Amidst a slow funding environment, Pakistani tech companies are looking towards mergers and acquisitions for their growth. Or at least Rider is, which announced last week that it’s considering buying rival BlueEx. To be a bit more pedantic, Universal Network Systems is selling the domestic e-commerce business to TPL Logistics.

This move comes only months after Abhi bought a 10% stake in BlueEx. If the deal goes through, it would make it the second instance of consolidation in the 3PL space after PostEx scooped up Call Courier last year. That calls for a deep dive into both BlueEx and the e-commerce fulfilment landscape of Pakistan. So let’s get started!

The E-commerce Fulfillment Landscape

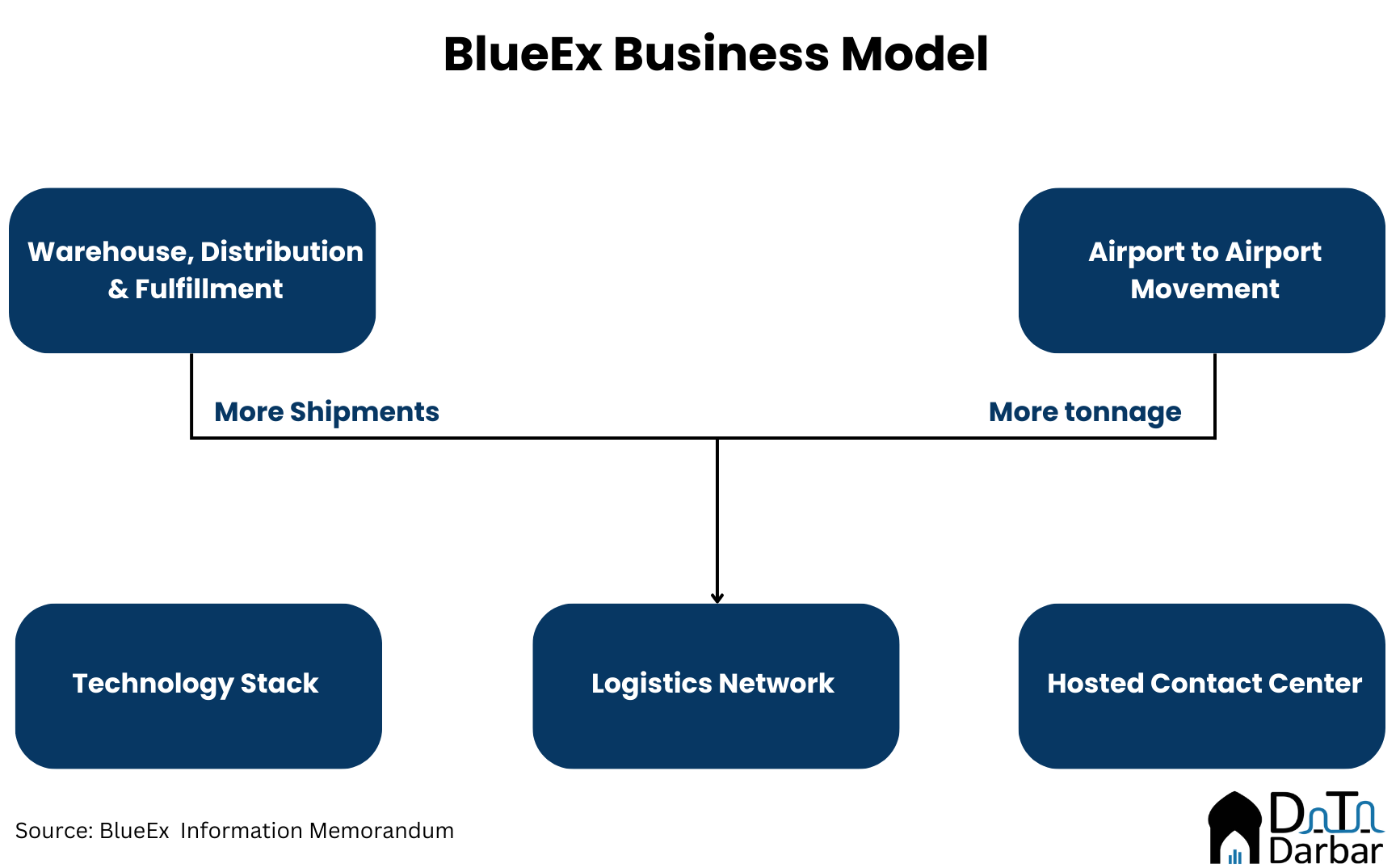

Formed in 2005, BlueEx was originally a courier company. In 2011, It pivoted to becoming a specialist e-commerce fulfilment company. E-commerce fulfilment, where BlueEx would deliver packages and collect payments from customers at their doorstep, was quite different from the traditional style of courier, which largely focused on documents.

It was quite early: even Daraz was yet to launch. But half a decade later, interest began to develop in the e-commerce fulfilment business. Among legacy names, TCS tried its hand, as did Leopards, while newer players like Trax entered the scene. But things really began to take off post-2020, as online shopping boomed in the wake of Covid-19. At the same time, venture dollars started flowing into Pakistan, which meant big discounts and more parcels to deliver for the last-mile industry.

Read: State of B2C E-commerce in Pakistan

Seeing this demand, new players entered: Jabberwock launched Swyft, and PostEx was founded, among others. In October 2021, Rider also announced a $2.3M seed round, and the following month, BlueEx listed on the newly created Growth and Enterprise Market board of the Pakistan Stock Exchange, raising PKR 446M.

Evaluating BlueEx

But despite being an early mover, BlueEx hasn’t exactly lived up to its potential. According to estimates, the company’s market share is in single digits, while newer entrants are in a much better position. In 2022, the topline from courier and allied services stood at PKR 1.03B, higher by 9.4% over the year before. Neither the absolute value nor the rate of increase is exceptional.

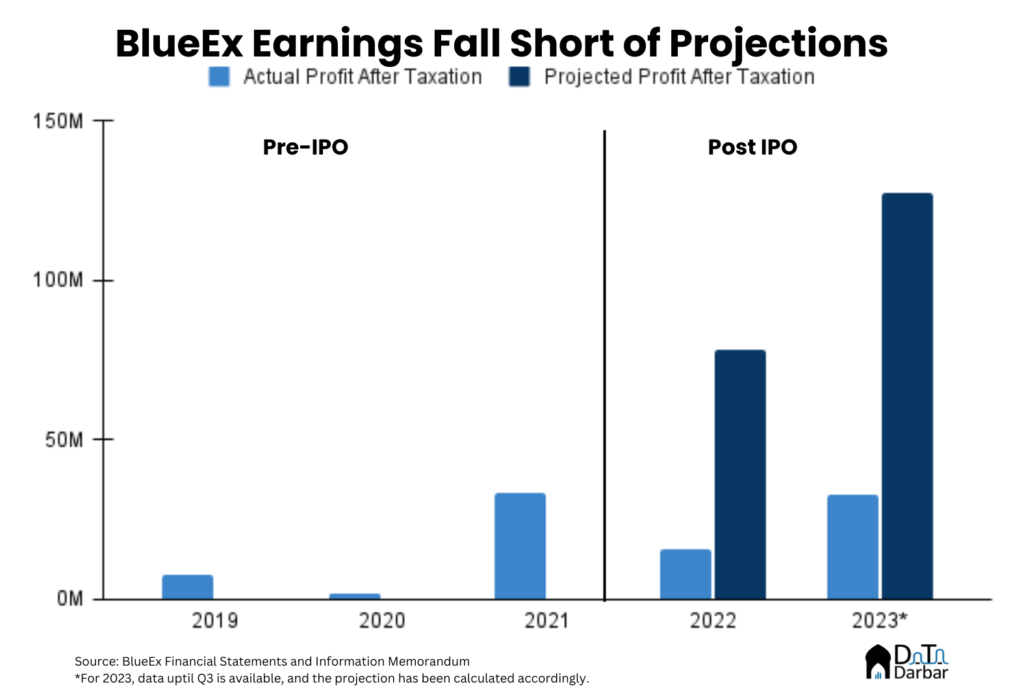

So far, it hasn’t disclosed the FY23 financial results. And as per a notice from Oct 2, it has until Nov 27 to do so. But in 9MFY23, GEMSUNL reported a profit after tax of PKR 33.05M, up 123.6% from PKR 14.78M in the same period of last year. At first look, the growth may seem incredible, so let’s put it in context. In the information memorandum at the time of its listing, the company had projected its FY22 net income to be PKR 78.6M. Instead, it managed only PKR 15.95M. Based on the current rate, it will miss the estimate by a margin this fiscal year, too.

This is quite familiar to anyone who keeps track of the Pakistan Stock Exchange and its few public offerings. Time and again, investment bankers come up with rosy projections to entice investors, and once they subscribe, estimates rarely ever turn into reality. Agha Steels is a good case in point, clocking in at a strike price of PKR 32 during its IPO. It currently trades at PKR 14.92. In a detailed note, a year after its listing, Arif Habib Ltd, the book runner to the issue, projected net sales for FY23 at PKR 32.76B. The actual revenues for the same period were PKR 20.58B.

Parcels to Payloads: BlueEx Pivots to International Freight

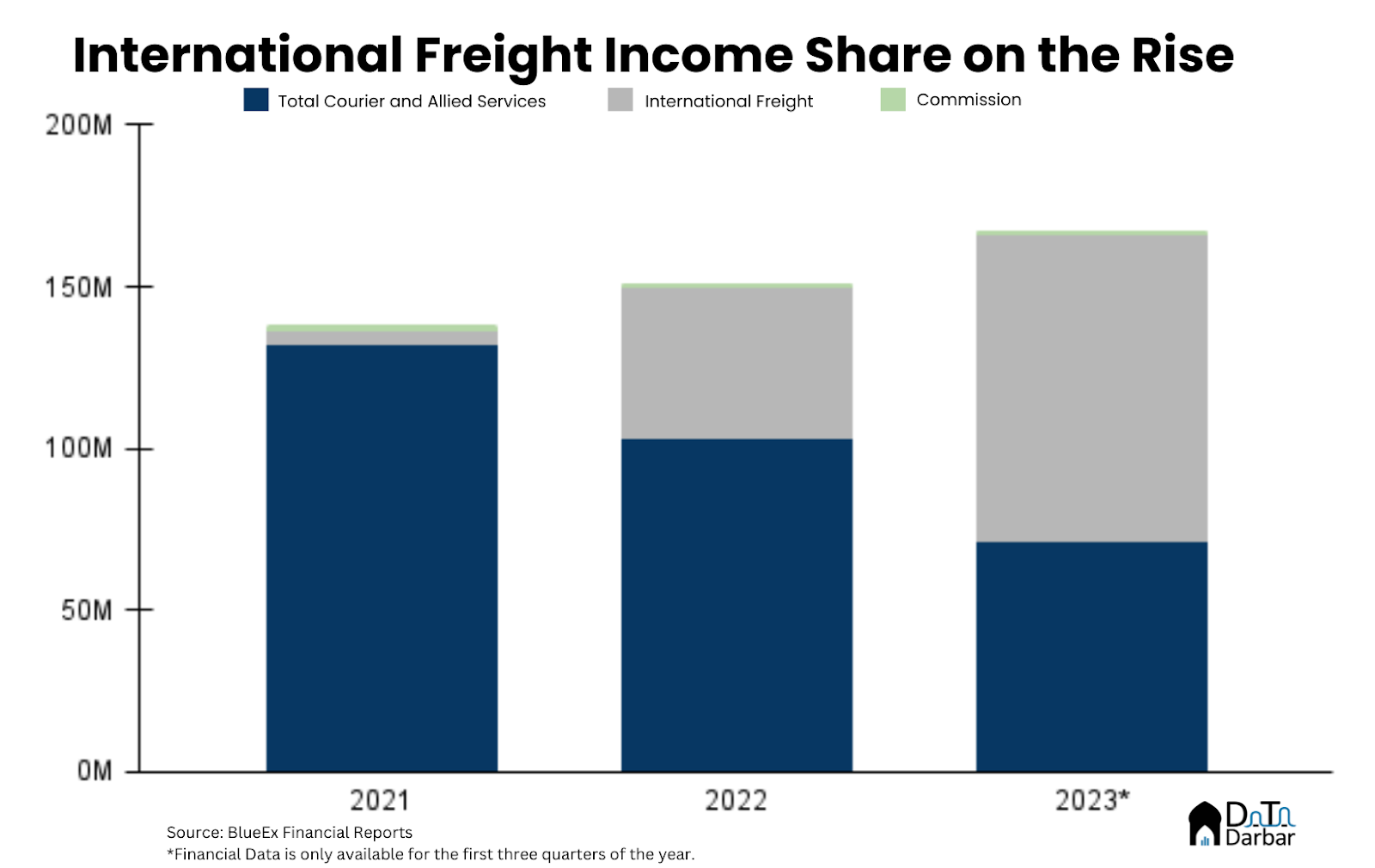

Anyway, we digress as that’s a whole other issue. Back to BlueEx now, where the more interesting bit is the aggressive underlying pivot. In FY21, international freight added only 3.3% to the company’s total income versus 31% in FY22. And for the three-quarters of FY2023 with disclosed data, the percentage has reached 57%.

So, the company has been very obviously trying to move away from courier and focus on freight. But why it’s doing so isn’t still clear. I mean, isn’t the future of logistics in Pakistan driven by e-commerce? Maybe, but apparently, it’s not a particularly lucrative segment unit economics-wise, as per BlueEx.

In its notice for the Extraordinary General Meeting, where the resolution for the courier segment’s sale will be voted upon, GEMSUNL said the transaction would improve margins. “The Cash on delivery domestic operations business has a negative impact on the profitability of the Company,” the document read, adding that “since the business segment being sold incurs are net losses, its sale would also create further cash flows availability [sic].”

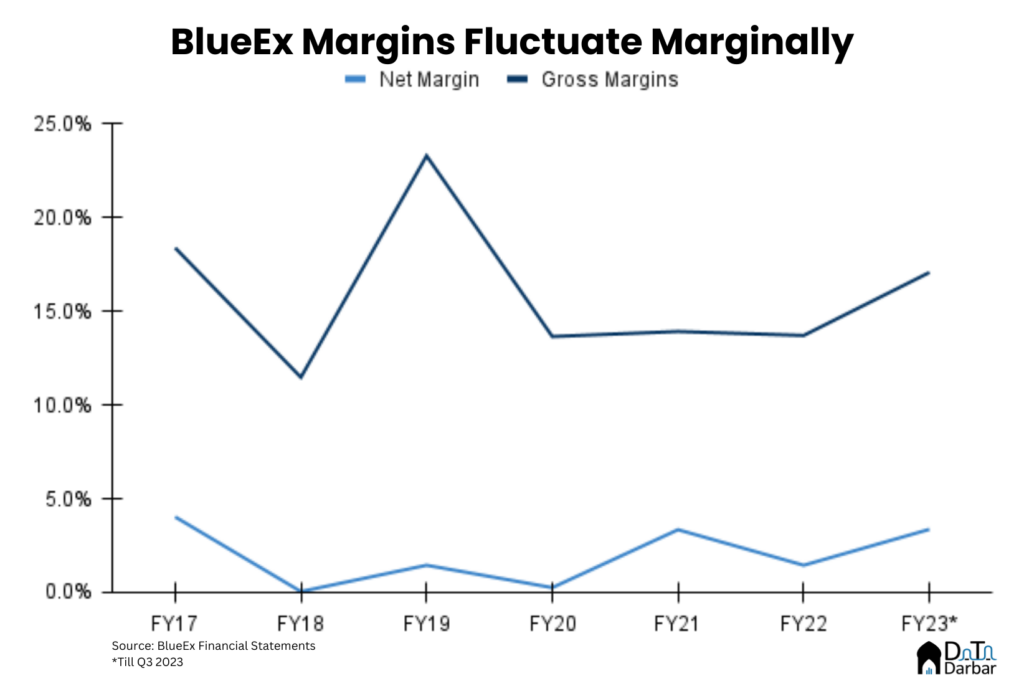

While the segment level breakdown for cost of sales is not available, the company had a gross margin of 17.08% in 9MFY23. At the first look, it’s an improvement from 13.78% in FY22 but still below the high of 23.3% in FY19. Meanwhile, net margins were 3.37%, up 1.92 percentage points, albeit off a pretty low base. For e-commerce business specifically, the numbers are apparently worse.

According to the same document, the current market price or fair value of this asset is around PKR 300M. Meanwhile, the costs are approximately PKR 250M, “including fixed assets, fixtures, fittings and other costs associated with the business including losses.” The company’s total market capitalization currently stands at PKR 1.3B.

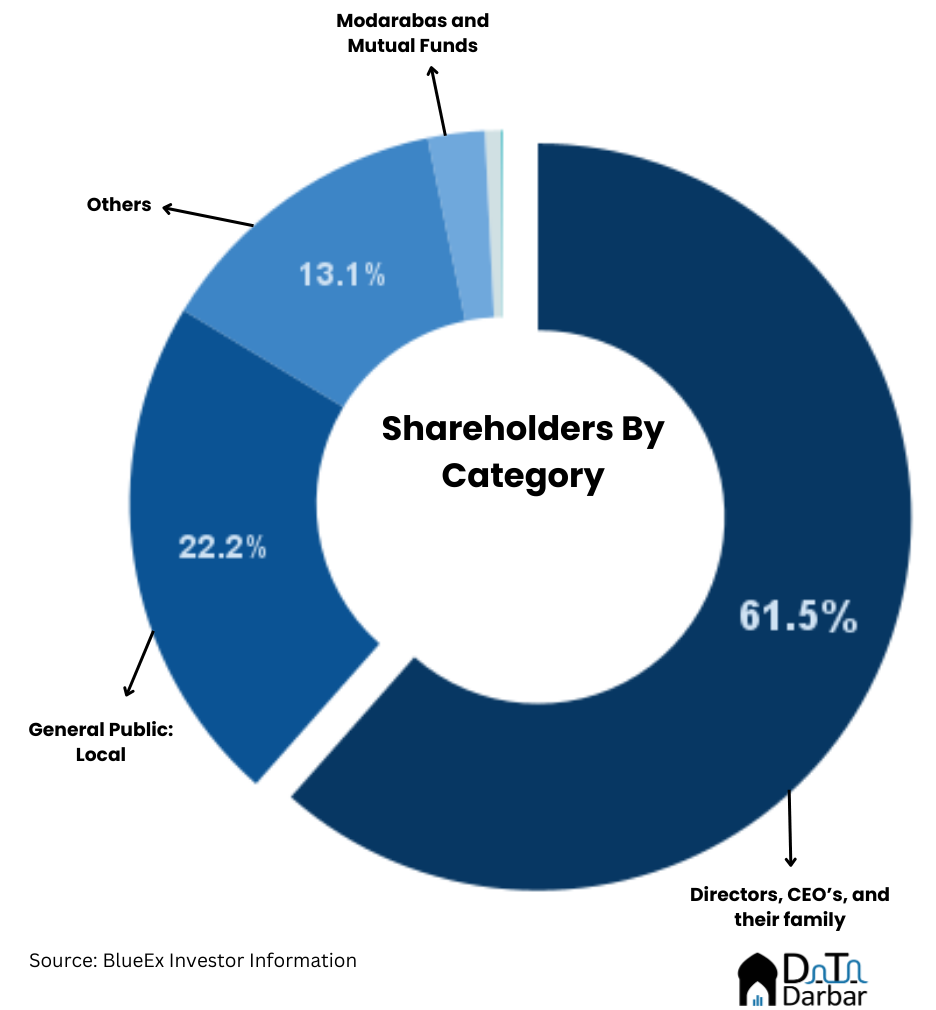

This pivot isn’t unwarranted, especially considering BlueEx’s owners. The majority stake is owned by Safina Danish Elahi, whose husband, Danish Elahi, is the CEO of the Elahi Group of Companies. In 2021, Danish Elahi acquired a 70% share in Mian Textile Mills. He then went on to transform it into a logistics company and changed its name to Cordoba Logistics, which then went on to acquire a stake in Trukkr, a tech-enabled logistics company.

For Rider, this acquisition would obviously bring some growth. But how much? As per BlueEx investor presentation from FY22, the company moved 4.05M shipments overall and had a gross revenue of PKR 573.4M in e-commerce, up 35.6% YoY. Assuming the same rate maintains, it means potentially PKR 777.8M of topline in FY23.

As per available estimates, it should double the market share of the YC-backed startup in the industry. But the impact on unit economics could be tricky as BlueEx’s e-commerce fulflilment is apparently loss-making and the consolidation won’t really be enough to result in any significant pricing power.