There’s been too much doom and gloom lately in Pakistan due to the economic unraveling with most data — from inflation to fiscal deficit — painting a rather unnerving picture. But let’s leave all of that for now and look at one of the bright spots: digital payments. This is one area where we have seen high double to even triple digit growth over the last few years . And the State Bank’s latest Payment Systems Review reiterates the same.

In FY23, 10.4% of total throughput and 42.2% of transactions in the country were digitized1. For context, the corresponding proportions stood at 1.5% and 11.5%, respectively back in June 2019. But let’s take a pause here and understand what channels of payments exist in Pakistan.

First is obviously the paper-based instruments such as over-the-counter cash deposits or demand drafts. Then you have PRISM, a high-value real-time gross settlement system, to which only 59 entities in the country have access. This is what banks use to send proceeds among themselves, or how money flows into government securities. Finally comes “e-banking”, which comprises:

- Real-time online branches — that facilitate transactions between branches

- ATM

- Internet banking

- Mobile Banking

- Call Center/IVR

- Point of Sale

- E-commerce

As a primarily retail channel, e-banking is what really matters to us. But not all of it are truly digital payments, at least from a user’s perspective. RTOB and ATM are largely cash-based so we’ll ignore them from our analysis. Instead, we will stick to POS, e-commerce, internet, and mobile banking. So let’s go over the key trends from the latest edition and put the numbers in context.

Mobile Banking

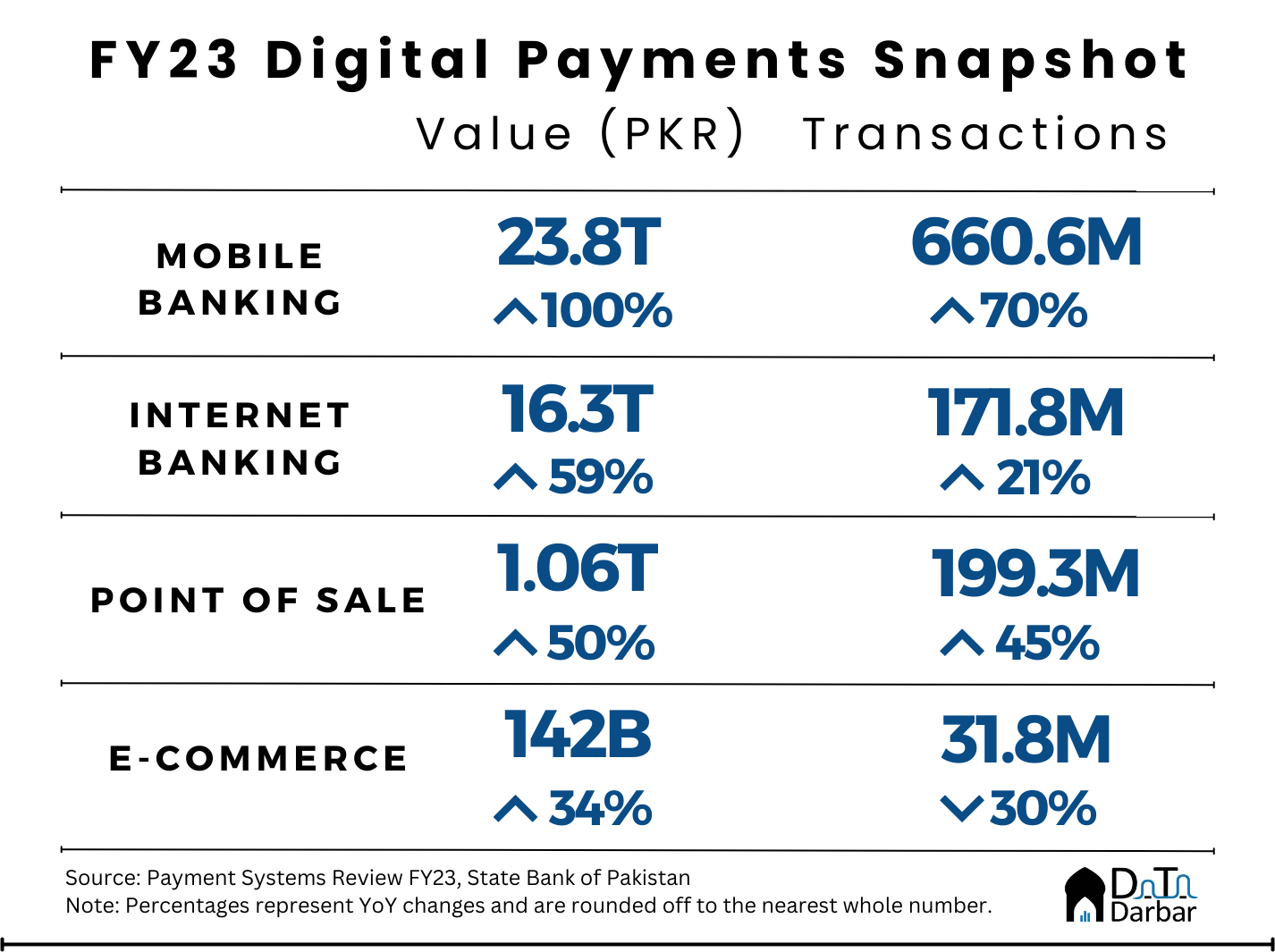

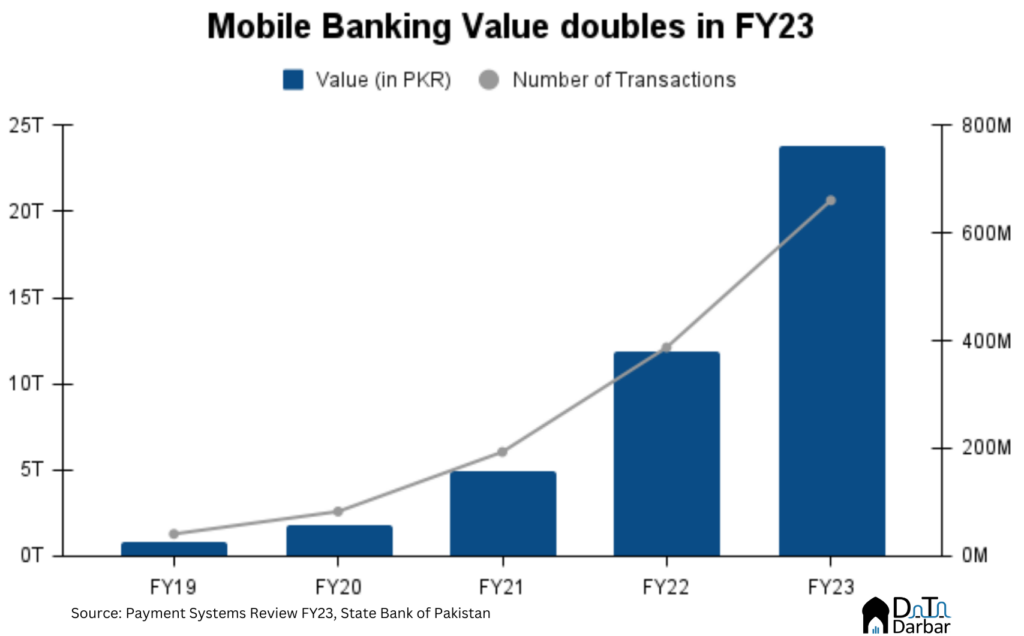

Mobile banking continued upwards trajectory as throughput doubled to PKR 23.8T in FY23, from PKR 11.9T. Meanwhile, the number of transactions surged by 70% to reach 660.6M, compared to 387.5M. This makes it the fastest growing channel by some distance. That reflects in quarterly data as well where MB value jumped 102% YoY and 9.5% QoQ to reach PKR 7.4T by June. Similarly, volume soared by 73.3% YoY and 8.9% QoQ to 195.7M.

Put another way, MB now accounted for 29.6% of ALL retail payments (excl PRISM and branchless) by volume and 6.8% by value during Q4-FY23. In the same period last year, the corresponding percentages were 21.1% and 3.8%. Steep uptick in throughput also pushed up the average transaction size to PKR 37,946 in the outgoing quarter and PKR 35,964 for the entire FY23.

Internet Banking

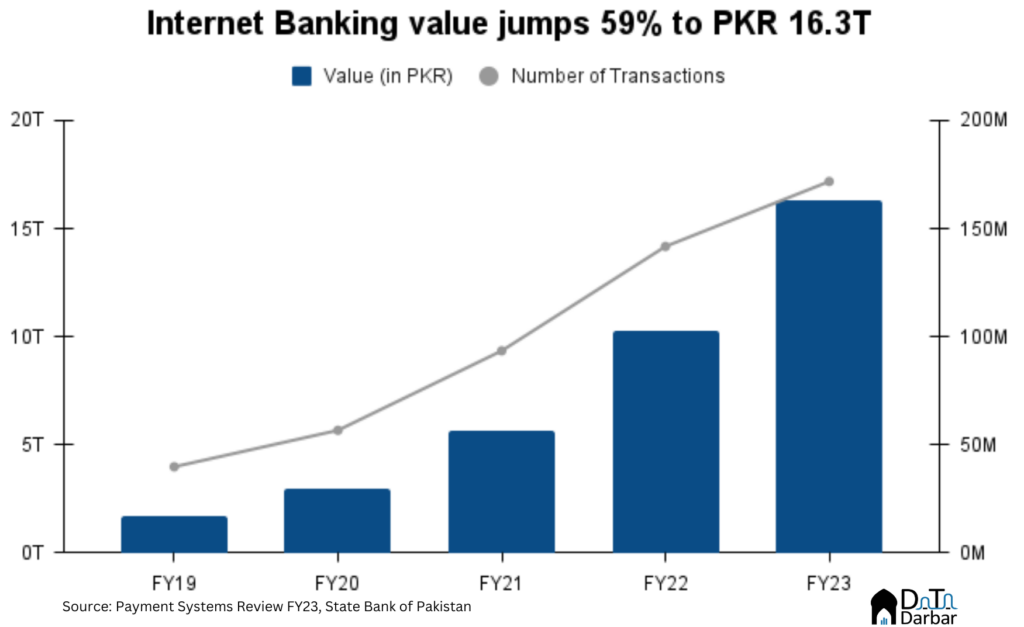

The extraordinary performance of MB sometimes steals the thunder of internet banking, which has consistently posted high double-digit growth rates for a while now. In FY23, IB throughput rose 59.3% while volumes increased by 21.2% to reach PKR 16.3T and 171.8M, respectively.

Quarterly data showed a similar story with IB value touching almost PKR 4.6T across 45.6M transactions. That represents YoY increase of 51% and 14%, respectively. One area where this channel outshines mobile is on average transaction size, which clocked in at PKR 95,055. That’s largely because of IB’s tilt towards corporates.

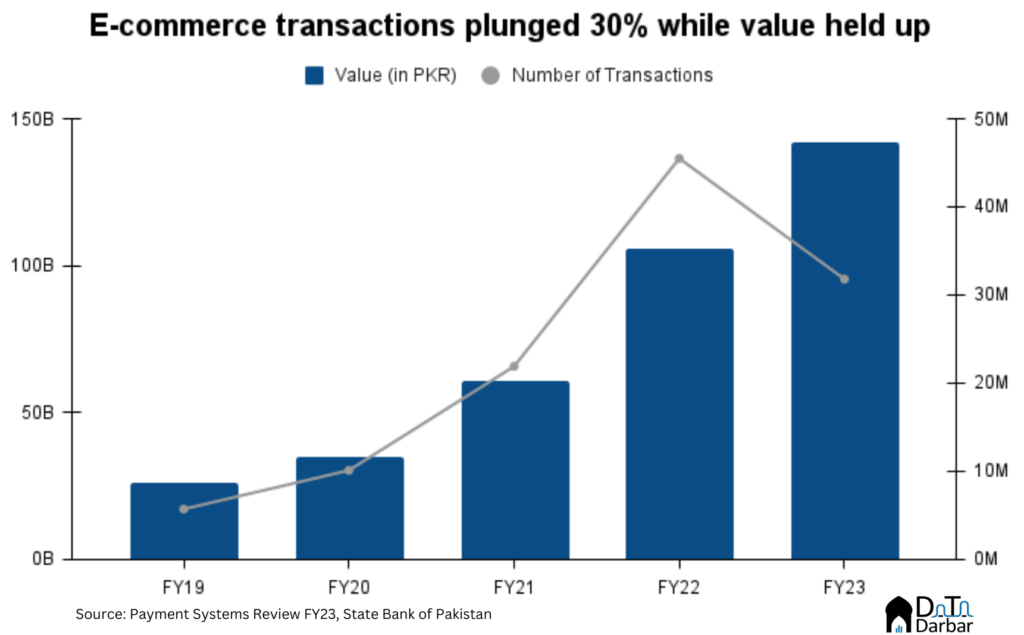

E-commerce

This is one important channel where the bright spot of digital payments gets rather dark again. While e-commerce throughput jumped 34% to PKR 142B in FY23, volume plunged by 30.1% to 31.8M. That’s a rough blow to a still nascent ecosystem of prepaid transactions where increase in value is at least partly due to inflationary pressures. However, Electronic Money Institutions (EMIs) at least partially compensated for it, processing 11.2M transactions worth PKR 17.3B.

On a quarterly basis, volumes recovered 28.1% QoQ amid a low base while still down 18.8% YoY. However, the growth continued unabated on the supply side as e-commerce merchants registered with banks reached 6,889 and another 4,956 through Electronic Money Institutions.

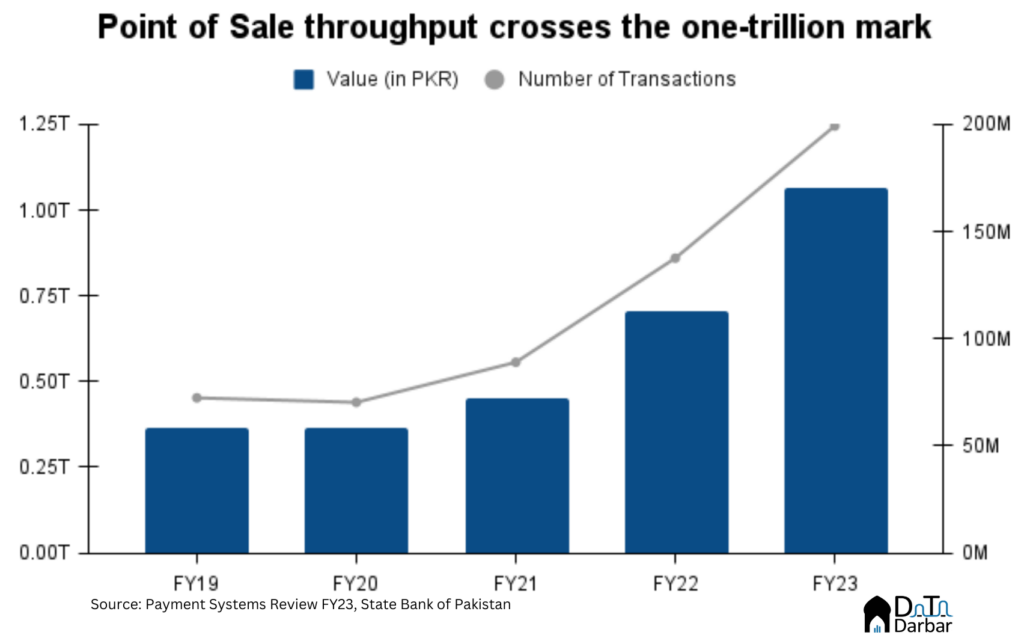

Point of sale

Point of sale ecosystem further picked up momentum as throughput crossed the one trillion rupee mark in FY23, higher by 50.4%. Similarly, volume reached 199.3M, representing an increase of 44.8% — second only to MB. In Q4-FY23 alone, POS value breached PKR 300B across 56.6M transactions.

The growth is partly the result of regulatory changes SBP implemented back in 2020, which improved the incentive structure for acquirers. As a result, new entrants like Paymob and Meezan entered the market. This helped the number of terminals reach 115,288 by June, compared to 104,865 the year before.

Raast and EMI: the next frontiers of digital payments

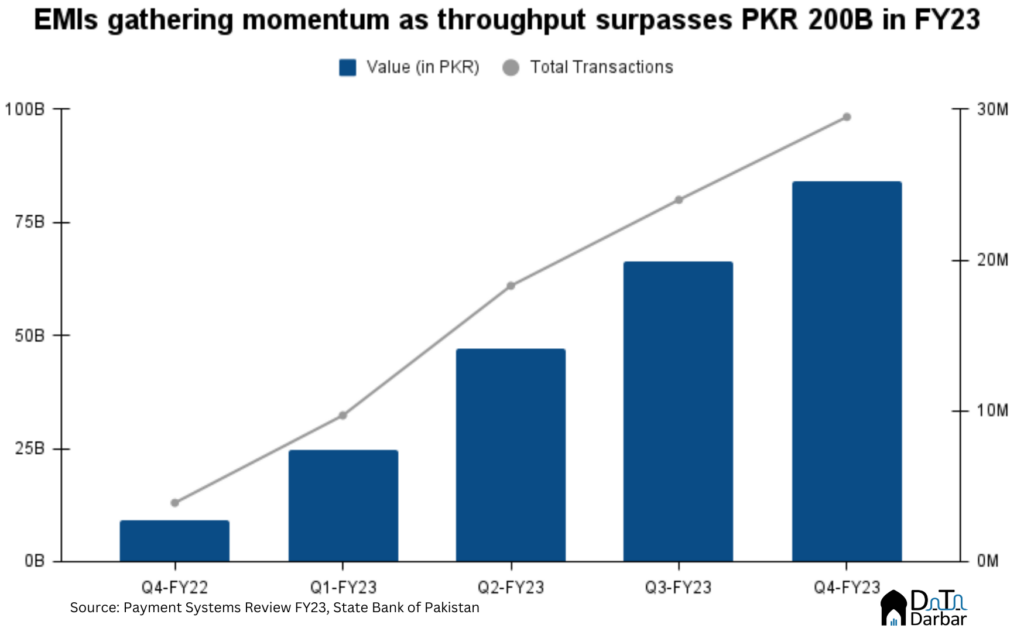

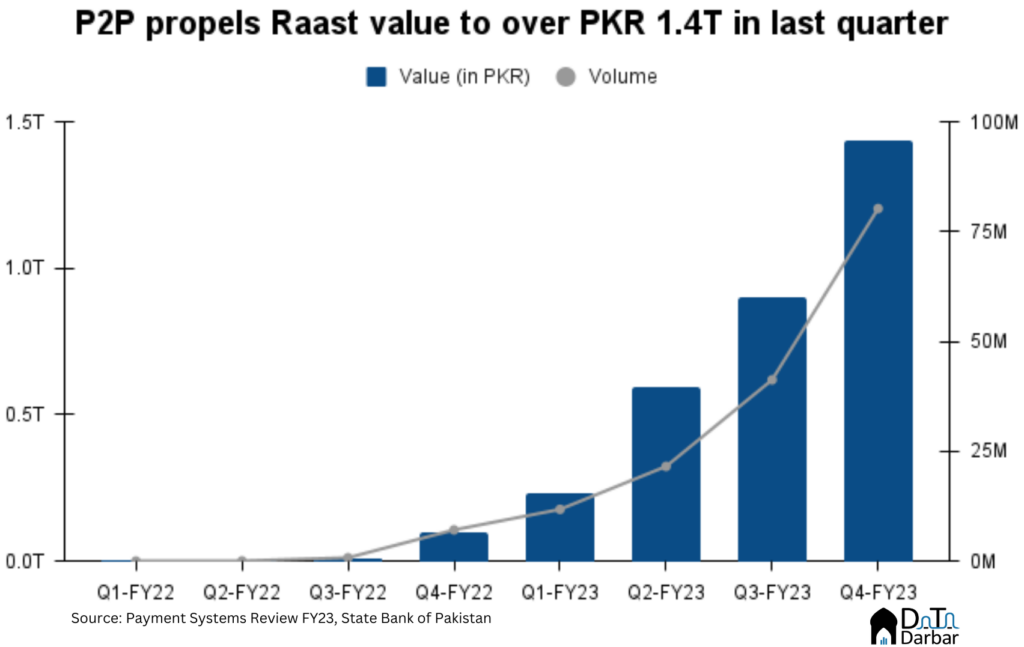

Over the last few years, we have heard A LOT about how Raast or the countless digital wallets will reshape the future of payments in Pakistan. Though for the most part, those were just claims as the industry was too nascent. But now, we have some data available which gives us an early picture.

For the commercially live entities, FY23 was a little mixed. Amid the economic environment, the two leading players had to start optimising for resources sooner than they probably otherwise would have. Sadapay introduced fees for card issuance while Nayapay passed on charges for failed transactions to the customers.

But that didn’t deter the growth as throughput crossed PKR 222.1B during the year across 81.5M transactions, from PKR 10B and 5.3M, respectively. Given the low base, it’s not too useful to look at the percentages as yet. Moreover, the SBP revised the regulatory regime towards the end of the year, addressing some of the challenges with the business model of EMIs.

The SBP also launched Raast’s request-to-pay module in September, which is meant to lay the rails for seamless merchant payments in Pakistan. Meanwhile, in the existing use cases, most growth came from P2P with a throughput of PKR 1.4T across 80.2M transactions in Q4-FY23. At least a part of this number were because of SBP’s force-routing. Ironically, bulk payments weren’t exactly bulky with a value of PKR 31.3B and volume only 70.9M.

- Digitization % is calculated as (IB + MB + POS + E-commerce) divided by (ATM + Paper-based + RTOB + IB + MB + POS + E-commerce).