If someone ever writes a book on the history of financial inclusion in Pakistan, Easypaisa would have a strong case to be featured on its cover. It truly reimagined the way money is sent and received, from megalopolises to the most remote areas. That came at a huge cost to the bottom line, as we have previously documented.

However, 2023 saw some major positive changes for the bank, starting with getting the no-objection for digital retail bank. It was among the five entities among some 20 odd contenders, and the only existing financial institution in the country, edging out rival JazzCash and legacy banks like HBL and Alfalah. That was topped by the year closing in profits, the first time after 2017. [We will use Telenor Microfinance Bank, or TMB, and Easypaisa interchangeably.]

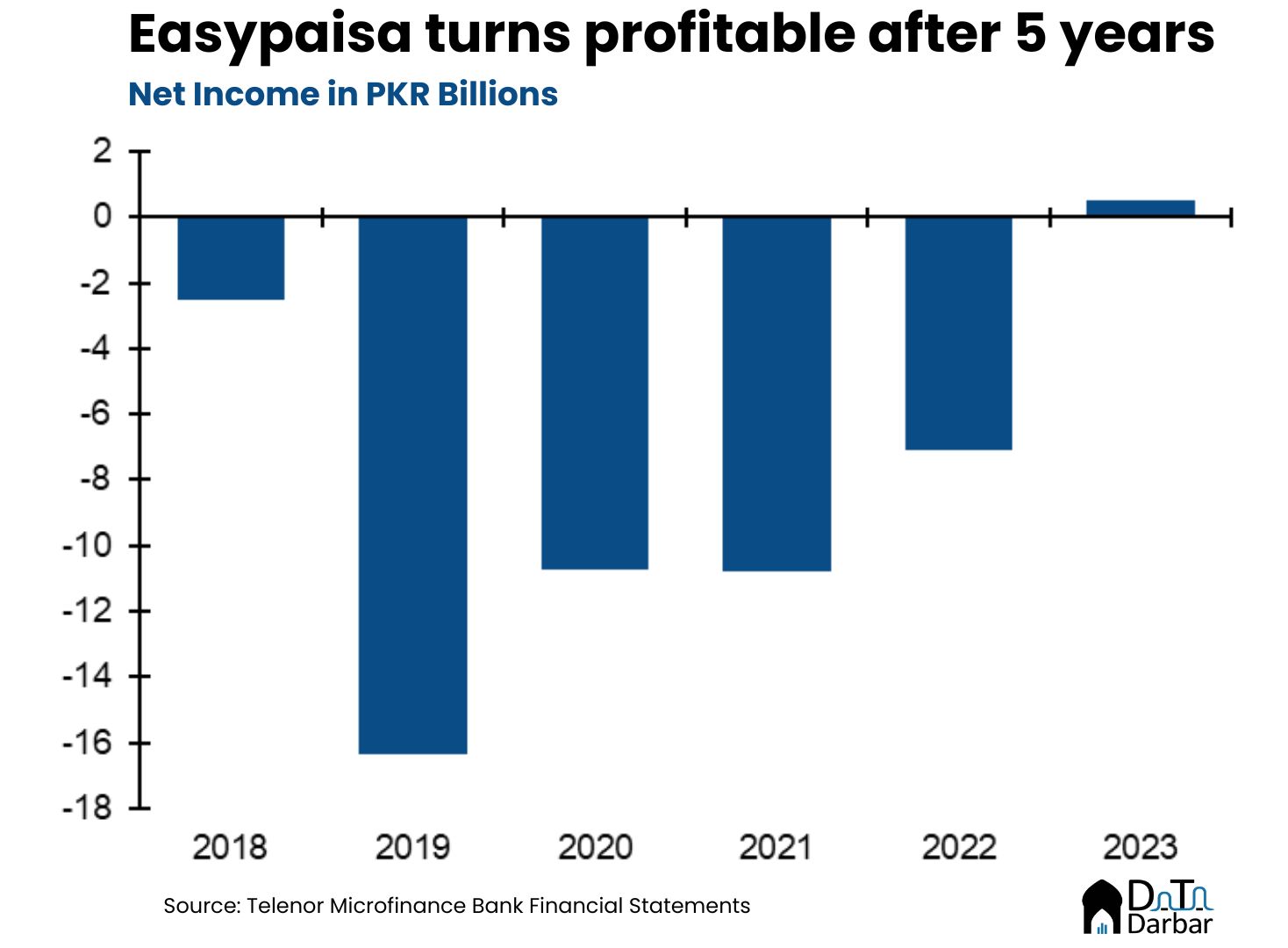

We decided to dig into Easypaisa’s financials to get a sense of where it’s headed. For the first time after five years, the bank posted positive net income at PKR 502.3M. This could be the shift of fortune TMB has been looking for quite a while but what led to it? After all, 2023 was a bumper year for banking as the high policy rate allowed for juicy returns.

In Pakistan, banks have traditionally relied on collecting cheap deposits from customers and investing most of them in government securities. Due to the sovereign’s ever-growing fiscal needs, and the prevailing interest rate environment, the industry has lately seen a high double-digit increase in profits. There are additional revenue streams too, like card issuance, bancassurance, etc, though their contribution to the bottom line is far smaller.

Payments business drives Easypaisa revenue growth

However, branchless is quite different in this regard. While the institutions do collect deposits and invest in sovereign bonds, the bulk of the markup revenue comes from advances. On the non-markup side, these institutions rely on fee and commission income for revenue, such as transaction charges. Until recently, this stream wasn’t enough to offset the underlying costs associated with running the huge agent network.

Sure enough, TMB also benefitted from the high-interest rate environment, doubling net markup income to PKR 11.3B in 2023. Back in 2021, the corresponding figure was at negative PKR 860M on the back of an impairment loss in 2021. But was this the only driver behind the turnaround? Not at all. Easypaisa did a good job in increasing non-markup income to PKR 14.1B, up from PKR 8.7B. What exactly is catalyzing this shift?

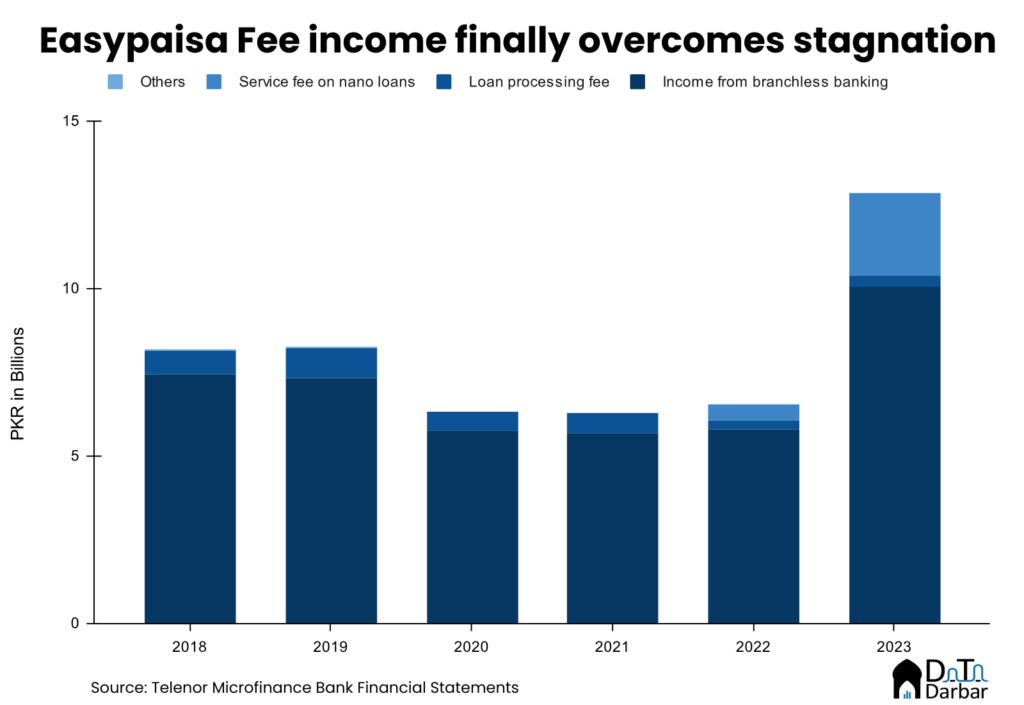

Easypaisa managed to finally change that in 2023 as fee, commission, and brokerage income almost doubled to PKR 12.9B, from PKR 6.5B the year before. The largest chunk came from PKR 10B branchless banking, which includes charges on fund transfers, cash deposits, and withdrawals among other categories. On the other hand, commission paid to branchless banking agents actually fell to PKR 3.6B, from PKR 4.9B. The payments business seems to have become meaningfully profitable, at last.

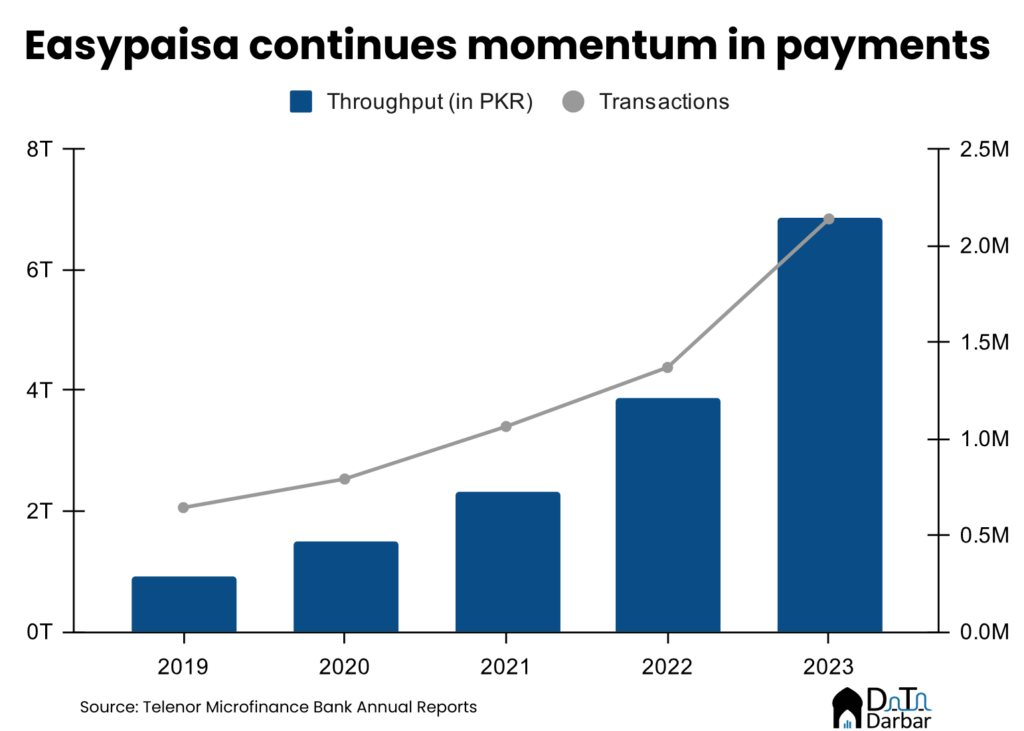

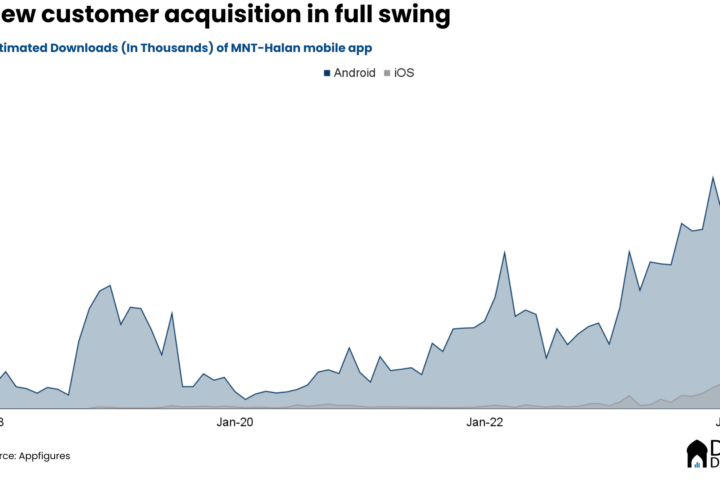

Part of the reason is that payments are increasingly shifting towards the app and away from agents. In 2023, Easypaisa’s throughput hit PKR 6.9T across 2.1B transactions, making it the second-largest player in the industry by volume. Monthly active users of the app increased to 9.6M while the m-wallet customer base was 13.2M.

Lending: The New Frontier

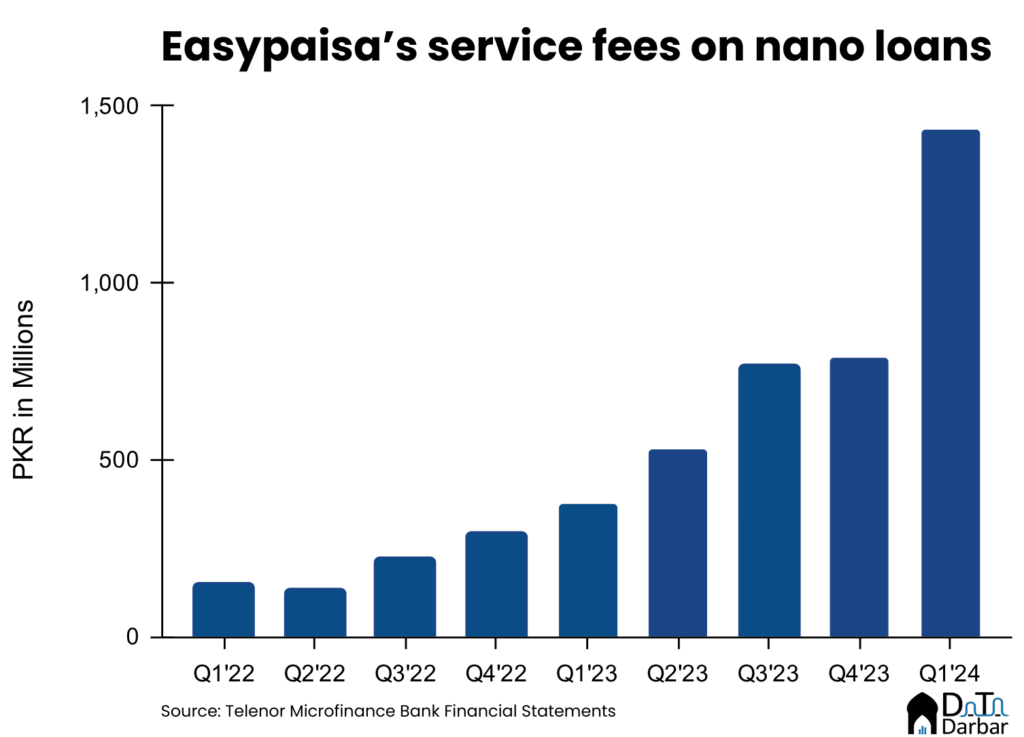

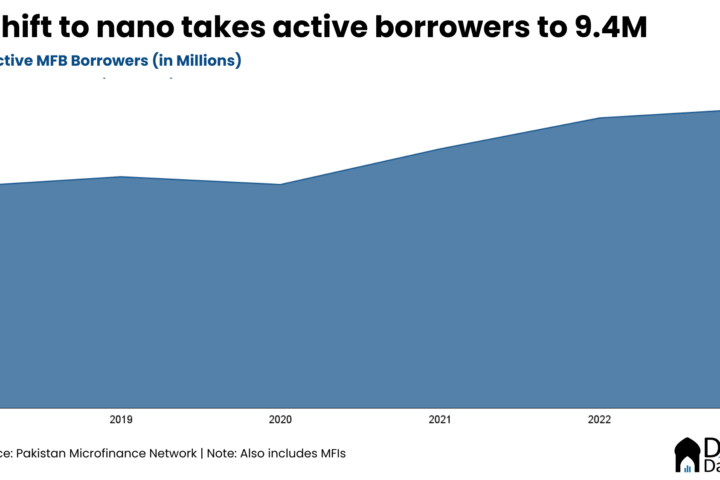

But the bigger story is lending, not payments. Years after the experiment had failed and cost hundreds of billions of rupees, Easypaisa is making a comeback with a clean slate. And this time, it’s all about nano — just like the rest of the industry. Coming out of nowhere just two years ago, “service fees on nano loans” has become a sizable contributor and added PKR 459M to the fee income in 2022 and PKR 2.4B in 2023. The latest quarter has seen this head grow to PKR 1.4B, almost double the last quarter.

This shift in strategy is reflected in the quantum of digital lending with disbursements jumping from PKR 4B in 2022 to PKR 21.5B in 2023. Similarly, the number of nano loans disbursed increased from 1.5M to 8.5M. As per our estimates, Easypaisa charged an 11.5% service fee per loan on average. Given the short tenor, this would easily translate into triple-digit on annualized basis. Once you incorporate the actual markup and late payment charges, the annual percentage rate would be even higher.

But let’s keep the moral aspect aside for now and just focus on the financial. Analysing the outstanding credit also reveals a similar scenario as unsecured advances have increased from PKR 7.5B to PKR 10.8B but the number of loans outstanding has grown 3x over the same period. So safe to say, Easypaisa is very clearly focusing on nano for growth.

At last, the stars are aligning for Easypaisa. Given its organizational structure and massive customer base, it already has a big headstart against other digital retail banks that all have to start from scratch. But hopefully, the management will have learned by now that banking on first-mover advantage is not a great idea, as JazzCash showed.

To compete the story you need to go back in history.

8 years ago , when I sold tameer bank to telenor , the bank was making $ 12.5 mm in pre – tax profit , had a CAR of 35 percent and bad debts and fraud under 1 percent ( for the past five years ). Telenor bank easypaisa managed to notch up a staggering loss of Rs 60 billion plus over the next 8 years.

The Bank is finally profitable. A better story would be to also explaine how the Bank managed to notch up this monumental loss ( takes special skills ) and then the turnaround bit .

Perhaps a better story to tell would be how telenor aquired crime-ridden Tameer from you on a throwaway price of 25M$ and then sold half of it in 200M$ to Ant Financial ONLY a few months later. To make things worse, nothing impactful came out of PlanetN either where u spent those 5-10M $. Karma is a bitch for sure.