Every morning, Shahrah-e-Faisal shows what happens when infrastructure fails to keep pace with demand. Despite multiple widenings, signal-free conversions, and repaving projects over the decades, the 18-kilometer stretch still chokes during rush hour each day, its 250,000 daily vehicles straining every lane. But at least the city kept widening it.

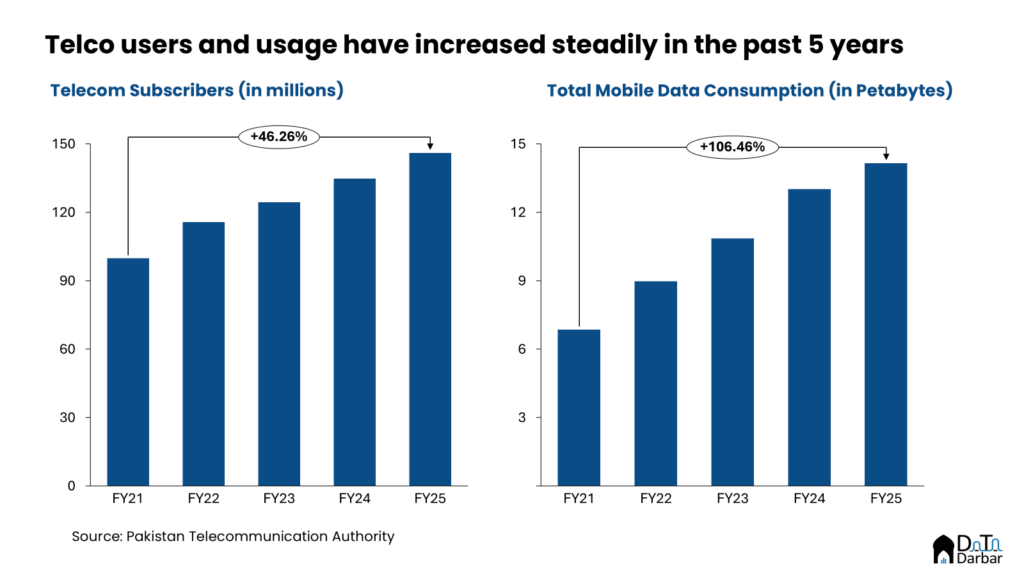

The same cannot be said about the connnectivity infrastructure, at least not to the same extent. Between FY22 and FY25, ~46 million cellular subscribers have been added while average monthly data consumption tripled from 3 GB per user in 2019 to 8.8 GB in 2025. Yet, supply has not caught up.

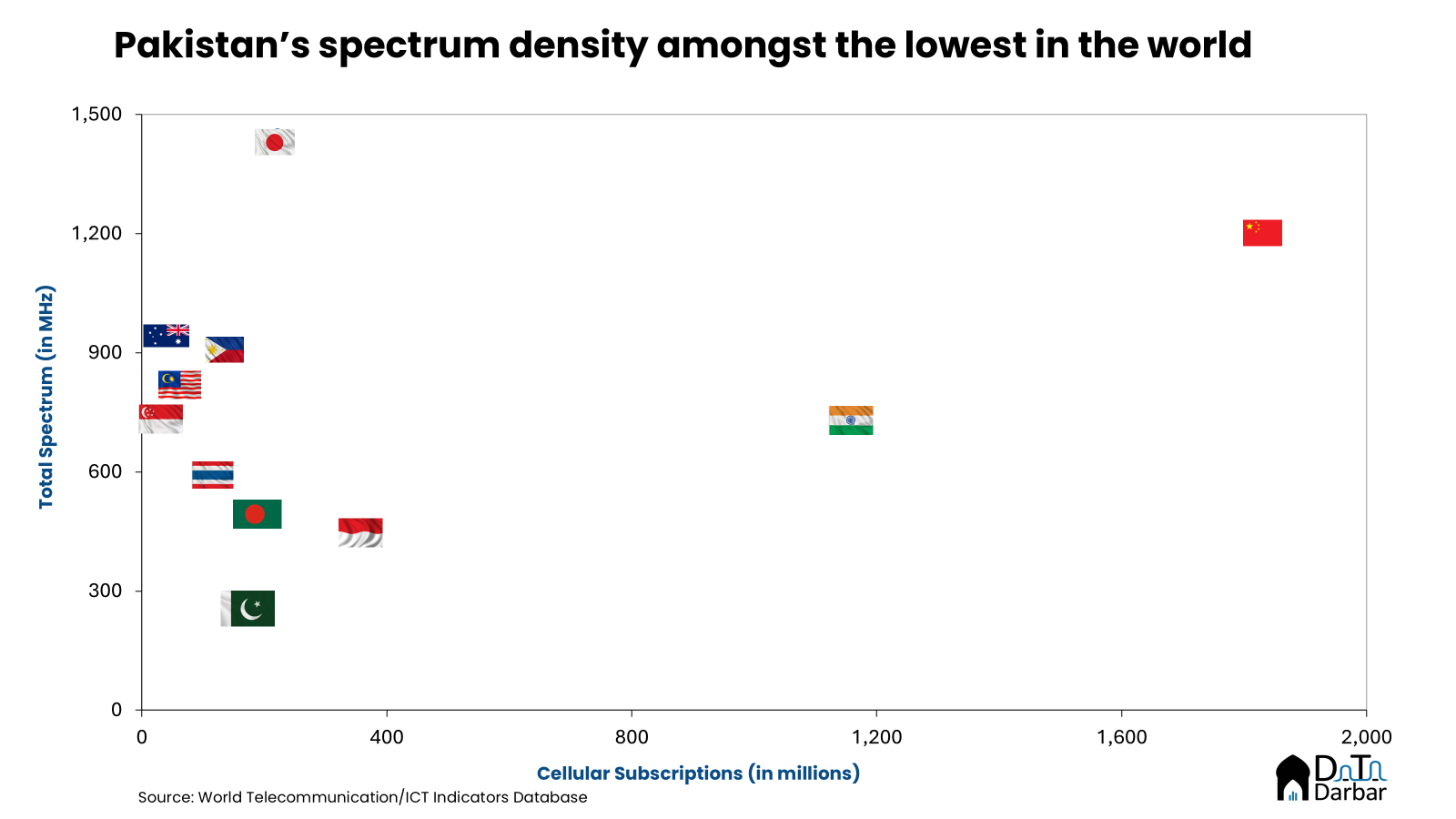

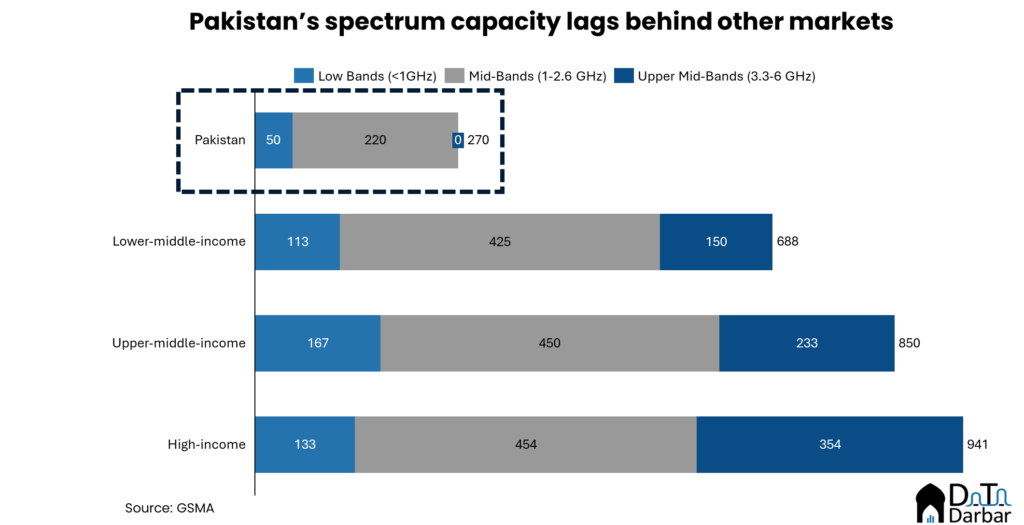

During this same period, only one spectrum auction has taken place, which saw the participation of only the then late-bloomer Ufone. Similarly, high reserve prices left 30% of the 2014 offering unsold. Consequently, Pakistan country operates on just 274 MHz — among the lowest in Asia, and roughly one-third of Bangladesh’s 600 MHz. This has an economic cost, with slower networks constraining the digital economy. According to GSMA, each year of delay in spectrum release costs Pakistan $1.8 billion in lost GDP.

That economic toll finally prompted action. On January 9th, 2026, Pakistan’s telecom regulator unveiled plans to auction 597.2 MHz of spectrum across six frequency bands, more than doubling the existing allocation. While the move was broadly welcomed, some specific provisions received pushback from operators, who argued deployment obligations were unrealistic given the magnitude and pace of capex required. So let’s look at what the IM proposes.

The Spectrum on Offer

Six frequency bands are up for auction, each with distinct characteristics. Four bands—700, 2300, 2600, and 3500 MHz—have never been available to Pakistani operators, with the 3500 MHz band (280 MHz) representing the global 5G standard.

- Low frequencies (700-900 MHz): Travel farther and penetrate buildings; ideal for countryside coverage but limited capacity

- Mid-bands (1800-2600 MHz): Balance reach and throughput for urban 4G

- 3500 MHz band: Delivers ultra-high speeds in dense areas but requires closely-spaced sites due to poor building penetration—regulators specifically mention science centers as suitable deployment locations

Spectrum Allocation Overview

| Band (MHz) | Type | Status | Total MHz Available | Number of Lots | MHz per Lot | Reserve Price per MHz | Reserve Price per Lot | Use Case |

|---|---|---|---|---|---|---|---|---|

| 700 | Low-band | NEW | 15 (paired) | 3 | 2×5 MHz | $6.50M | $32.50M | Rural coverage, building penetration |

| 1800 | Mid-band | LEGACY | 3.6 (paired) | 3 | 2×1.2 MHz | $14M | $16.80M | Urban 4G capacity |

| 2100 | Mid-band | LEGACY | 20 (paired) | 4 | 2×5 MHz | $14M | $70M | Urban 4G capacity |

| 2300 | Mid-band | NEW | 50 (unpaired) | 5 | 10 MHz | $1M | $10M | 5G capacity |

| 2600 | Mid-band | NEW | 190 (unpaired) | 19 | 10 MHz | $1.25M | $12.50M | 5G capacity |

| 3500 | High-band | NEW | 280 (unpaired) | 28 | 10 MHz | $0.65M | $6.50M | Primary 5G, ultra-high speeds |

Scroll horizontally to view all columns on mobile devices

Competition Safeguards

To prevent monopolization, four caps apply: operators cannot hold more than 40% of total spectrum (348.5 MHz), cannot concentrate excessive low-band frequencies (55 MHz limit), and face specific limits on 2600 MHz (140 MHz cap) and 3500 MHz (200 MHz cap). New entrants cannot bid on legacy 1800 MHz.

The availability of 5G spectrum could create opportunities for data-focused MVNOs targeting urban markets. Pakistan released its new MVNO framework two days before the Information Memorandum, though whether incumbents will genuinely open their networks remains to be seen.

Pricing Structure

- 700 MHz: $6.5m per MHz—expensive, but critical for countryside reach

- 1800 and 2100 MHz: $14m per MHz—highest prices, reflecting existing infrastructure compatibility

- Mid-bands (2300, 2600 MHz): $1-1.25m per MHz

- 3500 MHz: $0.65m per MHz—lowest despite being 5G’s workhorse

The 3500 MHz band costs just $0.65m per MHz despite being the global 5G standard, but operators need large blocks (100+ MHz) for effective deployment. The pricing is reflective of the far denser and costlier site networks needed to operate in this spectrum.

At reserve prices, the auction values spectrum at $897 million. Operators acquiring 150-180 MHz each might spend $225-270 million, though competition for scarce bands (particularly 700 MHz) could drive premiums. Conversely, weak demand could leave spectrum unsold, as happened in Pakistan’s 2014 and 2021 auctions, where GSMA says reserve prices pushed spectrum costs to 25-30% of operator revenue, double its recommended 12-15% threshold.

Deployment Obligations

License holders face aggressive buildout requirements designed to ensure nationwide coverage and prevent urban concentration. The nine-year timeline imposes both quantity and quality mandates.

Annual Site Deployment:

- Incumbents: 1,000 sites annually (200 greenfield builds + 800 equipment upgrades)

- New entrants: 200 sites annually

- Geographic constraint: Coverage must be split between urban and rural areas in each province. This matters because countryside subscribers generate far lower revenues and require more towers due to lower population density.

Fiber-to-the-Site (FTTS) Requirements: FTTS means cell towers connect to the core network via fiber optic cables rather than microwave links, which is essential for 5G’s bandwidth demands. Without fiber backhaul, towers cannot deliver 100 Mbps speeds even with 5G equipment. The escalating requirement ensures operators build robust infrastructure, not just add spectrum to bandwidth-starved towers.

- Incumbent operators: FTTS ratios escalate from 20% to 35% across four phases

- New entrants: 20% of sites must support FTTS and 20% must enable 5G from day one

Rollout Timeline:

- 2026-2028: Five major capitals

- 2028-2032: Additional cities prioritizing universities, transit hubs, hospitals, and tourist areas

- By 2035: Comprehensive coverage including smaller cities

Network Infrastructure Roadmap 2026-2035

| Phase | Years | Sites/Year | New Sites | 5G Cities | FTTS Ratio | 4G QoS (Mbps) | 5G QoS (Mbps) | Coverage Focus |

|---|---|---|---|---|---|---|---|---|

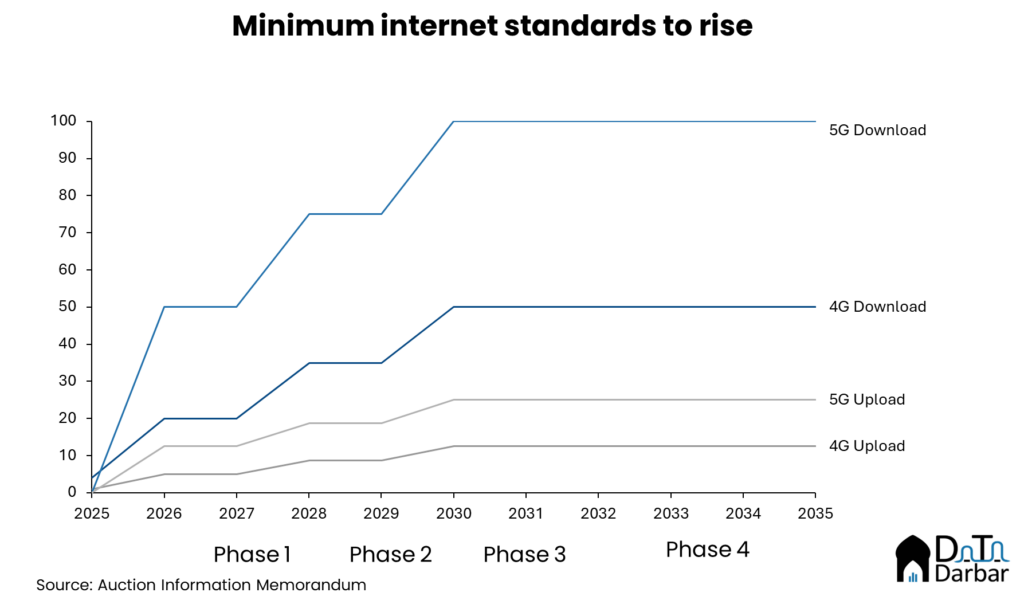

| 1 | 2026-2028 | 1,000 | 200 | 5 | 20% | 20/5 | 50/12.5 | Federal & provincial capitals (Islamabad/Rawalpindi, Karachi, Lahore, Peshawar, Quetta) |

| 2 | 2028-2030 | 1,000 | 200 | 15 | 25% | 35/8.75 | 75/18.75 | +10 cities (2/province), universities, tech parks, industrial zones, transit hubs |

| 3 | 2030-2032 | 1,000 | 200 | 25 | 30% | 50/12.5 | 100/25 | +10 cities, hospitals, tourist areas, coverage gap remediation |

| 4 | 2032-2035 | 1,000 | 200 | 40+ | 35% | 50/12.5 | 100/25 | +15 cities, comprehensive nationwide coverage |

Scroll horizontally to view all columns on mobile devices

Quality-of-Service Minimums: Speed requirements escalate over time, with 90% of consumers guaranteed these speeds:

- 4G speeds: Rise from 20 Mbps to 50 Mbps

- 5G speeds: Rise from 50 Mbps to 100 Mbps

- Upload speeds: Must hit 25% of downlink rates throughout, a ratio designed to support two-way applications like video calls and cloud uploads, not just passive consumption

Spectrum Unit Economics

The deployment obligations represent a far larger financial commitment than spectrum fees alone. Meeting the 1,000-sites-per-year requirement means building 200 new towers annually plus upgrading 800 existing sites with new equipment.

Cost per Site: Tower construction in Pakistan runs around $50,000 per site. Equipment upgrades cost perhaps a third to half as much per site. But 9,000 sites over nine years could still mean hundreds of millions in infrastructure investment.

An operator spending $250 million at auction might face total commitments approaching $400-600 million when infrastructure is included, though actual costs depend on vendor negotiations, fiber availability, and whether economies of scale materialize.

These figures assume operators build and own infrastructure. Pakistan’s telecom sector is moving away from that model. Jazz sold its 10,500-tower subsidiary to Engro Connect for $560 million in 2025, creating Pakistan’s largest independent tower company. Master lease agreements with towercos could convert construction costs into rental payments for all operators. Not every operator will need 200 new towers annually.

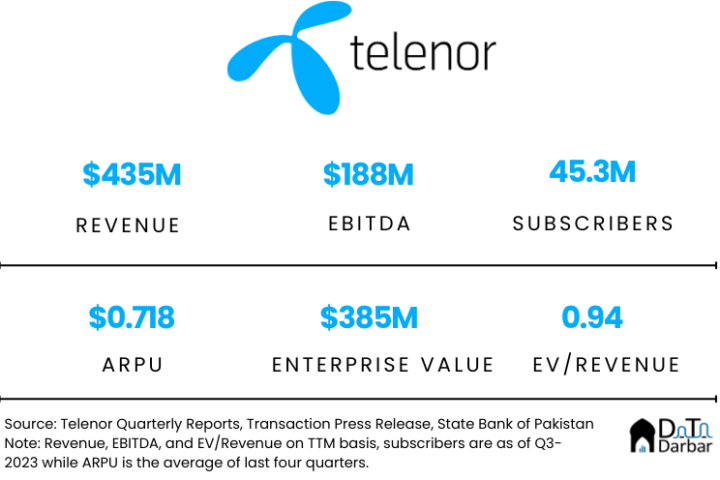

The payback period remains uncertain. Pakistan’s mobile ARPU sits at approximately $1.10 per month which is far below the $8.20 global average and among the lowest globally. However, superior networks could enable new monetization strategies. GSMA analysis shows speed-based tariffs, where operators could charge premiums for higher speeds rather than data volume, correlates with faster ARPU growth in multiple markets. Pakistan’s spectrum winners could offer basic 4G at existing rates while charging premiums for high-speed 5G in urban areas, where purchasing power is higher and willingness to pay for superior performance exists. The bet that superior networks could create willingness to pay is what makes this auction either visionary or reckless.

The Open Question

Operators argue the auction prioritizes serving the few over the many. With less than 2% of users owning 5G handsets (costing Rs 40,000 to 100,000) and only 15% of towers fiber-connected, they contend the 597 MHz should primarily expand 4G capacity for the masses rather than rush deployment of what Jazz CEO Aamir Ibrahim called “an expensive and empty 5G network.” A quarter of mobile customers still don’t use mobile broadband, despite 4G being available for over a decade.

Their wish list reflects these concerns: rupee-denominated spectrum pricing to match their revenue base, payment flexibility for infrastructure deployment, and policies prioritizing mass connectivity over elite urban showcase rollouts. Pakistan’s spectrum scarcity, with 274 MHz for 240 million people, is undeniable and costs billions in foregone GDP. Whether the auction widens the digital highway for all Pakistanis or becomes another toll road accessible only to the affluent depends on how regulators balance commercial realities against ambitions for universal fast internet.