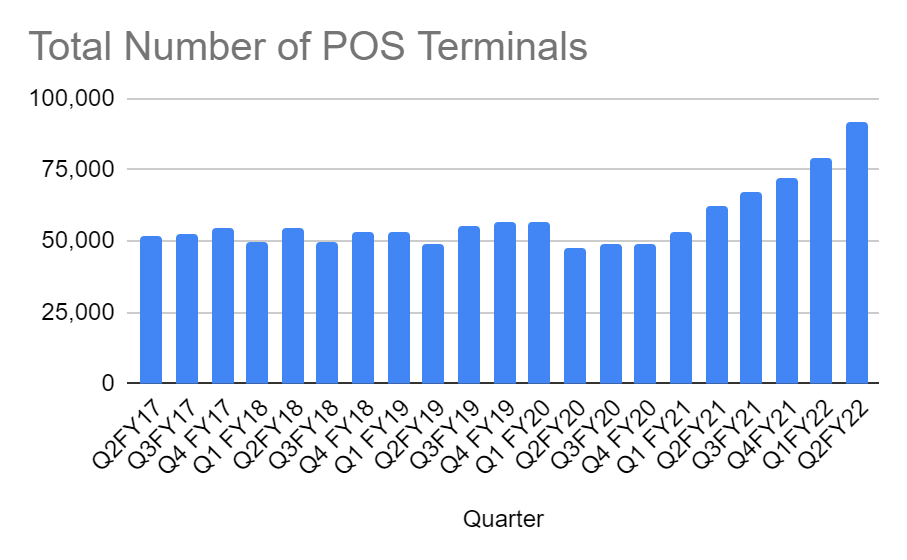

Pakistan is a highly cash-dependent country with more than Rs7 trillion of currency in circulation, meaning around 13% of the national gross domestic product circulates as cash. That’s no surprise to anyone who has tried paying digitally for stuff either online or at a physical store. The reason is that very few merchants accept payments by cards, as evidenced by the meager number of point of sale machines. However, if recent events are any indicator, Pakistan’s POS ecosystem is finally taking off.

According to the State Bank’s latest data, the number of PoS terminals increased to 92,153 by December 31, 2021. That represents a growth of 16% QoQ from 79,134 in Q1FY22 and 47% compared to 62,480 machines in Q2FY22. In terms of percentage, this is the second-highest quarterly and yearly jump in the past five years. The performance is even more impressive in absolute numbers: 13,019 new machines were added over Q1FY22 and 29,673 since Q2FY21.

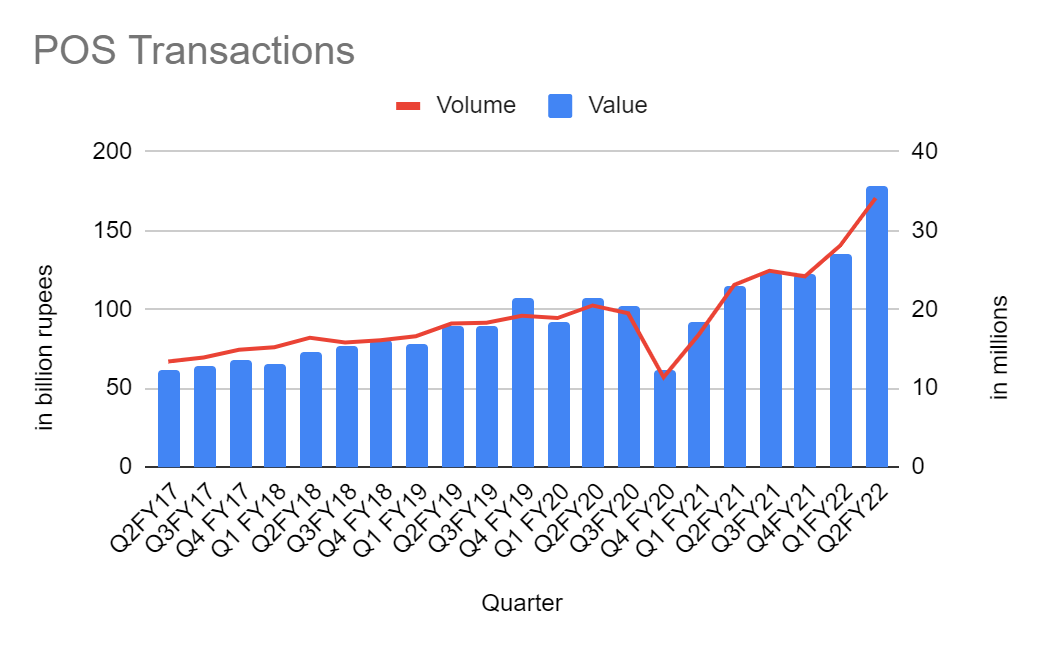

Similarly, both the value and volume of transactions hit their peaks at Rs178.1 billion and 34.1m, respectively. In fact, that’s been the case for the past five quarters straight after witnessing an almost four-year long sluggish period. After staying stagnant for around three years, activity in the PoS ecosystem seems to be reviving. In order to understand what happened, let’s rewind a little.

A new incentive structure for POS acquirers

Until a year back, there were only five players doing open-loop POS acquiring — HBL, UBL, MCB, Bank Alfalah, and Keenu. But the business model wasn’t too lucrative because of the lopsided distribution of the merchant discount rate (MDR). Let’s see how.

Say you pay Rs1,000 at KFC by swiping a Habib Metro debit card. The food chain will receive around Rs980 (assuming no federal excise duty) as the remaining Rs20 will go to the parties involved in the transaction. First, there’s the issuer, the bank — HMB here, which took the largest share (over 1%) of the amount. Then entered the card scheme — Visa, Mastercard, UnionPay and PayPak — and the processor, usually Euronet. Finally, the remaining went to the acquirer, which wasn’t enough to cover the entire cost of operations such as machines, maintenance etc.

To fix this problem, the SBP in January 2020 mandated that the MDR for acquirers should be 1.5-2.5%. It also put a cap on the interchange reimbursement fee (IRF) for debit and prepaid cards. This allowed some breathing space to the acquiring side and triggered interest from new players.

In fact, two new players – Meezan Bank and Nigerian fintech OPay – have already entered the market while a few others are looking to get in line soon. This should help maintain a healthy growth trajectory in the number of PoS machines and increase competition.

nts. First, the average amount of transactions has stayed flat at almost Rs5,000 since FY17. Second, the number of POS transactions per card in a given year is only 3.53. By the way, in developed markets like the European Union, the corresponding figure is 66.5.

Demand side of the problem

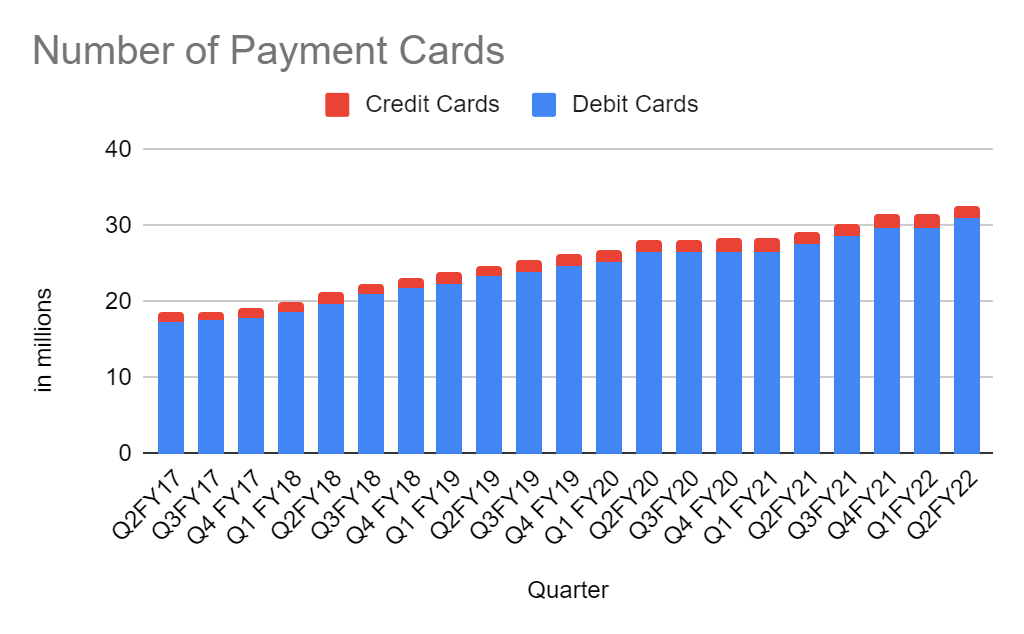

But acquiring is only part of the story. Demand-side has its own set of challenges, especially the low levels of financial inclusion. As of Q2FY22, there were less than 49 million payment cards in Pakistan — with almost 30m debit and only 1.7m credit. Considering how many individuals own more than one card, the percentage of population with a debit or credit card is no more than 10%.

While the number of cards – debit – has increased consistently, it hasn’t necessarily resulted in higher adoption of digital payments. This can be seen through two data points. First, the average amount of transactions has stayed flat at almost Rs5,000 since FY17. Second, the number of POS transactions per card in a given year is only 3.53. By the way, in developed markets like the European Union, the corresponding figure is 66.5.

Moreover, the value of POS transactions are barely a fraction of the retail e-banking amount. While mobile and internet banking reached Rs2.9tr and Rs2.4tr respectively in Q2FY22, POS value stood at just Rs178bn.

According to an industry source, the POS ecosystem runs on the 90-10 phenomenon: 90% transactions can be attributed to just 10% of the merchants. The Federal Board of Revenue has been trying to change this by getting large retailers to install POS machines. On the cards side, the SBP wants to replace the expensive Visa and Mastercard with domestic PayPak, though the banks have shown little interest. But with new players on the acquiring side and emerging fintechs with card offerings, Pakistan’s POS ecosystem is bracing for a new era.