As the Pakistan team was preparing for the 2021 T20 World Cup in UAE — effectively our home ground — Daraz announced its entry into the world of streaming. An e-commerce giant doing OTT? We had seen that movie before. With exclusive rights to digital channels, it was great timing to an ALMOST perfect tournament and raised big hopes of what’s ahead for the largest online marketplace in the country.

Two and a half years later, many of those hopes have crashed. The marketing department that brought Daraz into the world of cricket has now been centralized as the company conducted its second round of layoffs in 12 months. After firing 11% of the global workforce in February 2023 and another 25% in 2024. Even Bjarke Mikkelsen, the co-founder and CEO of Daraz Group, has departed and been replaced by an Alibaba executive.

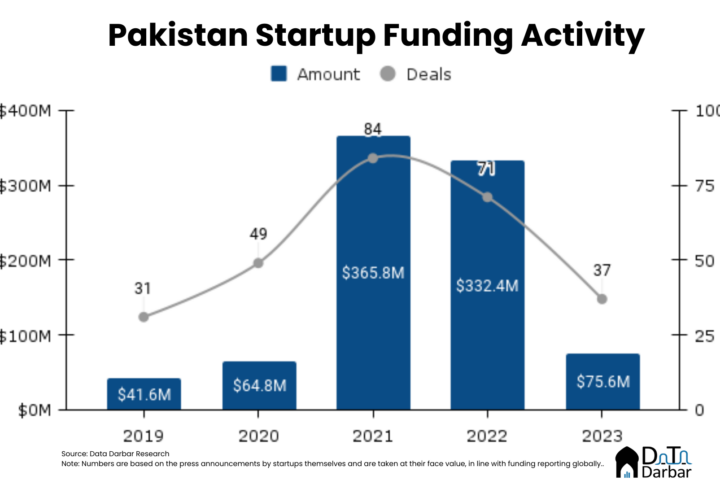

Like many other marketplaces, Daraz too spent the last few years focusing on maximizing topline growth. Even if it came at the cost of a heavy bottomline. With Alibaba behind them, there seemed to be more than enough money to pursue this strategy. The e-commerce boom right after Covid-19 ensured everyone was on it and the biggest player wasn’t obviously staying behind.

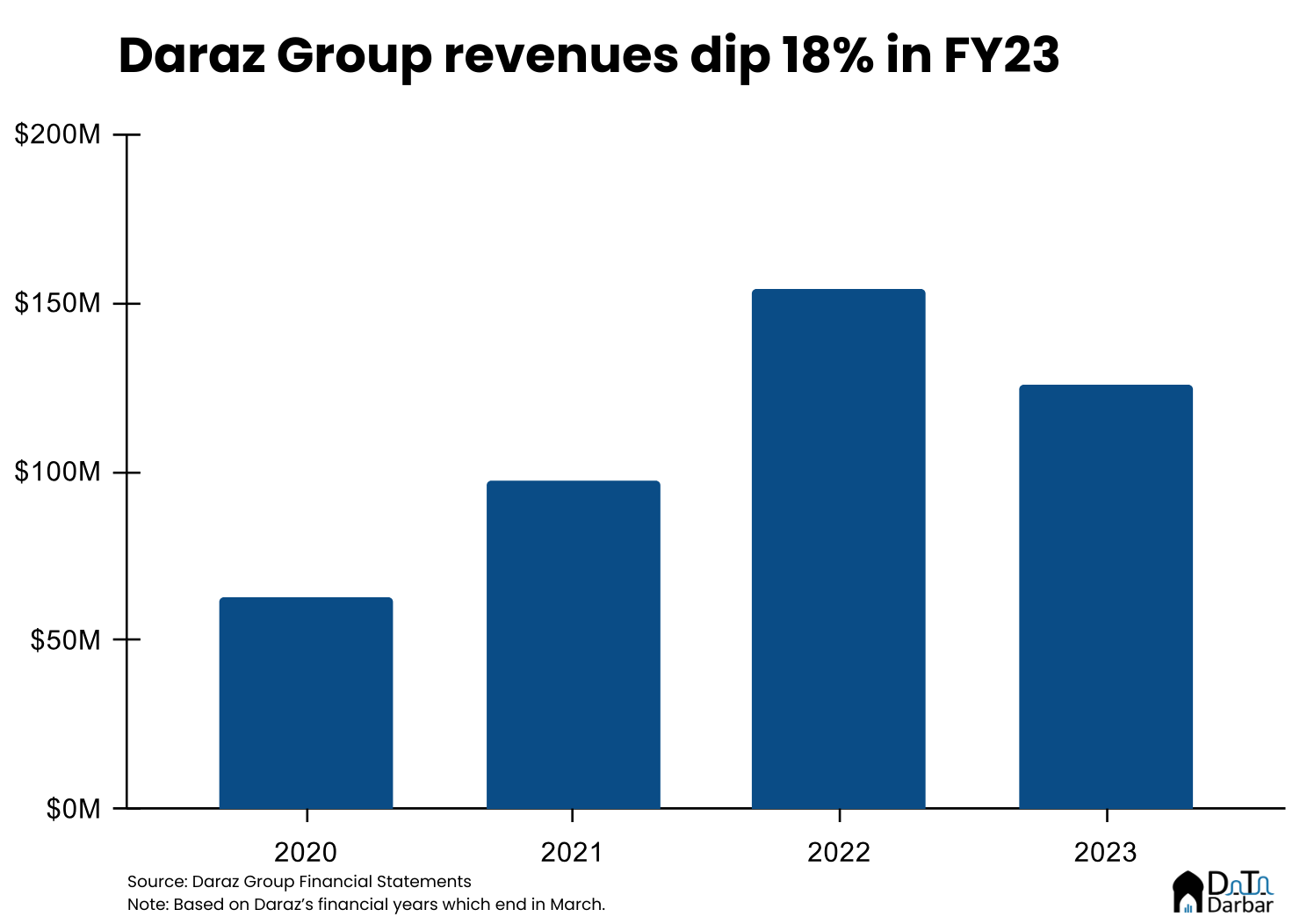

However, the losses eventually do catch up and start shaking up the confidence of the shareholders and Alibaba executives seem to be no exception. During the year ended March 2023, Daraz Group posted revenues of $125.5M, down 18.45% YoY from $153.9M. In contrast, the company had grown at 55%+ in both of the preceding years. While marketplace companies have typically struggled recently, Daraz was perhaps even more vulnerable given its geographic position.

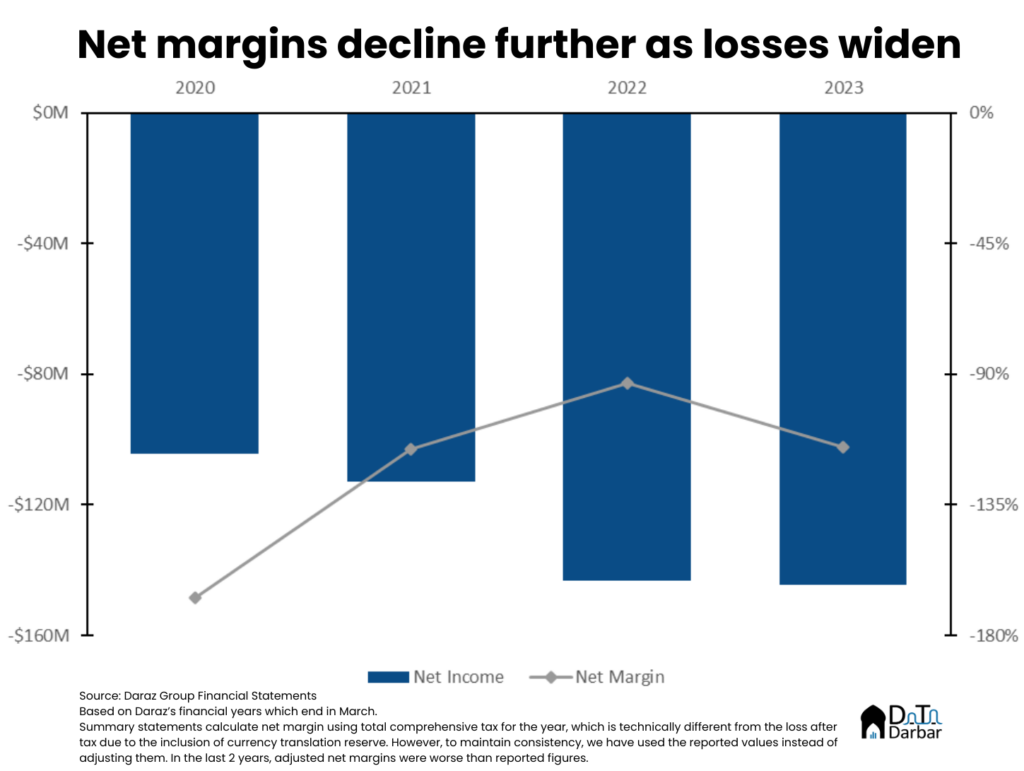

After all, it was a period of unprecedented economic uncertainty across South Asia where Sri Lanka defaulted on its external loans, Pakistan came dangerously close and even Bangladesh turned towards the International Monetary Fund. Consequently, Daraz booked a foreign exchange loss of $27.8M in FY23, which helped widen the loss after tax to $160.9M. As a result, net margins worsened further to -128.2%.

However, Daraz itself reports slightly better figures with loss at $144M and net margins at -115.1% in summary statements. Technically, it’s referring to total comprehensive loss, which is pumped up the $16.5M currency translation reserve. That’s typically a plug entry in accounting, which arises when the presentation currency (dollars in this case) fluctuates against the local currencies (such as rupee or taka).

Things were slightly better at the gross level, where the company recorded a loss of $1.4M in 2023, which was an improvement from $13.9M the year before. However, this was mostly due to a scaledown where revenue fell 18.5% and cost of revenue by relatively sharper 24.4%.

How Daraz spends and earns money

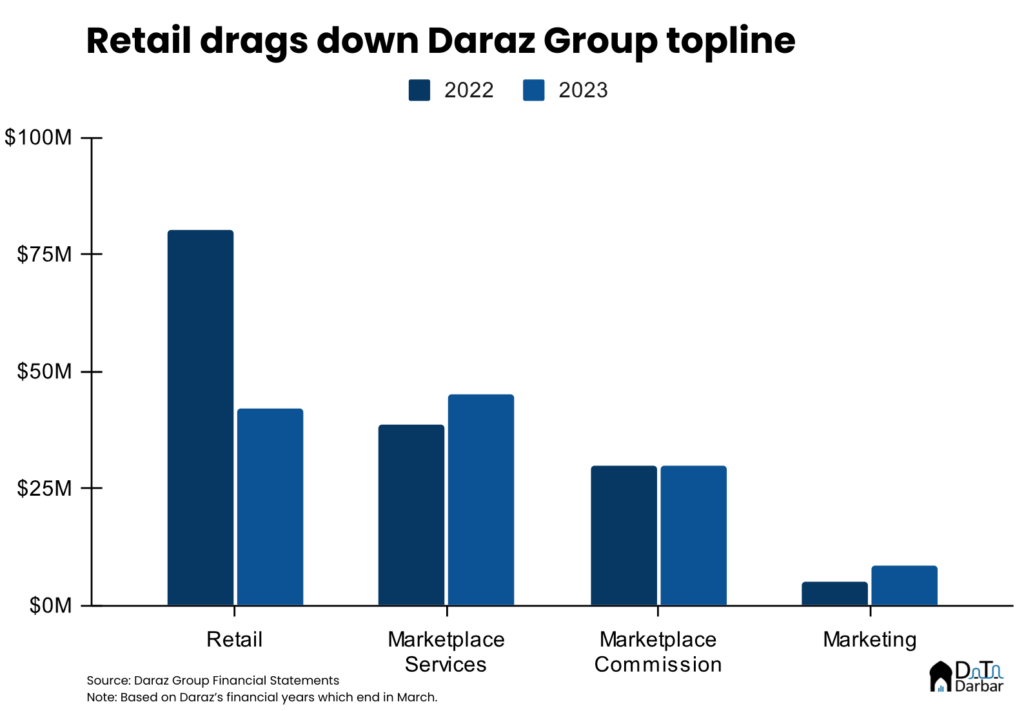

Now that all the big numbers are out, let’s review the revenue and cost mix to understand what exactly happened. So how does Daraz make money in the first place and where does it spend? As per the audit report, the company categorizes revenue into four streams: retail, marketplace services, marketplace commission, and marketing.

The first one refers to the goods Daraz sells from its inventory and singularly explains the decline in topline. Total sales from this segment plunged by 47.6% to $42.1M in FY23, from $80.3M the year before. Meanwhile, marketplace services — primarily referring to logistics — jumped 16.5% to almost $45.M and marketing surged 63.6% to $8.6M.

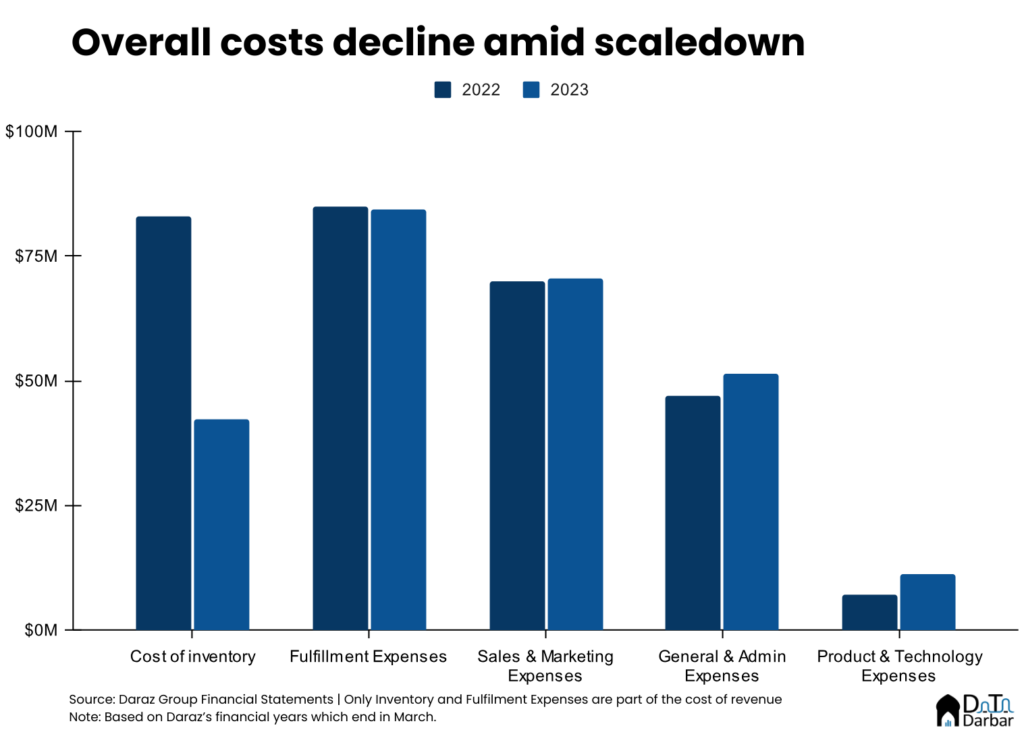

But beneath that, other cost heads either continued to grow or hold steady at best. Sales & marketing expenses were almost flat at $70.6M while both product & technology and general & admin costs rose to $11.1M and $51.1M, respectively. As a result, earnings before interest and taxes worsened to $143.9M in FY23, 4.1% higher compared to the year before. Basically, the income statement was a communist dream: red all over.

On the other side of the equation (well, not technically), cost of inventory almost halved to $42.4M in FY23 and stands significantly below even the FY21 levels. Daraz did manage to keep both the fulfillment, and sales & marketing expenses in check at $84.4M and $70.6M. However, product & tech, and general & admin costs grew.

Where Daraz stands against peers

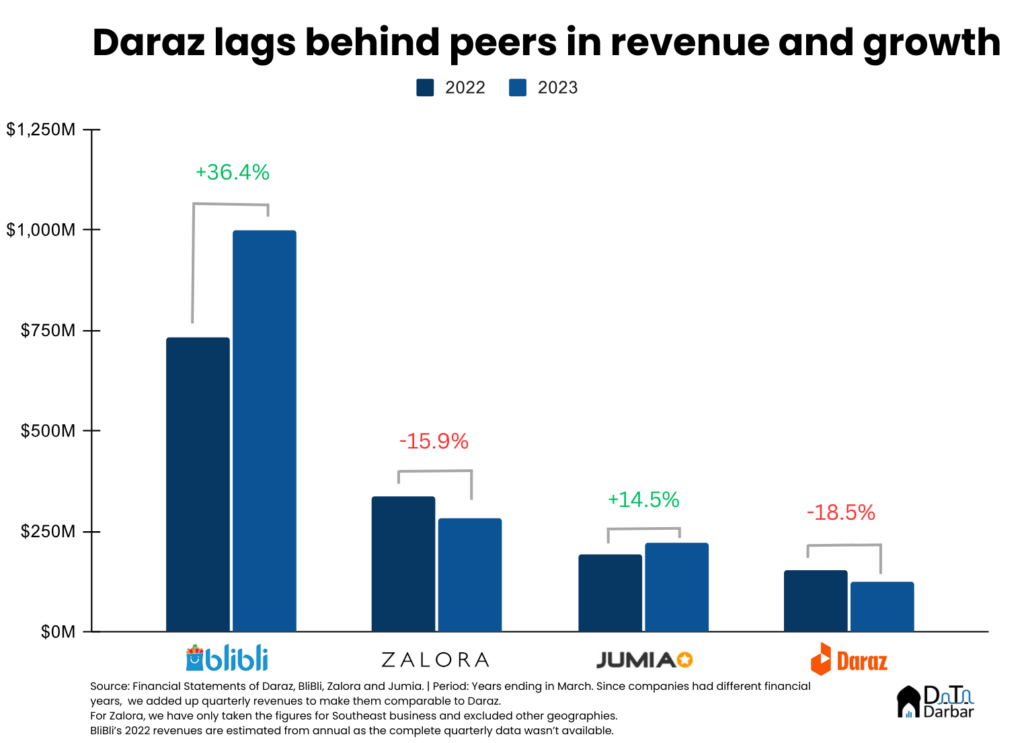

Chances are that you lost track somewhere in between with all those numbers so let me do a quick recap. By almost every indicator, FY23 was a bad year for Daraz as both its growth and margins took serious hits. But was it alone or did others in the industry fare similarly? That begs the question: who exactly are Daraz’s comparables? The answer may not be as clear-cut since many “peers” typically have far bigger scales and different geographical coverage.

For example, Shopee — which operates across Southeast Asian countries — did $2.6B of e-commerce revenue between January and March of 2023 alone while posting a gross margin of almost 45%. But let’s be honest, the market realities of South Asia are starkly different.

In any case, we looked at how Daraz’s parent, i.e. Alibaba International Digital Commerce, performed. This is the entity that owns Lazada and Trendyol, both of which managed to grow and take the international retail business higher by 17% to $7.3B. Do remember that Daraz is a fraction of these two and should post better growth because of low base. Plus, let’s also keep in mind that Turkey has seen serious economic unraveling of late, with inflation typically hovering well over 40% YoY every month.

Perhaps the only place with somewhat similar dynamics would be Africa, where Jumia has been struggling for a while now. Once a Rocket Internet venture like Daraz, it has seen a shake-up in key leadership as the company tries to contain losses. Their full-year results show progress as the company’s bottomline improved but during the period under our review, net margins were still -90%.

With the recent overhaul in management, Daraz is also undergoing similar measures. As per reports, tech and marketing are now entirely centralized and the local teams would primarily look after commercials. Such changes in organizational structures are not unusual, and given the extent of losses, maybe even needed. But would a top-down approach bring about the desired profitability and scale?