Last week, ProPakistani reported that the State Bank has given the greenlight to OPay for buying Finja’s EMI license. This gave credibility to the news that had been circulating in fintech circles for a while. But why is the Lahore-headquartered startup looking to divest from its prized asset? Before that, let’s first address the basics.

Finja’s origin story

Founded in 2015 by Monis Rehman, Qasif Shahid and Umer Munawar, Finja is among the most popular fintechs in Pakistan. They started out with SimSim — a digital wallet in partnership with Finca Microfinance Bank on a 40-60 basis, where Finja primarily brought in the tech, and Finca provided the banking (and license). While the startup ecosystem was nascent at the time, the company still managed to raise sizable venture funding.

Then, in 2019, the SBP introduced the Electronic Money Institutions (EMI) Rules, and Finja ditched the partnership with Finca to take this route for more control over the financial side. It was the second company to receive in-principle approval in October that year. By September 2020, it was ready to roll out pilot operations and finally got the nod for commercial launch in the same month of 2021, thus becoming only the second entity to get the greenlight from the regulator at the time (and one of the four so far).

But since EMI approvals take a long time and only allow payments, Finja also got the non-banking financial company license. This enabled it to start lending and basically become more of a financial super app.

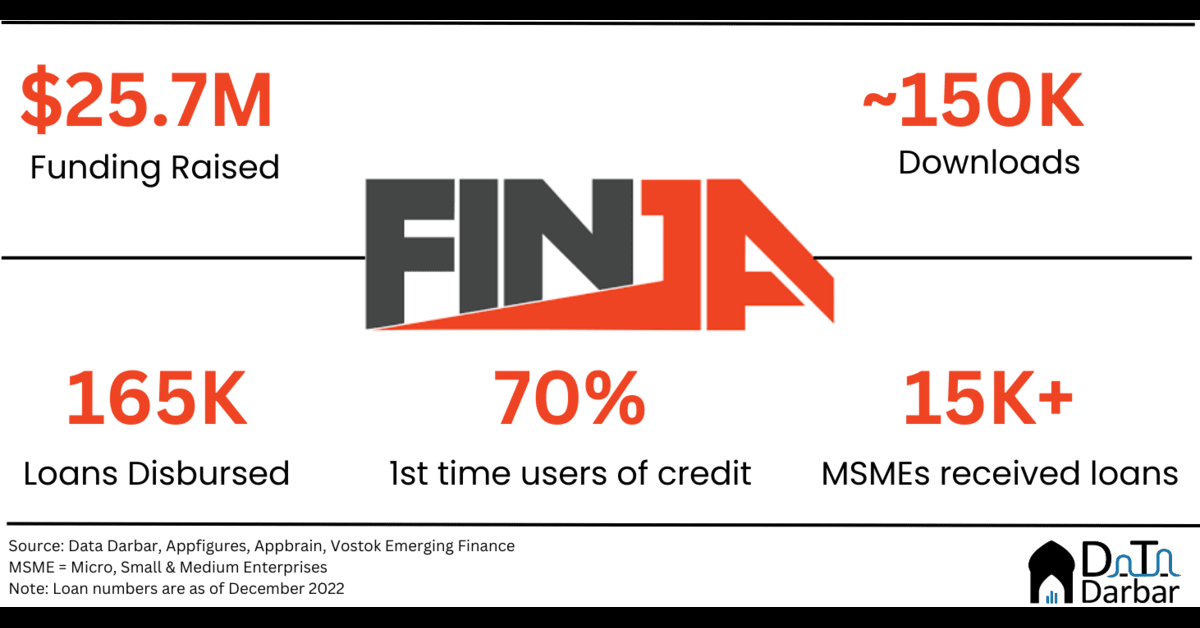

So Finja possessed two licenses: one allowing it to collect deposits from customers and the other for lending to them. In theory, these were the key ingredients required to build a successful fintech. Meanwhile, they continued an impressive fundraising trajectory, amassing a total capital of $25.65M — making them the seventh most funded startup in the country.

Note: Funding = Financing = Capital. The amount is based on Finja’s own press statements over the years and is not necessarily VC or equity.

A business model primer

That’s enough background. Now, why might Finja want to divest from the license it took them almost two years to get? As we have reported, EMI as a business has a skewed unit economics with primarily two revenue streams: transaction charges and interest income. The former are usually kept at zero either because of regulatory intervention (Raast) or due to company discounts. Meanwhile, the latter is insignificant since the average balance in customer accounts is negligible. The math doesn’t add up in the end, as you can test out in this calculator too.

On the other hand, lending has relatively better unit economics because you can price according to the risk. For example, Finja’s annualized percentage rates vary between 42% and 104%, depending on the tenor. In theory, it leaves a healthy margin — assuming the cost of funds at K+1, i.e. ~25%, notwithstanding the fact that it’s almost impossible to really grow the lending ecosystem in such a high-interest rate environment.

Finja’s valuation: gone with the wind

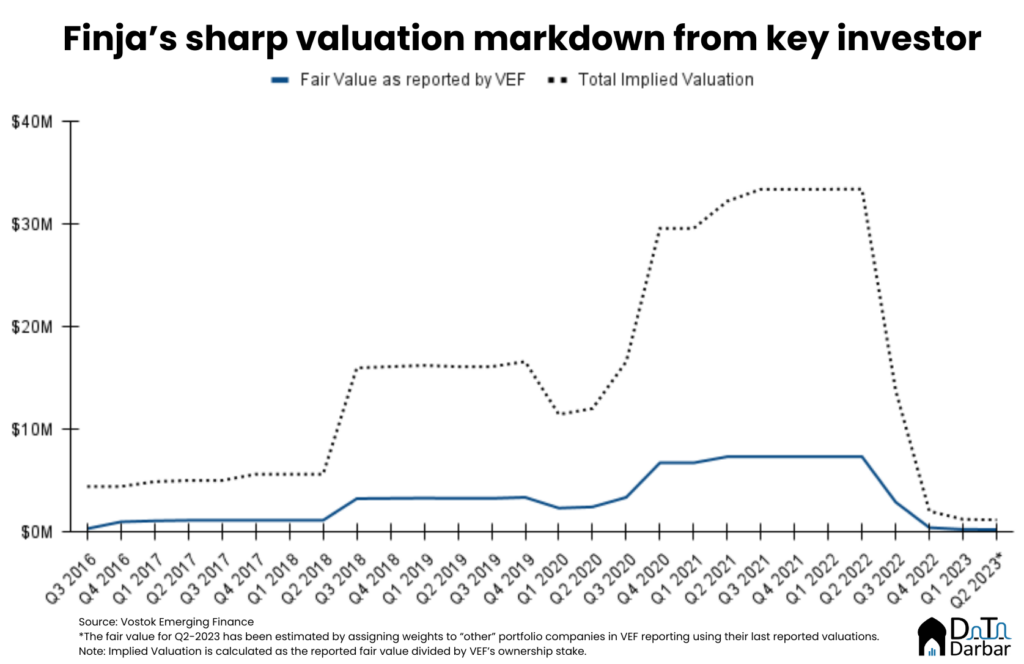

So far, we have talked only from a theoretical perspective on how payments are bad, and lending is good business. But how has the company performed? While we don’t have the financials, there is one proxy available to give us some sense of Finja’s direction. One of its earliest investors, VEF, is a listed entity and has been reporting its share of the fair value.

Based on that, you can see how the company’s fortunes reversed when its reported fair value suddenly plunged by $4.43M, or 60%, to $2.93M in Q2-2022. That trajectory continued for the next three quarters, and in the June 2023 report, VEF doesn’t even mention Finja and instead clubs it as part of “others” because the company accounts for well below even 1% of its portfolio. This yields a total implied valuation of the company at just $1.2M — a fraction of what it had raised.

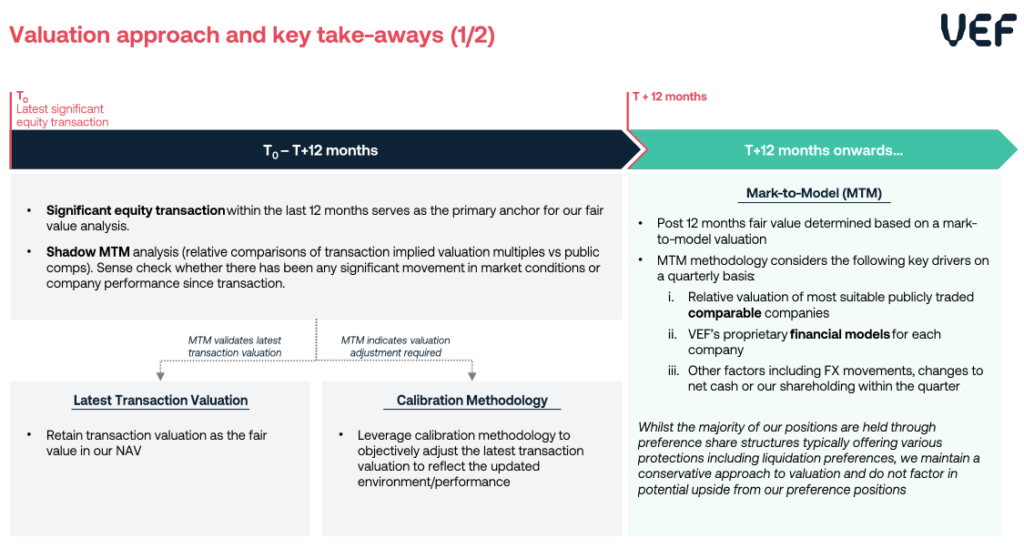

Remember, this is for Finja Inc., which is the holding company owning both the EMI and NBFC entities. You’d argue that how a particular investor reports its investments might have more to do with the accounting treatment than the underlying financial performance. It’s somewhat true, considering that VEF had classified Finja as a Level 3 asset, i.e. most illiquid and open to interpretation and assumptions.

In Q1-2023, when VEF last mentioned Finja, it used the mark-to-model valuation method (see the picture below). Perhaps other investors are treating the accounting a little differently and may still be valuing the company at a higher level. Nevertheless, such a steep markdown from one of the earliest shareholders raises alarm bells.

How to waste your headstart

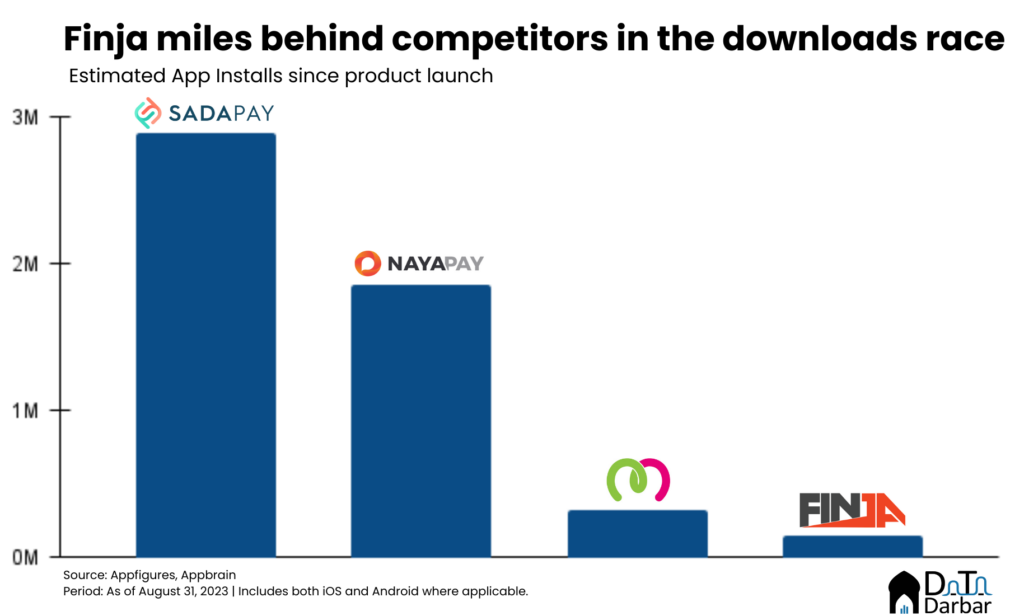

While Finja was among the earliest contenders for the digital wallet race, it lost all of its mojo a long time ago. On the consumer side, at least. Back in the olden days of Simsim, they wanted to be THE app for young people, with the CEO once even bragging about how half of the kids at LUMS were using it. But the entry of Sadapay and Nayapay upended the competitive landscape, and Finja was no longer cool enough.

This is reflected in the user uptake too. Where both Nayapay and Sadapay have crossed a million app installs on Google Play alone, Finja stands at just a paltry 100K+. That’s despite being only the second entity to get commercial approval, so they had a headstart too. And yes, downloads are an imperfect proxy, but when the numbers are this small, it gives you some idea about the size of the customer base. For context, Finja had opened a lot more Simsim wallets — a brand they didn’t even fully control.

On the lending side, it’s even harder to know about their progress because no financials are available. However, VEF noted in its 2022 report that Finja had disbursed 165K+ loans to over 15K MSMEs since inception. The corresponding numbers for 2020 were 35K and 3K. But understandably, there has been little commentary from the management in the more recent quarters about the company’s performance.

This is the business the company wants to focus its energies on. But things aren’t hunky dory here either as Kamran Zuberi, the CEO of Finja Lending Services, has apparently moved on. He is now part of Antler Riyadh’s first cohort working on his own startup. Reportedly, co-founder Qasif Shahid is stepping in to take the reins.

For what it’s worth, Finja’s leadership has remained pretty ambiguous with regard to its intent to sell the EMI business. “We have been receiving interest from several financial players in our EMI licence. We can only take proposals seriously after they receive approval from SBP,” Qasif Shahid told Profit. However, there is little ambiguity in the apathy with which their payments arm has been run.