In January 2025, we released a teaser of our report, with support from Indus Valley Capital, exploring the startup funding scene in the country. This comprehensive 88-page analysis offers a holistic view of Pakistan’s technological and investment ecosystem, exploring everything from startup funding to public markets, exports to talent development. Here are the most important takeaways.

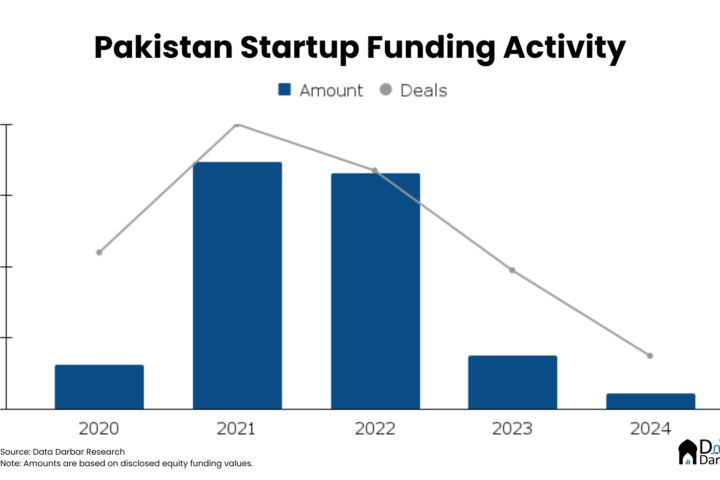

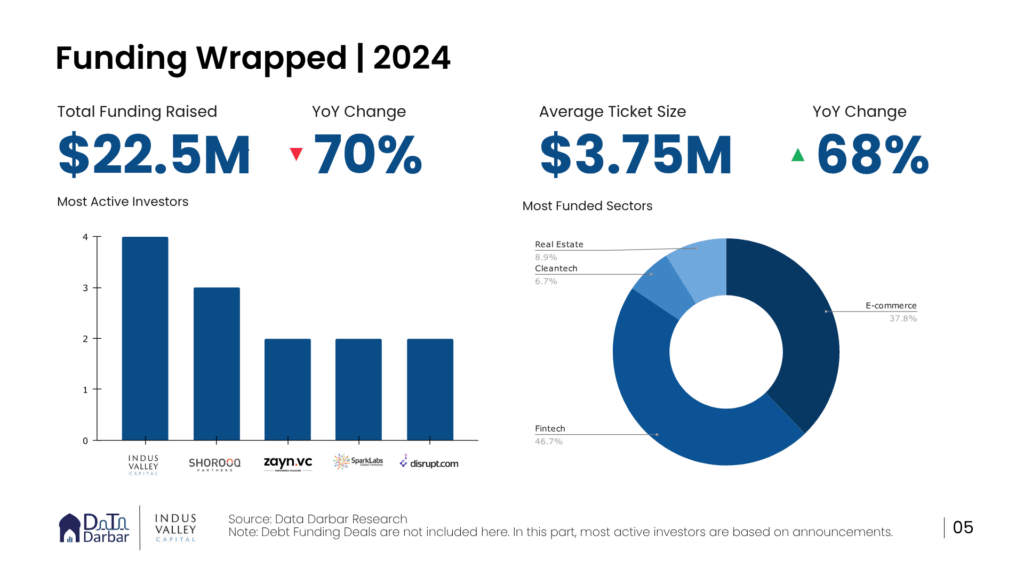

Pakistani startups raised just $22.5M in equity funding across 15 deals in 2024, marking a stark 70% decline from 2023’s already reduced $75.8M. This represents the ecosystem’s weakest performance since at least 2018. Interestingly, amid this contraction, the average deal size grew 68% to $3.75M, with median deal size surging even more dramatically to $3.1M, suggesting investors are making fewer but more substantial bets on promising ventures.

As equity funding contracted, alternative financing emerged as a notable trend. Debt financing gained traction, particularly in the fintech sector, with companies like Abhi, Neem, and KalPay announcing significant debt rounds. Accelerate Prosperity has been active in this space, providing 96 small-ticket loans worth $3.2M over five years, with average ticket sizes nearly doubling since 2020.

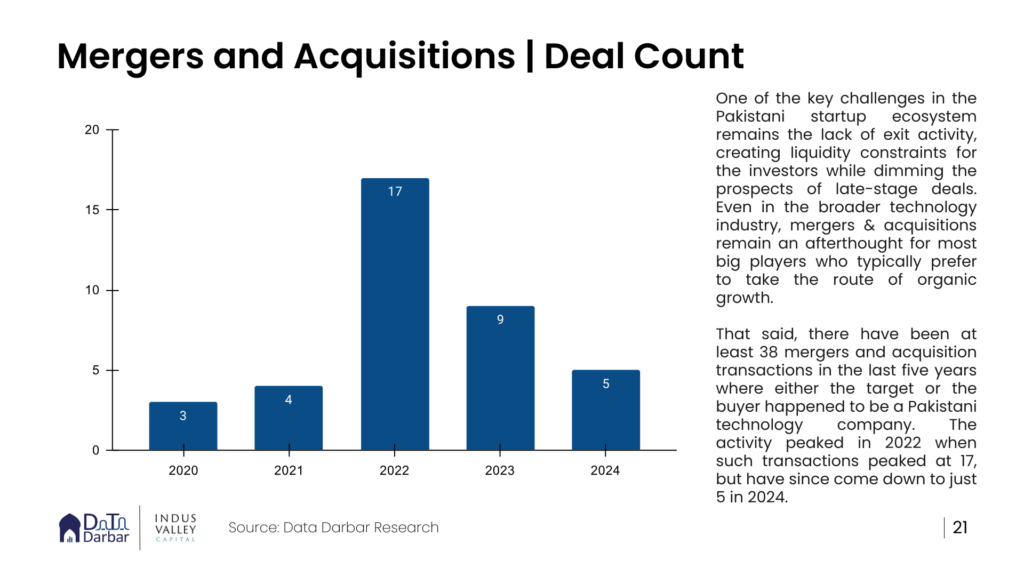

The M&A landscape showed an interesting shift towards domestic consolidation in 2024. While the overall number of transactions fell to just 5 (down from a peak of 17 in 2022), 80% were between domestic companies, a reversal from previous years’ cross-border dominance. Notable deals included Finja selling its license to OPay and Truck It In acquiring Rider, demonstrating how funding constraints are reshaping the startup landscape.

Despite funding challenges, Pakistan’s tech sector showed remarkable resilience. The Information & Communication sector grew at 8.5% in 2024, substantially outpacing the overall GDP growth of just 1.73%. ICT exports reached a record $3.6B, with company formations remaining robust—4,129 new IT firms registered in FY24, comprising 15% of all new businesses nationwide.

We can go on, but don’t wanna bore y’all with words. So just download the report and sift through the slides to better understand Digital Pakistan.