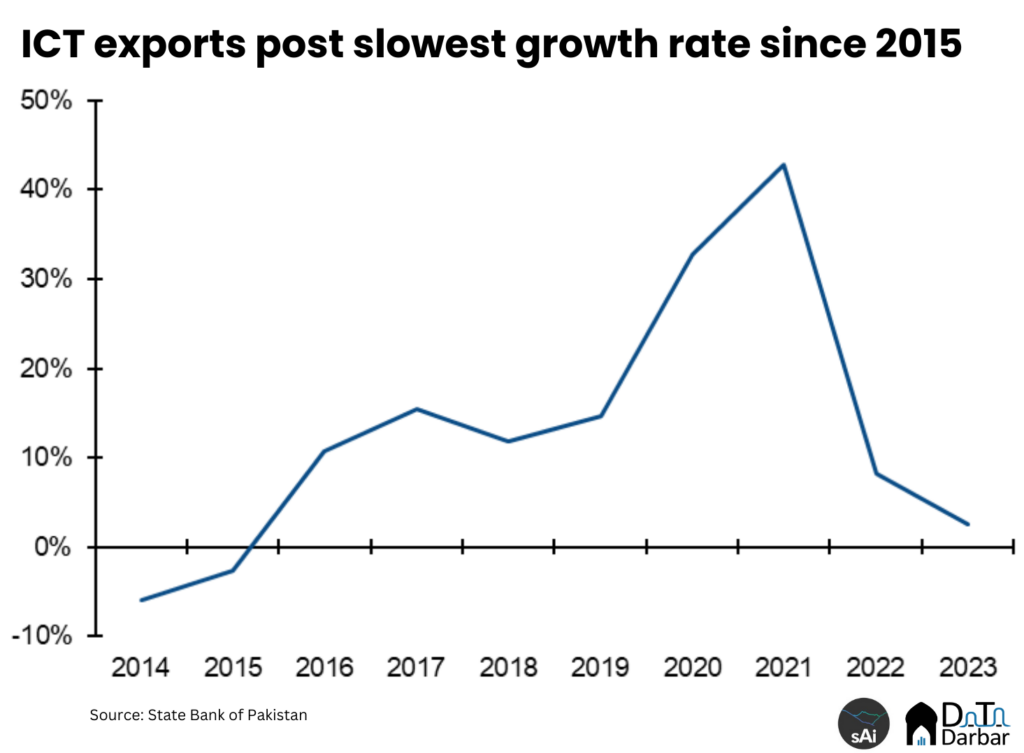

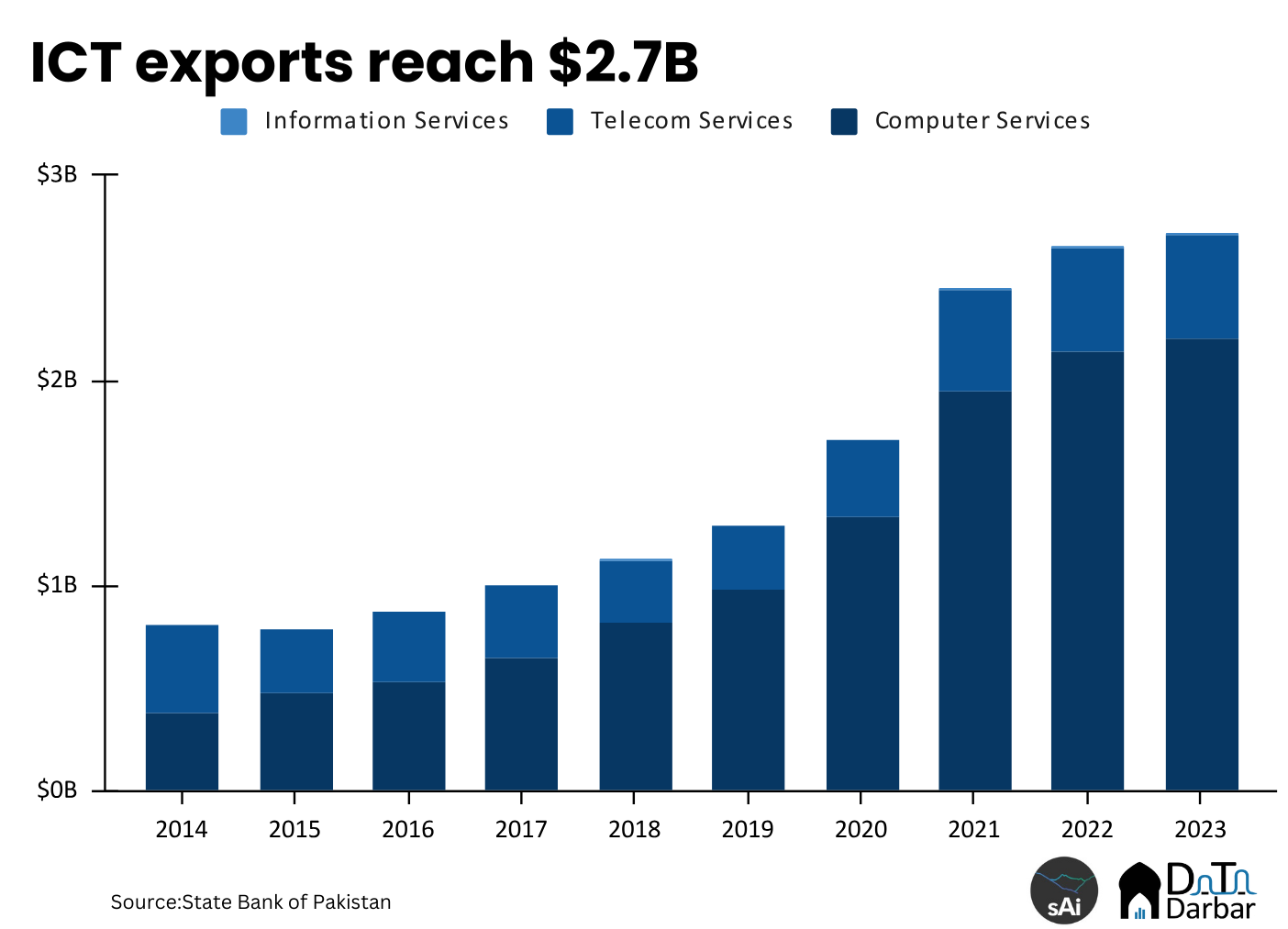

Pakistan’s information and communication technology (ICT) exports reached $310 million in April — the highest-ever monthly figure recorded. While this infuses optimism for the sector’s prospects, looking at the data over the last few years presents a mixed picture. In 2023, total ICT exports rose by a mere 2.5% to $2.72B — the lowest rate of increase since 2015 and the second straight year of single-digit growth.

No matter how you slice and dice the data, the trend persists. For instance, computer services, which include hardware and software consultancy, etc and account for 80% of all ICT proceeds, rose by just 3.2%. This is the worst rate of change in 14 years. Furthermore, exports of telecom services declined by 0.5% in 2023.

Many commentators have conveniently blamed this slowdown on the global macroeconomic environment where rising inflation has significantly impacted corporates’ discretionary spending on big digital transformation projects. While there’s no denying the sector’s headwinds, with even the likes of TCS and Infosys witnessing the slowest growth in years and tapering margins, they don’t exactly explain Pakistan’s lackluster performance.

Unlike IT services giants such as TCS, Pakistani companies are typically too small to be affected by global corporate spending because their clients are usually very small. According to the State Bank, almost 65% of all computer services companies and 80% of software consultancy companies in the country export under $100,000 annually. Those ticket sizes fall well below necessary IT spend across small and medium industries, but unfortunately, we’ve not been able to create any stickiness there either.

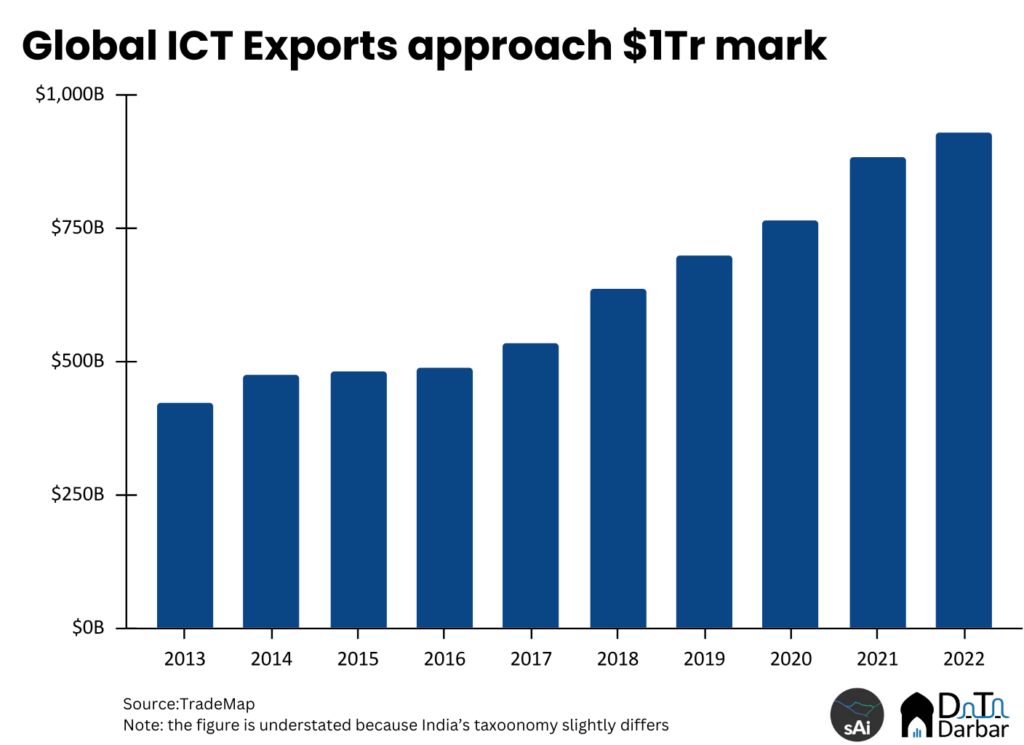

Globally, ICT continues to be the biggest driver of services trade and has exports of close to a trillion dollars. Between 2017 and 2022, ICT was the best-performing service exports category in every region, except for Oceania where it was the runner-up. Unfortunately, our share in this value chain is just 0.0003%, not even enough to be considered a rounding error.

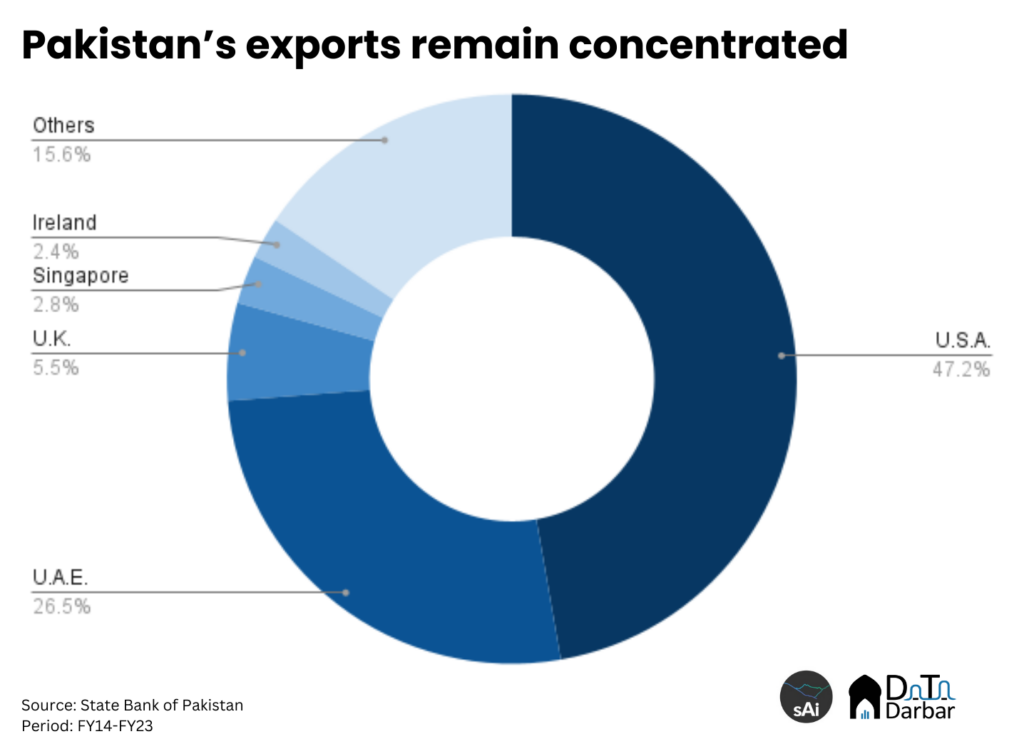

This negligible share is partly because our exports are highly concentrated in just a handful of geographies. Between FY13 and FY22, around 47% of Pakistan’s proceeds, or $9.15 billion, came from the United States. There’s nothing wrong with focusing on the biggest ICT services importer, but it shouldn’t come at the expense of other major markets. The country’s footprint in the other top five importers of ICT services is almost negligible. To Singapore, the fifth largest market globally at almost $27B annually, we have exported just over $533M over a decade.

For Pakistan to address its perennial external account woes, building a strong tech export base is the most realistic solution and recent history has proved this. Over the last two decades, ICT has been the only major sector driving growth. Just sample this: while overall service exports have increased just 2.2x since 2006, proceeds from ICT have surged by 11.2x. The sector now makes up more than two-fifths of all service exports, up from under 6% 18 years ago. So by all measures, both absolute and relative, ICT is among the most important sectors of our economy now.

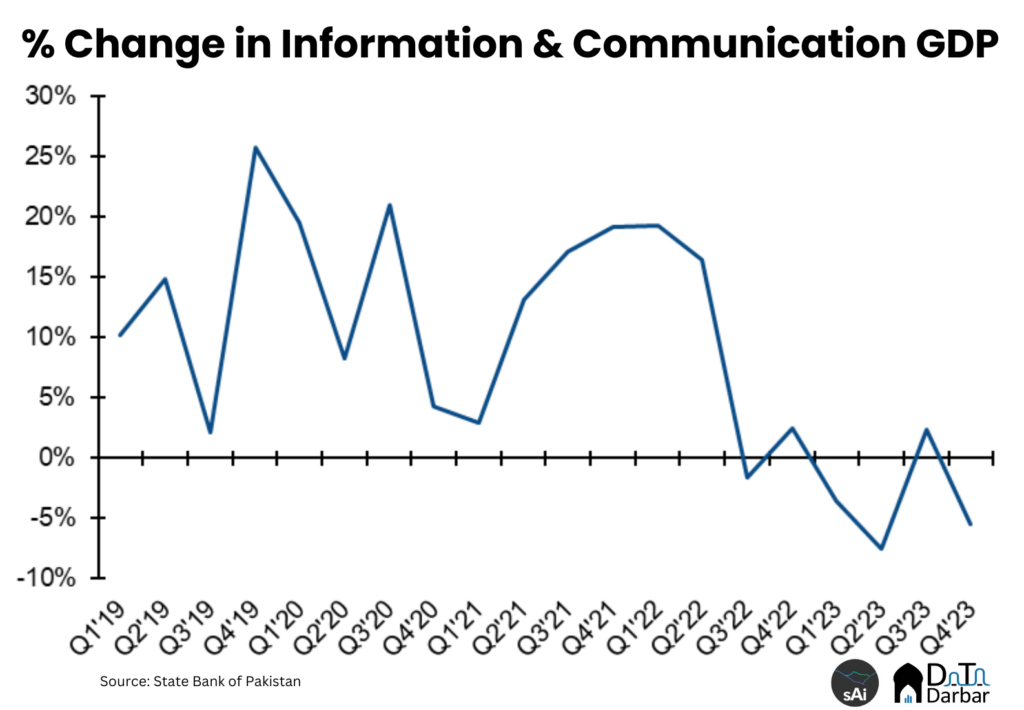

However, the recent signs of stagnation are quite clear and should raise serious alarm bells. In four of the last six quarters, the GDP of the information and communication sector, i.e. the total income, has declined year-on-year. This is in stark contrast to the yesteryears when the sector was posting annualized growth in double digits almost every quarter.

While the picture looks a little bleak if you put things this way, it’s certainly possible to quickly catch up. Japan serves as a good example in this regard. Its ICT exports of $2.7B in 2013 were almost on par with Pakistan today. But within a decade, the country managed to grow them to $10.3B. Poland and Romania chartered similar trajectories, and there’s no reason we can’t.

While there’s a certain level of cognizance among all stakeholders about the sector’s importance, the policy has not taken the long-term form required to leapfrog lost time. What are the requisite measures needed to take Pakistan’s IT industry to new heights? The next edition of this series will delve deeper into exactly this.

Great article. I like the way it contextualized the numbers.