With the continuous political turmoil, soaring inflation, tightening job market, and a newly announced budget with increased taxes, one can’t help but wonder if there’s any pocket of hope country is experiencing positive growth that genuinely benefits the masses.

However, amidst the gloom, there’s a silver lining that brings a glimmer of hope: recent data on Pakistan’s payment systems. The State Bank of Pakistan’s report released a few weeks back reveals a promising trend — the continuous rise in digital payments. Between January and March, 53.7% of all banking transactions and 15.7% of the throughput were digital, improving by 9.38pps and 4.59pps, respectively, compared to the same quarter of the last year.

To understand which payment channels have contributed to this increase, let’s closely examine the key trends presented in the report.

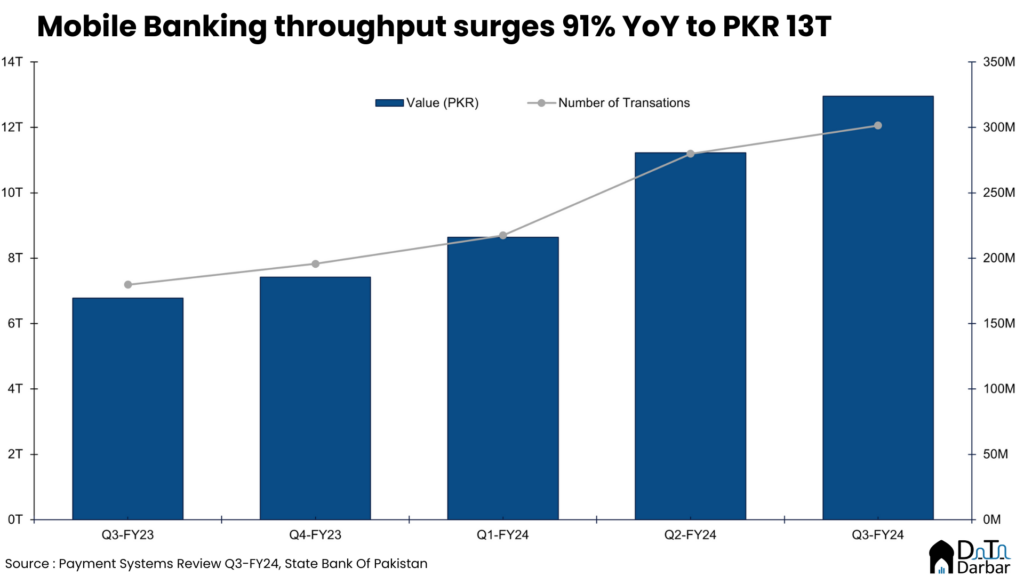

Mobile Banking

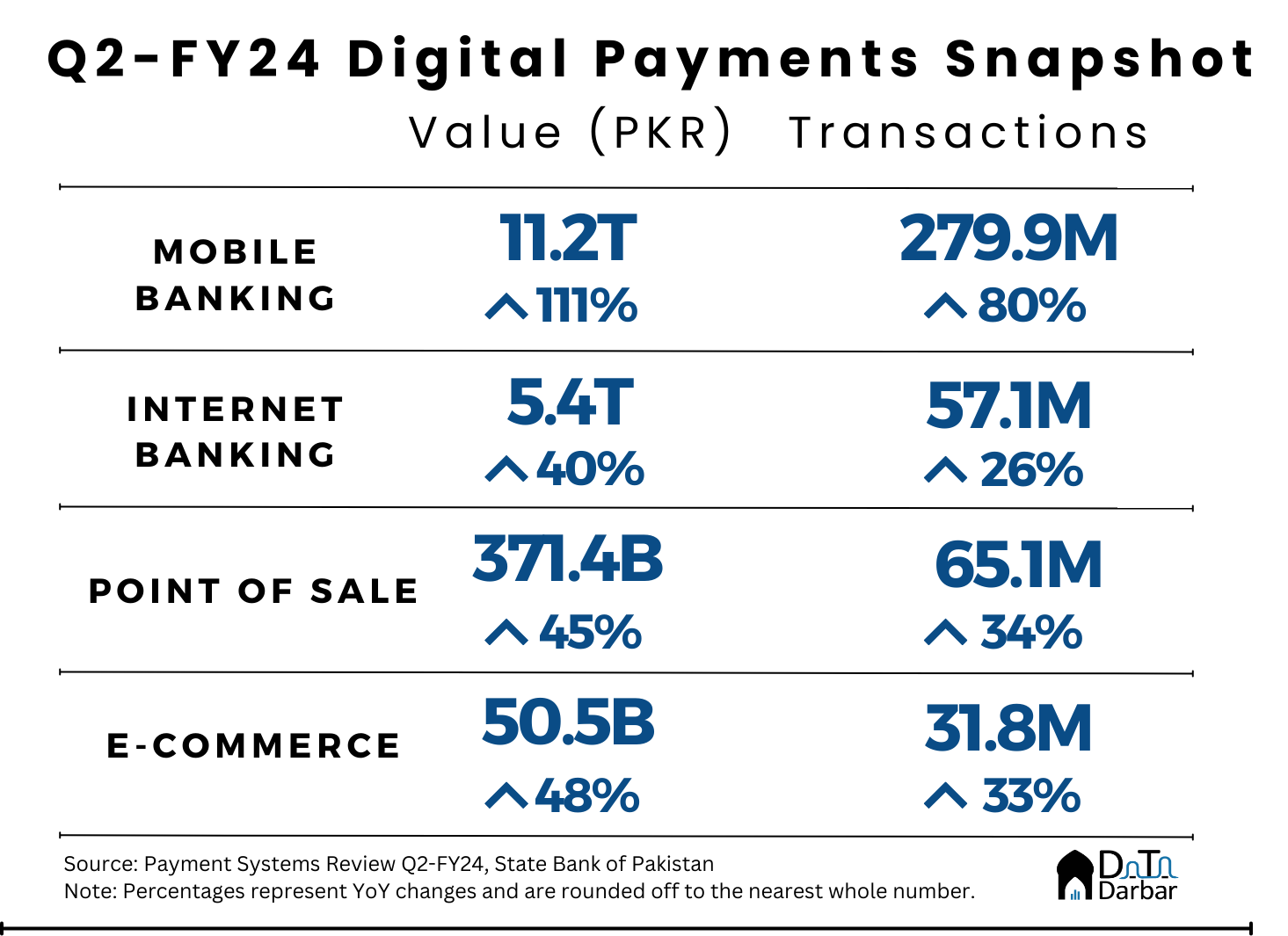

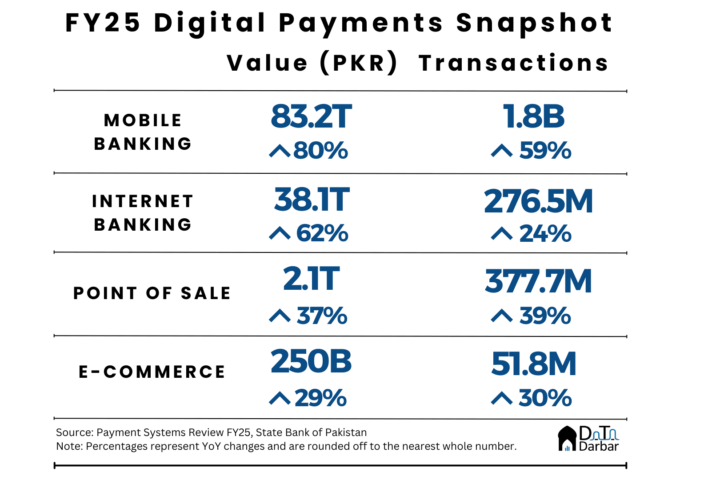

Mobile banking further solidified its position as the leading channel, accounting for nearly 65% of all digital transactions, both by volume and value. Its number of transactions experienced a QoQ rise of 7.7% to 301.5M while throughput climbed 15% to PKR 12.9 trillion. Despite the relatively higher base, MB has consistently outpaced other e-banking channels in terms of growth.

The average mobile banking transaction size clocked in at PKR 42,969, reflecting a jump of 7.13% QoQ — the highest since the start of the fiscal year — and a 13.85% YoY increase. Over the first three-quarters of FY24, the total value of mobile banking transactions has already reached PKR 32 trillion. If it continues to grow at a 15% QoQ growth rate, the throughput should hit at least PKR 47 trillion for the fiscal year.

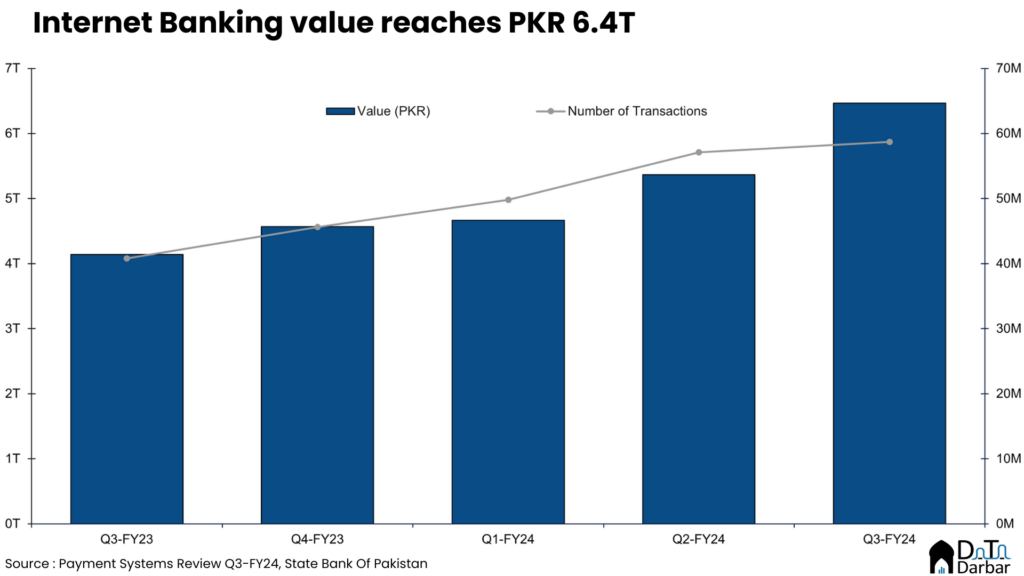

Internet Banking

Internet banking has emerged as a significant force in Pakistan’s digital payments, showcasing remarkable growth in Q3-FY24. Despite constituting only 12.7% of the volumes, it commands the second-largest share in throughput at 32.4%. Though behind MB, it still experienced a robust 56.2% YoY and 20.4% QoQ rise in value, reaching PKR 6.5 trillion with funds transfer accounting for 85% of the total.

Meanwhile, volumes increased by 43.9% to 58.7 million in Q3-FY24. The average transaction size also rose 17.6% QoQ to PKR 110,170, highlighting the channel’s tilt towards corporations and businesses, which typically make bigger ticket payments. As of March, the number of registered IB users reached 11M.

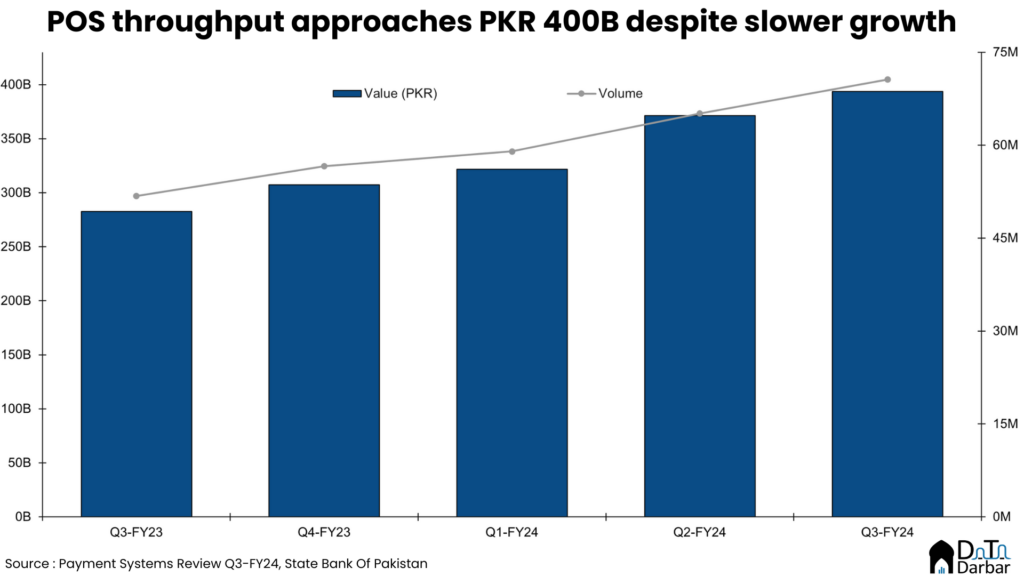

Point of Sale

Despite accounting for a substantial 15% of total digital transactions, POS contributed only 2% to the overall throughput in Q3-FY24. While the channel experienced a 39% YoY and 6% QoQ increase in value to reach PKR 394B, it was the slowest growth in five quarters and could indicate a slight tapering off. This growth, coupled with an 8.5% QoQ increase in volume to 71 million transactions, underscores the continued popularity of card payments for in-person purchases.

The cumulative value of POS transactions for the three quarters reached almost PKR 1.4T, surpassing 250 million transactions. However, the average ticket size declined by 2.20% QoQ to approximately PKR 5,500. While this decline could be attributed to shifting consumer behavior towards smaller purchases, the 0.9% decrease in terminals due to the removal of inactive machines by two banks in the last quarter might also be a contributing factor.

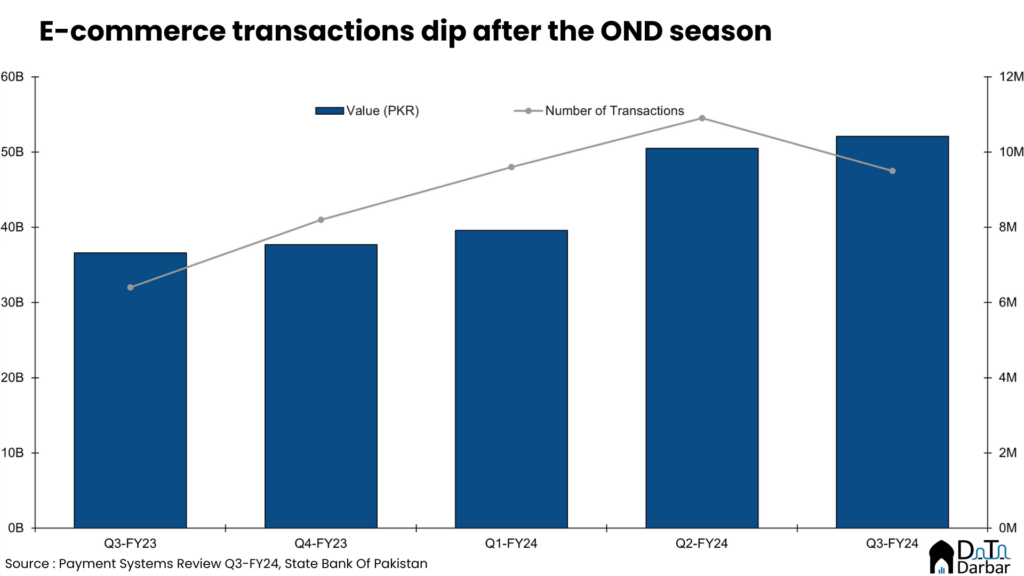

E-commerce

E-commerce continues to be the laggard and has been stuck in limbo for years now. As the OND season ended, volumes also fell to 9.5M in Q3-FY24, down from 10.9M in the preceding quarter. Compared to the same period last year, the channel shows remarkable recovery but that’s because of the low base effect.

Meanwhile, throughput clocked in at PKR 52.1B in the last quarter amid inflationary pressures, which took the average transaction size to PKR 5,427 during Jan-March. Acquiring activity by banks remained steady as they added 306 merchants, taking the total to 7,936.

EMIs

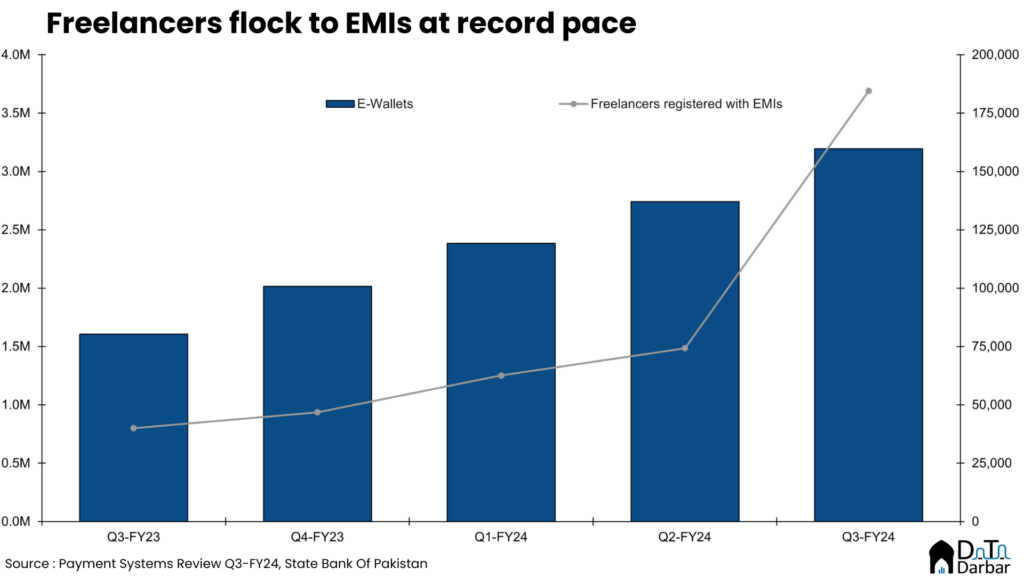

On the other hand, EMIs had a good quarter which also saw the acquisition of its poster boy Sadapay. Between January and March, 454,785 new e-wallets were opened, taking the aggregate to 3.2M. Combined, they did 22.9 million transactions worth PKR 62.1B, primarily for fund transfers, with an average ticket of Rs 1,937.

Despite building on a small base, this represents a significant increase of approximately 80.3% in transaction volume and 109% in throughput since Q4 FY23. But the biggest takeaway elsewhere: digital wallets are hitting it off with freelancers and now a 184,516 by March—a staggering 148% increase in just one quarter. This can be directly credited to the State Bank’s June 2023 amendments, which expanded the permissible products and services for licensed entities and eased transaction limits.

Raast

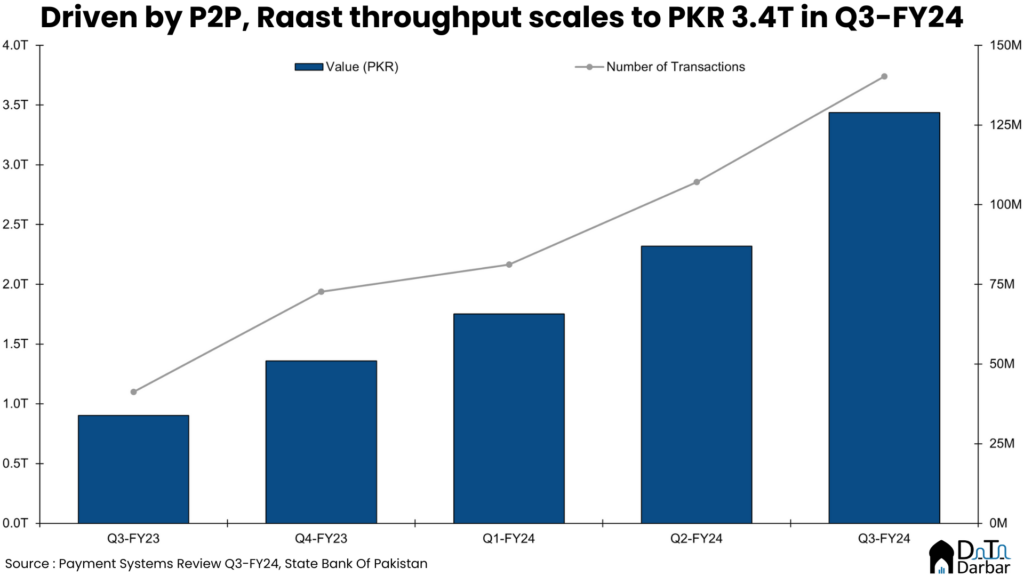

Raast, Pakistan’s instant payment system, has seen an extraordinary boom in both volume and value. In Q1-FY24 alone, it processed 81.2 million transactions worth PKR 1.7 trillion, reflecting an 11.7% surge in volume and a 29% increase in value compared to the previous quarter.

This impressive growth continued well into Q3-FY24, with volume soaring to 140.3M and value skyrocketing by 48% QoQ and 281% YoY to reach PKR 3.4T, almost entirely on the back of P2P transfers. Meanwhile, bulk payments, the oldest Raast module, still await its inflection point and recorded a modest throughput of just PKR 71.6B.

But now all eyes are on the Person-to-Merchant (P2M) module, which aims to digitize the retail sector payments through QR codes and request-to-pay. This phase has already been rolled out officially though most financial institutions are currently working on releasing their own products around it.