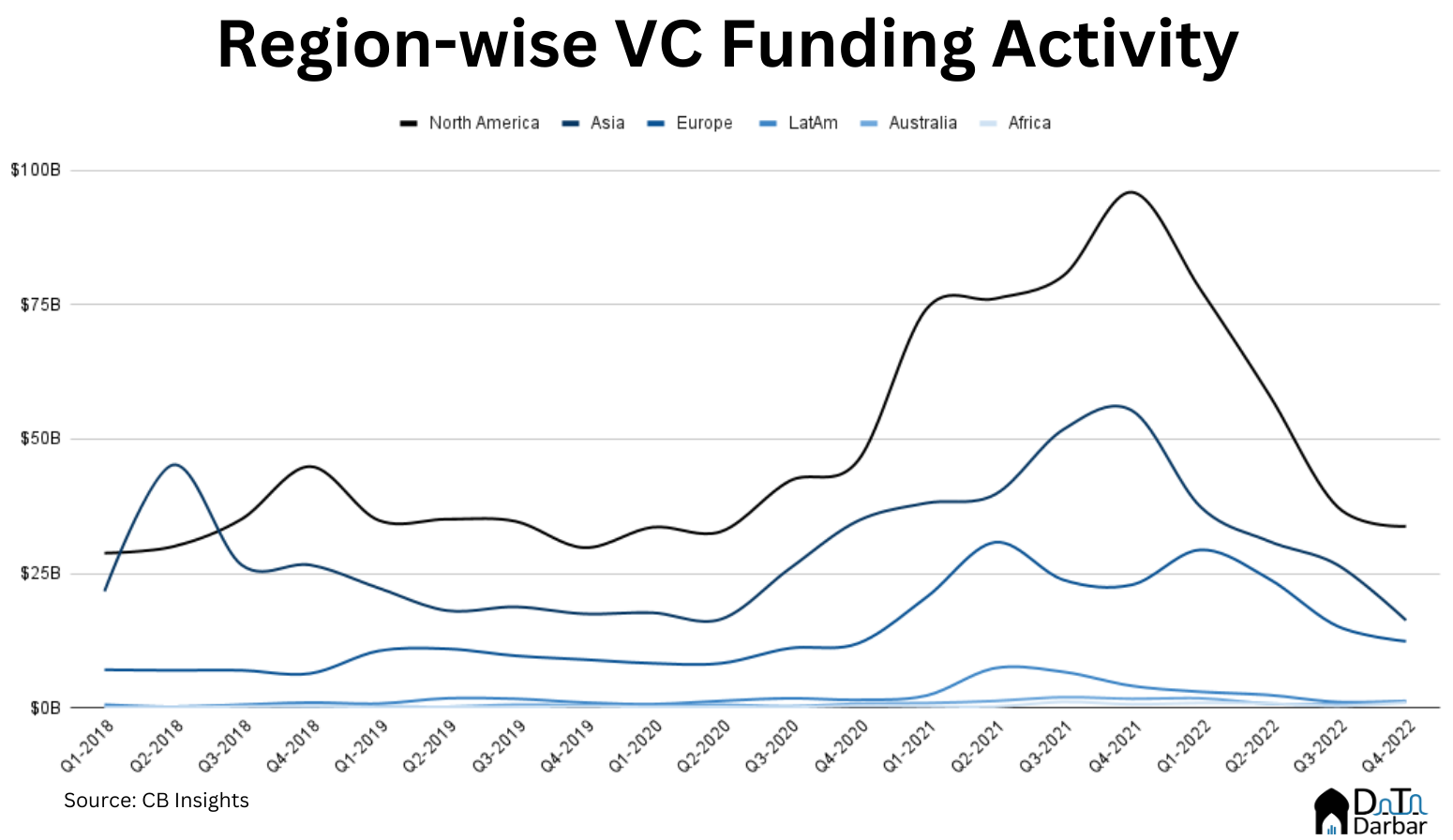

Before we really start, 2022 was rough for the asset class generally, characterized by layoffs, valuation cuts, and shutdowns. High inflation and contractionary monetary policy spoiled the exuberance that the venture ecosystem had become so used to. As a result, global VC investment dipped 35% to $415.1B in 2022, from $638.5B in 2021, according to CB Insights. However, looking at the annual figures actually mellows down the underlying cracks.

Quarterly data shows a consistent decline in VC investment amount. In Q4-2022, funding plunged 63.53% YoY and 19.04% to $65.9B — the worst since Q2-2020. This is still much better than Pakistan’s percentage decline, especially on a quarterly basis. Data from CB Insights shows that Africa was the sole outlier where funding actually jumped 46.38% YoY in Q4-2022. In fact, the continent saw its second-best quarter ever with investments of $991M.

On the other hand, Asia witnessed the steepest decline at 70.52% YoY and 38.72% QoQ. And somehow, even that doesn’t underscore the extent of the slowdown. With only $16.3B raised, it was the worst quarter in at least five years (CBInsights data goes up to Q1-2018). The deal count of 2,371 was the lowest during the period, spare for the first half of 2020 when large parts of the continent were under strict lockdowns.

CB Insights also published data for a few countries so we selected a peer group of emerging markets to compare Pakistan’s performance against them. Within that sample, we recorded the lowest investment of $15.15M in Q4-2022. All others were upwards of $100M, while Brazil was well ahead at $600M.

But it’s probably better to look at changes instead of absolute values since some of these countries have relatively mature ecosystems. But even there, Pakistan witnessed the sharpest QoQ decline in funding and the second-highest YoY, after Mexico. Meanwhile, Egypt had a great quarter as investment more than doubled QoQ and YoY. Similarly, Pakistan recorded the lowest level of deals at just eight, along with the worst YoY and QoQ dips among the peer group.

To be clear, any impact is amplified by our low base but even after that, the ecosystem has been hit hard. How much of it can we attribute to the global slowdown and what share to the worsening local macroeconomic conditions is up for debate.