Covid-19 has been a key driver of digitization, both in Pakistan and elsewhere. At home, usually the two points cited to support this claim are spike in online payments (mobile and internet banking) and the increase in broadband users. But there is another indicator that lends credibility to this argument: the rise of Pakistan’s app economy.

Pakistan first appeared in the list of top countries by downloads in Q42020, ranking 10th with around 700 million downloads and an impressive 59% YoY growth, as per Sensor Tower. Since then, it has managed to stay in that list in all but one quarter, reaching a high of seventh place in Q2-2022.

According to Sensor Tower 2022 Outlook, Pakistan is expected to grow the fastest, at 28% YoY, among the top markets. In absolute terms, that means app downloads during the year will increase by an additional 900M to hit 4B. Data.ai also ranks the country 12th in downloads and sixth in terms of hours spent.

Neither platform shares Pakistan’s market in dollar terms but Sensor Tower projects app-based consumer spending to be $76B in Asia. Plus, we account for 5.7% of the continent’s downloads in 2022, so even assuming a 0.5% share in spend yields a market of $380M. Estimates on Statista present a relatively humble, though still meaningful, opportunity at $147M.

All roads take us to the same place: Pakistan is one of the fastest growing app markets globally. Big enough for anyone to notice. Yet, local publishers are largely missing from the scene. That can be seen from how only a handful of the top free apps on Google Play are local.

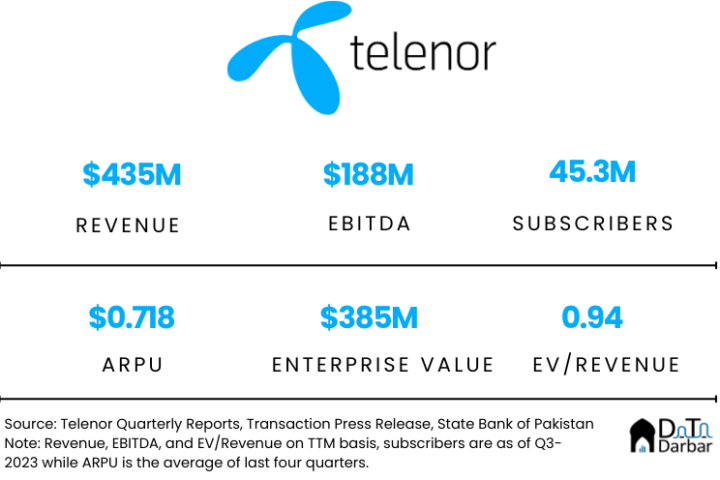

For example, on Aug 15 (date chosen to isolate the impact of Asia Cup), only six of the top free 50 apps on Google Play were by a Pakistan-based company. That includes products of multinationals like Daraz, Jazz and Telenor. In contrast, India had an equal number of home-grown publishers in the Top 10 alone.

But of course, this is not a fair comparison for India is too big a market by every standard. Against similar-sized countries, we don’t do so bad actually. According to Appfigures, there are 4,100 publishers from Pakistan with over 20,000 apps currently live across the two main stores. This is more than Egypt and Bangladesh – two of our closest comparables – combined.

So the problem is perhaps not a dearth of developers and publishers as such (more the merrier though). But that they are largely missing from cashing in on the domestic appetite for apps. Or at least do that successfully and at scale. Alternatively, they could be targeting markets with higher spend? Unfortunately, that’s generally not the case, except a few companies mostly concentrated on gaming.

According to Appfigures, there were only 64 local publishers that had at least one Android application with over 10M downloads. Change that filter to 100M and you are looking at just five names. Of the former, fewer than 10 were really targeting the Pakistani market. The App Store doesn’t provide similar benchmarks so it’s difficult to pinpoint numbers there. Note: there might be a little understatement as some of the Pakistan-based companies would have their accounts registered elsewhere and not show up in our list.

In any case, the market is big enough to warrant a deeper look, which is why we’ll be expanding to this space. There are essentially three areas that deserve attention. First is obviously the demand side – how consumers are behaving, which apps or categories are most popular and why? Second is supply, which includes both local and international companies catering to the Pakistani user but also the home-grown players targeting a global audience.

For that, we are launching a weekly newsletter, Appistan, where we’ll take you through the most important developments of this massive but under-reported driver of the tech ecosystem. If you’d like to stay on top of this, please do subscribe.