Islamabad-based fintech SadaPay has finally gotten the license from the State Bank of Pakistan to commercially launch its services. This announcement was followed by the fintech raising an extension of $10.7M for its seed round, bringing its total funding to more than $20M.

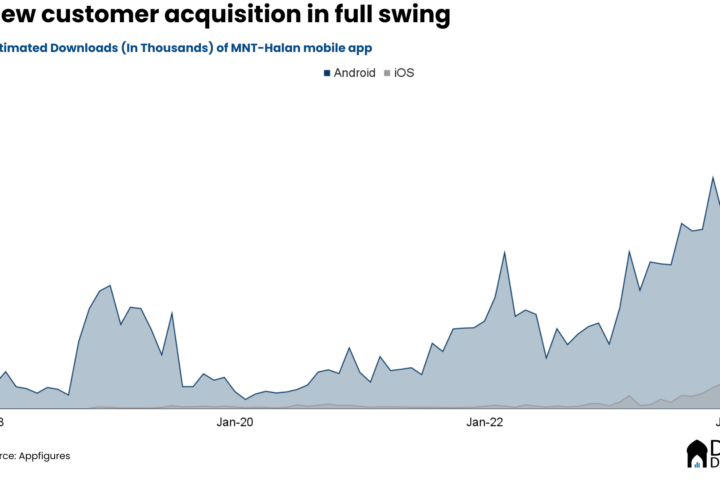

Founded in 2018 by Brandon Timinsky, the startup claims to have half a million people on its waitlist currently and its android app has over 190,000 downloads, according to Appfigures estimates. It had received in-principle approval from the SBP in April 2020 and got the nod to do pilot operations in December 2020, which allowed the fintech to on-board a maximum of 1,000 accounts.

With the latest approval, Sadapay has become the fourth EMI to have received license for commercial operations. The other three are Nayapay, Finja and PayMax. The State Bank had introduced the Regulations for Electronic Money Institutions in 2019 with the objective of promoting digital payments. Since then, 10 entities have obtained some sort of approval, with Careem Pay being the most recent one.

With commercial license, Sadapay can on-board customers for its digital wallet and offer utility bill payments, p2p transfers etc. It has also partnered with Mastercard to give its customers a debit card.