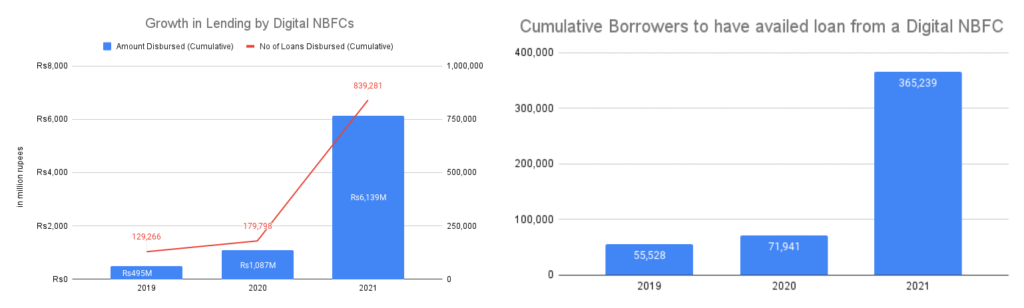

Instant credit has become a huge hit in Pakistan, with countless apps spending heavily on both performance and influencer marketing. As a result, downloads ballooned during the last year. Every other metric also leads to the same conclusion: cumulative number of borrowers have surged 558% between 2019 and 2021, while amount disbursed was up 1,140%.

You can see for yourself how the numbers shot up in 2021, as the SECP issued non-banking finance company licenses to four fintechs. This helped add over Rs5 billion in amount and 293K borrowers just the last year – more than 2019 and 2020 combined. Barwaqt alone claims to have done Rs4B in disbursements. On the other hand, average loan size fell from Rs11,715 to Rs7,660, signifying a further shift towards petty loans.

But this is just the licensed space, of which only one name actually dominated the Play Store in 2021. A large share of digital lending is actually outside the regulatory ambit, by shady companies offering exploitative rates and no consumer protection.

Error 404: Regulator not found

SECP inaction

Lending in Pakistan is a regulated business, where SBP has the mandate for banks and the SECP oversees non-banking finance companies. So to operate purely as a loan provider, one should have an NBFC license. With the exception of SeedCred Financial (Barwaqt) and Sarmaya Microfinance (PK Loan and Easy Loan), none of the names featuring the Top 100 chart on Play Store have a license.

In theory, that’s the bare minimum criteria to even start operations. Then obviously, complying with the NBFC Regulations of 2008 (updated in 2020), which requires ensuring access to “affordable financial services”. Open to everyone’s interpretation but interest plus other charges in triple digits doesn’t really sound affordable to me.

The existing regulations don’t cover digital lenders, but draft amendments were notified recently to this end. Under that, the SECP proposes the addition of “adequate and accurate disclosures” regarding the offered products along with their terms and conditions. The next point is regarding the minimum disclosure requirements for digital applications and websites.

Moreover, the draft talks about the “fair treatment of consumers/borrowers including devising appropriate pricing policies”. Rather vague yet again, considering how licensed players are charging exorbitant rates. After all, what’s an “appropriate” price really depends on the user’s risk profile. And that is very high risk in uncollateralized, algorithm-based instant lending targeting low or middle income people. Whether caps are a good idea or not, I don’t know but the amendments should be more specific at the very least.

After much buzz around social media on the mushrooming of instant credit apps, the SECP seems to have finally woken up. It has called a meeting with nano lenders on Tuesday to take up the complaints of high rates.

Dude, where’s the PTA?

However, the issue is that most of the apps are not even registered entities, let alone licensed NBFCs. Many are actually based outside Pakistan so how does the SECP regulate them when they don’t fall under the local jurisdiction? Luckily (or unluckily), we have the Pakistan Telecom Authority mandated with dealing with such issues.

But those guys are more interested in blocking and penalizing what you post on social media. Or whether you are using TikTok and God forbid, some dating app. Illegal lending platforms ripping off customers with no regard for data privacy? Not their problem. Point being, they can block certain platforms engaging in fraudulent or illegal activities the same way they did over 1.1 million URLs in 2021.

Hello SBP, my old friend

While the issue doesn’t fall under SBP’s mandate, it has in the past shown its penchant for overreach. Like the time it directed banks, electronic money institutions and payment service operators/providers to block payments for Indian content. This was after the release of Churails by Zee5, which managed to threaten a lot of fragile egos and the instruction actually came from the Cabinet Division.

So the central bank does have the tools to deal with the issue, as it ultimately regulates payments. Hence, theoretically, it can order EasyPaisa, JazzCash (the most common intermediaries for loan apps) and others to not deal with unregulated players at least. Just to be clear, the argument here is not for further SBP overreach but to highlight the priorities, i.e. policing morality. A web series can attract all the might of state institutions but people getting ripped off concerns no one.

Google Play’s policy on instant credit apps

The issue of frauds has become so prevalent that Google is finally taking action. In 2021, it launched a program in the UK where financial service advertisers would need extra disclosures. The policy will next roll out in Australia, Singapore and Taiwan so our turn is not anytime soon.

Till then, the local authorities will have to do something. That’s where the problem lies: in inter-regulatory subjects, there is a pattern of missing regulator(s). Even in political matters, that’s quite evident where provincial and federal governments keep quibbling over issues. Meanwhile, citizens and consumers will continue to bear the brunt of that inaction.