It takes a lot of nerve to try and do it all in one go, but that has not deterred Ahmed Khan, a veteran of Pakistan’s e-commerce circuit.

Cheetay was launched in 2015 when Ahmed realized two critical challenges faced by the industry in Pakistan: payment systems and logistics.

“We wanted to do something to address these bottlenecks. While the former was too expensive a venture, the latter was well within our line of sight,” Ahmed recalls.

What’s better than having the world at the tip of your fingers, all day every day? Imagine a website that can deliver food as well as medicines with just a few clicks, depending of course on what you require (but surely that goes without saying).

Well, Cheetay got you covered. Currently operating in food and healthcare products, they are set to add three more categories: books, beauty products, and groceries. Given their growth focus, they are eyeing investors for their next round of funding by September.

Competing against giants like TCS (Hazir) in the vast but underserved market of Pakistan, Ahmed believes Cheetay’s relatively smaller size makes them nimbler. What makes them unique is how they have sought to merge two different models not only in terms of services offered but also in generating revenues: earning commission on sales from suppliers like Foodpanda and charging delivery costs from consumers like Bykea.

This may sound like big talk, but Ahmed has an edge. Unlike the college campus-based start-ups that begin everything from scratch, Cheetay has the luxury to work with a team of highly experienced professionals. That is no overstatement.

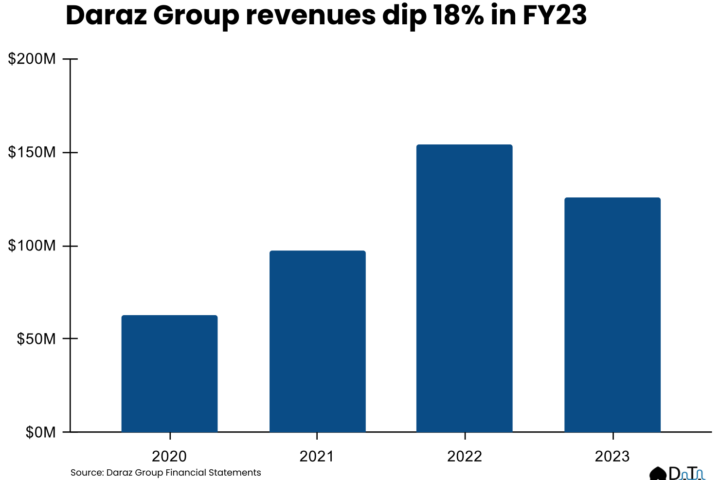

Ahmed, for example, has worked with the German venture capital Rocket Internet where he founded both Daraz and Kaymu. His personal brand name also comes in handy to further the group’s credibility among investors and other industry players.

The biggest problem, in his opinion, is the constant fixation of the Pakistani consumer on bargaining and discounts. Until a retail market with fixed prices becomes the norm for the consumer, the market for his product won’t truly kick-off, he says.

“We have a predominantly discount-driven culture which has altered the dynamics of the market,” he says.

“The entire success of Careem, Daraz.pk, Uber, etc is built on a discount-driven strategy. One-third of their revenue is generated from sale-dedicated days like Black Friday which hinge on superfluous discounts. I believe e-commerce, in general, is cheaper and more convenient than conventional retail so why is there a need to discount it further? The success of e-commerce is incumbent on volume. This culture is destroying the market because what we see is a race between venture capitals where whoever raises the most money wins because they can sustain exorbitant discounts due to greater financial sustainability.

It is imperative to compete on operations, technology, product offering and convenience instead. It’s becoming a real problem for companies to survive because they’re up against deep pockets who are very happy burning their pool of cash,” Ahmed says.

The limited access to online payments in the country is another hurdle that greatly limits the scalability of Cheetay as well as that of the industry at large. But with the entry of giants like Jazz and Telenor through JazzCash and EasyPaisa, the landscape is being revolutionized and Ahmed is betting on it.

“Cash on delivery in an intangible, cashless marketplace is a very successful financial model. In burgeoning markets where you’re building trust for ease of transactions and scale, it becomes very limiting because the riders or delivery personnel have to carry a lot of cash.

The sheer volume of cash involved makes smooth operations prohibitive. These players will effectively reduce friction and make transactions cheaper by reducing reliance and dependence on cash by prompting real-time deliveries of orders and payment,” he continued.

According to Ahmed, the burgeoning local start-up scene has also changed the investors’ outlook as major players like Fatima Group and JS have entered the private equity and venture capital arena. With economic orthodoxy gradually crumbling, more people are starting to look past the dinosaurs like textiles. “Start-ups are the new cool,” he notes, adding that now only the biggest multinational FMCGs are ahead of the local companies when it comes to recruitment at campuses across the country.

Bearing the brunt of the country’s archaic laws that use yardsticks for the traditional economy on the new economy, Ahmed advises policymakers to look eastwards for inspiration or even consider India’s hugely successful deregulation model if nothing else. “We still don’t have a defined policy when it comes to the tech or e-commerce sectors – like for example capital requirements for some of the tax incentives basically make it impossible for an online retailer to benefit from them,” he tells Dawn.

With a 400 percent growth in website users over the past year, Cheetay is racing away at a tiger’s speed and is set to start operations in Islamabad and Lahore. While being the Amazon of Pakistan might seem like a distant goal to many, to Ahmed, shooting for anything less would plainly be a bore.

This post was originally published in Dawn.