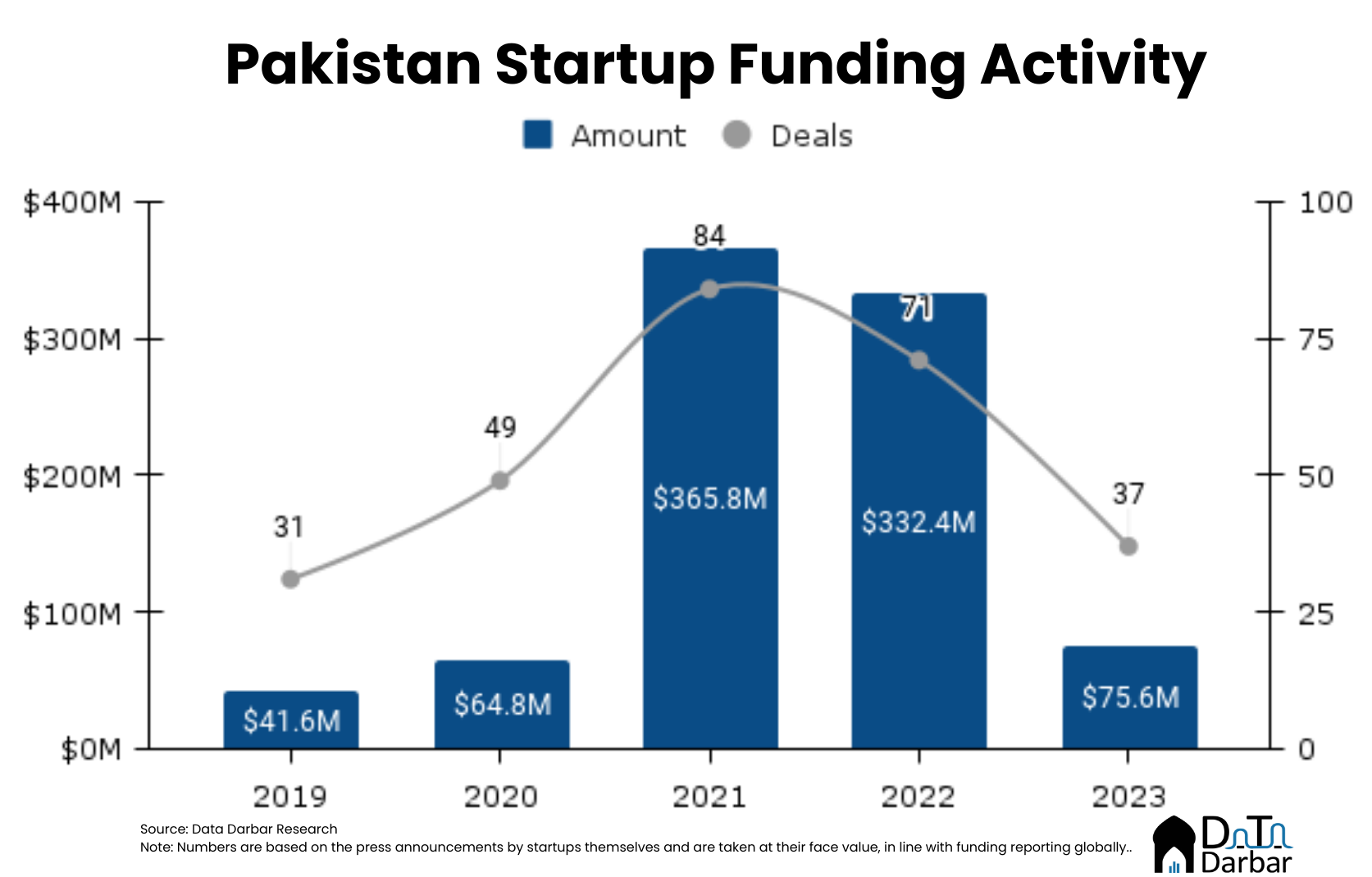

Pakistani startups raised $75.6M in funding across 37 deals in all of 2023 — representing a decline of 77.2% and 47.9% over the last year, respectively. Over half of the money came during the fourth quarter, which saw 15 investments worth $38.6M. Of these, 10 announcements were made at the +92 Disrupt organized by Katalyst Labs.

Though the decline is sharp compared to the previous two years, startup funding is still higher than the 2019 and 2020 levels. However, this is mostly because of Retailo’s $15M, which was originally part of its $36M Series A in 2022 but the tranche never came at the time. Nevertheless, the average ticket size still plunged to $2.4M in 2023, down 60% over the year before.

As reported plenty of times before and discussed over a million conferences, the decline in funding is not unique to Pakistan. Globally, VC has seen a sharp correction since the highs of 2021 amid the rate hike by the Federal Reserve. In Q3’23, global investment value and volumes receded to lows of 6+ years. Region-wise, Latin America has witnessed the steepest fall of 88.2% and 66.8% respectively from peak levels. In our upcoming detailed report, with support from Indus Valley Capital, we’ll break down more of these trends. Sign up here to get your copy in time.

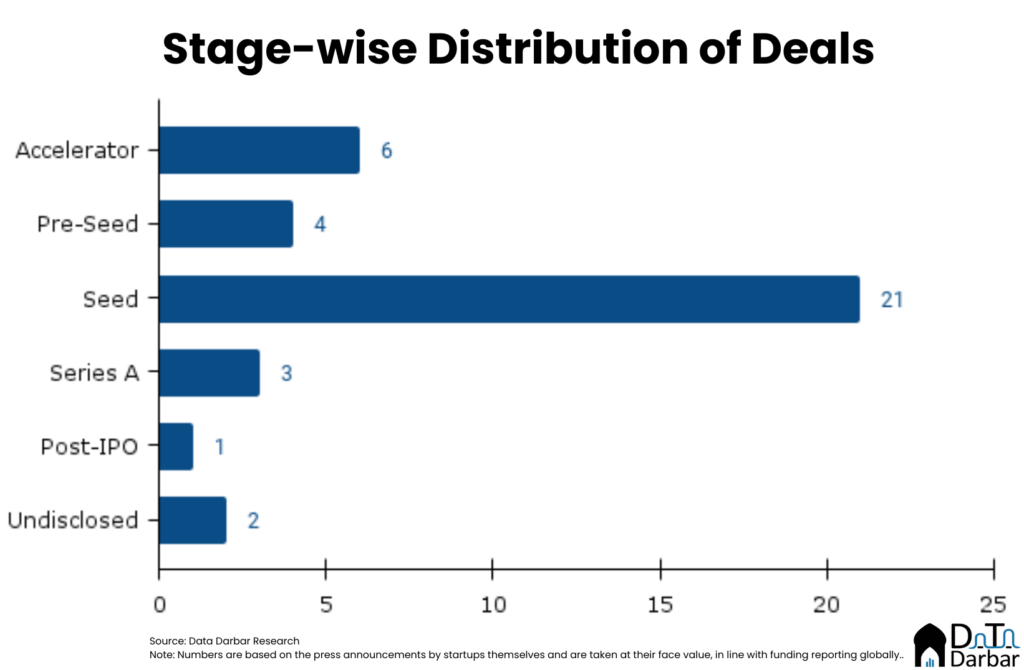

Moving on, 21 of the 37 deals were at seed stage, raising $46M during the year. Accelerator rounds were a distant second at 6 while their amount of $1.8M was even further behind. Ever since the pullback in VC globally, cohort-based programs like SOSV or Techstars have become popular among Pakistani founders. This could be due to their relatively non-cyclical nature or the access to a strong international network.

Meanwhile, $19.2M was deployed at Series A though $16.5M came from Retailo’s bridge. This signifies the capital crunch at growth stage where deals aren’t either closing or the investors aren’t following through on their commitments, as reportedly happened with Jugnu.

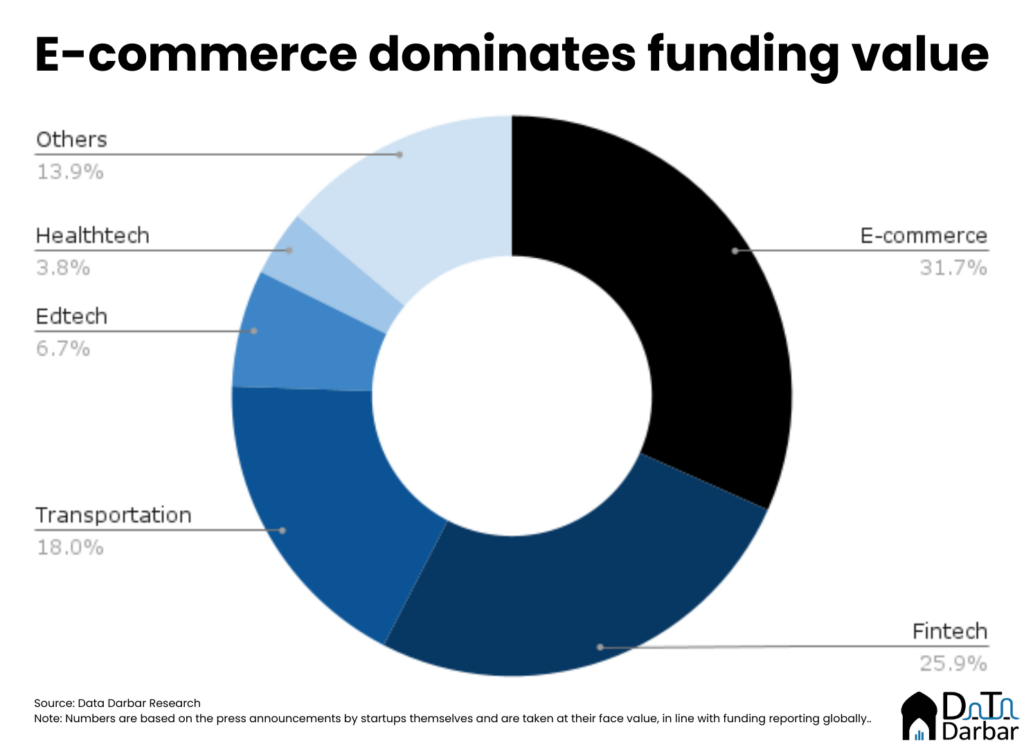

Sector-wise, e-commerce grabbed the largest chunk of startup funding at $23.95M, continuing its dominance for another year. Yet again, Retailo’s round, given its size, pumped up the numbers. However, it is probably not reflective of the actual fundraising environment. On the other hand, fintech dominated deal count at 7 ($19.6M) while transport and logistics bagged $13.6M across 6 deals.

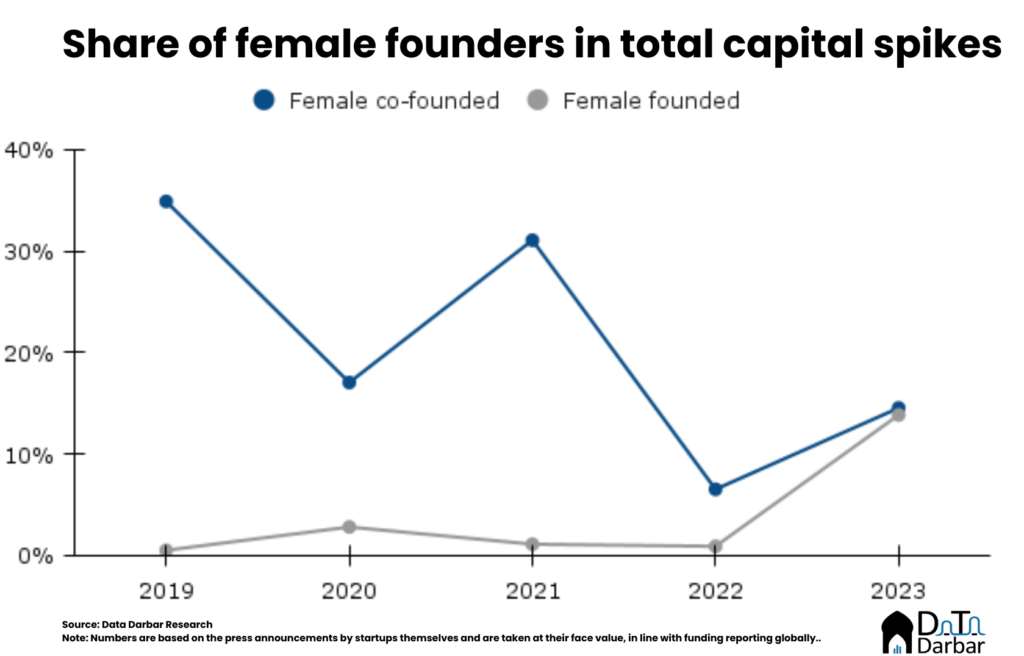

It was also the best year on record for female-founded startups which recorded funding of $10.5M. This took their share in overall investment to 13.9% and well above the average of 1.34% between 2019-2022. On the other hand, female co-founded companies saw a decline in absolute dollar value to $11M. However, it still represented 14.5% of the annual total amid a much lower denominator.